Together, Medicare and Social Security payroll taxes are known as FICA taxes (Federal Insurance Contributions Act taxes). Lawmakers on both sides of the aisle have proposed a variety of reforms for both Social Security and Medicare, but Republicans are much more likely to focus on privatization, means testing, and increasing the age at which people become eligible for benefits.

Is Social Security tax the same as Medicare tax?

Mar 15, 2022 · 한국어 Русский Tiếng Việt Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes. Social Security and Medicare Withholding Rates

How does social security work with Medicare and CMS?

Jan 16, 2022 · Social Security And Medicare Tax Deductions FICA refers to the combined taxes withheld for Social Security and Medicare . On your pay statement, Social Security taxes are referred to as OASDI, for Old Age Survivor and Disability Insurance. Medicare is shown as Fed Med/EE. Your FICA withholdings depend on the employee group you belong to:

What is Social Security tax and how does it work?

The Parts of Medicare. Social Security enrolls you in Original Medicare (Part A and Part B). Medicare Part A (hospital insurance) helps pay for inpatient care in a hospital or limited time at a skilled nursing facility (following a hospital stay). Part A …

What are FICA taxes for Social Security and Medicare?

Aug 28, 2020 · FICA tax is a combination of a 6.2% Social Security tax and a 1.45% Medicare tax the IRS imposes on employee earnings. For 2019, only the first $132,900 of earnings was subject to the Social Security part of the tax; in 2020, it’s $137,700.

What are Social Security and Medicare taxes called?

the Federal Insurance Contributions Act (FICA)Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes.Mar 15, 2022

Are FICA and Social Security the same thing?

Is FICA the same as Social Security? No, but they are closely connected. FICA, the Federal Insurance Contributions Act, refers to the taxes that largely fund Social Security retirement, disability, survivor, spousal and children's benefits. FICA taxes also provide a chunk of Medicare's budget.

What is the difference between Oasdi and Medicare tax?

The Breakdown of FICA Tax Within that 7.65%, the OASDI (Old Age, Survivors, and Disability program, AKA, Social Security) portion is 6.2%—up to the annual maximum wages subject to Social Security. The Medicare tax is 2.9% – 1.45% for employees and employers on all employee earnings with no limit.May 28, 2020

Is Oasdi the same as Social Security?

The OASDI program—which for most Americans means Social Security—is the largest income-maintenance program in the United States. Based on social insurance principles, the program provides monthly benefits designed to replace, in part, the loss of income due to retirement, disability, or death.

Is FICA both Social Security and Medicare?

FICA helps fund both Social Security and Medicare programs, which provide benefits for retirees, the disabled, and children.

Is FICA Medicare and Social Security?

FICA refers to the combined taxes withheld for Social Security and Medicare (FICA stands for the Federal Insurance Contributions Act). On your pay statement, Social Security taxes are referred to as OASDI, for Old Age Survivor and Disability Insurance. Medicare is shown as Fed Med/EE.

What is the difference between FICA and SECA?

SECA, or the Self Employment tax, is similar to the FICA tax that employed people who earn salaries or wages must pay to cover their various insurance costs. The main difference between Self Employment tax and FICA taxes is that employees only pay half of their FICA tax amount and the employer covers the other half.Mar 28, 2019

What is EE Social Security tax?

Any annual wages beyond $106,800 are not taxed for Social Security. The designation "EE" stands for the Social Security taxes paid by the "employee," as opposed to the Social Security taxes paid by the employer, which are designated as SS ER.

What is Med EE?

Fed MED/EE stands for Federal Medicare/Employer-Employee, which is a tax that funds the Medicare Health Insurance program. Every American taxpayer is required to pay the Medicare tax, unless they offer a qualified exception.Feb 7, 2022

What is the 2021 Social Security limit?

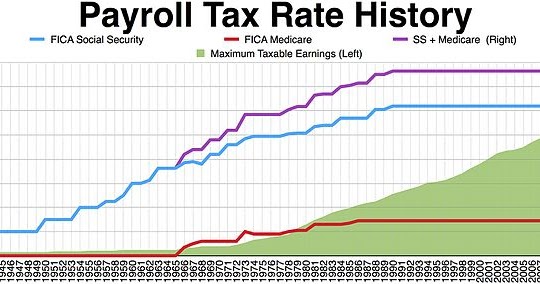

$142,800Maximum Taxable Earnings Each YearYearAmount2019$132,9002020$137,7002021$142,8002022$147,0004 more rows

At what age is your Social Security not taxable?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

What is the max Social Security?

The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2022, your maximum benefit would be $3,345. However, if you retire at age 62 in 2022, your maximum benefit would be $2,364.Dec 9, 2021

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

Early Benefits Shrank Your Social Security Check

For most people retiring now, the full retirement age for Social Security purposes is either 66 or 67, depending on the year when you were born. But it is possible to begin taking your Social Security retirement benefits as early as age 62. While that can give you some financial relief if youre strapped for cash, there is a tradeoff.

Reducing Cost Of Living Adjustment

At present, a retiree’s benefit is annually adjusted for inflation to reflect changes in the consumer price index.

New Medicare Cards Will Be Issued Without Social Security Numbers

The Center of Medicare & Medicaid has announced its plan to remove Social Security numbers from Medicare ID cards. Social Security numbers have been used as the beneficiary identifier for administering services.

Remove Social Security Numbers From Medicare Cards

The Social Security Administration advises Americans to keep their Social Security card in a safe place. At the same time, the Centers for Medicare and Medicaid Services tells their beneficiaries to carry their Medicare card which includes their Social Security number with them at all times.

Does Social Security Pay For Medicare

Social Security does not pay for Medicare, but if you receive Social Security payments, your Part B premiums can be deducted from your check. This means that instead of $1,500, for example, youll receive $1,386.40 and your Part B premium will be paid.

Social Security And Medicare Tax Deductions

FICA refers to the combined taxes withheld for Social Security and Medicare . On your pay statement, Social Security taxes are referred to as OASDI, for Old Age Survivor and Disability Insurance. Medicare is shown as Fed Med/EE.

How To Receive Federal Benefits

To begin receiving your federal benefits, like Social Security or veterans benefits, you must sign up for electronic payments with direct deposit.

FICA Tax Rates

However, if you do take advantage of the exemption, you will be ineligible to receive any of the benefits offered by Social Security. First, FICA taxes remove a percentage of your wages to help fund Social Security (which may show up on your paycheck as FICA OASDI, representing the Old-Age, Survivors, and Disability Insurance Trust).

All About the FICA Tax

There are, however, exemptions available to specific groups of taxpayers. If you fall under one of these categories, you can potentially save a significant amount of money.

What is FICA Tax and How is it Calculated?

Federal law requires employers to withhold taxes from an employee’s earnings to fund the Social Security and Medicare programs. These are called Federal Insurance Contributions Act (FICA) taxes. As an employer, the City also pays a tax equal to the amount withheld from an employee’s earnings.

What is FICA tax?

FICA Tax. FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA.

What is the most important tax to stay on top of and get correct?

FICA taxes are the most important tax to stay on top of and get correct. Not withhold or paying the correct amount of FICA taxes will result in serious consequences for the employer. All businesses must report FICA taxes quarterly to the IRS using Form 941.

What is the Medicare tax rate for 2019?

In 2019, the tax rate for employees was 1.45% for Medicare and 6.2% for Social Security. High-income employees are charged an additional 0.9% Medicare surtax. Employers have the responsibility of withholding FICA taxes from their employees’ wages.

What happens if you don't pay Social Security taxes?

If an employee makes more than the set $132,900, Social Security tax should not be withheld from their pay for any earning made above this amount. If you do not follow Social Security, Medicare, or FICA instruction carefully, you may end up either not deducting enough or too much.

What is the Medicare tax rate if you make more than the threshold?

The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional Medicare tax of 0.9%.

Do you pay Medicare tax on your paystub?

The Medicare program ensures all Americans 65 years and older have access to federal health insurance. The Medicare tax that you see on your paystub is what supports this program. Both employees and employers must pay Medicare tax .

Do self employed people pay Medicare taxes?

If you are self-employed, you will pay self-employment tax, which is the equivalent of both employee and employer portions of the Medicare Tax. In 2019, the rate of Medicare tax was 1.45% of an employee’s gross earnings. The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional ...

Why are FICA taxes called payroll taxes?

FICA taxes are called payroll taxes because they are based on income paid to employees. FICA taxes have two elements that are withheld from employee paychecks and paid by employees: Social Security (Old-Age, Survivors and Disability Insurance or OASDI) and. Medicare. 1 .

What is FICA tax?

Dotdash. There are certain taxes on income that everyone has to pay, and FICA (Federal Insurance Contributions Act) taxes for Social Security and Medicare are at the top of the list. Employers must withhold these taxes from employee paychecks and pay them to the IRS. FICA taxes are called payroll taxes because they are based on income paid ...

How much is FICA tax?

The total FICA tax is 15.3% based on an employee's gross pay. The employer and employee each pay 7.65%. Here is a breakdown of these taxes: Within that 7.65%, the OASDI (Old Age, Survivors, and Disability program, AKA, Social Security) portion is 6.2%—up to the annual maximum wages subject to Social Security.

When did self employment start paying taxes?

Self-Employment Tax. FICA taxes were set up by the Federal Insurance Compensation Act (FICA) in the 1930s, first to fund the Social Security benefits program, and later, the Medicare program. A separate program, called the Self-employment Contributions Act (SECA) of 1954, requires self-employed individuals to pay Social Security ...

Is FICA withheld from self employed business?

Some payments to certain individuals are not subject to FICA taxes. For example, the income of self-employed business owners is not withheld under the FICA system, but there is a different law requiring the payment of these taxes, called the Self Employed Contributions Act (SECA). 2

Do I have to send FICA to IRS?

You must send FICA tax deposits— along with amounts withheld from employee pay for federal income tax—to the IRS periodically. You must make deposits of these amounts either semi-weekly or monthly, depending on the average size of deposits for the past year (new businesses deposit monthly).

Can you withhold too much FICA?

Withholding Too Much FICA Tax. If you continued to deduct Social Security tax above the maximum, you withheld too much FICA tax and must refund the money to the employee. Make sure your payroll software doesn't count this as income to the employee; it doesn't affect the employee's gross pay so it's not income. 6.