To determine if a claim is appealable, locate the claim-specific group reason codes, such as claim adjustment reason code (CARC) and remittance advice remark code (RARC) on the electronic remittance advice (ERA) or standard paper remittance (SPR).

Full Answer

What are the different codes used on an RA?

Three different sets of codes are used on an RA: reason codes, group codes and Medicare-specific remark codes and messages. Medicare-Specific Remark Codes - Convey information about remittance processing or to provide a supplemental explanation for an adjustment already described by a claim adjustment reason code.

How do I determine if a claim is appealable?

To determine if a claim is appealable, locate the claim-specific group reason codes, such as claim adjustment reason code (CARC) and remittance advice remark code (RARC) on the electronic remittance advice (ERA) or standard paper remittance (SPR).

What are remark codes and reason codes?

Medicare-Specific Remark Codes - Convey information about remittance processing or to provide a supplemental explanation for an adjustment already described by a claim adjustment reason code. Reason Codes - Explain why a claim was not paid or how claim was paid.

What is a remark code for Medicare?

Medicare-Specific Remark Codes - Convey information about remittance processing or to provide a supplemental explanation for an adjustment already described by a claim adjustment reason code. Each RA remark code identifies a specific message as shown in RA remark code list

What is the difference between reason codes and remark codes?

Claim Adjustment Reason Codes explain why a claim was paid differently than it was billed. Remittance Advice Remark Codes provide additional information about an adjustment already described by a CARC and communicate information about remittance processing.

What are reason codes?

Reason codes, also called score factors or adverse action codes, are numerical or word-based codes that describe the reasons why a particular credit score is not higher. For example, a code might cite a high utilization rate of available credit as the main negative influence on a particular credit score.

What are claim adjustment reason codes?

Claim Adjustment Reason Codes (CARC) Every adjudicated claim submitted to ProviderOne that has been finalized will have a Claim Adjustment Reason Code (CARC) applied to the claim or to each claim line. The CARC may be an informational code or may be an encompassing denial code.

What is Adjustment Reason code 18?

A: You will receive this reason code when more than one claim has been submitted for the same item or service(s) provided to the same beneficiary on the same date(s) of service. • QA18 = Exact duplicate claim/service.

What is reason code A1?

Description. Reason Code: A1. Claim/Service denied. At least one Remark Code must be provided (may be comprised of either the NCPDP Reject Reason Code, or Remittance Advice Remark Code that is not an ALERT.) Remark Code: N370.

What is Reason code 23?

Change Request (CR) 8297, from which this article is taken, modifies Medicare claims processing systems to use Medicare Claim Adjustment Reason Codes (CARC) 23 to report impact of prior. payers' adjudication on Medicare payment in the case of a secondary claim.

How often are claim adjustment reason codes and remark codes updated?

Claim adjustment reason codes and remark codes are updated three times each year.

What does Adjustment reason code 45 mean?

45 Charge exceeds fee schedule/maximum allowable or contracted/legislated fee arrangement.

What is reason code B4?

Charges that have not been paid by Medicare and/or are not included in a. Late filing penalty (reason code B4)

What is reason code 015?

Reason Code 15: Duplicate claim/service. This change effective 1/1/2013: Exact duplicate claim/service. Reason Code 16: This is a work-related injury/illness and thus the liability of the Worker's Compensation Carrier. Reason Code 17: This injury/illness is covered by the liability carrier.

What does PR 242 mean?

242 Services not provided by network/primary care providers. Reason for this denial PR 242: If your Provider is Not Contracted for this member's plan. Supplies or DME codes are only payable to Authorized DME Providers. Non- Member Provider.

What does denial code B15 mean?

Comprehensive Coding Initiative Edit Denial Information CO-B15: Payment adjusted because this procedure/service requires that a qualifying service/procedure be received and covered. The qualifying other service/procedure has not been received/adjudicated.

What is a Medicare specific remark code?

Medicare-Specific Remark Codes - Convey information about remittance processing or to provide a supplemental explanation for an adjustment already described by a claim adjustment reason code. Each RA remark code identifies a specific message as shown in RA remark code list

What is a reason code?

Reason Codes - Explain why a claim was not paid or how claim was paid. Also show reason for any claim financial adjustments, such as denials, reductions or increases in payment

What is ERA 835?

EDISS - Electronic Remittance Advice (ERA) 835 - Electronic version of SPR. Serves as a notice of payments and adjustments sent to providers, billers and suppliers. Explains reimbursement decisions of payer

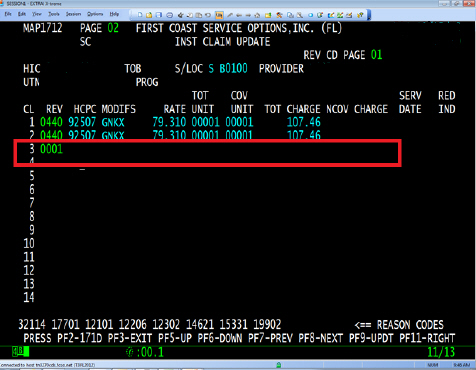

What is the frequency code of an adjusted claim?

An adjusted claim contains frequency code equal to a ‘7’, ‘Q’, or ‘8’, and there is no claim change reason code (condition code D0, D1, D2, D3, D4, D5, D6, D7, D8, D9, or E0.

When is condition code A6 required?

Condition code 'A6' is required when billing the influenza or pneumococcal vaccine (s) and/or administration.

What is the NPI of a service line?

The service line contains a line level rendering physician NPI but the first digit of the NPI is not equal to 1 or the 10th digit of the NPI does not follow the check digit validation routine.

What is non-covered revenue code?

A non-covered revenue code is shown on the claim with covered charges greater than $0.00.

How long does Medicare have to submit a claim?

The claim was not submitted timely. Medicare regulations require claims to be submitted within one year of the date of service (through ‘To’ date of service on the claim).

What is missing in a CPT code?

A principal procedure code or a surgical CPT/HCPCS code is present, but the operating physician's National Provider Identifier (NPI), last name, and/or first initial is missing.

Is the revenue code valid for Medicare?

The revenue code is not valid for this type of bill, or the covered charges are not valid for this type of bill, or services not covered by Medicare.

Why is my claim denied with reason code 37236?

Claims are denied with reason code 37236 when the NPI and/or physician’s last name submitted on the home health claim does not match the physician’s information at the Provider Enrollment, Chain, and Ownership System (PECOS).

What is the reason code for hospice election?

When another hospice NOE is submitted that overlaps the election/benefit period posted to CWF, including a duplicate NOE, the NOE will receive reason code U5106.

What is the fifth position of the HIPPS code?

A home health final claim was received, and the fifth position of the HIPPS code billed contains the letters S, T, U, V, W, or X, but supply revenue codes are not present on the claim.

When do you report HCPCS code Q5001?

Due to data reporting requirements in Change Request 8136, for home health final claims beginning on or after July 1, 2013, home health agencies must report the HCPCS code Q5001, Q5002, or Q5009 to indicate the location of where services were provided.

What is the OC code for hospice?

Hospices use occurrence code (OC) 27 and the date on all notices of election (NOEs) and initial claims following a hospice election. OC 27 and the date are also required on all subsequent claims when the claim's dates of service overlap the first day of the next benefit period. When OC 27 is required, but not reported, or does not include the correct date, the NOE or claim will receive this reason code.

When is the 8XB code assigned to hospice bills?

This reason code is assigned to hospice 8XB or 8XD type of bills when the start date falls within a previously established hospice election period.

How to verify beneficiary MBI?

Changes to a beneficiary's MBI may occur. Verify the MBI using the MBI look-up tool via myCGS. Refer to the myCGS MBI Look-up Tool for details on how to verify the MBI. If the MBI has changed, update Item M0063 on the OASIS and resubmit the claim.

Why is PR B9 not covered?

PR B9 Services not covered because the patient is enrolled in a Hospice.

Why is the 30 payment adjusted?

30 Payment adjusted because the patient has not met the required eligibility, spend down, waiting, or residency requirements.

What is PR 1?

PR 1 Deductible Amount Member’s plan deductible applied to the allowable benefit for the rendered service (s).

Is a referring provider eligible to refer?

52 The referring/prescribing/rendering provider is not eligible to refer/prescribe/order/perform the service billed.

Is a 47 diagnosis covered?

47 This (these) diagnosis ( es) is ( are) not covered, missing, or are invalid.

Is PR 168 denied as service?

PR 168 Payment denied as Service (s) have been considered under the patient's medical plan. Benefits are not available under this dental plan

Is PR 32 an eligible dependent?

PR 32 Our records indicate that this dependent is not an eligible dependent as defined.

What is the first level of appeal?

The first level of appeal is a redetermination. Please use the Medicare Part A redetermination and clerical error reopening form when requesting a redetermination.

What is Medicare reconsideration?

Reconsideration is the second level of appeal. If you do not agree with the outcome of a redetermination, you may request a 'reconsideration' with the qualified independent contractor. Please refer to the Tutorial: How to complete the Medicare reconsideration request form (CMS-20033) for instructions and mailing information.

How to verify redetermination request?

To verify the status of your redetermination request, you may use the appeals inquiry status tool or Novitasphere ( JH ) ( JL)

What is a CMS clerical error?

CMS defines clerical errors (including minor errors or omissions) as human or mechanical errors on the part of the party or the contractor, such as:

What should a complete copy of a claim include?

Complete copies should include specific records to support the services on the claim (s) you are appealing and, as applicable, the following:

When requesting a clerical error reopening, please be sure to give a clear and?

When requesting a clerical error reopening, please be sure to give a clear and accurate description of what is to be changed on the claim and send in a corrected UB-04 claim form.

Does reopening a case delay the appeal?

Requesting a reopening does not delay the timeframe to request an appeal.