Some additional out-of-pocket expenses that can be incurred with Medicare include:

- Part B excess charges If you receive services or products that are covered under Part B from a provider that does not...

- Foreign emergency care Medicare does not typically provide coverage for emergency care received outside of the U.S.,...

- First three pints of blood The first three pints...

Full Answer

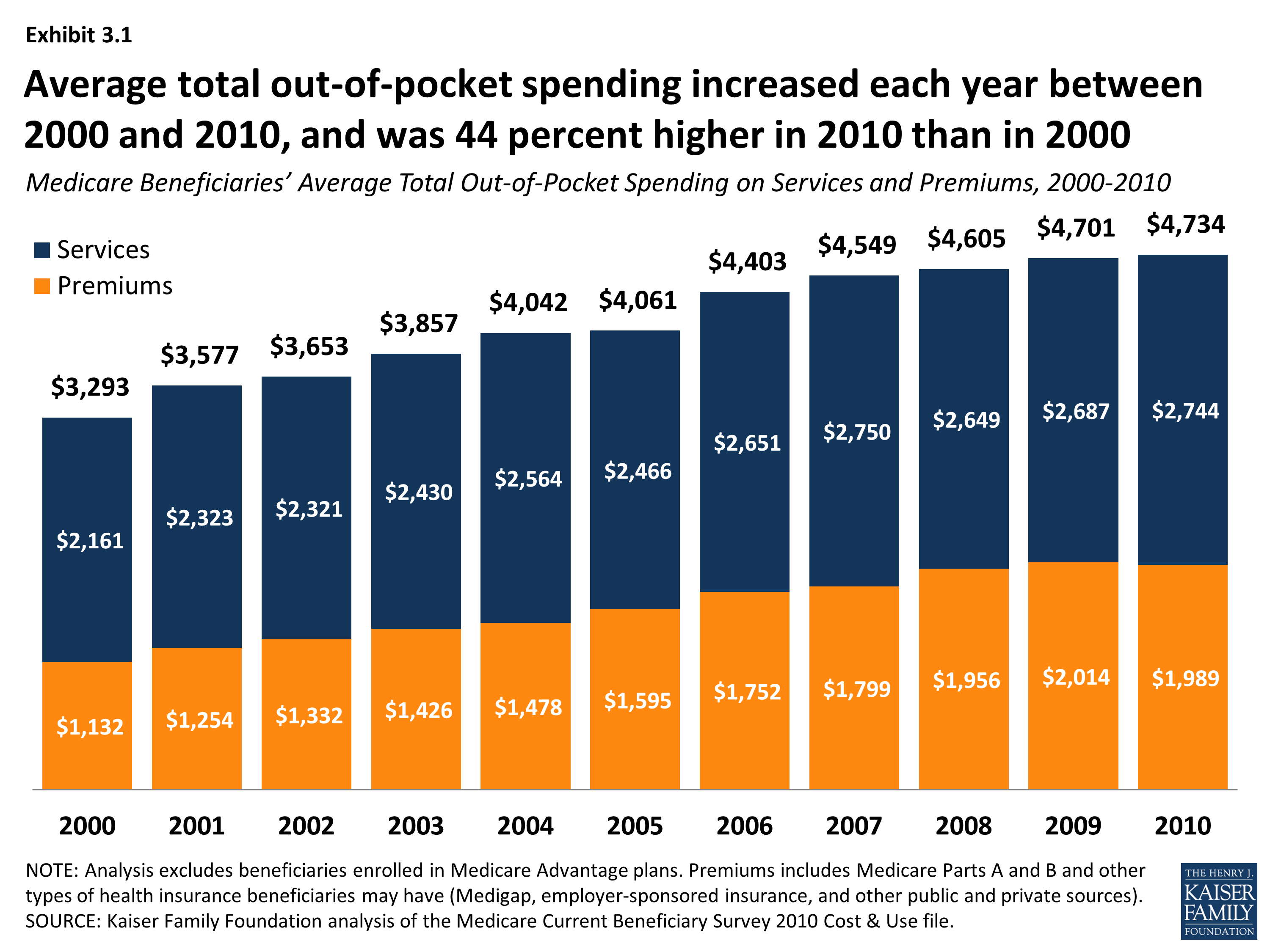

How much are healthcare out of pocket costs?

6 rows · Feb 15, 2022 · Fortunately, there are some ways you may be able to get coverage for some of your out-of-pocket ...

How much is health insurance out of pocket cost?

This means there is an automatic limit on the amount of money you will spend for covered healthcare during any given year. For in-network services in 2021, the highest Medicare out-of-pocket maximum a Part C plan could allow was $7,550. Many Part C plans also offer lower out-of-pocket limits of $6,000 or less.

How much did you pay out of pocket?

Jan 03, 2022 · Common Out-of-Pocket Costs Some of the out-of-pocket costs you can expect to pay with Original Medicare include deductibles, copayments and coinsurance. Deductible A deductible is the amount you must pay for covered medical …

How much does Medicare take out of your paycheck?

For example, you might be surprised to learn that Original Medicare offers limited coverage for most dental services, 1 most corrective lenses 2 or hearing aids. 3 So if a dental visit for a toothache turns into a $1,000 bill for a root canal, you’ll pay that out of pocket. And the next time you really can’t find your glasses?

What is the Maximum Medicare Out-of-Pocket Limit for in 2022?

Many people are surprised to learn that Original Medicare doesn’t have out-of-pocket maximums. Original Medicare consists of two parts — Part A and...

What is the Medicare out-of-pocket maximum ?

Let’s face it, higher-than-expected medical bills can happen to anyone, even those in perfect health. That’s a scary reality we hope won’t happen t...

How Much do Medicare Patients Pay Out-of-Pocket?

To summarize, Medicare beneficiaries pay varying out-of-pocket amounts, based upon the type of coverage they have.

What’s included in the out-of-pocket maximum for Medicare Part C plans?

The costs you pay for covered healthcare services all go towards your Part C out-of-pocket maximum. These include:

What is Medicare out of pocket?

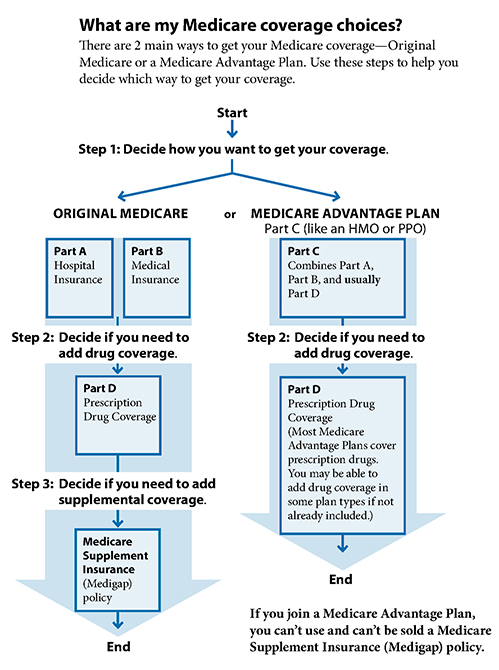

Original Medicare (Part A and Part B) is the federal health insurance program for people age 65 and older and individuals with certain disabilities. Although Original Medicare provides comprehensive coverage, it still leaves some out-of-pocket costs to recipients.

What is the deductible for Medicare Part A in 2021?

In 2021, the deductible for Medicare Part A is $1,484 per benefit period , and the deductible for Medicare Part B is $203 per year.

How much is Medicare Part A coinsurance for 2021?

In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows: Days 1-60: $0 coinsurance for each benefit period. Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each lifetime reserve day after day 90 for each benefit period ...

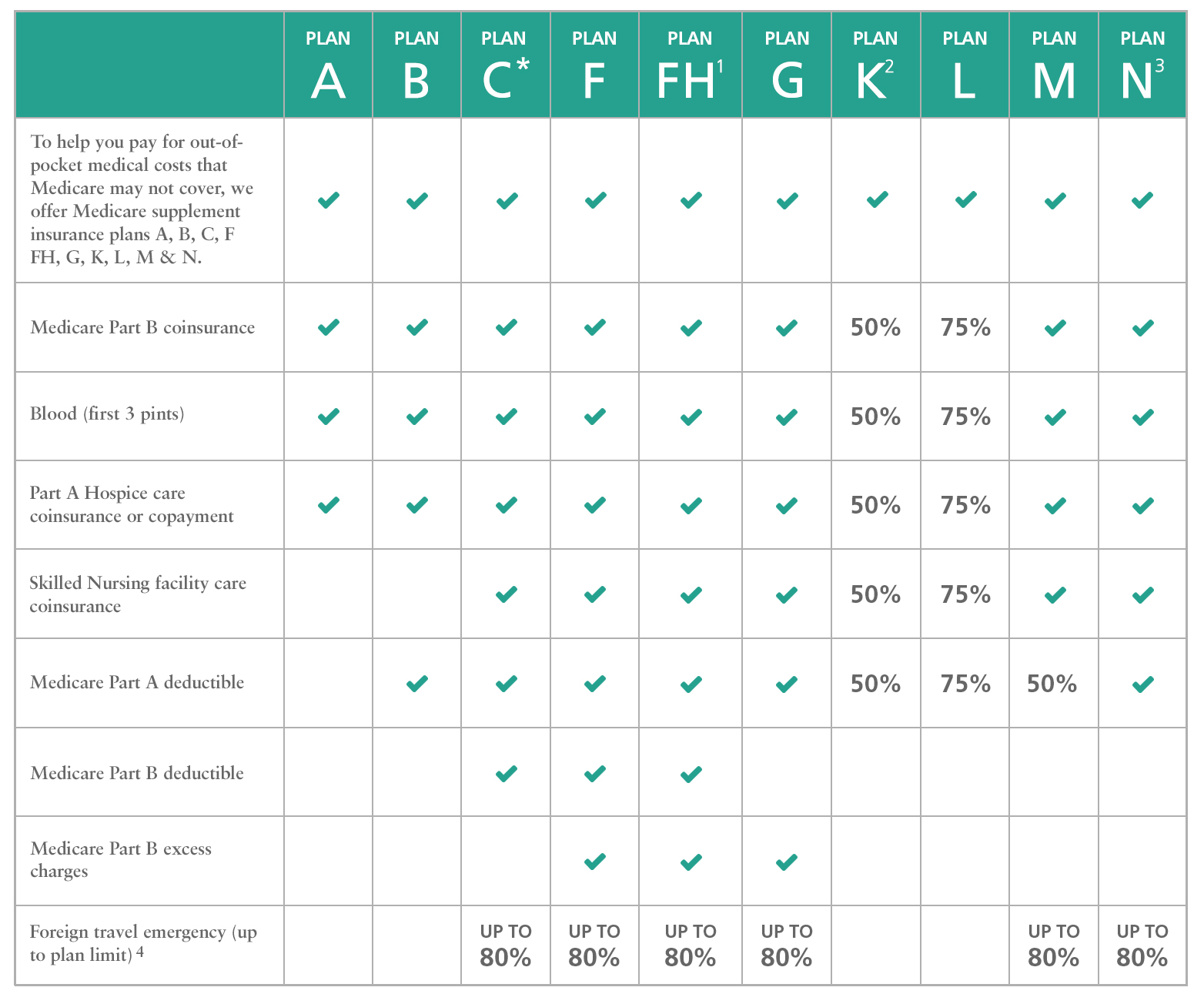

How many Medigap plans are there?

Medicare Supplement Insurance provides full or partial coverage for some of the out-of-pocket expenses listed above. There are currently 10 standardized Medigap plans available in most states, and each includes a unique blend of basic benefits.

What is coinsurance in Medicare?

Coinsurance is the percentage of costs you pay for health care expenses after your deductible is met. In most cases, your Medicare Part B coinsurance is 20 percent of the cost of Medicare-approved services. In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows:

Is Plan F available for Medicare?

Important: Plan F and Plan C are not available to beneficiaries who became eligible for Medicare on or after January 1, 2020. All 10 standardized Medigap plans provide at least partial coverage for: Medicare Part A coinsurance and hospital costs. Medicare Part B coinsurance or copayment. First three pints of blood.

Get help paying costs

Learn about programs that may help you save money on medical and drug costs.

Part A costs

Learn about Medicare Part A (hospital insurance) monthly premium and Part A late enrollment penalty.

Part B costs

How much Medicare Part B (medical insurance) costs, including Income Related Monthly Adjustment Amount (IRMAA) and late enrollment penalty.

Costs for Medicare health plans

Learn about what factors contribute to how much you pay out-of-pocket when you have a Medicare Advantage Plan (Part C).

Compare procedure costs

Compare national average prices for procedures done in both ambulatory surgical centers and hospital outpatient departments.

Ways to pay Part A & Part B premiums

Learn more about how you can pay for your Medicare Part A and/or Medicare Part B premiums. Find out what to do if your payment is late.

Costs at a glance

Medicare Part A, Part B, Part C, and Part D costs for monthly premiums, deductibles, penalties, copayments, and coinsurance.

What is the maximum out of pocket cost?

The security of an annual limit on out-of-pocket costs 1 The study found that those in a Medicare Advantage health maintenance organization (HMO) plan on average spent $5,976 a year out of pocket for healthcare. 2 Those with traditional Medicare and no Medicare Supplemental insurance on average spent $8,115 a year out of pocket for healthcare. 2

How much is Part B deductible?

Part B deductible and coinsurance1. In 2020, the annual deductible for Part B coverage is $198 per year, after which you typically pay 20% of the Medicare-approved amount for most doctor services, outpatient therapy, and durable medical equipment (DME) Annual maximum out-of-pocket costs. There is no maximum out-of-pocket limit with Original ...

What is a Part D premium?

Part D premium (prescription drug plan) Part D premiums, deductibles and copays vary by plan. See costs for our Medicare prescription drug plans. Medicare Supplement insurance. There is a monthly premium for these plans. Medicare Supplement plans help pay some of the healthcare costs that Original Medicare doesn't cover, like copayments, ...

When does the SNF benefit period end?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after 1 benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period.

Does Medicare cover dental?

That makes perfect sense, but it’s important to know what Medicare doesn’t cover, as well. Those numbers can add up. For example, you might be surprised to learn that Original Medicare offers limited coverage for most dental, vision and hearing services. So if a dental visit for a toothache turns into a $1,000 bill for a root canal, ...

Is there an annual limit on Medicare?

The security of an annual limit on out-of-pocket costs. One of the benefits of enrolling in a Medicare Advantage plan is that there are annual limits on your out-of-pocket spending.

Does Humana cover vision?

They generally don't cover long-term care, vision or dental care, hearing aids, eyeglasses, or private-duty nursing. See costs for our Medicare Supplemental plans. Optional supplemental benefits: vision, dental and fitness. There is a monthly premium for these plans. See costs for Humana’s optional supplemental benefits.

How many days can you use Medicare?

Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once. Part B: Typically, 20 percent of the Medicare-approved cost of the service for most services.

How much will Medicare Advantage cost in 2021?

If you sign up for a Medicare Advantage plan that includes prescription drugs with a mid-priced premium, CMS predicts you’ll pay $4,339 in 2021. These are just estimates, of course, but they can help you choose the policy that’s best for your health care needs and financial situation.

What happens if you can't leave your home?

If you cannot leave your home, Medicare will allow your doctor to order a test to be brought to you and administered there. The Specified Low-Income Medicare Beneficiary (SLMB) program helps pay only for Part B premiums, not the Part A premium or other cost sharing.

Does Medicaid pay out of pocket?

If you qualify for Medicaid, the federal-state health insurance program for people with low incomes and individuals with disabilities, it will pay some or all of your out-of-pocket expenses. Individuals on both Medicare and Medicaid are known as “dual eligibles.”.

Does Medicare have out of pocket costs?

Medicare’s out-of-pocket costs — premiums, deductibles, copays and coinsurance — can easily result in a large tab each year. If you’re struggling to meet those expenses, you might be eligible for federal and state assistance. If you qualify for Medicaid, the federal-state health insurance program for people with low incomes ...

What are the costs of Medicare?

When you enroll in Original Medicare (Part A and Part B), you may be responsible for several different costs: 1 Your Part A and Part B deductibles 2 Your 20% Part B coinsurance, your daily Part A coinsurance for inpatient stays lasting longer than 60 days 3 Certain outpatient copayments.

What are the different types of Medicare coverage?

Some types of Medicare coverage include annual out-of-pocket limits. Medicare Supplement Plans K and L. Medicare Advantage plans. There are a lot of new terms to learn when you enroll in health insurance, like Medicare. You may see words such as assignment, coinsurance, and out-of-pocket limit. It’s important to understand what these words mean so ...

What is Medicare Supplement?

Medicare Supplement insurance plans are private plans, which means premiums are set by the insurance companies, not the government. Generally speaking, a plan with a higher out-of-pocket limit may have a lower premium than one with a lower limit. Plan K and Plan L generally have lower premiums compared to other Medicare Supplement insurance plans ...

Is there a cap on out of pocket medical expenses?

You can think of an out-of-pocket limit as a “cap.”. There is no cap on your share of medical expenses under Original Medicare. For example, you usually pay 20% of your allowable Medicare Part B charges regardless of the total amount.

Does Medicare have an out-of-pocket limit?

Original Medicare, Part A and Part B, doesn’t have an out-of-pocket limit. That means if you were hospitalized several times over the year or had many medical expenses, you might have to pay a lot of money. Some types of Medicare coverage include annual out-of-pocket limits. Medicare Supplement Plans K and L. Medicare Advantage plans.