...

Percentage of people covered by Medicare in the United States from 1990 to 2020.

What percent of wages goes to Medicare?

Sep 24, 2021 · As of 2020, approximately 18 percent of the U.S. population was covered by Medicare, a slight increase from the previous year. As of 2019, California, Florida, and Texas …

What percent of Americans want Medicare for all?

Nonetheless, nearly 16% of its massive population of 39.5 million has Medicare, totaling about 6.3 million individuals. With Texas as the second most populous U.S. state, as of 2019, roughly …

What percentage of gross pay is withheld for Medicare?

The Henry J. Kaiser Family Foundation Headquarters: 185 Berry St., Suite 2000, San Francisco, CA 94107 | Phone 650-854-9400 Washington Offices and Barbara Jordan Conference Center: …

What percentage of your check goes to Medicare?

May 02, 2019 · How much US residents spend on health care. According to BLS, U.S. residents in the country's lowest income decile spend 35% of their pre-tax incomes on health care, …

How many people are on Medicare in 2019?

In 2019, over 61 million people were enrolled in the Medicare program. Nearly 53 million of them were beneficiaries for reasons of age, while the rest were beneficiaries due to various disabilities.

Which state has the most Medicare beneficiaries?

With over 6.1 million, California was the state with the highest number of Medicare beneficiaries . The United States spent nearly 800 billion U.S. dollars on the Medicare program in 2019. Since Medicare is divided into several parts, Medicare Part A and Part B combined were responsible for the largest share of spending.

When was Medicare introduced?

Get in touch with us now. , May 15, 2020. Medicare is a federal social insurance program and was introduced in 1965 . Its aim is to provide health insurance to older and disabled people. In 2018, 17.8 percent of all people in the United States were covered by Medicare.

What is Medicare insurance?

Medicare is a federal social insurance program and was introduced in 1965. Its aim is to provide health insurance to older and disabled people. In 2018, 17.8 percent of all people in the United States were covered by Medicare. Unlike Medicaid, Medicare is not bound to lower incomes or a certain state of poverty.

Which state has the highest Medicare enrollment?

With over 6.1 million, California was the state with the highest number of Medicare beneficiaries .

What is Medicare 2020?

Research expert covering health, pharma & medtech. Get in touch with us now. , May 15, 2020. Medicare is a federal social insurance program and was introduced in 1965. Its aim is to provide health insurance to older and disabled people. In 2018, 17.8 percent of all people in the United States were covered by Medicare.

Which state has the most Medicare?

Of course, California holding the title of most populous state translates to a higher Medicare population. Nonetheless, nearly 16% of its massive population of 39.5 million has Medicare, totaling about 6.3 million individuals. With Texas as the second most populous U.S. state, as of 2019, roughly 14% of Texas’ population has Medicare.

How many people in Texas have Medicare?

Nonetheless, nearly 16% of its massive population of 39.5 million has Medicare, totaling about 6.3 million individuals. With Texas as the second most populous U.S. state, as of 2019, roughly 14% of Texas’ population has Medicare. By comparison, the state of Maine has over 25% of its population on Medicare.

How to contact Medicare by phone?

Contact us by phone! Dial (800) 950-0608 with your Medicare questions. With the aim of helping older Americans buy health insurance, Medicare became part of President Lyndon B. Johnson’s “Great Society” vision created in 1965. Although Medicare eligibility has nothing to do with income levels, it can provide healthcare both for Americans ...

What is the number to call for Medicare?

Dial (800) 950-0608 with your Medicare questions. With the aim of helping older Americans buy health insurance, Medicare became part of President Lyndon B. Johnson’s “Great Society” vision created in 1965. Although Medicare eligibility has nothing to do with income levels, it can provide healthcare both for Americans with disabilities as well as ...

How many people are on medicare in 2020?

About 19 million people enrolled when Medicare first started. By 2020, that number grew to nearly 63 million. Overall, how many people per state enroll in Medicare?

What is Medicare health plan?

As often as monthly, the Centers for Medicare and Medicaid Services keep tabs on trends in the Medicare population by: Generally meant by the term Medicare health plan are Medicare-approved health insurance products that works in addition to having Original Medicare.

What is Medicare Advantage?

As a means of getting benefits that can exceed Medicare, you can choose from Medicare health plans: Medicare Advantage (Part C) – Private companies enter contracts with Medicare to offer Part A and Part B benefits, and often more.

How many people are covered by Medicare?

Published: Aug 20, 2019. Medicare, the federal health insurance program for more than 60 million people ages 65 and over and younger people with long-term disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the most recent historical ...

How much did Medicare pay in 2018?

In 2018, Medicare benefit payments totaled $731 billion, up from $462 billion in 2008 (Figure 2) (these amounts do not net out premiums and other offsetting receipts). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased from 50 percent to 41 percent, spending on Part B benefits (mainly physician services and hospital outpatient services) increased from 39 percent to 46 percent, and spending on Part D prescription drug benefits increased from 11 percent to 13 percent.

Is Medicare spending comparable to private health insurance?

Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Is Medicare spending going up?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis. According to CBO’s most recent long-term projections, net Medicare spending will grow from 3.0 percent of GDP in 2019 to 6.0 percent in 2049.

Does Medicare Advantage cover Part A?

Medicare Advantage plans, such as HMOs and PPOs, cover Part A, Part B, and (typically) Part D benefits. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium, and may pay an additional premium if required by their plan; about half of Medicare Advantage enrollees pay no additional premium.

How much US residents spend on health care

According to BLS, U.S. residents in the country's lowest income decile spend 35% of their pre-tax incomes on health care, compared with 3.5% of U.S. residents in the country's highest income decile.

Trends could be fueling push for 'Medicare-for-All'

Gary Claxton, Bradley Sawyer, and Cynthia Cox, who authored the KFF report, said these trends could be part of "what is fueling interest in proposals like Medicare for All and options for employers and/or workers to buy into Medicare."

Health Insurance 101: Get the slide decks

Confused about the U.S. health insurance system? You're not alone—it's one of the most complicated systems in the world. If you missed our recent webconference series diving deep into the system, don't worry; we've got you covered.

What does Medicare cover?

Medicare coverage: what costs does Original Medicare cover? Here’s a look at the health-care costs that Original Medicare (Part A and Part B) may cover. If you’re an inpatient in the hospital: Part A (hospital insurance) typically covers health-care costs such as your care and medical services. You’ll usually need to pay a deductible ($1,484 per ...

Does Medicare Advantage work?

To answer that question, here’s a quick rundown on how the Medicare Advantage (Medicare Part C) program works. When you have a Medicare Advantage plan, you still have Medicare – but you get your Medicare Part A and Part B benefits through the plan, instead of directly from the government.

Does Medicare cover prescription drugs?

Medicare Part A and Part B don’ t cover health-care costs associated with prescription drugs except in specific situations. Part A may cover prescription drugs used to treat you when you’re an inpatient in a hospital. Part B may cover medications administered to you in an outpatient setting, such as a clinic.

Does Medicare Supplement cover Part A and Part B?

If you’re concerned about how much Original Medicare (Part A and Part B) doesn’ t typically cover, you might want to learn about Medicare Supplement (Medigap) insurance. This type of insurance works alongside your Original Medicare coverage. Medicare Supplement insurance plans typically help pay for your Medicare Part A and Part B out-of-pocket ...

Does Medicare cover out of pocket expenses?

Unlike Original Medicare, Medicare Advantage plans have annual out-of-pocket spending limits. So, if your Medicare-approved health -care costs reach a certain amount within a calendar year, your Medicare Advantage plan may cover your approved health-care costs for the rest of the year. The table below compares health-care costs ...

How long do you have to pay coinsurance?

You pay this coinsurance until you’ve used up your “lifetime reserve days” (you get 60 altogether). After that, you typically pay all health-care costs. *A benefit period begins when you’re admitted as an inpatient. It ends when you haven’t received inpatient care for 60 days in a row.

What does Part B cover?

Part B typically covers certain disease and cancer screenings for diseases. Part B may also help pay for certain medical equipment and supplies.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

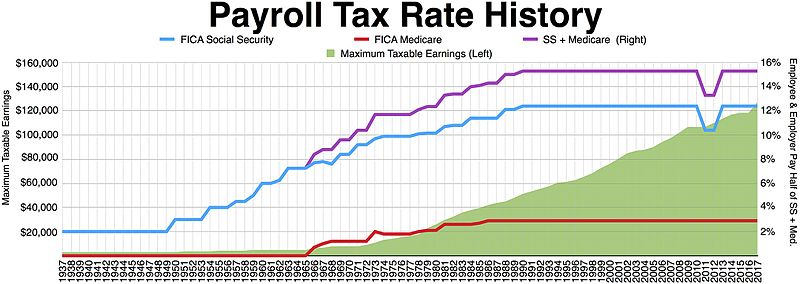

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

How much is Medicare Part A deductible?

– Initial deductible: $1,408.

What is Medicare Advantage?

Medicare Advantage (MA): Eligibility to choose a MA plan: People who are enrolled in both Medicare A and B, pay the Part B monthly premium, do not have end-stage renal disease, and live in the service area of the plan. Formerly known as Medicare+Choice or Medicare Health Plans.

Summary

Health

Cost

Causes

- Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care …

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future inc...

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…