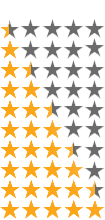

Medicare Supplement Insurance Star Ratings & Quality Score

| A++ & A+ | Superior |

| A & A- | Excellent |

| B++ & B+ | Good |

| B & B- | Fair |

| C++ & C+ | Marginal |

Do Medicare supplement insurance companies have star ratings?

Part C) and Medicare Part D Star Ratings each year to measure the quality of health and drug services received by consumers enrolled in Medicare Advantage (MA) and Prescription Drug Plans (PDPs or Part D plans). The Star Rating system helps Medicare consumers compare the quality of Medicare health and drug plans being offered.

What is a 5-star rating for Medicare?

10 rows · Medicare Supplement Insurance Star Ratings & Quality Score Many people are starting to learn ...

How often are Medicare star ratings updated?

Feb 03, 2022 · Medicare Supplement Insurance Company Ratings. by Christian Worstell | Published June 18, 2021 | Reviewed by John Krahnert. The federal government issues star ratings for Medicare Advantage plans and Medicare Part D Prescription Drug plans but not for Medicare Supplement Insurance companies. If you want to compare Medicare Supplement …

What percentage of Medicare Advantage plans have 4 or more stars?

Medicare Supplement (Medigap) plans aren’t eligible for star ratings. Explore top-rated Medicare plans All of our HealthPartners Medicare Advantage and Cost plans received an overall Star Rating of 5 out of 5 for 2022 – the highest score possible.

What is included in Medicare star ratings?

Medicare uses a Star Rating System to measure how well Medicare Advantage and Part D plans perform. Medicare scores how well plans perform in several categories, including quality of care and customer service. Ratings range from one to five stars, with five being the highest and one being the lowest.

What are stars scores?

Medicare Star RatingsStar RatingWhat it means(five stars)Excellent(4 stars)Above Average(3 stars)Average(2 stars)Below Average1 more row•Oct 7, 2021

What Medicare has a 5-star rating?

What Does a Five Star Medicare Advantage Plan Mean? Medicare Advantage plans are rated from 1 to 5 stars, with five stars being an “excellent” rating. This means a five-star plan has the highest overall score for how well it offers members access to healthcare and a positive customer service experience.

What is a 2 star Medicare rating?

4-star rating: Above Average. 3-star rating: Average. 2-star rating: Below Average. 1-star rating: Poor.

Who sets the standards for Medicare star ratings?

The Centers for Medicare & Medicaid Services (CMS) uses a five-star quality rating system to measure the experiences Medicare beneficiaries have with their health plan and health care system — the Star Rating Program.

How are star ratings calculated?

Summary star ratings are an average of a provider's question level star ratings. Patient star ratings are calculated by dividing the patient's aggregate mean score by 20. For clients using only one question in the patient star rating, the star rating would simply be the individual question score, divided by 20.

What is devoted star rating?

This lets you easily compare plans based on quality and performance. Star Ratings are based on factors that include: • Feedback from members about the plan's service and care. • The number of members who left or stayed with the plan. • The number of complaints Medicare got about the plan.

How are CMS Star Ratings calculated?

The results are now published annually. The Star Ratings are calculated based on a hospital's performance on certain measures found on the Care Compare website. Hospitals submit data to the Hospital IQR, OQR, Value-Based Purchasing, Readmission Reduction and HAC Reduction programs.Jan 15, 2021

Why did CMS create star ratings?

CMS created the Five-Star Quality Rating System to help consumers, their families, and caregivers compare nursing homes more easily and to help identify areas about which you may want to ask questions.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also known as Medigap ) are sold by private insurance companies to cover some of Original Medicare's out-of-pocket costs. These costs can include Medicare deductibles, coinsurance, copayments and more.

When will Medicare stop covering Part B?

Recent legislation has forced Medigap plans to stop covering the Part B deductible for anyone who became eligible for Medicare after Jan. 1, 2020.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What are the benefits of Medigap?

All 10 standardized Medigap plans provide at least partial coverage for: 1 Medicare Part A coinsurance for hospital care (and an additional 365 days for hospital stays) 2 Medicare Part A coinsurance or copayment for hospice care 3 Medicare Part B coinsurance or copayment 4 The first three pints of blood

What is the star rating for Medicare?

Medicare plans are rated on a scale of 1 to 5, with a 5-star rating being the highest score ...

What is chronic conditions management?

Chronic conditions management: Plans are rated for care coordination and how frequently members received services for long-term health conditions. Member experience: Plans are rated for overall satisfaction with the health plan.

How to know if you are enrolled in Medicare Supplement?

If you've already shopped for Medicare Supplement Plans, you know the drill when using the Medicare-Plans site: enter your zip code, birth date, gender, indicate if you're already enrolled in Medicare Part A and/or B, and then your name and email address. On the final page, you're asked for your street address and phone number - and then there's the disclaimer that you're consenting to texts, calls, emails, and postal mail from their "marketing and remarketing network, and up to eight insurance companies or their affiliates". Worthy to note.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

How many states does United Medicare Advisors work in?

While this is fairly common in today's internet age, it's still something to note. Another fact is that United Medicare Advisors is active in 44 states, leaving out Alaska, California, Hawaii, Massachusetts, New York and Rhode Island. If you live in one of those states, you should keep reading further in our reviews.

Who are United Medicare Advisors?

United Medicare Advisors specializes in Medicare and related supplemental plans, giving you unbiased information and access to many different insurance companies. In business since 2009, they have enrolled hundreds of thousands of Medicare Supplement policies across the country. They work with over 20 carriers, including some of the major names in the industry (such as Aetna, Mutual of Omaha, and Humana).

How long has Aetna been around?

Aetna. Aetna has been around for a LONG time: over 160 years, as a matter of fact. And, as the insurer most often quoted during our process of finding Medicare Supplement Plans, Aetna is an obvious company to consider for your coverage needs.

How many stars does a health insurance plan have?

As a result of changes made in the Affordable Care Act (ACA), plans that receive at least 4 stars and those without ratings ...

What is the MLR for Medicare Advantage?

However, plans’ ability to keep these and other payments as profit is not unlimited – Medicare Advantage plans must meet medical loss ratio (MLR) requirements of at least 85 percent, and are required to issue rebates to the federal government if their MLRs fall short of required levels.

What is Medicare Advantage 2021?

Medicare Advantage in 2021: Star Ratings and Bonuses. Medicare Advantage plans receive a star rating based on performance measures that are intended to help potential enrollees compare plans available in their area as well as encourage plans to compete based on quality. All plans that are part of a single Medicare Advantage contract are combined ...

How much will Medicare pay in 2021?

Medicare spending on bonus payments to Medicare Advantage plans totals $11.6 billion in 2021. Between 2015 and 2021, the total annual bonuses to Medicare Advantage plans have nearly quadrupled, rising from $3.0 billion to $11.6 billion. The rise in bonus payments is due to both an increase in the number of plans receiving bonuses, ...

What is a quality rating?

Quality ratings are assigned at the contract level, rather than for each individual plan, meaning that each plan covered under the same contract receives the same quality rating. Most contracts cover multiple plans, and can include individual plans, as well as employer-sponsored and special needs plans (SNPs).

How much is the bonus for Medicare 2021?

UnitedHealthcare and Humana, which together account for 46% of Medicare Advantage enrollment, have bonus payments of $5.3 billion (46% of total bonus payments) in 2021. BCBS affiliates (including Anthem BCBS) and CVS Health each have $1.6 billion in bonus spending, followed by Kaiser Permanente ($1.1 billion), Cigna and Centene ($0.2 billion each).

Is Medicare Advantage enrollment growing?

As Medicare Advantage enrollment continues to grow and fiscal pressure on the Medicare program increases, questions pertaining to the quality rating system, associated bonus payments, and related costs to Medicare and taxpayers may be on the agenda.