CMS Part D 2014 Standard Benefit Model Plan Details

- Initial Deductible: will be decreased by $15 to $310 in 2014

- Initial Coverage Limit: will decrease from $2,970 in 2013 to $2,850 in 2014

- Out-of-Pocket Threshold: will decrease from $4,750 to $4,550 in 2014

What is the deductible for Medicare Part C and D?

For CY 2014, Medicare has released the following cost-sharing requirements, in comparison to those in effect for CY 2013. PART A. Per benefit period, 90 covered inpatient . Hospital Days: Inpatient hospital deductible: $1,184.00 (2013) $1,216.00 (2014) (single deductible for days 1-60) Inpatient hospital coinsurance: $ 296.00 (2013) $ 304.00 (2014)

How much will Medicare cover me if I Meet my deductible?

(If you’re under 65 and disabled, you can continue to get premium-free Part A for up to 8 1/2 years after you return to work.) The 2014 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $426. The Medicare Part A deductible for all Medicare beneficiaries is $1,216.

What are the Medicare Part A and Part B deductibles?

Nov 09, 2013 · Part B. Most of the Medicare annual change amounts have been released for 2014, and the good news is that the Part B premium and deductible will not change. That is, the Part B monthly premium will stay at $140.90, and the annual deductible at $147. This is particularly nice for beneficiaries as your Social Security cost-of-living increase will only be 1.5%, but none of …

What is the Medicare Part B deductible for 2020?

Nov 23, 2013 · Click here to view the new rates for Medicare Part A deductibles and Part B monthly Premiums for 2014. Related Posts: Special Needs Planning and Retirement Assets , Choosing the Right Executor for Your Will , Promissory Note Planning & Gift Using POA Declared Void , The Pitfalls of Do-It-Yourself Legal Documents

What is the deductible each year for Medicare?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What was the Medicare deductible for 2013?

This will increase to $1,184 in 2013, up from $1156 this year (an increase of 2.4%). Medicare Part B Deductible: The deductible will increase to $147 in 2013, from $140.Nov 16, 2012

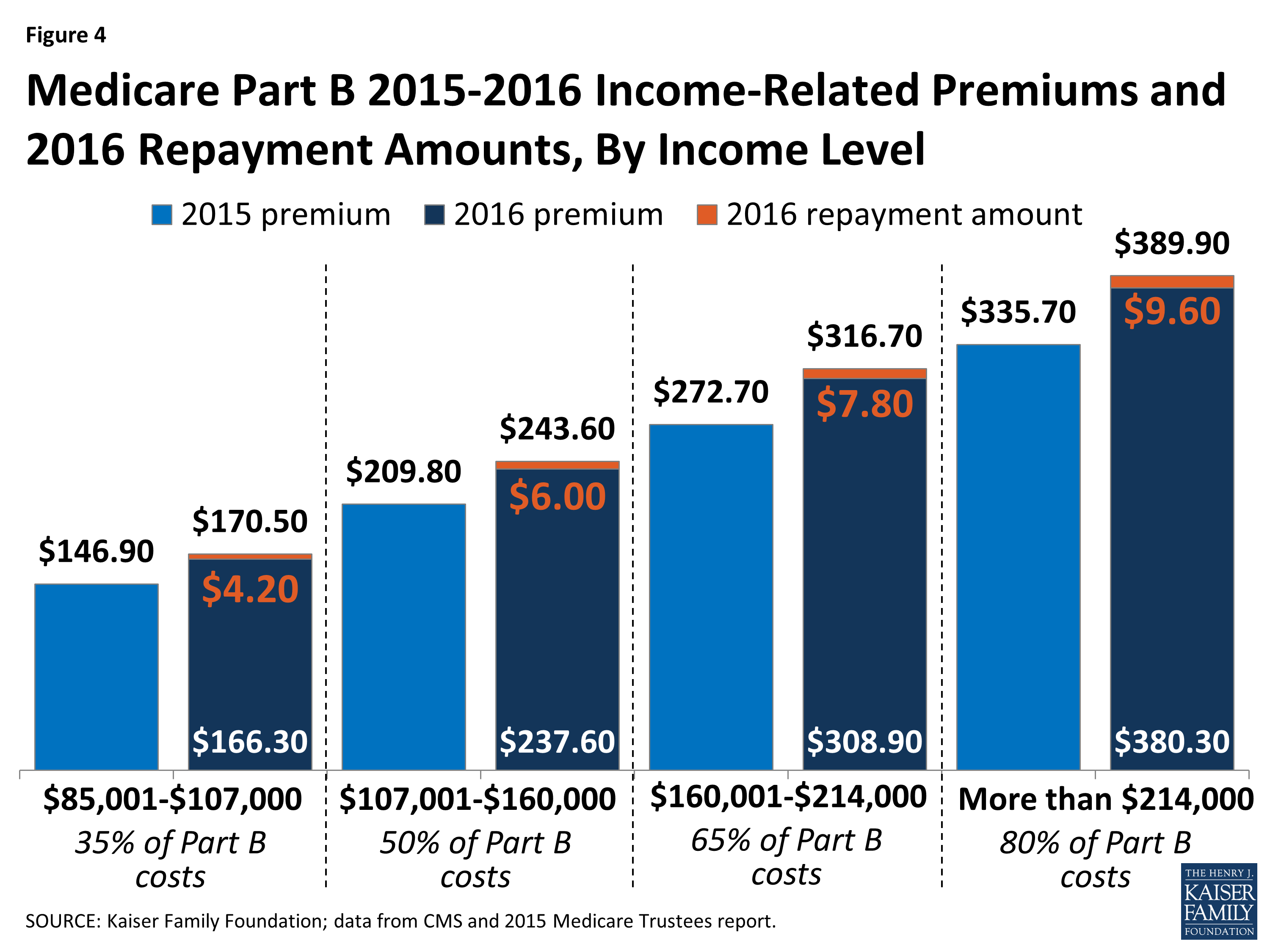

What were Medicare premiums in 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What were Medicare premiums in 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018....What You'll Pay for Medicare in 2018.Income (adjusted gross income plus tax-exempt interest income):$133,501 to $160,000$267,001 to $320,000$348.305 more rows

What were Medicare premiums in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What was the Medicare Part B premium for 2018?

The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. However, a statutory “hold harmless” provision applies each year to about 70 percent of enrollees.Nov 17, 2017

What is the Medicare premium for 2014?

2014 Medicare Part A Premium: The Medicare Part A premium, which only about 1 percent of Medicare recipients are required to pay, will be $426, a $15 decrease from the 2013 rate.

How much did Medicare pay for hospital stays in 2014?

For a hospital stay of 91-150 days, the per-day Medicare Part A co-payment in 2014 is $608, a $16 increase from 2013. After 150 days, Medicare no longer helps pay for hospital expenses.

How much did Medicare pay for skilled nursing in 2014?

2014 Medicare Part A Skilled Nursing: After 20 days in a skilled nursing facility, the per-day Medicare Part A skilled nursing co-payment in 2014 will be $152, or $4 more than in 2013.

When did Medicare Part B and Part A change?

The Medicare administration has announced Medicare Part A and Part B rates for 2014, with changes taking effect Jan. 1, 2014.

Does Plan F cover Medicare Part A?

With fixed premiums that can easily fit into your budget, Plan F covers all Medicare Part A and Part B deductibles along with “excess charges” you would otherwise have to pay out of pocket. Excess charges are the difference between what Medicare pays and what your medical provider charges—and they can add up fast without ...

What is the deductible for Medicare Part B in 2014?

If you have to pay a higher amount for your Part B premium and you disagree, you can appeal the IRMAA. The 2014 Medicare Part B annual deductible remains $147 (unchanged from 2013). *If you pay a late-enrollment Penalty, your monthly premium is higher.

What is Medicare Advantage 2014?

2014 Part C (Medicare Advantage) Monthly Premium. Medicare Advantage plan premiums*, deductibles, and benefits will depend on the Medicare Advantage plans available in your service area (county or ZIP code). Along with your Medicare Advantage plan premium, you must continue to pay your Part B premium ...

How much is the 2014 Part D premium?

The 2014 Part D plan premiums range from $3 to $175. The 2014 standard Part D plan deductible is $310, however the actual plan deductible can be anywhere from $0 to $310 .

Do you pay Social Security if your adjusted gross income is above a certain amount?

However, if your modified adjusted gross income as reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS) is above a certain amount (see chart below), you may pay more.

What is the Medicare deductible for 2014?

Most of the Medicare annual change amounts have been released for 2014, and the good news is that the Part B premium and deductible will not change. That is, the Part B monthly premium will stay at $140.90, and the annual deductible at $147. This is particularly nice for beneficiaries as your Social Security cost-of-living increase will only be 1.5%, but none of this rather modest increase will be eaten up by any rise in your Part B premium.

What is the deductible for Part D in 2014?

And, in general, beneficiaries will pay less for their drugs in 2014. As usual, the overall recommended structure has changed somewhat. The recommended deductible is $310, but remember that many plans have none or a smaller deductible than this. The next payment band, the 25% Coinsurance Band, covers the next $2,540 of your drugs, and you pay 25% of this, or $635, while your plan covers $1,905. Your plan may structure this differently. In the “donut hole,” also known as the “coverage gap,” in 2014 for brand name drugs, the plan will pay 52.5% of the cost of a drug, and you, the beneficiary, 47.5%. (These figures were the same in 2013.) And for generic drugs , the government will pay 28% and, you, the beneficiary, 72%. (In 2013 the government paid 21% and the beneficiary, 79%, so you get a better deal.) The beneficiary will remain in the donut hole until their “drug expenses” total $4,550. And, finally, in the Catastrophic (or 5% Insurance) Band, which starts when your drug “expenses” reach $4,550, you will pay a minimum of $2.55 for a generic or $6.35 for a brand name drug, but no more that 5% of its cost, if that is greater than these amounts. (And by “expenses” is meant your deductible, anything you spent in the 25% band and in the donut hole, AND the 52.5% that manufacturers discount on your brand name drugs in the donut hole (but not the 28% the government pays on your generics). Unless otherwise noted, all the amounts for 2014 are lower than the 3013 amounts; this is laid out in greater detail in my posting of October 3.

How much did Medicare deductible increase in 2014?

The Centers for Medicare and Medicaid Services also announced that the Medicare Part A deductible, which people pay when admitted to the hospital, will increase by $32 in 2014, to $1,216.

How much was Medicare Part B in 2014?

How much will I pay in premiums for Medicare Part B in 2014? And is there still a high-income surcharge for Part B and Part D prescription-drug coverage? The monthly premium for Medicare Part B remains $104.90 for most people in 2014 – the same as in 2013.

What is the income limit for seniors in 2012?

Seniors whose 2012 adjusted gross income (plus tax-exempt interest income) was more than $170,000 if married filing jointly or $85,000 if single will continue to pay higher premiums, as they have since 2007. The high-income surcharges remain the same as in 2013.

What is the Part B and Part D surcharge based on?

Both the Part B and Part D surcharges are based on your income in 2012, which is the last tax return the government has on file for most people.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

Does Medicare Advantage have coinsurance?

They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage.

Medicare Part A and Part B Changes from 2013 to 2014

Medicare Part A in 2014

- 2014 Medicare Part A Premium:

The Medicare Part A premium, which only about 1 percent of Medicare recipients are required to pay, will be $426, a $15 decrease from the 2013 rate. - 2014 Medicare Part A Deductible:

The 2014 Medicare Part A deductible will be $1,216per benefit period, up from $1,184 per benefit period in 2013.

Medicare Part B in 2014

- 2014 Medicare Part B Premium:

The standard 2014 Medicare Part B premium will remain at $104.90per month, the same rate as in 2013. Higher Part B premium rates for people with higher incomes will also remain at 2013 levels. - 2014 Medicare Part B Deductible:

The Medicare Part B 2014 deductible will remain unchanged at $147.

Medigap Protection Against Deductibles, Co-Pays, and Coinsurance

- Medicare supplement plans go a long way toward helping eliminate Medicare out-of-pocket costs that often go up from one year to the next. An excellent, budget-friendly solution is Medicare Supplement Plan F, which covers all Medicare-approved costs not covered by Medicare Part A and Medicare Part B. With fixed premiums that can easily fit into your budget, Plan F covers all …