What is excluded from coverage under Medicare Part B?

What is the patient responsibility for Medicare Part B?

How do I get my $144 back from Medicare?

Can you lose Medicare Part B coverage?

Does Medicare Part B pay 80% of covered expenses?

Does Medicare Part B pay 80 percent?

Why does zip code affect Medicare?

Will Social Security get a $200 raise in 2021?

What is the Medicare Part B deductible for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is deducted from your monthly Social Security check?

How can I reduce my Medicare coverage?

- You no longer have a qualifying disability.

- You fail to pay your plan premiums.

- You move outside your plan's coverage area.

- Your plan is discontinued.

Does Medicare come out of Social Security?

What does Medicare Part B cover?

Routine vision care. Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting. Hearing aids. 24-hour home health care. Long-term care, such as you might get in a nursing home.

What is not covered by Medicare Part B?

What doesn’t Medicare Part B cover? 1 Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B. 2 Some tests and services that your doctor might order or recommend for you. If your doctor wants you to have lab tests, or any services beyond your standard annual wellness visit, you might want to ask whether Medicare covers them. Medicare Part B might cover some of these services. 3 Routine dental care 4 Routine vision care 5 Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting. 6 Hearing aids 7 24-hour home health care 8 Long-term care, such as you might get in a nursing home. If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it.

How much is Medicare Part B 2021?

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services.

How much is the 2021 Medicare premium?

The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021.

Is a doctor's visit covered by Medicare?

These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B. Some tests and services that your doctor might order or recommend for you.

What happens if you don't sign up for Medicare Part B?

However, when that coverage ends, be aware that if you don’t sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty. Here’s one reason you might want to sign up for Medicare Part B. Suppose you decide you’d like to buy a Medicare Supplement insurance plan.

How much is the Part B deductible for 2021?

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021. After you pay your deductible, you generally pay a 20% coinsurance (as mentioned above) for most covered services.

Do you have to pay Part A and Part B?

Also enroll in or already have Part B. To keep premium Part A, the person must continue to pay all monthly premiums and stay enrolled in Part B. This means that the person must pay both the premiums for Part B and premium Part A timely to keep this coverage. Premium Part A coverage begins prospectively, based on the enrollment period ...

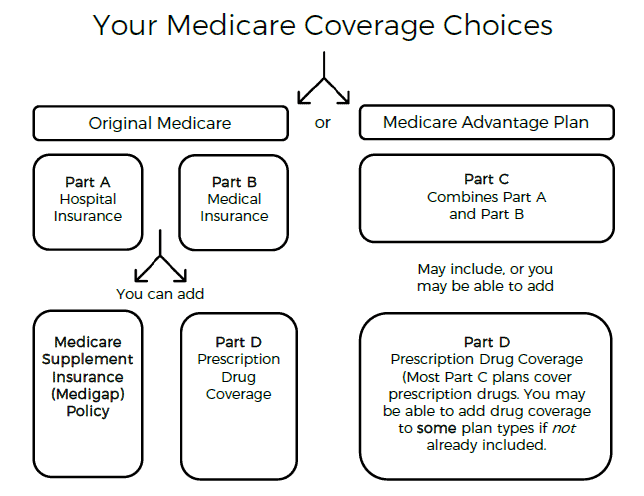

What is Medicare Part A?

Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is MEC in Medicare?

Medicare and Minimum Essential Coverage (MEC) Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

How long does Part A coverage last?

If the application is filed more than 6 months after turning age 65, Part A coverage will be retroactive for 6 months. NOTE: For an individual whose 65th birthday is on the first day of the month, Part A coverage begins on the first day of the month preceding their birth month.

When does Part A start?

NOTE: For an individual whose 65th birthday is on the first day of the month, Part A coverage begins on the first day of the month preceding their birth month. For example, if an individual's birthday is on December 1, Part A begins on November 1.

What does Medicare Part B cover?

Medicare Part B covers 80 percent of the Medicare-approved costs of certain services. Most, though not all, of these services are administered on an outpatient basis. This means you don’t receive them as a patient in a hospital.

What is the eligibility for Medicare Part B?

In order to be eligible for Medicare Part B, you must be at least 65 years old. You must also be a U.S. citizen or a permanent U.S. resident living in the United States for at least 5 consecutive years.

What are the exceptions to the eligibility rules for Medicare Part B?

Being age 65 or older isn’t always a requirement for Medicare Part B coverage.

How much does Medicare Part B cost?

In 2021, Medicare Part B has an out-of-pocket annual deductible of $203 which must be met before medically necessary services will be covered.

When can you enroll in Medicare Part B?

You can sign up for Medicare Part B during the 7-month period that begins 3 months before your 65th birthday and 3 three months after that birthday.

What are the rules for Medicare Part B?

Medicare Part B provides outpatient /medical coverage. The list below provides a summary of Part B-covered services and coverage rules: 1 Provider services: Medically necessary services you receive from a licensed health professional. 2 Durable medical equipment (DME): This is equipment that serves a medical purpose, is able to withstand repeated use, and is appropriate for use in the home. Examples include walkers, wheelchairs, and oxygen tanks. You may purchase or rent DME from a Medicare-approved supplier after your provider certifies you need it. 3 Home health services: Services covered if you are homebound and need skilled nursing or therapy care. 4 Ambulance services: This is emergency transportation, typically to and from hospitals. Coverage for non-emergency ambulance/ ambulette transportation is limited to situations in which there is no safe alternative transportation available, and where the transportation is medically necessary. 5 Preventive services: These are screenings and counseling intended to prevent illness, detect conditions, and keep you healthy. In most cases, preventive care is covered by Medicare with no coinsurance. 6 Therapy services: These are outpatient physical, speech, and occupational therapy services provided by a Medicare-certified therapist. 7 Mental health services. 8 X-rays and lab tests. 9 Chiropractic care when manipulation of the spine is medically necessary to fix a subluxation of the spine (when one or more of the bones of the spine move out of position). 10 Select prescription drugs, including immunosuppressant drugs, some anti-cancer drugs, some anti-emetic drugs, some dialysis drugs, and drugs that are typically administered by a physician.

What is a provider service?

Provider services: Medically necessary services you receive from a licensed health professional. Durable medical equipment (DME): This is equipment that serves a medical purpose, is able to withstand repeated use, and is appropriate for use in the home. Examples include walkers, wheelchairs, and oxygen tanks.

What are some examples of DME?

Examples include walkers, wheelchairs, and oxygen tanks. You may purchase or rent DME from a Medicare-approved supplier after your provider certifies you need it. Home health services: Services covered if you are homebound and need skilled nursing or therapy care. Ambulance services: This is emergency transportation, typically to and from hospitals.