Medicare Part D: Prescription Drug Coverage

- Helps people on Medicare lower their prescription drug costs and protect against future drug costs.

- Provides greater access to medically necessary drugs.

- Some Medicare Advantage plans, including Medical Mutual plans, include Part D prescription Drug coverage for no additional costs.

What is covered by Medicare Part D?

MEDICARE PART D DEFINED STANDARD BENEFIT FOR CY2022 Beneficiary Plans Manufacturers Medicare Initial Catastrophic Deductible Coverage Limit Coverage Gap Phase $480 $4,430 $10,690* 75% Plans 100% Beneficiary 25% Beneficiary 70% Manufacturers 80% Medicare 25% Beneficiary 5% Plans 5% Beneficiary 15% Plans

What Medicare Part D plan is best for me?

Aug 23, 2011 · The Part D drug benefit (also known as “Medicare Rx”) helps Medicare beneficiaries to pay for outpatient prescription drugs purchased at retail, mail order, home infusion, and long-term care pharmacies. [2] Unlike Parts A and B, which are administered by Medicare itself, Part D is “privatized.”

How do you add Part D to Medicare?

Mar 06, 2022 · Definition of Medicare Part D Part D is an optional Medicare benefit that helps pay for your prescription drug expenses. If you want this coverage, you will have to pay an additional premium. Private insurance companies contract with the federal government to offer Part D programs through the Medicare system.

Who is eligible for Medicare Part D?

Medicare Prescription Drug Benefit Manual . Chapter 6 – Part D Drugs and Formulary Requirements . Table of Contents (Rev. 18, 01-15-16) Transmittals for Chapter 6 10 - Definition of a Part D Drug. 10.1 - General. 10.2 - Covered Part D Drug. 10.3 - Commercially Available Combination Products. 10.4 - Extemporaneous Compounds

What is the main benefit of Medicare Part D?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...Jun 4, 2019

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

What is Medicare Part D and how does it work?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications.

What is not covered under Medicare Part D?

Drugs not covered under Medicare Part D Weight loss or weight gain drugs. Drugs for cosmetic purposes or hair growth. Fertility drugs. Drugs for sexual or erectile dysfunction.Jun 5, 2021

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.Sep 27, 2021

Does Medicare Part D come out of your Social Security check?

Your Medicare Part B premiums will be automatically deducted from your Social Security benefits. Most people receive Part A without paying a premium. You can choose to have your Part C and Part D premiums deducted from your benefits. Medicare allows you to pay online or by mail without a fee.Dec 1, 2021

What is the maximum out of pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

Does Medicare Part D cover prescriptions?

Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1.

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What are the 4 phases of Medicare Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.Oct 1, 2021

Is Part D mandatory?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is Medicare Part D 2021?

Part D plans have different formularies (drug lists), tiers, coverage rules, and networks, which will affect how you get your drugs covered. Part D plans have different formularies (drug lists), tiers, coverage rules and networks, which will affect how you get your drugs covered.

What are the rules for Part D?

The rules may include: Quantity limits. Prior authorization. Step therapy. If you or your medical practitioner believes that one of your Part D plan’s coverage rules should be waived, you may request a plan exception.

What is a Medicare formulary?

A formulary is a drug list that shows which drugs are covered by a plan. You may face higher out-of-pocket costs if you need a medication ...

What is the donut hole in Medicare?

The Part D "donut hole" coverage gap may affect how much you have to pay out-of-pocket to use your Medicare Part D benefits in 2021.

Can Part D plan change?

A Part D plan formulary may change from year to year. Insurance providers may change plan benefits as long as the changes follow Medicare guidelines. If you currently take a covered prescription medication, your Part D plan provider must notify you if any formulary changes will impact your coverage.

Does Part D cover prescriptions?

If you fill a prescription at a non-network pharmacy, your plan may not cover your medication’s cost at all. Your Part D plan’s network pharmacies may include retail pharmacies, preferred pharmacies, mail-order programs, and 30- or 90-day retail pharmacy programs.

Do Part D plans have higher out-of-pocket costs?

You may face higher out-of-pocket costs if you need a medication that is not on your plan’s approved drug list. Many Part D plan formularies also place prescription drugs into different tiers. Drugs in different tiers will have different costs. Prescription drugs in lower tiers usually have smaller copayments than drugs in higher tiers.

What is Medicare Part D based on?

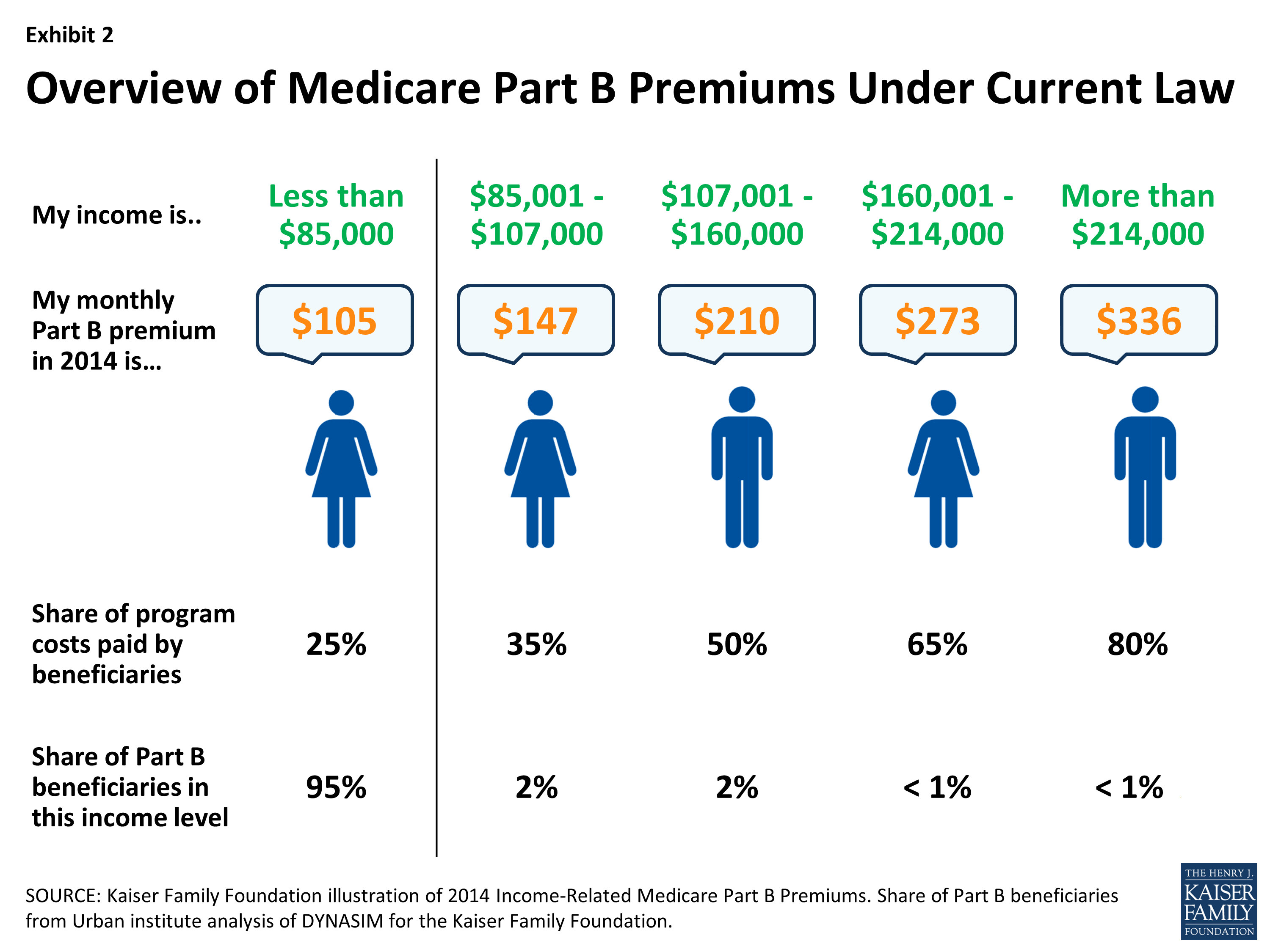

Medicare Part D beneficiaries with higher incomes pay higher Medicare Part D premiums based on their income, similar to higher Part B premiums already paid by this group. The premium adjustment is called the Income-Related Monthly Adjustment Amount (IRMAA). The IRMAA is not based on the specific premium of the beneficiary's plan, but is rather a set amount per income-level that is based on the national base beneficiary premium (the national base beneficiary premium is recalculated annually; for 2016 it is $34.10). In effect, the IRMAA is a second premium paid to Social Security, in addition to the monthly Part D premium already being paid to the plan.

What is the gap in Medicare Part D?

The costs associated with Medicare Part D include a monthly premium, an annual deductible (sometimes waived by the plans), co-payments and co-insurance for specific drugs, a gap in coverage called the "Donut Hole," and catastrophic coverage once a threshold amount has been met.

What is Medicare Savings Program?

Medicare Savings Programs help low income individuals to pay for their Medicare Part A and/or Part B co-pays and deductibles. There are four Medicare Savings programs, all of which are administered by state Medicaid agencies and are funded jointly by states and the federal governments. Participants in these programs are sometimes called "partial dual eligibles." Individuals who qualify for a Medicare Savings program automatically qualify for the Part D Low Income Subsidy (LIS), which is also known as "Extra Help." The LIS helps qualified individuals pay their Part D expenses, including monthly premiums, co-pays and co-insurance. The LIS also covers people during the deductible period and the gap in coverage called the "Donut Hole."

What is LIS in Medicare?

Individuals who qualify for a Medicare Savings program automatically qualify for the Part D Low Income Subsidy (LIS), which is also known as "Extra Help.". The LIS helps qualified individuals pay their Part D expenses, including monthly premiums, co-pays and co-insurance.

Does Medicare have a DS?

Most plans do not follow the defined Standard Benefit (DS) model. Medicare law allows plans to offer actuarially equivalent or enhanced plans. While structured differently, these alternative plans cannot impose a higher deductible or higher initial coverage limits or out-of-pocket thresholds. The value of benefits in an actuarially equivalent plan must be at least as valuable as the Standard Benefit.

Does Medicare cover outpatient prescriptions?

Medicare did not cover outpatient prescription drugs until January 1, 2006, when it implemented the Medicare Part D prescription drug benefit, authorized by Congress under the "Medicare Prescription Drug, Improvement, and Modernization Act of 2003.". This Act is generally known as the "MMA.".

Is Part D a good plan?

Many Part D plan sponsors offer multiple plans that may be viewed as analogous to commercial "good, better and best" options . Buyers need to evaluate these choices carefully as it is sometimes the case that the "best" (and most expensive) plans offer little or no extra value for their higher prices.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

What drugs are covered by Part D?

Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

What is a Part D drug?

Part D covered drug is available only by prescription, approved by the FDA (or is a drug described under section 1927(k)(2)(A)(ii) or (iii) of the Act), used and sold in the United States, and used for a medically accepted indication (as defined in section 1927(k)(6) of the Act). A covered Part D drug includes prescription drugs, biological products, insulin as described in specified paragraphs of section 1927(k) of the Act, vaccines licensed under section 351 of the Public Health Service Act and for vaccine administration on or after January 1, 2008, its administration. The definition also includes medical supplies directly associated with delivering insulin to the body, including syringes, needles, alcohol swabs, gauze, and insulin injection delivery devices not otherwise covered under Medicare Part B, such as insulin pens, pen supplies, and needle-free syringes, can satisfy the definition of a Part D drug. CMS defines those medical supplies to include syringes, needles, alcohol swabs, gauze, and those supplies directly associated with delivering insulin into the body.

Does Medicare cover outpatient prescriptions?

Traditional Medicare (Part A/B) does not cover most outpatient prescription drugs. Medicare bundled payments made to hospitals and skilled nursing facilities generally cover all drugs provided during a stay. Medicare also makes payments to physicians for drug or biological products that are not usually self-administered. This means that coverage is usually limited to

Is inhalation drug covered by Part B?

Answer 1 – No. Since there currently is no coverage under Part B for inhalation drugs delivered through metered-dose inhalers and dispensed by a pharmacy, these drugs would be covered under Part D.

Is IVIG covered by Part B?

Answer 5 – It depends. Part B coverage for IVIG in the home is for individuals whose diagnosis is primary immune deficiency disease. Part D would provide coverage for IVIG in the home for all other medically accepted indications. Prior authorization requirements could be used to ensure appropriate payment in accordance with the Part D sponsor’s medical necessity criteria. It would not be appropriate to routinely require a rejection of a claim under Part B before processing a Part D claim. Such a policy would be disruptive to beneficiaries and pharmacies and would unnecessarily increase Part B contractor costs.

Is an external infusion pump covered by Part B?

Answer 2 – No, drugs that require an external infusion pump are not covered under Part B under those circumstances because the law limits coverage under Part B’s DME benefit to those items that are furnished for use in a patient’s home, and specifies that a hospital or SNF cannot be considered the beneficiary’s “home” for this purpose.

Does Part B coverage affect Part D?

Answer 5 - First, it is important to keep in mind that in most cases Part B drug coverage should not impact payment decisions by Part D sponsors since Part B coverage is generally in a provider setting or physician's office rather than for drugs dispensed at a pharmacy.

Is a drug approved by the FDA a Part D drug?

Answer 4 - No. Once a drug is approved by the FDA it is a Part D drug. While it is not automatically a covered Part D drug, that is, it may not be included on a Part D sponsor’s formulary, a member could request coverage on an exception basis.

What is Medicare Part D?

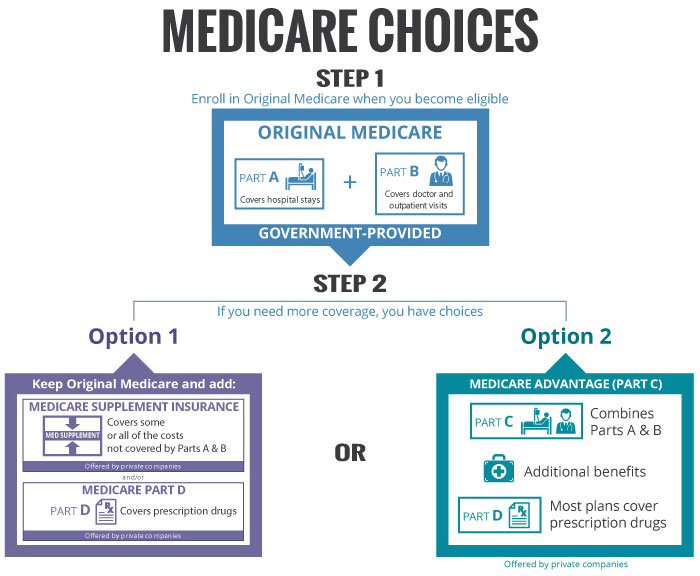

Summary: The Medicare Part D program authorizes Medicare-approved private insurance companies to provide prescription drug coverage. You must have Part A or Part B to join a Medicare Prescription Drug Plan. You can get this coverage in the form of a Medicare Advantage Prescription ...

What is the Medicare Part D coverage gap?

The Medicare Part D coverage gap is also called the “donut hole.”. Not all plans have a coverage gap or donut hole. Out-of-pocket threshold (coverage gap): If you and your plan spend $4,020 on covered prescription drugs in 2020, you’ll reach an out-of-pocket threshold. If you reach the threshold in 2020, you generally pay 25% ...

How much is the deductible for Medicare 2020?

Deductible: No Medicare Prescription Drug Plan can have a deductible higher than $435 in 2020. However, your actual deductible will depend on the particular plan you choose. Many plans do have a deductible, and you usually pay all of your drug costs up to that amount.

How long does it take to enroll in Medicare?

There are certain times when you can enroll in a Medicare prescription drug plan. When you’re new to Medicare, you get a seven-month Medicare Initial Enrollment Period (IEP). It starts three months before the month you qualify for Medicare, includes your birthday month.

What does the purple notice mean for Medicare?

Medicare will mail you a purple-colored notice to let you know that you automatically qualify for the program. Once you find out that you qualify, you should enroll in a stand-alone Medicare Prescription Drug Plan or Medicare Advantage Prescription Drug plan, if you do not already have Medicare Part D coverage.

When is the open enrollment period for Medicare Part D?

The Annual Election Period (or Fall Open Enrollment) for Medicare Part D Prescription Drug Plans lasts from October 15 to December 7 every year.

Do you have to have Part A or Part B?

You must have Part A or Part B to join a Medicare Prescription Drug Plan. You can get this coverage in the form of a Medicare Advantage Prescription Drug plan (MAPD) if you have both Part A and Part B, or a stand-alone Medicare Part D Prescription Drug Plan, which only requires Part A or Part B. Find affordable Medicare plans in your area.

Medicare Part D Formulary (Drug Lists) and Tiers

- Your Part D plan’s formulary and tierswill determine if your prescription drugs are covered and how much you will pay out-of-pocket for those drugs. A formulary is a drug list that shows which drugs are covered by a plan. You may face higher out-of-pocket costs if you need a medication that is not on your plan’s approved drug list. Many Part D plan formularies also place prescriptio…

Plan Formulary Updates

- A Part D plan formulary may change from year to year. Insurance providers may change plan benefits as long as the changes follow Medicare guidelines. If you currently take a covered prescription medication, your Part D plan provider must notify you if any formulary changes will impact your coverage.

Coverage Rules

- Part D prescription drug plan coverage rules may affect how and when you receive your prescription drugs. The rules may include: 1. Quantity limits 2. Prior authorization 3. Step therapy If you or your medical practitioner believes that one of your Part D plan’s coverage rules should be waived, you may request a plan exception. Medicare.gov provides more information about your …

Network Pharmacies

- Part D plans may have contracts with pharmacies in an established plan network. If you visit in-network pharmacies, your prescription drug costs may be lower. If you fill a prescription at a non-network pharmacy, your plan may not cover your medication’s cost at all. Your Part D plan’s network pharmacies may include retail pharmacies, preferred pha...