What changes are coming to Medicare in 2021?

What are the 2021 proposed changes to Medicare?Increased eligibility. One of President Biden's campaign goals was to lower the age of Medicare eligibility from 65 to 60. ... Expanded income brackets. ... More Special Enrollment Periods (SEPs) ... Additional coverage.Nov 22, 2021

What changes are being made to Medicare?

The annual Part B deductible will be $233 this year, an increase of $30. For Medicare Part A, which covers hospitalizations, hospice care and some nursing facility and home health services, the inpatient deductible that enrollees must pay for each hospital admission will be $1,556, an increase of $72 over 2021.Jan 3, 2022

What is the new Medicare payment for 2021?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Is Medicare getting an increase in 2021?

The increase in the standard monthly premium—from $148.50 in 2021 to $170.10 in 2022—is based in part on the statutory requirement to prepare for expenses, such as spending trends driven by COVID-19, and prior Congressional action in the Continuing Appropriations Act, 2021 that limited the 2021 Medicare Part B monthly ...Nov 12, 2021

How much is Medicare going up next year?

Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021). And those with fewer than 30 quarters worth of Medicare taxes will likely see a jump from the current rate of $471 in 2021 to $499 in 2022.Jan 4, 2022

What is the Irmaa for 2021?

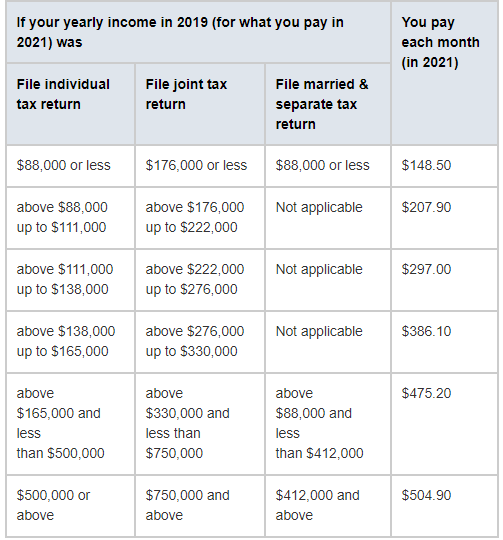

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $111,000 but less than or equal to $138,000$297.00More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.9012 more rows•Dec 6, 2021

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

How much does Medicare take out of Social Security?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

What are the changes to Medicare?

What Are the Medicare Changes for 2021? 1 Medicare premiums and deductibles have increased across the various plans. 2 The “donut hole” in Medicare Part D was eliminated in 2020. 3 Changes have been made to Medicare coverage to respond to COVID-19.

What is Medicare Supplement?

Medicare supplement, or Medigap, plans are Medicare plans that help you pay for a portion of your Medicare costs. These supplements can help offset the costs of premiums and deductibles for your Medicare coverage. Plans are sold by private companies, so rates vary. In 2021, under Plan G, Medicare covers its share of costs, ...

How much is Medicare Part A deductible in 2021?

This deductible covers an individual benefit period, which lasts 60 days from the first day of hospital or care facility admission. The deductible for each benefit period in 2021 is $1,484 — $76 more than in 2020.

How much is coinsurance for Medicare Part A?

For hospitalization, this means Medicare Part A will charge participants a coinsurance of $371 per day for days 61 through 90 — up from $352 in 2020. Beyond 90 days, you must pay a rate of $742 per day for lifetime reserve days — up from $704 in 2020. For admissions to skilled nursing facilities, the daily coinsurance for days 21 ...

What is the deductible for Medicare 2021?

In 2021, under Plan G, Medicare covers its share of costs, and then you pay out-of-pocket until you have reached a $2,370 deductible. At that point, Plan G will pay for the remainder of costs.

How much will Medicare cost in 2021?

Premium. Most people with Medicare Part B pay a premium for this plan, and the base cost in 2021 is $148.50 per month for individuals who make less than $88,000 per year or couples who make less than $176,000 per year. Premium costs increase incrementally based on income.

How many people will be on medicare in 2020?

In 2020, about 62.8 million people were enrolled in Medicare. It’s up to the Centers for Medicare & Medicaid (CMS), a division of the U.S. Department of Health and Human Services, to keep the needs of enrollees and the cost of the program in check as laid out in the Social Security Act.

How much is Medicare tax for 30 quarters?

The premium for those who paid Medicare taxes for 30-39 quarters increased from $252 to $259; those who paid for less than 30 quarters, it increased from $458 to $471. If you have questions about any of these changes to Medicare or how they affect your coverage, GoHealth can help. We have experienced, licensed insurance agents ...

What will Medicare do in 2021?

What Are The Changes To Medicare For 2021? Your Medicare coverage in 2021 may expand to provide lower costs and more services. This year will bring a cap on insulin prices and extended coverage for telehealth and COVID-19 services. Medicare Advantage coverage expands to acupuncture and beneficiaries with end stage renal disease.

What is Medicare Advantage?

Medicare Advantage ( Medicare Part C) is health insurance for Americans aged 65 and older that blends Medicare benefits with private health insurance. This typically includes a bundle of Original Medicare (Parts A and B) and Medicare Prescription Drug Plan (Part D). starting in 2021. Telehealth and telemedicine coverage will extend to 2021, ...

What is a copayment for insulin?

Insulin copayment. A copayment is the fixed amount you pay directly to your provider for medical services or prescription drugs covered in your plan. For example: If your plan includes a copayment of $20 for office visits, you'll pay $20 to your doctor whenever you have an appointment.

How much has Medicare increased in 2020?

For comparison, the premium increased 6.7% from 2019 to 2020. The Part A premium — which must only be paid by enrollees who paid Medicare taxes for less than 10 years (40 quarters) through an employer — also experienced modest increases.

How long does back pain last?

To be eligible, your back pain must: Have lasted 12 weeks or longer. Not be associated with pregnancy or past surgery.

Will Medicare expand telehealth?

CMS expanded telehealth and telemedicine services in 2020 as a way of keeping seniors safe during the COVID-19 pandemic. Those expansions will remain in place for 2021. That means you can take advantage of services like E-visits, check-ups, and more — all via your computer’s camera and microphone. This development should have a significant impact on Medicare in 2021 as recent studies show that 68% of Medicare-eligible adults had access to a computer and the internet at their homes.

Original Medicare changes in 2021

The Centers for Medicare and Medicaid Services, or CMS, announced in November that it is increasing premium and deductible costs in the Original Medicare program. Here’s a snapshot:

Medicare Part A premium

The premium for Medicare Part A (hospital insurance) is free for beneficiaries who have paid into Medicare through working at least 40 quarters of eligible employment. This population includes around 99% of beneficiaries.

Medicare Advantage changes 2021

The cost of Medicare Advantage premiums and deductibles vary based on the plan a beneficiary chooses and the zip code in which they live. Overall, CMS expects that the average premium cost for 2021 Medicare Advantage plans will decline by 11% to $21, down from $23.63 on average in 2020.

2021 Medicare Supplement changes

Medicare Supplement or Medigap monthly premiums vary depending on the plan you choose.

Changes to Medicare in the COVID-19 pandemic

The coronavirus pandemic brought significant changes to the Medicare program. Critically, CMS announced in October that Medicare would cover 100% of the cost of COVID-19 vaccines approved by the Food and Drug Administration. You will not need to pay a deductible or coinsurance for vaccine administration.

What is Medicare Part D?

Medicare Part D introduced a program to help people control their insulin costs, increased the maximum deductible allowed for standard plans, and raised the threshold spending amount to enter catastrophic coverage. Some Medicare Supplement Insurance plans, more commonly known as Medigap plans, received changes to their deductible amounts ...

How much is the out of pocket limit for Medigap Plan L?

Medigap Plan L’s out-of-pocket limit is $3,110 ($2,940 in 2020) Depending on the plan, your out-of-pocket costs may be different in 2021, even if no changes were made to the plan itself. Take Medigap Plan G, for instance. Medigap Plan G doesn’t cover the Medicare Part B deductible, which rose to $203 this year.

What is the deductible for Medicare Part D 2021?

What Are the Changes to Medicare Part D in 2021? Rules for Medicare Part D plans were also updated for 2021: The highest deductible amount that standard plans can set is now $445. The “donut hole” (coverage gap) has been eliminated, and the threshold to enter the catastrophic coverage phase has been raised to $6,550.

What is the maximum out of pocket limit for Medicare Advantage 2021?

The highest maximum out-of-pocket limit plans can set is $7,550 ($6, 700 in 2020) ...

What is the Medicare number for 2021?

If you still have questions about the 2021 changes in Medicare, we’re here to help. Give us a call at (877)896-4612 TTY 711 and one of our knowledgeable licensed insurance advisors will be happy to assist you.

How much is Medicare Part A deductible?

Medicare Part A deductible is $1,484 per benefit period. Medicare Part A hospital inpatient coinsurance for days 61-90 is $371 ($352 in 2020) Medicare Part A hospital inpatient coinsurance for lifetime reserve days is $742 ($704 in 2020) The vast majority of people on Medicare don’t have to pay an additional premium for Part A.

Does Medicare cover end stage renal disease?

People with End-Stage Renal Disease are no longer limited to certain types of Medicare Advantage plans, and the maximum out-of-pocket spending limit allowed has changed. Medicare often puts changes into effect at the start of a new year, and this year was no different. Let’s take a look at the most notable changes in Medicare for 2021.

What Are the 2021 Cost Changes for Medicare Part A?

Hospital and inpatient services are covered by Medicare Part A. Most Medicare beneficiaries are still eligible for premium-free Part A. For those who don’t qualify for free Part A (depending on how many years you’ve worked and paid social security taxes), you could pay up to $471 per month — $13 more than in 2020.

What Are the 2021 Cost Changes for Medicare Part B?

Medicare Part B is your medical insurance, covering doctor visits, medical supplies, and more.

Medicare Advantage Increases Coverage in 2020

Beginning in 2020, Medicare Advantage plans can offer benefits that aren’t strictly medical. For example, transportation, meal delivery, personal care services, and many more are now covered.

Medicare Part D Changes for 2021

Original Medicare beneficiaries who want coverage for prescription drugs can enroll in a Medicare Part D plan. Like Medicare Advantage, there are many Part D plans, and you can use the Medicare Plan Finder tool to find and compare plans available to you.

2021 Medigap Cost Updates

Available Medicare Supplement plans (also known as Medigap) changed in 2021. Medigap Plans C and F are no longer available for purchase by newly-eligible Medicare beneficiaries.

How Much Will Medicare Part A Cost?

You are not required to pay for Medicare Part A if you (or your spouse) have worked for 10 years paying payroll taxes. Most Medicare recipients meet this qualifying work criteria and will not need to pay for Medicare Part A.

How Much Will Medicare Part B Cost?

Unlike Medicare Part A, you are required to pay a monthly premium for Medicare Part B. Most people will pay the standard monthly premium amount, but your premium could be higher if you earn more than $87,000 annually as an individual or $174,000 as a household.

What are the Medicare Advantage Plan Changes?

Medicare Advantage plans are an alternative way of receiving your Medicare benefits. These plans are offered by private insurance companies and take the place of Original Medicare (Medicare Parts A and B).

What are the Medicare Part D Changes?

Just like Medicare Part B, you must pay a monthly premium for Medicare Part D plans, and the cost varies based on income.

What are the Medicare Supplement Plan changes?

Medicare Supplement Plan F is the most popular plan chosen by enrollees. It is also the most comprehensive plan with fewer out-of-pocket costs, which is likely why it is so desirable.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

How long is a skilled nursing deductible?

See more Medicare Survey results. For care received in skilled nursing facilities, the first 20 days are covered with the Part A deductible that was paid for the inpatient hospital stay that preceded the stay in the skilled nursing facility.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

PinPoints

Medicare made some modifications to the 2021 deductible. The rising cost of healthcare necessitates an increase in Medicare premiums and deductibles.

What changes are made to Medicare Part A in 2021?

Medicare Part A covers hospitalization, nursing home care, and a portion of home healthcare.

The adjustments to Medicare Part B for 2021 are as follows

Part B of Medicare covers physician costs, outpatient treatments, some home health care services, medical equipment, and medications.

Medicare Part D will have the following changes in 2021

Medicare prescription medication coverage is another name for Medicare Part D.

What changes are coming to Medigap in 2021?

Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

To fight the coronavirus (COVID-19)

On March 20, 2020, Medicare was modified to fulfil the needs of enrollees.

Conclusion

Apart from increased Medicare premiums and deductibles, there are more ways to save money on healthcare.