The Donut Hole remains the third phase or part of your Medicare Part D prescription drug coverage and you only enter the Donut Hole when (if) the total retail value of your purchased medications exceeds your plan's 2021 Initial Coverage Limit (ICL) of $4,130.

How big is the Medicare Donut Hole?

Jan 19, 2021 · In 2021, the Medicare Part D donut hole starts once you and your prescription drug plan have spent $4,130 on covered drugs and lasts until you have spent $6,550, at which time you enter the catastrophic coverage phase. While you’re in the donut hole, you pay 25% of the costs for your covered generic and brand name drugs.

What is a RX Donut Hole?

pocket total. You remain in the Donut Hole until your out-of-pocket total during the calendar year reaches $6,550. This stage begins when your out-of-pocket total reaches $6,550. See right for your drug costs during this stage. You remain in the Catastrophic Coverage Stage until January 1, 2021. You pay 25% Drug manufacturer pays 70% Plan pays 5%

What is the Medicare Part D Donut Hole?

Aug 09, 2010 · A number of visitors to www.HealthCare.gov have told us they’d like to know more about the Medicare “donut hole” in the Part D program. If you aren’t familiar with Medicare, it is a health insurance program for people 65 or older, people under 65 with certain disabilities, and people with End-Stage Renal Disease (permanent kidney failure). People with Medicare have …

What is part D coverage gap?

Sep 01, 2020 · If the retail value of your formulary drug purchases is over $ 345 per month, you will enter the Donut Hole sometime in 2021. The Donut Hole remains the third phase or part of your Medicare Part D prescription drug coverage and you only enter the Donut Hole when (if) the total retail value of your purchased medications exceeds your plan's 2021 Initial Coverage …

Will the donut hole go away in 2021?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

What is the Medicare donut hole amount for 2021?

$4,130Standard plans have a deductible, then you pay 25% of the cost of drugs until you reach the donut hole (in 2021, this happens once you and your health plan have spent $4,130 on your medications; for 2022, that threshold will increase to $4,430).

How do I avoid the Medicare donut hole?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.Jun 5, 2021

What happens when you reach the donut hole in Medicare?

The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs. In the past, you were responsible for a higher percentage of the cost of your drugs.

Can I avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

Will the donut hole ever go away?

The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year. That limit is not just what you have spent but also includes the amount of any discounts you received in the donut hole.

Is there insurance to cover the donut hole?

There is no Donut Hole Insurance but there are ways to reduce your overall Part D spending. Insurance to cover the Donut Hole in Medicare Part D does not exist. There is no Donut Hole insurance policy that you can buy just to cover the higher expenses during the coverage gap.Aug 8, 2014

Does the donut hole reset each year?

You will remain in the Catastrophic Coverage Stage until January 1. This process resets every January 1.

Does Medigap cover the donut hole?

There is not a Medicare plan that covers the donut hole. You may wonder if a Medigap could help you avoid donut hole costs. Medigap policies are private Medicare supplement insurance plans that are sold to cover additional costs and some services not traditionally covered by Original Medicare.Dec 2, 2021

How is the donut hole calculated?

Any discount you get on brand-name drugs. For example, if your plan gives you a manufacturer's discount of $30 for a medication, that $30 counts toward the Medicare Part D donut hole (coverage gap).

What counts towards donut hole?

The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs. Once you and your Medicare Part D plan have spent a certain amount on covered prescription drugs during a calendar year ($4,430 in 2022), you reach the coverage gap and are considered in the “donut hole.”

What is the donut hole gap in coverage for prescription drugs?

Most plans with Medicare prescription drug coverage (Part D) have a coverage gap (called a "donut hole"). This means that after you and your drug plan have spent a certain amount of money for covered drugs, you have to pay all costs out-of-pocket for your prescriptions up to a yearly limit.

What Is the Medicare Part D Donut Hole?

The “donut hole” refers to a coverage gap that exists in Medicare prescription drug coverage. When you’re in the donut hole coverage gap, your Medicare drug plan pays a limited amount of the drug costs for generic drugs and brand name drugs.

How does the donut hole affect beneficiaries?

Let’s say your Medicare drug plan has a coinsurance requirement of 10%. During the initial coverage phase, you will be responsible for 10% of the cost of your prescriptions.

Did the Donut Hole Go Away in 2020?

The Medicare donut hole started shrinking and was set to close to its current rate in 2020, due to provisions in the Affordable Care Act (also known as ACA or Obamacare), which was signed into law in 2010 by President Barack Obama.

How does Medicare Part D work in 2010?

In 2010, basic Medicare Part D coverage works like this: You pay out-of-pocket for monthly Part D premiums all year. You pay 100% of your drug costs until you reach the $310 deductible amount. After reaching the deductible, you pay 25% of the cost of your drugs, while the Part D plan pays the rest, until the total you and your plan spend on your ...

Does Medicare Extra Help cover out-of-pocket costs?

These plans also may charge a higher monthly premium.) For those that qualify, there is also a program called Medicare Extra Help that helps you pay your premiums and have reduced or no out-of-pocket costs for your drugs.

Will Part D drugs be covered in 2020?

By 2020, the coverage gap will be closed, meaning there will be no more “donut hole,” and you will only pay 25% of the costs of your drugs until you reach the yearly out-of-pocket spending limit. Throughout this time, you will get ...

Does Medicare Part D cover prescriptions?

Throughout this time, you will get continuous Medicare Part D coverage for your prescription drugs as long as you are on a prescription drug plan. If you would like more information on the one-time rebate check, feel free to call 1-800-MEDICARE.

Part 1 of your drug coverage

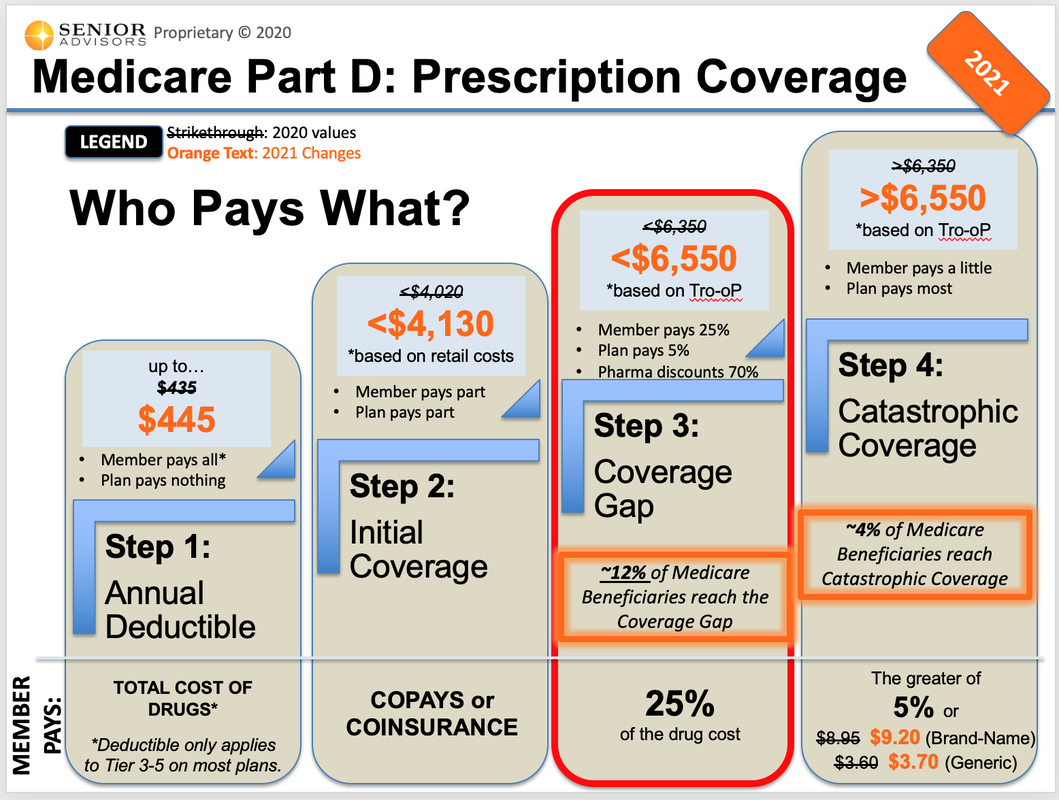

The Initial Deductible Phase The standard Initial Deductible can change each year. In 2021 , the Initial Deductible is $445. In 2020, the standard Initial Deductible was $435. If your Medicare Part D plan has an Initial Deductible , you will usually pay 100% for your medications and the amount you pay will count toward the Donut Hole.

Part 2 of your drug coverage

The Initial Coverage Phase After the Initial Deductible (if any), you will continue into your Initial Coverage phase where your Medicare Part D plan covers a portion of your prescription costs and you pay some cost-sharing (co-payment or co-insurance).

Part 3 of your drug coverage

The Coverage Gap or Donut Hole You will leave the Initial Coverage phase and enter the Donut Hole when your total retail drug cost (what you spent plus what your Medicare drug plan spent) exceeds the Initial Coverage Limit ($4,130). As mentioned, the Coverage Gap this is the portion of your Medicare Part D coverage where you traditionally paid a larger percentage of the retail drug cost.

Part 4 of your drug coverage

The Catastrophic Coverage Phase You will stay in the Coverage Gap or Donut Hole phase until your out-of-pocket costs (called TrOOP or total drug spend) reaches a certain level. The TrOOP level in 2021 is $6,550 .

What is Medicare Part D?

Medicare Part D is a program that helps pay for your prescription drug coverage.

Name-Brand Prescriptions

During this time you will be responsible for no more than 25% of the cost of your name-brand prescription medications.

When does the Donut hole end?

In order to get out of the “donut hole”, your total out-of-pocket costs must reach $6,550 in 2021 ( click here for the most up-to-date figure ).

Will the donut hole ever go away?

The Part D drug plan had a coverage gap when it was first implemented in 2006.

Summary

The Medicare “donut hole” refers to the 3rd payment stage of Part D drug plans.

About the Author: Eugene Marchenko

Eugene obtained his license in 2010 while working in the banking industry. After the decline of the economy in 2008 and countless conversations with folks about ways to keep their homes, Eugene realized it is time to focus on an industry that actually helps people.

What is a donut hole?

What is the Donut Hole? The Medicare Part D Donut Hole, or Coverage Gap, is one of four stages you may encounter during the year while a member of a Part D prescription drug plan. Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached ...

What tiers are deductibles?

The deductible counts toward any combination of drugs on Tiers 3, 4, and 5. You will not pay a separate deductible for each tier. After you pay the deductible, you will pay only your copay for Tier 3, 4, and 5 drugs.

How to contact Medicare for copays?

If you qualify, you may receive help paying for your monthly premium and prescription drug copays. For more information, contact Medicare at 1-800-633-4227 (TTY 1-877-486-2048), the Social Security Office at 1-800-772-1213 (TTY 1-800-325-0778), or the Office of Medicaid Commonwealth of Massachusetts at 1-617-573-1770.

Does Tufts Medicare have a Part D deductible?

All other plans do not have a Part D deductible. If you are a member of Tufts Medicare Preferred HMO Value Rx, Basic Rx, or Saver Rx plan: There is no deductible for drugs on Tier 1 and Tier 2. The is a deductible for drugs on Tier 3, Tier 4, and/or Tier 5.

What is the Medicare donut hole?

The Medicare donut hole is a coverage gap in Plan D prescription coverage. You enter it after you’ve passed an initial coverage limit. In 2021, you’ll have to pay 25 percent OOP from when you enter the donut hole until you reach the OOP threshold.

How much money do you have to spend to get out of the donut hole?

This is the amount of OOP money that you have to spend before you exit the donut hole. For 2021, the OOP threshold has increased to $6,550. This is up from $6,350 in 2020, meaning that you’ll have to pay more OOP than before in order to get out of the donut hole.

What is the donut hole?

The donut hole is a gap in prescription drug coverage during which you may pay more for prescription drugs. You enter the donut hole once Medicare has paid a certain amount toward your prescription drugs in one coverage year. Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions ...

What is the minimum copay for 2021?

After you exit the donut hole, you’ll receive what’s called catastrophic coverage. This means that you’ll have to pay whatever is greater for the rest of the year: 5 percent of a drug’s cost or a small copay. The minimum copay for 2021 has increased a little from 2020: Generic drugs: minimum copay is $3.70, which is up from $3.60 in 2020.

What is Medicare Part D?

Understanding Medicare Part D. Medicare Part D is an optional plan under Medicare for coverage of prescription drugs. Insurance providers approved by Medicare provide this coverage. Prior to Part D, many people received prescription drug coverage through their employer or a private plan. Some had no coverage.

What happens if you fall into a donut hole?

Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions until you reach the yearly limit. Depending on the type of coverage you choose, when you hit this limit, your plan may help pay for your prescriptions again. Continue reading as we discuss more about the donut hole and how may it affect how ...

What to consider before choosing a Medicare plan?

Below are some things to consider before choosing a plan. Use the Medicare website to search for a plan that’s right for you. Compare a Medicare Part D with a Medicare Advantage (Part C) plan. Medicare Advantage plans include health care and drug coverage on one plan and sometimes other benefits like dental and vision.

How much is a deductible for 2021?

The deductibles vary between plans and some Part D plans have no deductible. In 2021, the deductible can’t be more than $445.

What is the limit for Part D coverage in 2021?

If the combined amount you and your drug plan pay for prescription drugs reaches a certain level during the year—that limit is $4,130 in 2021—you enter the Part D coverage gap or “donut hole.”.

What is a Medicare Part D gap?

When Medicare Part D prescription drug plans first became available, there was a built-in gap in coverage. This coverage gap opened after initial plan coverage limits had been reached and before catastrophic coverage kicked in. While in this gap, plan members had to pay the full cost of their covered drugs until their total costs qualified them ...

How much will you pay for prescription drugs in 2021?

For 2021, once you've spent $6,550 out of pocket, you're out of the coverage gap and move into phase 4—catastrophic ...

What is phase 3 coverage gap?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap, and it doesn’t apply to members who get Extra Help to pay for their Part D costs. Once in the gap, you’ll pay no more ...

Is the donut hole closed?

Where members once paid 100% of their costs in the gap, now their share of costs in the donut hole is limited to 25% for both brand-name and generic drugs. The donut hole has essentially closed. 2.

Do you pay coinsurance for Part D?

In this last phase of Part D plan coverage, you’ll only pay a small coinsurance amount or copayment for covered drugs for the rest of the year. When your new plan year begins, you start over at phase 1.