Region 1: Escambia, Okaloosa, Santa Rosa and Walton Region 2: Bay, Calhoun, Franklin, Gadsden, Gulf, Holmes, Jackson, Jefferson, Leon, Liberty, Madison, Taylor, Wakulla, and Washington Region 3: Alachua, Bradford, Citrus, Columbia, Dixie, Gilchrist, Hamilton, Hernando, Lafayette, Lake, Levy, Marion, Putnam, Sumter, Suwannee, and Union

Full Answer

How many Medicare Advantage plans are there in Florida?

More than half of Florida Medicare beneficiaries select Medicare Advantage plans. Depending on where they live, some Florida residents can select from among fewer than 20 Medicare Advantage plans in 2022, while others have more than a100 plan options. Florida has a tool residents can use to compare prices on Medigap plans in each county.

What is the focus of Medicaid in Florida?

The focus will also be on long term care, whether that be at home, a nursing home, adult foster care, or assisted living. Medicaid in Florida is sometimes referred to as the Statewide Medicaid Managed Care (SMMC) program.

What are the different types of Medicare Part A?

1 Medicare Part A. Medicare Part A is hospital insurance. ... 2 Medicare Part B. Medicare Part B is medical insurance that covers everyday care needs like doctor’s appointments, urgent care visits, counseling, medical equipment, and preventive care. 3 Medicare Part C. Medicare Part C is also called Medicare Advantage. ... 4 Medicare Part D. ...

Are Florida seniors eligible for Medicaid long-term care?

All other health care services outside of long-term care are provided via the Managed Medical Assistance (MMA) program. The American Council on Aging now offers a free, quick and easy Medicaid eligibility test for seniors. There are several different Medicaid long-term care programs for which Florida seniors may be eligible.

What region is Florida in for Medicare?

Jurisdiction C is serviced by CGS and includes Alabama, Arkansas, Colorado, Florida, Georgia, Louisiana, Mississippi, New Mexico, North Carolina, Oklahoma, Puerto Rico, South Carolina, Tennessee, Texas, Virginia, West Virginia and the US Virgin Islands.

What is the MAC locality?

However, the Medicare Administrative Contractors (MACs) have been allowed to process claims using what we refer to as the “locality rule”. The “locality rule” allows for when patients normally seek medical attention at a few regional hospitals on a regular basis.

What is a rating area?

A rating area is a group of zip codes that corresponds to a particular rate charged by a dental plan. Each dental plan can have up to five rating areas. Your residence zip code may be in rating area 1 for one plan but in rating area 2 for another plan. You can find your rating area on the dental rating area chart.

What is the difference between Medicare and Medicaid?

The difference between Medicaid and Medicare is that Medicaid is managed by states and is based on income. Medicare is managed by the federal government and is mainly based on age. But there are special circumstances, like certain disabilities, that may allow younger people to get Medicare.

How many Mac localities are there?

As a result of these changes to the locality structure, there are currently 112 total PFS localities; 34 localities are statewide areas (that is, only one locality for the entire state).

What does locality region county mean?

More Definitions of Locality Locality means any county, city, or town in the Commonwealth.

Which rating method is based on your service area or geographic location?

What is community rating? Community rating refers to a health insurance pricing system where health insurers can't charge people within a geographic area higher premiums based on their age, gender, health status, or claims history.

When I turn 65 do I have to pay for Medicare?

Medicare pays for services first, and your job-based insurance pays second. If you don't sign up for Part A and Part B, your job-based insurance might not cover the costs for services you get. Ask the employer that provides your health insurance if you need to sign up for Part A and Part B when you turn 65.

How do I qualify for dual Medicare and Medicaid?

Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. To be considered dually eligible, persons must be enrolled in Medicare Part A (hospital insurance), and / or Medicare Part B (medical insurance).

What's the difference between Medicare A and B?

If you're wondering what Medicare Part A covers and what Part B covers: Medicare Part A generally helps pay your costs as a hospital inpatient. Medicare Part B may help pay for doctor visits, preventive services, lab tests, medical equipment and supplies, and more.

How many Medicare Advantage plans are there in Florida?

Nearly half of Florida Medicare beneficiaries select Medicare Advantage plans. Residents in Florida can select from between seven and 83 Medicare Advantage plans in 2020, depending on where they live. Florida has a tool residents can use to compare prices on Medigap plans in each county. Florida law guarantees access to Medigap plans ...

How many people will be on Medicare in Florida in 2020?

Medicare enrollment in Florida. Medicare enrollment in Florida stood at 4,672,774 as of October 2020. That’s more than 21 percent of the state’s total population, compared with about 19 percent of the United States population enrolled in Medicare. For most people, Medicare coverage enrollment happens when they turn 65.

What is a Medigap plan?

Medigap plans are used to supplement Original Medicare, covering some or all of the out-of-pocket costs (for coinsurance and deductibles) that people would otherwise incur if they only had Original Medicare on its own.

What is Medicare Advantage?

Medicare Advantage includes all of the basic coverage of Medicare Parts A and B, and these plans generally include additional benefits — such as integrated Part D prescription drug coverage and extras like dental and vision — for a single monthly premium.

What percentage of Florida Medicare beneficiaries are private?

43 percent of Florida Medicare beneficiaries selected private Medicare Advantage plans in 2018. Nationwide, the average was 34 percent, so Medicare Advantage is more popular in Florida than it is nationwide. Most of the remaining 52 percent of the state’s Medicare beneficiaries had opted instead for coverage under Original Medicare, ...

How to contact Medicare in Florida?

Visit the SHINE website or call 1-800-963-5337. Visit the Medicare Rights Center.

When is Medicare Advantage enrollment?

Medicare Advantage enrollment is available when a person is initially eligible for Medicare, but there’s also an annual enrollment window each fall (October 15 – December 7) when Medicare beneficiaries can select a different Medicare Advantage plan, or switch between Medicare Advantage and Original Medicare.

How to save money on Medicare Supplement?

Many with Original Medicare save money by adding a Medicare Supplement Insurance policy . Opting for a plan that includes prescription drug coverage or adding this coverage to your policy may help you save money over time.

What is Florida glow?

Florida SHINE is a statewide program that provides free health insurance counseling for those who qualify for Medicare. Through its network of trained volunteers, you can get answers to questions regarding Original Medicare costs and benefits, help identifying and comparing the Medicare Advantage Plans available in your region, and assistance with understanding medical billing statements. Volunteers may advocate on your behalf and help you dispute denied claims for covered services. The program also provides community and one-on-one education to recognize and prevent Medicare fraud through the Senior Medicare Patrol.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap, covers some of your cost-sharing responsibilities to reduce your overall expenses. These policies are provided by private health insurance companies and have monthly premiums that you pay in addition to your Medicare premium.

What is the Florida Senior Legal Helpline?

The firm also operates the Florida Senior Legal Helpline, which is available to seniors throughout the state and answers Medicare questions. The helpline is operational on weekdays from 9 a.m. to 4:30 p.m. and is reached at 888-895-7873. Contact Information: Website | 800-625-2257.

How much Medicare does Florida pay?

In general, you can expect to pay up to $471 per month for Part A coverage and around $149 per month for Part B. As an alternative to Original Medicare, Florida has 67 Medicare Advantage Plans ...

What can a counselor do for Medicare?

They can help you organize and settle medical bills , spot billing errors, dispute denied claims, and understand your Original Medicare benefits . Counselors can also help you identify the available Medicare Advantage Plans in your region and compare their prices and coverage options.

What is Bay Area Legal Services?

Bay Area Legal Services is a nonprofit law firm providing free civil legal services to those in the Tampa Bay area. Through the firm, you can get information on qualifying and applying for Medicare benefits, understanding what different Medicare plans cover, and identifying public benefits to help you cover health care expenses. The firm also operates the Florida Senior Legal Helpline, which is available to seniors throughout the state and answers Medicare questions. The helpline is operational on weekdays from 9 a.m. to 4:30 p.m. and is reached at 888-895-7873.

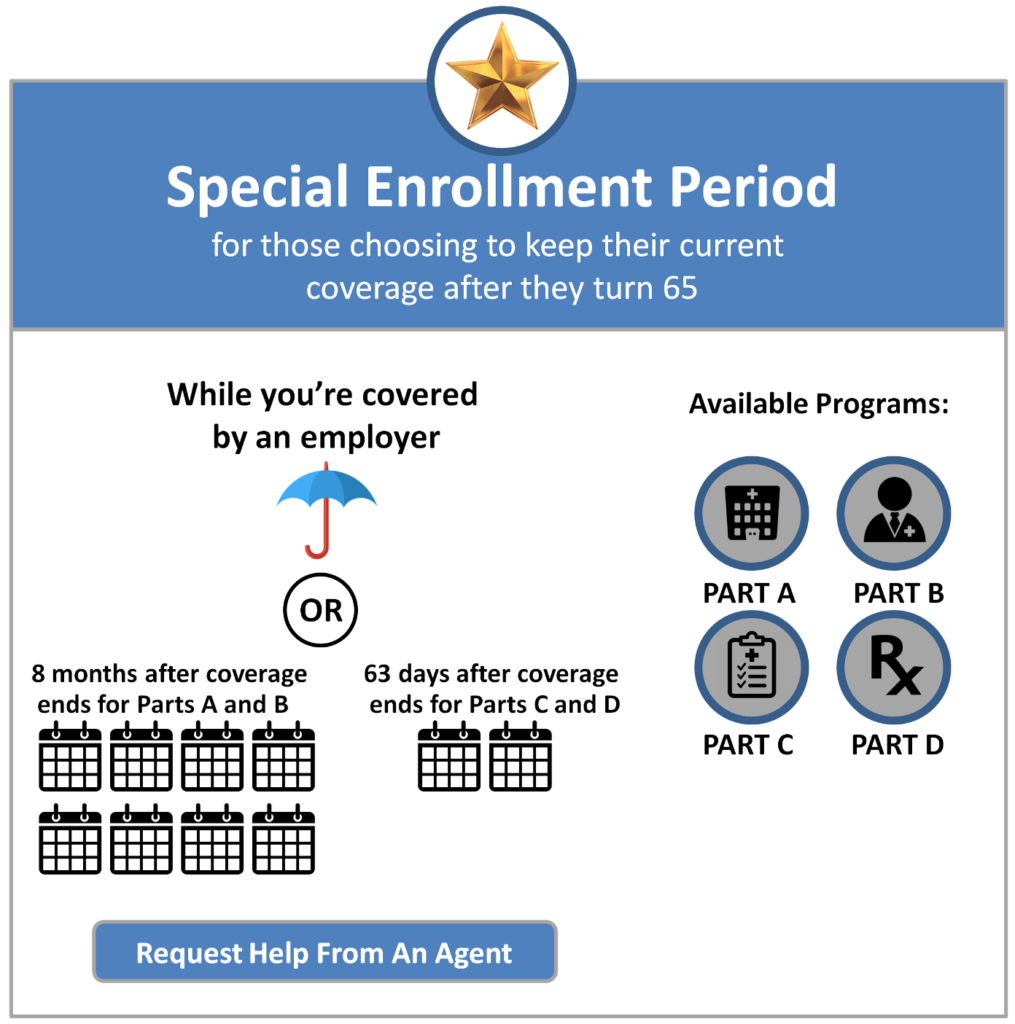

How long do you have to sign up for Medicare if you have delayed enrollment?

Special enrollment period. If you delayed Medicare enrollment for an approved reason, you can later enroll during a special enrollment period. You have 8 months from the end of your coverage or the end of your employment to sign up without penalty.

What is the maximum amount you can pay for Medicare in 2021?

In 2021, the out-of-pocket maximum for plans is $7,550. Note.

What does Medicare Part A cover?

Medicare Part A covers the care you receive when you’re admitted to a facility like a hospital or hospice center. Part A will pick up all the costs while you’re there, including costs normally covered by parts B or D.

What are the parts of Medicare?

Each part covers different healthcare services you might need. Currently, the four parts of Medicare are: Medicare Part A. Medicare Part A is hospital insurance. It covers you during short-term inpatient stays in hospitals and for services like hospice.

How many people are on medicare in 2018?

Medicare is a widely used program. In 2018, nearly 60,000 Americans were enrolled in Medicare. This number is projected to continue growing each year. Despite its popularity, Medicare can be a source of confusion for many people. Each part of Medicare covers different services and has different costs.

What is Medicare for seniors?

Medicare is a health insurance program for people ages 65 and older, as well as those with certain health conditions and disabilities. Medicare is a federal program that’s funded by taxpayer contributions to the Social Security Administration.

How old do you have to be to get Medicare?

You can enroll in Medicare when you meet one of these conditions: you’re turning 65 years old. you’ve been receiving Social Security Disability Insurance (SSDI) for 24 months at any age. you have a diagnosis of end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) at any age.

How does a state group health plan work with Medicare?

How does the State Group health plan work with Medicare? Your State Group health plan will become secondary insurance - health insurance that pays secondary to Medicare Part B (even if you fail to enroll in Part B) when Medicare pays or pays primary when Medicare doesn't pay. Prescription drug coverage that pays primary for most prescription drugs ...

Does Medicare Advantage have retroactive enrollment?

Medicare Advantage Plans do not allow retroactive enrollment and claims can only be paid if you are approved for the plan. Medical and prescription drug coverage are included. Medicare Tiers: the state offers three coverage tiers for Medicare eligible retirees: Medicare I: a single policy for you.

Do you need to enroll in a separate Medicare Part D plan?

Creditable Coverage for Medicare Part D: If you are enrolled in the State Group secondary health insurance, you do not need to enroll in a separate Medicare Part D plan. The state's prescription drug coverage is as good as or better than Medicare Part D and is approved by Medicare as creditable coverage. Medicare (Retiree) Advantage Plan: Capital ...

Does Florida Blue have a PPO?

Prescription drug coverage that pays primary for most prescription drugs is included. Florida Blue administers the nationwide PPO secondary plan; Aetna, AvMed and UnitedHealthcare administer the HMO secondary plans in their respective service areas. Creditable Coverage for Medicare Part D: If you are enrolled in the State Group secondary health ...