Supplemental health insurance is any type of health insurance policy that you can buy to “supplement” your current health care coverage. Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Which insurance company is best for a Medicare supplement?

The 10 Best Medicare Supplement Insurance Companies of 2021

- Humana. With over 13 million customers nationwide, Humana is one of the most respected insurance providers in the industry.

- Aetna. Founded in 1853, Aetna serves nearly 40 million customers across the United States. ...

- Cigna. ...

- AARP by United Healthcare. ...

- Mutual of Omaha. ...

- State Farm. ...

- Anthem Blue Cross. ...

- ManhattanLife. ...

- Bankers Fidelity. ...

- Transamerica

How much does a Medicare supplemental insurance plan cost?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

Is a Medicare supplement insurance plan worth it?

Medicare Supplement plans would help cover the 20% you’re responsible for paying. Medicare Supplement plans, or Medigap policies, are insurance plans sold by private insurance companies. You pay the insurance company a monthly premium for your Medigap plan, in addition to the Part B premium you pay to Medicare.

Who needs a Medicare supplement insurance policy?

You must be enrolled in both Medicare Part A and Part B before you can buy a Medigap plan. If you are under 65 years of age and are qualified for Medicare because of a disability, you may or may not be able to purchase a plan, depending on the state in which you live .

What is the purpose of Medicare supplemental insurance?

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is the difference between an Advantage plan and a supplemental plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Which is an example of a supplemental insurance plan?

Examples of supplemental health insurance include dental plans, critical illness plans, and hospital indemnity plans. Whether a supplemental health plan is right for you depends on your health, the costs of the plan, and the benefits of the policy you're thinking about buying.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Is it worth it to get supplemental life insurance?

Supplemental life insurance can be a useful add-on, particularly if health conditions make it tough for you to get enough coverage elsewhere. But be sure to compare policies and prices. In some cases, the benefits may not be worth the cost.

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

What are the 4 phases of Medicare Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...

Who might benefit from supplemental insurance and why?

Supplemental health insurance can be an added layer of protection used to cover what a traditional health insurance plan does not. It can also help pay for nonmedical expenses that can go with illness or injury, such as lost income or childcare.

Do Medicare Supplement plans cover prescription drugs?

Medicare supplement plans don't include prescription drug coverage. You'll need a separate Medicare Part D prescription drug plan if you: Have a plan purchased after 2006.

What must be included in a Medicare Supplement plan?

Medicare Supplement insurance Plan A covers 100% of four things:Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up.Medicare Part B copayment or coinsurance expenses.The first 3 pints of blood used in a medical procedure.More items...

How much does Medicare pay for a doctor bill?

Medicare Part B requires beneficiaries to pay 20% of all Medicare-approved costs of services. For a $1,000 doctor bill, then, Medicare would pay $800, while you would pay $200 (deductibles and other fees aside).

Do you have to pay Medicare premiums?

Most Medicare recipients don’t have to pay a premium for Medicare Part A (hospital insurance). However, those who haven’t paid enough taxes (at least 10 years worth) while they worked may have to pay a Part A premium.

What is supplement insurance?

Supplemental health insurance helps to pay for healthcare costs that aren't typically covered by traditional health insurance. Some cover specific situations, like hospital or disability insurance, while others cover specific health conditions like cancer. Learn more about these policies and how they work.

What are some examples of supplemental health insurance?

Examples of supplemental health insurance include dental insurance, critical illness insurance, and hospital indemnity insurance. Whether a supplemental health insurance plan is right for you depends on your health, the costs of the plan, and the benefits of the policy you're considering. Many of these plans are inexpensive, ...

What is cash benefit insurance?

This type of insurance provides a cash benefit paid directly to you if you require treatment for a specific disease such as cancer. You can typically spend the cash any way you choose, and getting your benefit has nothing to do with how much your insurance pays for your medical costs. 2

What is accidental death insurance?

Accidental Death and Dismemberment Insurance. This type of insurance typically reimburses you for medical costs resulting from accidents. Benefits are paid to your beneficiaries if you die. Premiums are usually low, and no medical exam is required.

How Medicare works with other insurance

Learn how benefits are coordinated when you have Medicare and other health insurance.

Retiree insurance

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

What's Medicare Supplement Insurance (Medigap)?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

When can I buy Medigap?

Get the facts about the specific times when you can sign up for a Medigap policy.

How to compare Medigap policies

Read about different types of Medigap policies, what they cover, and which insurance companies sell Medigap policies in your area.

Medigap & travel

Read about which Medigap policies offer coverage when you travel outside the United States (U.S.).

What is Medicare Supplement Insurance Plan?

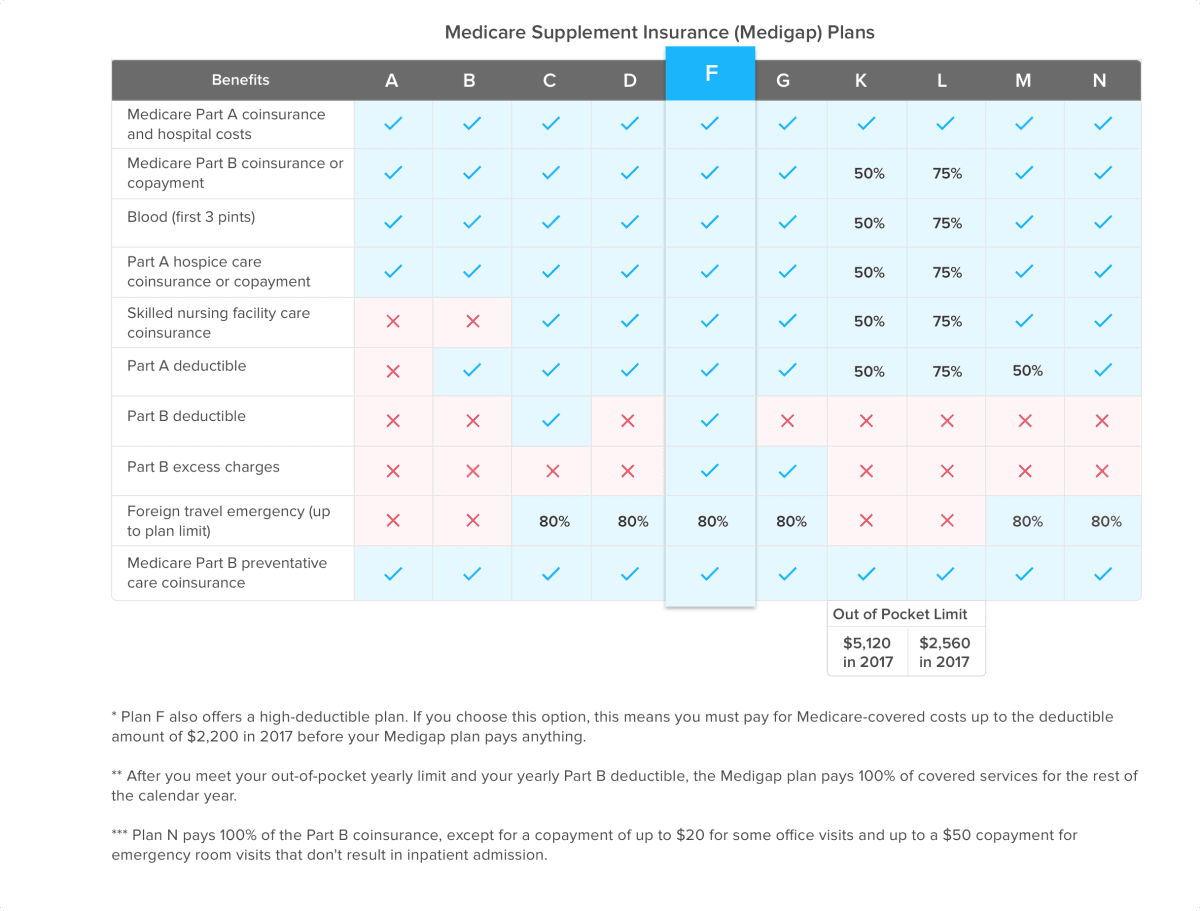

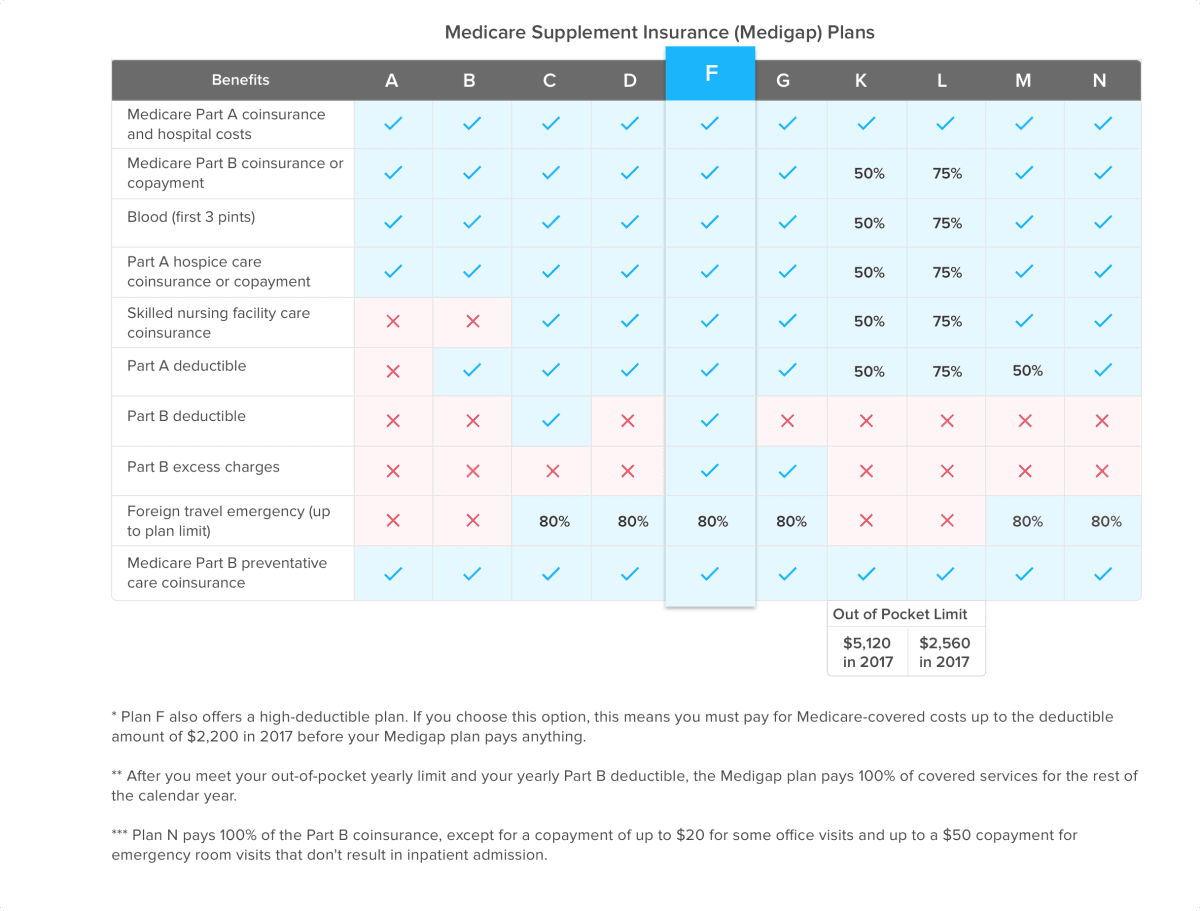

What Is a Medicare Supplement Insurance Plan? A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits. Use the following guide to compare Medicare ...

Which is the most popular Medicare Supplement?

Medigap Plan F Is the Most Popular. Medicare Supplement Insurance Plan F is the most popular Medigap plan, largely because it offers the most comprehensive range of basic benefits. Plan F is the only Medigap plan that covers all nine of the basic Medigap benefits, including the Medicare Part B deductible and Part B excess charges.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When is the best time to buy Medicare Supplement?

The best time to buy a Medicare Supplement Insurance plan is during your Medigap open enrollment period. During your open enrollment period, insurance companies cannot consider any pre-existing conditions when deciding whether or not to offer you a policy. They also cannot charge you more for a Medigap plan based on pre-existing conditions.

Does Medicare Supplement Insurance require coinsurance?

Medicare Supplement Insurance Plans. Medicare Part A and Part B both require deductibles and coinsurance or copays. Medigap plans help beneficiaries fill in these cost "gaps" that can add up to potentially large dollar amounts. The chart below lists the basic benefits offered by each type of Medigap plan. Click here to view enlarged chart.

What is Medicare Supplement Insurance?

Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation. Combine this with the fixed income that so many seniors find themselves on, ...

How much does Medicare Supplement cover?

Choosing Medicare Supplement insurance can help. It can cover up to 100% of out-of-pocket costs, depending on the plan. One out of every three Original Medicare beneficiaries — over 13 million seniors — have chosen to do so. 1.

What is the deductible for hospitalization in 2020?

You are responsible for the balance (or coinsurance). In 2020, the Part A deductible for hospitalization is $1,408 per benefit period and the Part B annual deductible is $198. 3. Medicare Supplement insurance is designed to help cover these out-of-pocket deductibles and coinsurance.

How long is the open enrollment period for Medicare?

The Medigap Open Enrollment Period covers six months. It starts the month you are 65 or older and are enrolled in Medicare Part B. In this period, no insurer offering supplemental insurance in your state can deny you coverage or raise the premium because of medical conditions.

How many separate insurance plans are there?

Premiums for the same policy can vary between insurance companies. But, only the quoted price and the reputation of the insurer will vary. There are ten separate plans, labeled A through N. Two plans, C and F, are no longer offered to newly eligible beneficiaries.

What is Part B deductible?

After that, you pay daily coinsurance amounts, depending on the length of your stay. Part B also has an annual deductible. Once you reach it, Part B covers 80% of eligible doctor-related, testing and medical-equipment expenses. You are responsible for the balance (or coinsurance).

Does Medicare Supplement cover all costs?

Original Medicare does not cover all costs. Medicare Supplement insurance, or Medigap, can cover what Medicare does not. Private insurance companies – vetted by the federal government – offer it to help manage out-of-pocket expenses. These policies do not add coverage.

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

How long does a Supplement 1 plan cover?

The Supplement 1 plan covers 120 days of mental health hospitalization and the state-mandated benefits, plus the deductibles for Medicare Part A and Part B, co-insurances for services at a skilled nursing facility under Part A, and emergency medical costs when traveling outside of the U.S.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”