Medicare Advantage Plan Benefits

- Fitness. ...

- Dental. ...

- Vision. ...

- OTC (Over-the-Counter) The OTC (over-the-counter) benefit helps members save at least 40% on OTC medications and products. ...

- Hearing. ...

- Virtual Visits through Preferred Telehealth Partners. ...

Full Answer

What are the advantages and disadvantages of Medicare Advantage plans?

Medicare Advantage Plans cover almost all Part A and Part B services. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies. In all types of Medicare Advantage Plans, you’re always covered for

Why should I get a Medicare Advantage plan?

Some Medicare Advantage plans may feature $0 monthly premiums. Most Part C plans offer prescription drug coverage. Some plans may also cover routine vision and dental care as well as a number of other benefits such as free gym memberships and transportation costs related to medical care, all of which is not covered by Original Medicare.

What do you pay in a Medicare Advantage plan?

Mar 07, 2022 · Medicare Advantage Plan Benefits Medicare Advantage Plan Benefits to Help You Live Healthier When you choose a Medicare Advantage plan from UnitedHealthcare, you get more for your Medicare dollar. UnitedHealthcare Medicare Advantage plans are built with the features and benefits you need to help you live healthier.* Fitness Dental Vision Hearing

How do I choose the best Medicare Advantage plan?

Most Medicare Advantage Plans include drug coverage (Part D). In most cases, you’ll need to use health care providers who participate in the plan’s network. These plans set a limit on what you’ll have to pay out-of-pocket each year for covered services. Some plans offer non-emergency coverage out of network, but typically at a higher cost.

What are the disadvantages of a Medicare Advantage plan?

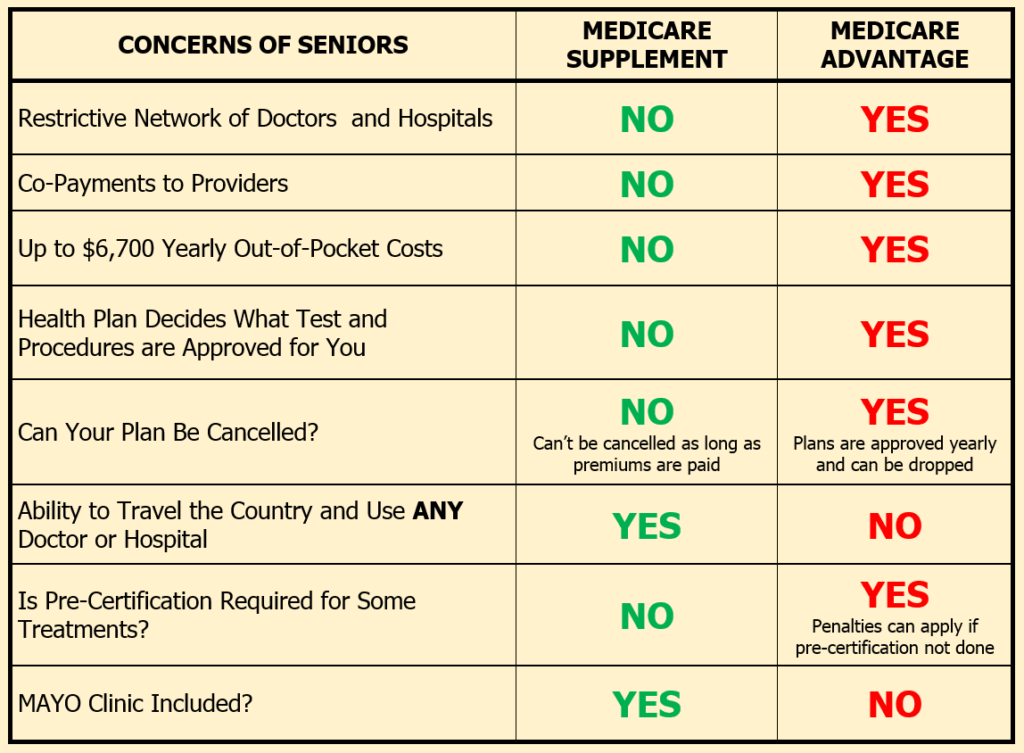

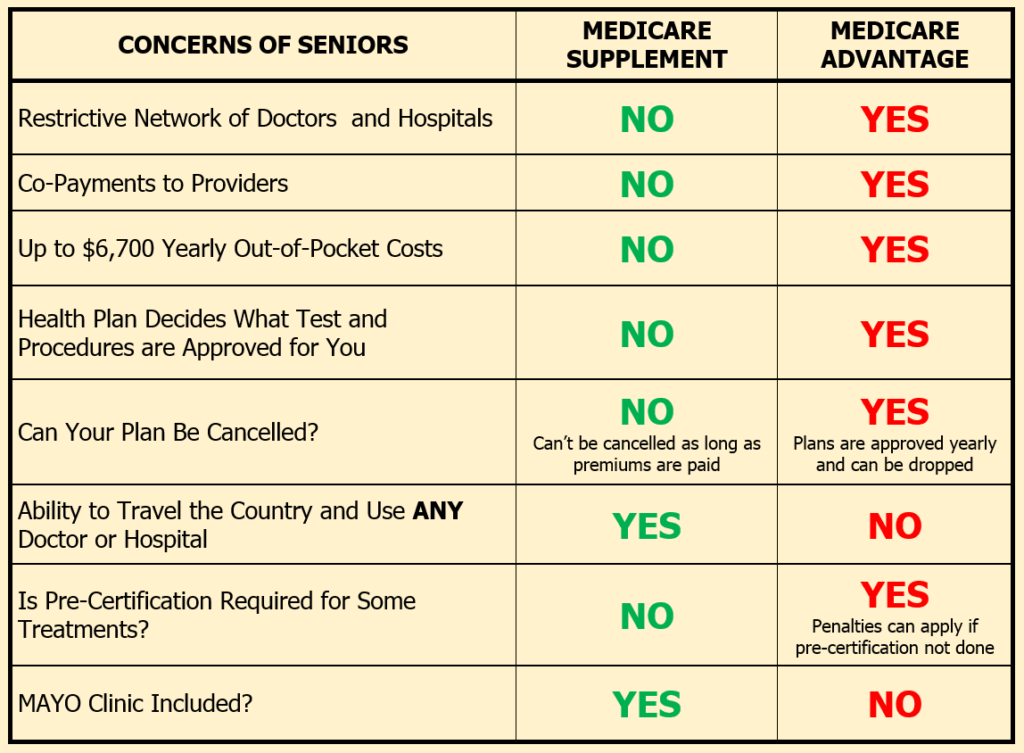

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

What are the advantages of having a Medicare Advantage plan?

Most Medicare Advantage Plans offer coverage, for some things Original Medicare doesn't cover, like some vision, hearing, dental, and fitness programs (like gym memberships or discounts). Plans also have a yearly limit on your out-of-pocket costs for all Part A and Part B medical services.

What is the benefit of choosing Medicare Advantage rather than the original Medicare plan?

Under Medicare Advantage, you will get all the services you are eligible for under original Medicare. In addition, some MA plans offer care not covered by the original option. These include some dental, vision and hearing care. Some MA plans also provide coverage for gym memberships.Oct 12, 2021

What is the difference between a regular Medicare plan and an Advantage plan?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

Can I switch from a Medicare Advantage plan back to Original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Does getting a Medicare Advantage plan make you lose original Medicare?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Do Medicare Advantage plans have a lifetime limit?

Medicare Advantage plans have no lifetime limits because they have to offer coverage that is at least as good as traditional Medicare, says Vicki Gottlich, senior policy attorney at the Center for Medicare Advocacy in Washington, D.C. “There has never been a cap on the total amount of benefits for which Medicare will ...Aug 23, 2010

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is Medicare Advantage?

Medicare Advantage (Medicare Part C) plans are privately administered , so costs and benefits can vary according to the particular plan you choose . Some Medicare Advantage plans may feature $0 monthly premiums. Most Part C plans offer prescription drug coverage. Some plans may also cover routine vision and dental care as well as a number of other benefits such as free gym memberships and transportation costs related to medical care, all of which is not covered by Original Medicare. However, it’s important to check with an insurance agent or with your plan carrier to find out exactly what benefits may be covered under your Medicare Advantage plan.

When will Medicare Advantage plans be expanded?

The list of benefits covered by Medicare Advantage plans grew to be more expansive when new federal laws took effect in 2019. Even more new additional benefits may offered by some Medicare Advan...

What is the difference between Medicare Part A and B?

Original Medicare (Parts A and B) typically covers emergency care (under Medicare part A) and outpatient health care, preventive care and medical devices (under Medicare Part B). Most people who enroll in Original Medicare will have to pay a monthly premium for Part B coverage.

What is Medicare 101?

Medicare 101: Your Guide to Additional Benefits. Original Medicare (Medicare Part A and Part B) helps cover some hospital and medical costs for people age 65 and older and people younger than 65 who have a qualifying disability or medical condit... Read More.

What is the benefit of yoga for older adults?

10 Benefits of Yoga for Older Adults. For many senior adults, the downward dog and camel poses are just as much part of their morning routine as coffee and the newspaper. Yoga can help improve muscle strength, aerobic fitness, balan... Read More.

What is a silver sniper?

SilverSneakers is a fitness program for older adults that is offered in conjunction with gyms and fitness centers all over the U.S. One of the additional benefits that may be offered by some M... Read More.

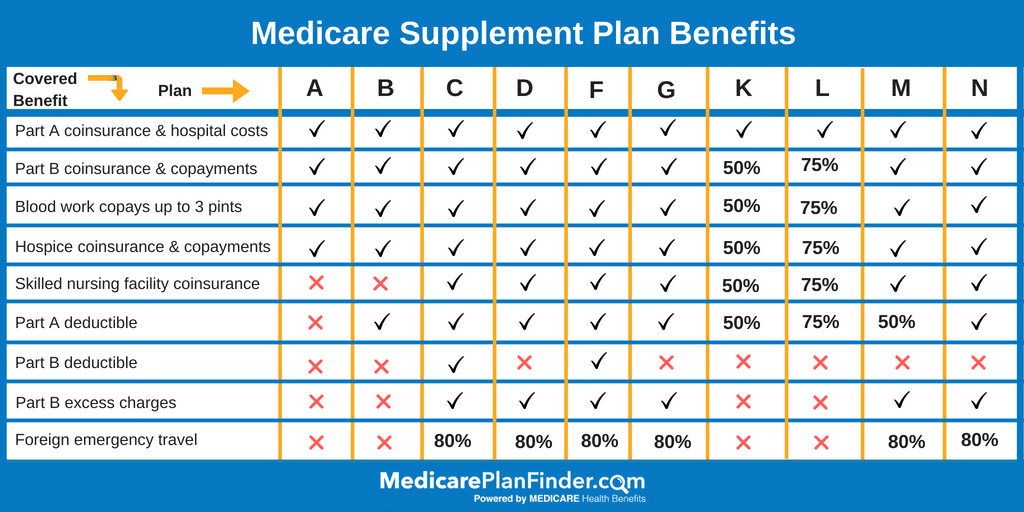

What is Medicare Supplement?

Medicare Supplement (Mediga p) plans can help pay for some out-of-pocket Medicare costs such as deductibles, copays and coinsurance. In addition to help covering costs associated with Original Medicare, some plans also can help pay for medical care needed while traveling internationally.

What are the benefits of Medicare Advantage Plan?

Medicare Advantage Plan Benefits to Help You Live Healthier. When you choose a Medicare Advantage plan from UnitedHealthcare, you get more for your Medicare dollar. UnitedHealthcare Medicare Advantage plans are built with the features and benefits you need to help you live healthier.*. Fitness. Dental.

Is Fitbit a registered trademark?

Fitbit and the Fitbit logo are trademarks or registered trademarks of Fitbit, Inc. in the US and other countries. Additional Fitbit trademarks can be found at www.fitbit.com/legal/trademark-list. 2 Availability of the SilverSneakers program varies by plan/market. Refer to your Evidence of Coverage for more details.

Does Medicare cover dental insurance?

Dental. Dental coverage is available with most Medicare Advantage plans. All plans that include a dental benefit cover services not covered by Original Medicare, such as exams, annual x-rays and routine cleanings—all for a $0 copay with in-network dentists.

Does UnitedHealthcare offer renew active?

Fitness. Most Medicare Advantage plans from UnitedHealthcare offer Renew Active™, a fitness program for body and mind designed to help members stay active, at a gym or from home, at no additional cost.1 Learn more about Renew Active.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

What is a special needs plan?

Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

What are the disadvantages of Medicare Advantage?

A possible disadvantage of a Medicare Advantage plan is you can’t have a Medicare Supplement plan with it. You may be limited to provider networks. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

What is the out of pocket limit for Medicare Advantage?

Once you meet this limit, your plan covers the costs for all Medicare-covered services for the rest of the year. In 2021 the out of pocket limit is $7,550, according to the Kaiser Family Foundation.

What are the benefits of a syringe?

Other extra benefits may include: 1 Meal delivery for beneficiaries with chronic illnesses 2 Transportation for non-medical needs like grocery shopping 3 Carpet shampooing to reduce asthma attacks 4 Transport to a doctor appointment or to see a nutritionist 5 Alternative medicine such as acupuncture

Does Medicare have an out-of-pocket maximum?

You may not know that Original Medicare (Part A and Part B) has no out-of- pocket maximum. That means that if you face a catastrophic health concern, you may be responsible to pay tens of thousands of dollars out of pocket.

Does Medicare Advantage have a deductible?

Under Medicare Advantage, each plan negotiates its own rates with providers. You may pay lower deductibles and copayments/coinsurance than you would pay with Original Medicare. Some Medicare Advantage plans have deductibles as low as $0.

What is Pro 8?

Pro 8: ESRD coverage. Medicare Advantage plans can now accept you if you’re a Medicare beneficiary under age 65 who has ESRD (end-stage renal disease, a type of kidney failure).

Can you use any provider under Medicare Advantage?

Many Medicare Advantage plans have networks, such as HMOs (health maintenance organizations) or PPOs* (preferred provider organization). Many Medicare Advantage plans may have provider networks that limit the doctors and other providers you can use. Under Original Medicare, you can use any provider that accepts Medicare assignment.