Original Medicare Part A and Part B for 2021

| Costs | |

| Part A deductible and coinsurance1 | $1,484 deductible for each benefit perio ... |

| Part B premium1 | The standard Part B monthly premium amou ... |

| Part B deductible and coinsurance5 | In 2021, the annual deductible for Part ... |

| Annual maximum out-of-pocket costs | There is no maximum out-of-pocket limit ... |

Full Answer

How much are healthcare out of pocket costs?

Feb 15, 2022 · If you only paid between 30 and 39 quarters worth of Medicare taxes (7.5 to 9.75 years) you will be required to pay a premium of $274 per month. If you paid fewer than 30 quarters worth of Medicare taxes, your monthly Part A premium could be as high as $499. Part B The standard Medicare Part B premium is $170.10 per month.

How much is health insurance out of pocket cost?

Jan 03, 2022 · Common Out-of-Pocket Costs Some of the out-of-pocket costs you can expect to pay with Original Medicare include deductibles, copayments and coinsurance. Deductible A deductible is the amount you must pay for covered medical …

How much did you pay out of pocket?

5 rows · Part B premium 1 The standard Part B monthly premium amount in 2021 is $148.50 or higher, depending ...

How much does Medicare take out of your paycheck?

How Much do Medicare Patients Pay Out-of-Pocket? To summarize, Medicare beneficiaries pay varying out-of-pocket amounts, based upon the type of coverage they have. Most Medicare beneficiaries pay the Part B monthly deductible. With Part A, expect to pay $1,556 per benefit period plus coinsurance costs if you are an inpatient.

What is the out-of-pocket expense for Medicare?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

What is the maximum out-of-pocket per year for Medicare?

Medicare Advantage Out of Pocket Maximums In 2021, the Medicare Advantage out-of-pocket limit is set at $7,750 per individual. Plans are allowed to set limits below this amount but cannot make a person pay more than that out of pocket.Jan 21, 2022

What types of costs can be included in your out-of-pocket costs?

Common examples of work-related out-of-pocket expenses include airfare, car rentals, taxis/Ubers, gas, tolls, parking, lodging, and meals, as well as work-related supplies and tools. Health insurance plans have out-of-pocket maximums.

What is the Medicare out-of-pocket for 2021?

$7,550Since 2011, federal regulation has required Medicare Advantage plans to provide an out-of-pocket limit for services covered under Parts A and B. In 2021, the out-of-pocket limit may not exceed $7,550 for in-network services and $11,300 for in-network and out-of-network services combined.Jun 21, 2021

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

How do you reduce out-of-pocket expenses?

Strategies such as free screening programs, universal health coverage, pay for performance, promoting the quality of care services and replacing the brand drug with generic have been common in both developed and developing countries.Aug 4, 2021

What is a good out-of-pocket maximum?

2018: $7,350 for an individual; $14,700 for a family. 2019: $7,900 for an individual; $15,800 for a family. 2020: $8,150 for an individual; $16,300 for a family.

What is individual out-of-pocket maximum?

The most you have to pay for covered services in a plan year. After you spend this amount on deductibles, copayments, and coinsurance for in-network care and services, your health plan pays 100% of the costs of covered benefits.

What is the Maximum Medicare Out-of-Pocket Limit for in 2022?

Many people are surprised to learn that Original Medicare doesn’t have out-of-pocket maximums. Original Medicare consists of two parts — Part A and...

What is the Medicare out-of-pocket maximum ?

Let’s face it, higher-than-expected medical bills can happen to anyone, even those in perfect health. That’s a scary reality we hope won’t happen t...

How Much do Medicare Patients Pay Out-of-Pocket?

To summarize, Medicare beneficiaries pay varying out-of-pocket amounts, based upon the type of coverage they have.

What’s included in the out-of-pocket maximum for Medicare Part C plans?

The costs you pay for covered healthcare services all go towards your Part C out-of-pocket maximum. These include:

What is Medicare out of pocket?

Original Medicare (Part A and Part B) is the federal health insurance program for people age 65 and older and individuals with certain disabilities. Although Original Medicare provides comprehensive coverage, it still leaves some out-of-pocket costs to recipients.

How much is Medicare Part A coinsurance for 2021?

In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows: Days 1-60: $0 coinsurance for each benefit period. Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each lifetime reserve day after day 90 for each benefit period ...

What is the deductible for Medicare Part A in 2021?

In 2021, the deductible for Medicare Part A is $1,484 per benefit period , and the deductible for Medicare Part B is $203 per year.

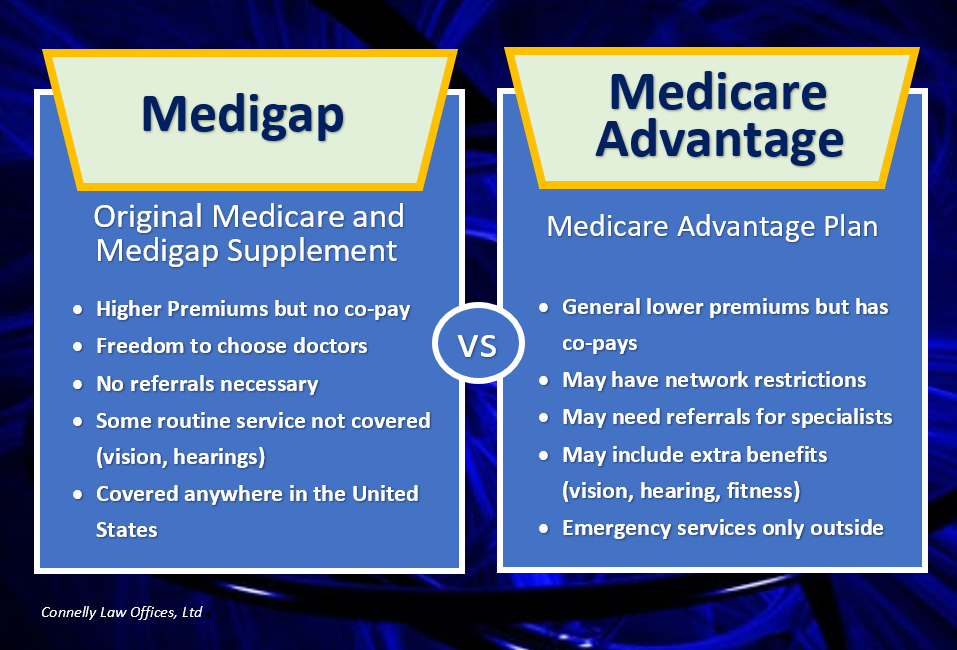

How many Medigap plans are there?

Medicare Supplement Insurance provides full or partial coverage for some of the out-of-pocket expenses listed above. There are currently 10 standardized Medigap plans available in most states, and each includes a unique blend of basic benefits.

What is coinsurance in Medicare?

Coinsurance is the percentage of costs you pay for health care expenses after your deductible is met. In most cases, your Medicare Part B coinsurance is 20 percent of the cost of Medicare-approved services. In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows:

Is Plan F available for Medicare?

Important: Plan F and Plan C are not available to beneficiaries who became eligible for Medicare on or after January 1, 2020. All 10 standardized Medigap plans provide at least partial coverage for: Medicare Part A coinsurance and hospital costs. Medicare Part B coinsurance or copayment. First three pints of blood.

What is the maximum out of pocket cost?

The security of an annual limit on out-of-pocket costs 1 The study found that those in a Medicare Advantage health maintenance organization (HMO) plan on average spent $5,976 a year out of pocket for healthcare. 2 Those with traditional Medicare and no Medicare Supplemental insurance on average spent $8,115 a year out of pocket for healthcare. 2

How much is Part B deductible?

Part B deductible and coinsurance1. In 2020, the annual deductible for Part B coverage is $198 per year, after which you typically pay 20% of the Medicare-approved amount for most doctor services, outpatient therapy, and durable medical equipment (DME) Annual maximum out-of-pocket costs. There is no maximum out-of-pocket limit with Original ...

What is a Part D premium?

Part D premium (prescription drug plan) Part D premiums, deductibles and copays vary by plan. See costs for our Medicare prescription drug plans. Medicare Supplement insurance. There is a monthly premium for these plans. Medicare Supplement plans help pay some of the healthcare costs that Original Medicare doesn't cover, like copayments, ...

When does the SNF benefit period end?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after 1 benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period.

Does Medicare cover dental?

That makes perfect sense, but it’s important to know what Medicare doesn’t cover, as well. Those numbers can add up. For example, you might be surprised to learn that Original Medicare offers limited coverage for most dental, vision and hearing services. So if a dental visit for a toothache turns into a $1,000 bill for a root canal, ...

Is there an annual limit on Medicare?

The security of an annual limit on out-of-pocket costs. One of the benefits of enrolling in a Medicare Advantage plan is that there are annual limits on your out-of-pocket spending.

Does Humana cover vision?

They generally don't cover long-term care, vision or dental care, hearing aids, eyeglasses, or private-duty nursing. See costs for our Medicare Supplemental plans. Optional supplemental benefits: vision, dental and fitness. There is a monthly premium for these plans. See costs for Humana’s optional supplemental benefits.

How much will Medicare Advantage cost in 2021?

If you sign up for a Medicare Advantage plan that includes prescription drugs with a mid-priced premium, CMS predicts you’ll pay $4,339 in 2021. These are just estimates, of course, but they can help you choose the policy that’s best for your health care needs and financial situation.

How many days can you use Medicare?

Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once. Part B: Typically, 20 percent of the Medicare-approved cost of the service for most services.

What happens if you can't leave your home?

If you cannot leave your home, Medicare will allow your doctor to order a test to be brought to you and administered there. The Specified Low-Income Medicare Beneficiary (SLMB) program helps pay only for Part B premiums, not the Part A premium or other cost sharing.

Does Medicaid pay out of pocket?

If you qualify for Medicaid, the federal-state health insurance program for people with low incomes and individuals with disabilities, it will pay some or all of your out-of-pocket expenses. Individuals on both Medicare and Medicaid are known as “dual eligibles.”.

Does Medicare have out of pocket costs?

Medicare’s out-of-pocket costs — premiums, deductibles, copays and coinsurance — can easily result in a large tab each year. If you’re struggling to meet those expenses, you might be eligible for federal and state assistance. If you qualify for Medicaid, the federal-state health insurance program for people with low incomes ...