- Medicare Part B premiums are often taken out of a recipient’s Social Security income.

- If Medicare premiums increase, a hold harmless provision protects recipients to ensure that any cost of living adjustment won’t be wiped out.

- There are exceptions to the protections that hold harmless provisions provide.

What is Medicare's "hold harmless" rule?

Medicare Hold Harmless Provision Understanding the Medicare Hold Harmless Provision. The Medicare hold harmless provision stems from a statutory restriction that prevents Medicare from raising most Social Security recipients' Medicare Part B premiums by ... Requirements for the Hold Harmless Provision. ... Special Considerations. ...

Which part of Medicare requires premium payment?

- Social Security

- Railroad Retirement Board

- Office of Personnel Management

How much is part a Medicare premium?

Medicare’s “Part B” outpatient premium will jump by $21.60 next year, one of the largest increases ever. Officials said Friday a new Alzheimer’s drug is responsible for about half of that. The increase guarantees that health care will gobble up a ...

Can I avoid paying more in Medicare premiums?

You may pay more for your premiums based on your level of income. If you have limited income, you might qualify for assistance in paying Medicare premiums. Medicare is available to all Americans who are age 65 or older, regardless of income.

What is the hold harmless provision for Medicare?

Do you have to pay out of your Social Security for Medicare Part B?

About this website

What is the hold harmless rule in Social Security?

There is a special rule for Social Security recipients, called the "hold harmless rule," that ensures that Social Security checks will not decline from one year to the next because of increases in Medicare Part B premiums. The hold harmless rule applies to most, but not all, Social Security recipients.

Are Medicare Part B premiums locked in?

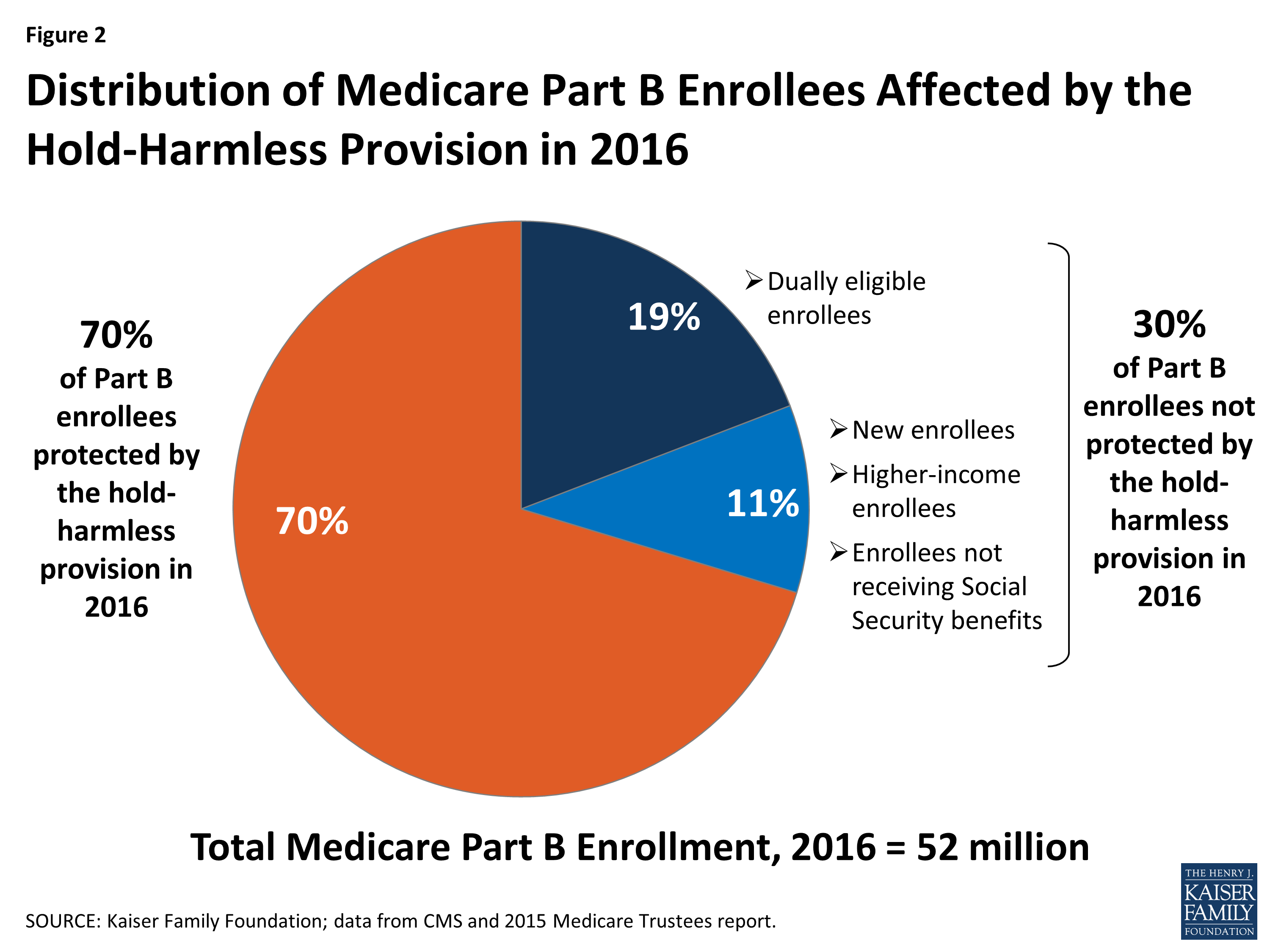

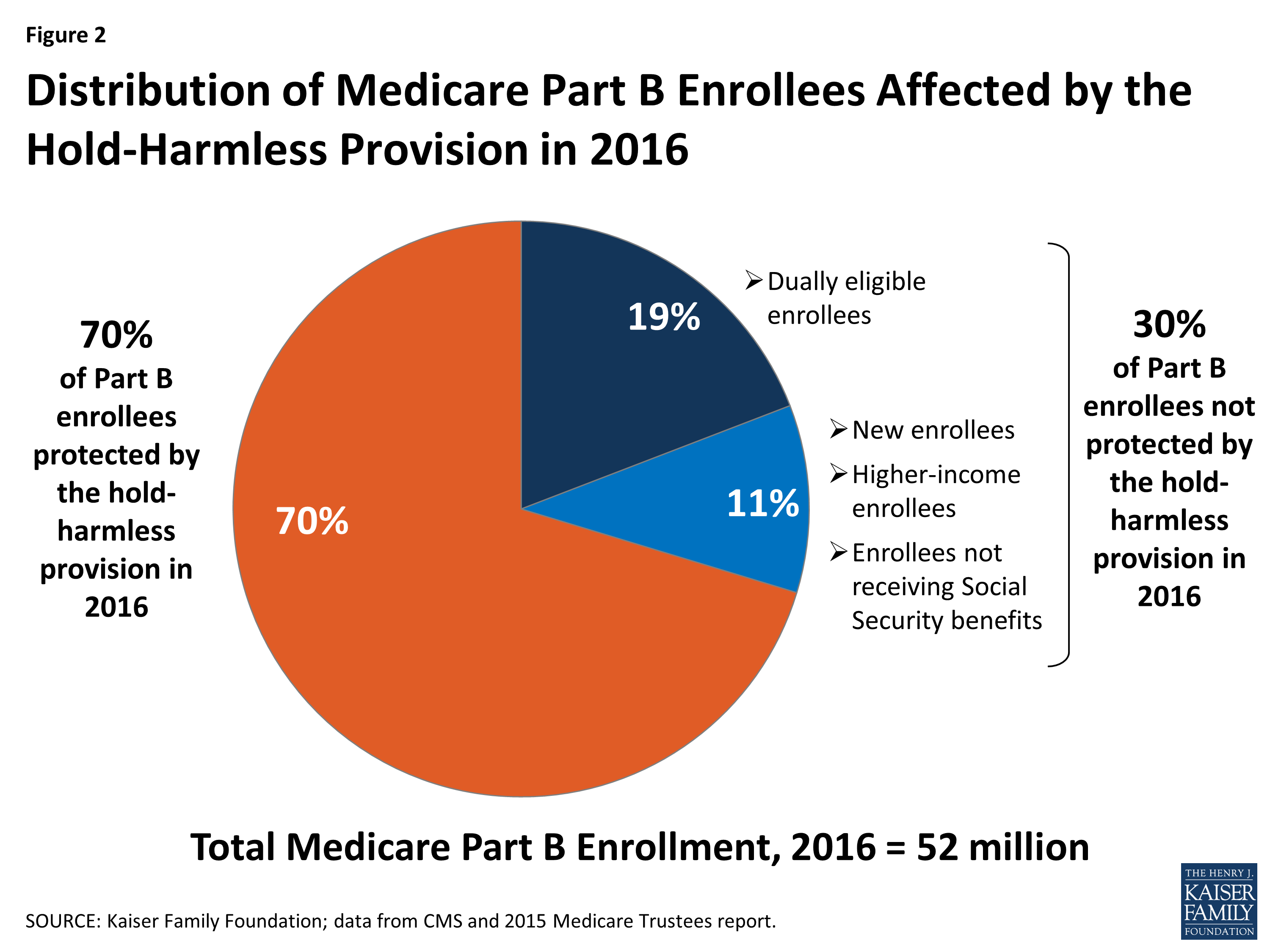

This is called the “hold harmless” provision, and it protects about 70 percent of Medicare beneficiaries from having to pay the full amount of the Part B premium increase in years when the COLA wouldn't be enough to cover the premium hike.

Why is my Part B premium so high?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What will the Medicare Part B premium be in 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

Why is Medicare Part B so expensive?

Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

At what income do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

Will Social Security Benefits Decrease if Medicare Premiums Goes Up?

For most Social Security recipients, no. That’s due to the “hold harmless” provision of the Social Security Act, which prevents Social Security payments from going down because Medicare premiums go up.

Cost-Increase Looms as 2022 Medicare Open Enrollment Period Approaches

During the period beginning October 15 of this year and ending December 7, U.S. seniors will be able to enroll in or alter their Medicare coverage for 2022. Among the changes facing enrollees ...

Column: Why is my Medicare Part B premium more than my husband’s?

Sue: I am at the end of my Medicare rope! In 2016 (and previously), both mine and my spouse’s Medicare Part B insurance premiums, which are deducted from Social Security, have been the same ...

What is the hold harmless provision for Medicare?

The Medicare hold harmless provision stems from a statutory restriction that prevents Medicare from raising most Social Security recipients’ Medicare Part B premiums by more than the cost of living adjustment (COLA) provided by Social Security in a given year. The administration calculated the adjustment for 2021 at 1.3%. 1

Do you have to pay out of your Social Security for Medicare Part B?

To qualify for reduced payments under this provision, you must receive Social Security benefits and have Part B premiums paid out of those benefits for at least two months in the previous year. Those who make payments for Part B insurance directly to Medicare and those who have premiums paid by Medicaid do not qualify and, as a result, may be subject to higher premiums. 2

How to qualify for hold harmless?

To qualify for the hold harmless provision, you must: Receive Social Security benefits or be entitled to Social Security benefits for November and December of the current year. Have your Medicare Part B premiums for December and January deducted from your monthly benefits.

Why do people pay Medicare premiums?

Most people with Medicare will pay the new premium amount because the increase in their benefit amount will cover the increase. However, a small number of people will see little or no increase in their Part B premium — and their Social Security benefit checks will remain the same — because the amount of their cost-of-living adjustment isn’t large ...

Does Social Security reduce Medicare?

Social Security works together with the Centers for Medicare & Medicaid Services to make sure you won’t have a reduction in your Social Security benefits as a result of Medicare Part B premium increases.

Does hold harmless apply to Part B?

The hold harmless provision does NOT apply to you if: You enroll in Part B for the first time in 2021. You pay an income-related monthly adjustment amount premium. You are dually eligible for Medicaid and have your premium paid by a state Medicaid agency. You can learn more by visiting Medicare. Tags: Medicare.

What Is the Medicare Hold Harmless Provision?

What is the hold harmless provision in Medicare? It sounds like a fancy legal term, but it’s actually a simple protection put in place for recipients. It ensures that this year’s Medicare premium increases won’t completely eliminate the cost of living increase you received this year.

Hold Harmless Provision Requirements

Once you understand what the hold harmless agreement represents in Medicare, it’s time to look at some of the exceptions to the provision. In order to cap your Medicare increases, you have to meet the following criteria as a Social Security recipient:

Special Considerations

COLA has been pretty good to Social Security recipients in recent years. But it wasn’t too long ago that the economy was suffering, leading the COLA to fall to zero. In 2016, this was the case for only the third time in 40 years. The cost of Medicare for social security recipients had to stay stagnant because of the hold harmless provision.

Final Thoughts

Inflation is inevitable, but at least Social Security recipients know they’ll get a raise to compensate for it. Medicare premiums could increase, as well, though. Thanks to the hold harmless provision, Social Security recipients have the confidence of knowing they won’t lose money because premiums increased more than the cost of living.

What is the hold harmless provision for Medicare?

The Medicare hold harmless provision stems from a statutory restriction that prevents Medicare from raising most Social Security recipients’ Medicare Part B premiums by more than the cost of living adjustment (COLA) provided by Social Security in a given year. The administration calculated the adjustment for 2021 at 1.3%. 1

Do you have to pay out of your Social Security for Medicare Part B?

To qualify for reduced payments under this provision, you must receive Social Security benefits and have Part B premiums paid out of those benefits for at least two months in the previous year. Those who make payments for Part B insurance directly to Medicare and those who have premiums paid by Medicaid do not qualify and, as a result, may be subject to higher premiums. 2

What Is The Medicare Hold Harmless Provision?

- What is the hold harmless provision in Medicare? It sounds like a fancy legal term, but it’s actually a simple protection put in place for recipients. It ensures that this year’s Medicare premium increases won’t completely eliminate the cost of living increase you received this year. Here’s an example of the Medicare Part B hold harmless provision....

Hold Harmless Provision Requirements

- Once you understand what the hold harmless agreement represents in Medicare, it’s time to look at some of the exceptions to the provision. In order to cap your Medicare increases, you have to meet the following criteriaas a Social Security recipient: 1. You must have been entitled to benefits in both November and December of the current year. 2. Medicare Part B premiums mus…

Special Considerations

- COLA has been pretty good to Social Security recipients in recent years. But it wasn’t too long ago that the economy was suffering, leading the COLA to fall to zero. In 2016, this was the case for only the third timein 40 years. The cost of Medicare for social security recipients had to stay stagnant because of the hold harmless provision. As recently as 2016, 70 percent of enrollees di…

Final Thoughts

- Inflation is inevitable, but at least Social Security recipients know they’ll get a raise to compensate for it. Medicare premiums could increase, as well, though. Thanks to the hold harmless provision, Social Security recipients have the confidence of knowing they won’t lose money because premiums increased more than the cost of living. If you’re currently planning your retirement, a C…