Is Medicare free for seniors, the disabled and retirees?

Since Medicare pays first after you retire, your retiree coverage is likely to be similar to coverage under Medicare Supplement Insurance (Medigap). Retiree coverage isn't the same thing as a Medigap policy but, like a Medigap policy, it usually offers benefits that fill in some of Medicare's gaps in coverage—like

Can you get Medicare at 62?

Your Medicare eligibility date, however, is later. You are eligible to sign up for both Medicare Part A and Part B at age 65, regardless of whether you have signed up for retirement income benefits yet. When you enroll in Social Security does, however, affect whether your Medicare enrollment is automatic or requires you to take action.

Who doesn't qualify for Medicare?

Beneficiaries Who Don't Qualify for Medicare Part A

- Single, Never Married. Take your Notice of Award, Disapproved Claim or both to your local ID card office to update your...

- Widow/Widower. Apply for Medicare Part A under your deceased spouse’s social security number. You'll get a Notice of...

- Married/Divorced: Spouse Age 62 or Older. Apply for Medicare under your...

Do seniors pay for Medicare?

Senior Citizens on Social Security in the U.S. have to pay for Medicare while "illegal immigrants" get it for free. In May and June 2019, a misleading but widely seen meme about immigrants and Medicare benefits continued to circulate on Facebook:

What makes you not eligible for Medicare?

Did not work in employment covered by Social Security/Medicare. Do not have 40 quarters in Social Security/Medicare-covered employment. Do not qualify through the work history of a current, former, or deceased spouse.

Does everyone automatically get Medicare at 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Does everyone get Medicare regardless of income?

Medicare is available to all Americans who are age 65 or older, regardless of income. However, your income can impact how much you pay for coverage. If you make a higher income, you'll pay more for your premiums, even though your Medicare benefits won't change.

Do all retired people get Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

What happens if you don't enroll in Medicare Part A at 65?

The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled. For example, suppose that: You were eligible for Medicare in 2020, but you didn't sign up until 2022.

How do you pay for Medicare Part B if you are not collecting Social Security?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

Can you be denied Medicare?

In all but four states, insurance companies can deny private Medigap insurance policies to seniors after their initial enrollment in Medicare because of a pre-existing medical condition, such as diabetes or heart disease, except under limited, qualifying circumstances, a Kaiser Family Foundation analysis finds.

Can my wife get Medicare if she never worked?

Can I Get Medicare If I've Never Worked? If you've never worked, you may still qualify for premium-free Medicare Part A. This is based on your spouse's work history or if you have certain medical conditions or disabilities. It's also possible to get Medicare coverage if you pay a monthly Part A premium.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

What is full retirement age?

Full retirement age is the age when you can start receiving your full retirement benefit amount. The full retirement age is 66 if you were born from 1943 to 1954. The full retirement age increases gradually if you were born from 1955 to 1960, until it reaches 67.

What is the eligibility criteria for Medicaid?

Medicaid beneficiaries generally must be residents of the state in which they are receiving Medicaid. They must be either citizens of the United States or certain qualified non-citizens, such as lawful permanent residents. In addition, some eligibility groups are limited by age, or by pregnancy or parenting status.

Who qualifies for Medicaid?

Those who earn more than 150% of the federal poverty level must pay a monthly premium to purchase Medicaid coverage. Income limits: income limits change annually and are determined by the Social Security Administration.

Health insurance for seniors without Medicare is possible, although there are certain details you should know about when looking

There’s no way to overstate the fact that healthcare is enormously expensive and near impossible for most people to access without the help of an insurance plan. That’s why understanding how to find health insurance for seniors without Medicare is critically important.

5 Best Stocks to Buy in February

Find out which stocks you should buy this month to make money in this volatile market.

Learn from Expert Analyst Nancy Zambell

Nancy Zambell has spent 30 years educating and helping individual investors navigate the minefields of the financial industry. As a lecturer and educator, Nancy has led seminars for individual investors at the National Association of Investors, Investment Expo and the Money Show.

How many people are covered by medicaid?

Medicaid also provides coverage to 4.8 million people with disabilities who are enrolled in Medicare.

Can you be covered by Medicare and Medicaid?

Individuals who are enrolled in both Medicaid and Medicare, by federal statute, can be covered for both optional and mandatory categories.

Can Medicare help with out of pocket medical expenses?

Medicare enrollees who have limited income and resources may get help paying for their premiums and out-of-pocket medical expenses from Medicaid (e.g. MSPs, QMBs, SLBs, and QIs).

What happens if you don't enroll in tricare?

However, you losing your creditable coverage should trigger a special enrollment period for Part B (generally people would have Part B and TRICARE, but if TRICARE was considered creditable coverage for you, then it shouldn’t be the case).

Does a woman with no work credit qualify for Medicare?

She does not have enough work credits to qualify for social security which means she will not qualify for Medicare either. She does not want to purchase medicare because she does not have any income other than a small monthly SSI check and the monthly premiums for Medicare are too high.

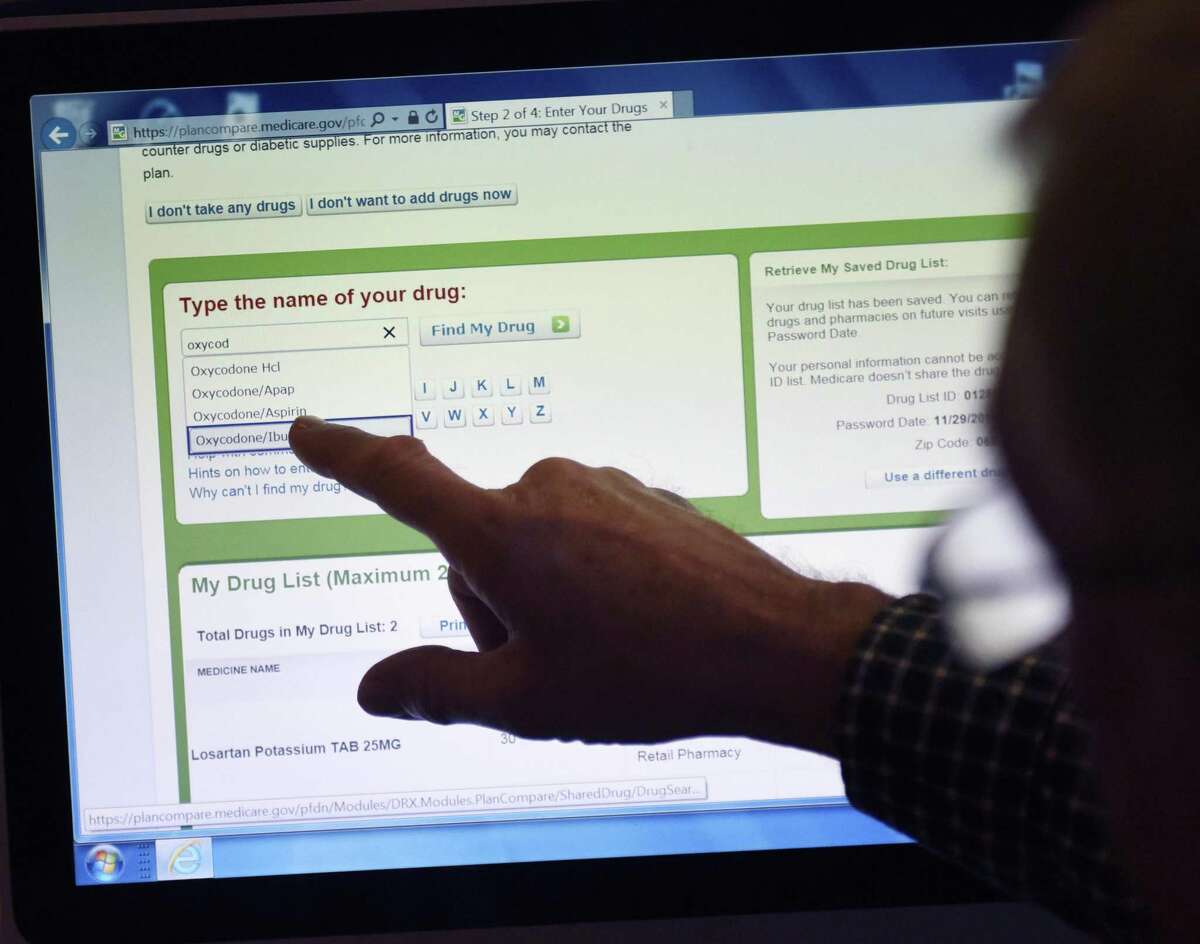

Is Medicare.Gov a good place to start?

If you are Medicare age a great place to start your journey is Medicare .Gov, if not then Healthcare.gov is best. It isn’t that these are your only options, it is that this is a good place to start when you are confused. Enrolling in Medicare is a little complex and must be done during open enrollment periods.

Can I get marketplace insurance if I qualify for Medicare?

If you qualify for Medicare then you can’t get marketplace insurance. One can however apply for assistance via Medicare. https://www.medicare.gov/your-medicare-costs/get-help-paying-costs. Reply. Anne McDannels on June 9, 2021. I am a senior and didn’t take part b medicare as I was still covered by Tricare Prime.

Can you sell a non-Medicare plan on the Marketplace?

IMPORTANT: If you do have access to Medicare, it is illegal for someone to sell you a non-Medicare health plan and you won't be able to shop on the Marketplace.

Can you replace ACA health insurance with other coverage?

If you have retiree health benefits you’re considered covered under the ACA and won't be penalized. You can replace that coverage with other coverage. However, if your retirement coverage is considered affordable and meets certain minimum standards, or if you are eligible for Medicare but have chosen not to enroll, ...

What is the income limit for seniors in 2020?

In 2020, that means an annual income of no more than $49,960 for a single individual and $67,640 per year for a couple.

How much does a 62 year old woman have to pay for health insurance?

For example, a 62-year-old woman living in Charlottesville, Virginia, and earning $50,000 a year (slightly over 400% of the federal poverty level) would have to pay, at a minimum, a premium of $797 per month, or nearly 20% of her income, for a bronze plan purchased through Virginia’s health insurance exchange.

What are the best health insurance plans?

But it is possible to get adequate coverage without spending a lot on monthly premiums and other costs. Your options include: 1 Private insurance (through your employer or purchased on your own) 2 COBRA 3 Affordable Care Act (Obamacare) plans 4 Short-term health insurance 5 Association health plans

What are the pros and cons of short term health insurance?

There are pros and cons to short-term health insurance: These plans don’t cover preexisting conditions or all of the essential health benefits that ACA plans do. Your medical history can affect coverage, and these policies limit how much they pay in benefits. 7. Kaiser Family Foundation.

How much would a woman get if she earned $48,000?

However, if she earned $48,000 instead, she would qualify for $689 per month in premium subsidies. That would allow her to buy the least expensive bronze plan for $108 per month. She could also get a silver plan for $345 per month. You can get quotes for ACA plans, with and without premium subsidies, at healthcare.gov.

How much money do seniors withdraw from their savings?

In recent years, many older Americans have struggled with these rising costs; one 2019 report found that seniors withdrew an estimated $22 billion from their long-term savings in the previous 12 months to pay for healthcare. 1. Gallup.

Can a health insurance company refuse to cover a person?

Under the Affordable Care Act (ACA), a health insurance company cannot refuse to cover a person or charge them more because they have a preexisting condition, meaning a health issue that existed before the start date of new healthcare coverage. 2. U.S. Department of Health and Human Services.

Though Medicare eligibility begins at 65, that's not necessarily the ideal age to sign up

For many people, turning 65 is a big milestone, and understandably so. In fact, age 65 is when you're first allowed to get coverage under Medicare.

1. You're still working and have access to a group health plan

Just because you're turning 65 doesn't mean you're on the cusp on retirement. You may still have plans to work another few years -- or longer.

2. You're retired but are still covered under your spouse's group health plan

The penalties that come with not enrolling in Medicare on time only apply if you don't have access to an eligible group health plan. It may be the case that you're retired and don't have employer benefits at all.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.