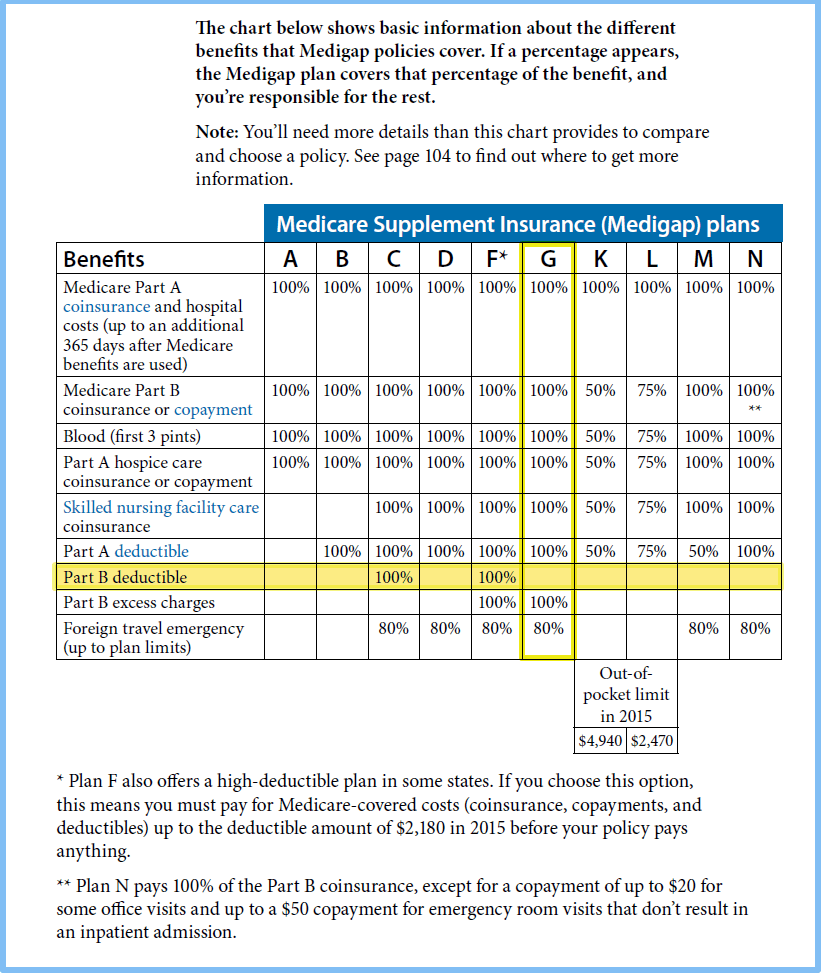

Here’s an overview of what each of the 10 Medigap plans cover:

| Medigap plan | Coverage |

| Plan A | Medicare Part A coinsurance and the cost ... |

| Plan B | Medicare Part A coinsurance and the cost ... |

| Plan C | Medicare Part A coinsurance and the cost ... |

| Plan D | Medicare Part A coinsurance and the cost ... |

What is the best Medicare plan?

They are here to talk about their 5 star medicare plans available to switch your current plan or during the election periods throughout the year. As independent agents, Deb and Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers.

How to choose a Medicare plan?

- Issue-age rated: premiums are based on your age when you enroll and don’t go up as you get older.

- Community-rated: all plan members pay the same premium, regardless of their age.

- Attained-age rated: premiums are based on your current age, so your premium costs rise as you get older.

How do I know what Medicare plan I have?

- Review your Medicare plan coverage options. It’s a good idea to review your Medicare coverage every year to make sure the benefits of your Medicare plan remain aligned with your ...

- Make changes to your Medicare plan coverage during the right time of year. ...

- Find out what Medicare plan may fit your needs. ...

What are the types of Medicare plans?

Here are some key findings from our survey:

- Two-thirds ( 67%) trust at-home technology for when it comes to monitoring their health, and.

- 19% currently use a wearable device such as an Apple Watch or Fitbit to monitor their health and daily activity. ...

- 42% have used telemedicine at least once since March 2020, with 64% saying they will continue to use telemedicine even after the pandemic.

What are 3 plans for Medicare?

Different types of Medicare health plansMedicare Advantage Plans. ... Medicare Medical Savings Account (MSA) Plans. ... Medicare health plans (other than MA & MSA) ... Rules for Medicare health plans.

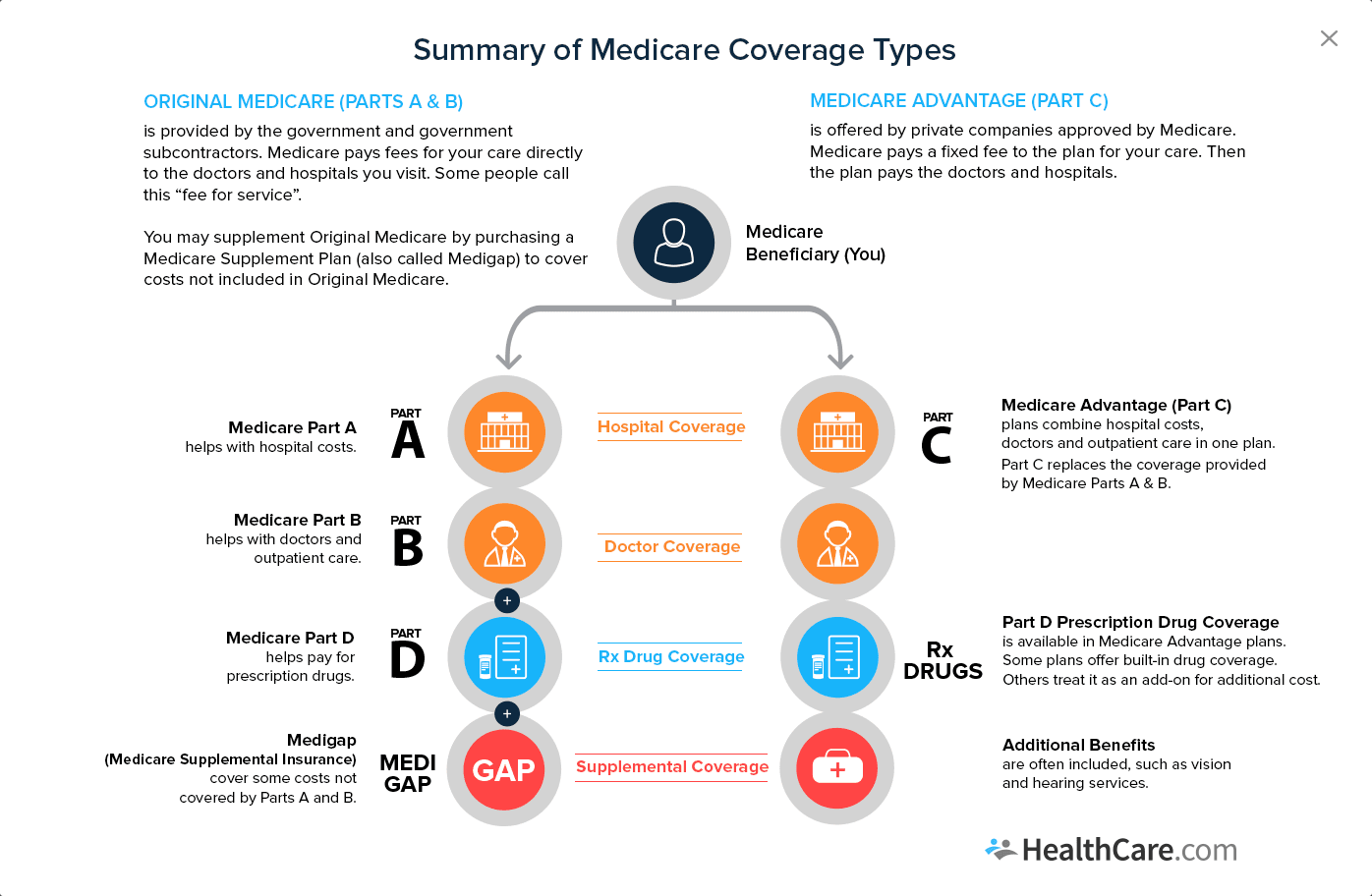

What is the difference between Medicare A and B?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers.

What are the 2 types of Medicare plans?

Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). You can join a separate Medicare drug plan to get Medicare drug coverage (Part D). You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

What Medicare plan provides the most coverage?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Which is Better Part A or Part B?

Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care. These plans aren't competitors, but instead are intended to complement each other to provide health coverage at a doctor's office and hospital.

What is covered by Medicare Part C?

Medicare Part C outpatient coveragedoctor's appointments, including specialists.emergency ambulance transportation.durable medical equipment like wheelchairs and home oxygen equipment.emergency room care.laboratory testing, such as blood tests and urinalysis.occupational, physical, and speech therapy.More items...

What are 4 types of Medicare plans?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What are the top 3 Medicare Advantage plans?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the difference between Medicare Part B and Medicare Advantage?

Part B covers doctors' visits, and the accompanying Part A covers hospital visits. Medicare Part C, also called Medicare Advantage, is an alternative to original Medicare. It is an all-in-one bundle that includes medical insurance, hospital insurance, and prescription drug coverage.

Is Medicare G the best plan?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.Best Medicare Supplement Plan G Providers of 2022 - The Balancehttps://www.thebalance.com › best-medicare-supplement-...https://www.thebalance.com › best-medicare-supplement-...

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022What's the Best Medicare Part D Plan? - ValuePenguinhttps://www.valuepenguin.com › best-medicare-part-dhttps://www.valuepenguin.com › best-medicare-part-d

How do I know which Medicare plan is right for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.Finding the best Medicare plan for me - AARPhttps://www.aarp.org › health › finding-the-best-plan-for-...https://www.aarp.org › health › finding-the-best-plan-for-...

What are the extra benefits that Medicare doesn't cover?

Plans may offer some extra benefits that Original Medicare doesn’t cover—like vision, hearing, and dental services.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is Medicare Supplement Insurance?

You can get a Medicare Supplement Insurance (Medigap) policy to help pay your remaining out-of-pocket costs (like your 20% coinsurance). Or, you can use coverage from a former employer or union, or Medicaid.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is a Medigap plan?

Coverage. Plan A. Medicare Part A coinsurance and the costs of 365 days’ worth of care after Medicare benefits are exhausted, Part B coinsurance or copayments, the first 3 pints of a blood transfusion, and hospice care coinsurance or copayments. Plan B.

What age does Medicare cover?

Medicare provides healthcare coverage to people over age 65 and those with disabilities or certain health conditions . This complex program has many parts, and it involves the federal government and private insurers working together to offer a wide variety of services and products.

What is Medicare Part B?

Medicare Part B is the part of original Medicare that covers the costs of your outpatient care. You’ll pay a monthly premium for this coverage based on your income level.

How much will Medicare cost in 2021?

Under Medicare Part B, you can expect to pay the following costs in 2021: a premium of at least $148.50 per month (this amount increases if your individual income is above $88,000 per year or $176,000 per year for married couples) a $203 deductible for the year.

What is Medicare Supplement Insurance?

Medicare supplement insurance, or Medigap, plans are private insurance products meant to help cover costs not paid for by Medicare parts A, B, C, or D. These plans are optional.

Why do people not pay Medicare Part A?

Most people do not pay a monthly premium for Part A because they paid into the program through taxes during their working years.

Does Medicare cover prescription drugs?

Prescription medication coverage must be offered at a standard level set by Medicare. But different plans can choose which medications they list in their drug lists or formularies. Most prescription drug plans group covered medications by:

How many insurance companies are there for Medicare?

A: In 2017, most Medicare beneficiaries can choose from a variety of plans from at least six insurance companies. The plans may have different provider networks, cover different drugs at different pharmacies, and can charge different monthly premiums, annual deductibles, and copayments or coinsurance for hospital and nursing home stays, and other services. — Read Full Answer

Who sells Medicare Part D?

A: Medicare Part D drug coverage is sold by private insurance plans that set their own premiums, prescription prices and other charges that can vary from plan to plan. — Read Full Answer

How long does it take to get Medicare if you are 65?

If you are under 65 and get disability benefits, the Social Security Administration will enroll you in Medicare after you have received benefits for 24 months. — Read Full Answer.

Does Medicare automatically enroll you in Medicare Advantage?

A:Medicare doesn’t automatically enroll you in a Medicare Advantage plan — you need to choose a plan and sign up directly. — Read Full Answer

Does Medicare cover prescription drugs?

You can also get Medicare prescription drug coverage to help cover some of the costs of your prescription drugs . AARP’s Medicare Question and Answer Tool is a starting point to guide you through the different Medicare plans.

What determines when you reach the coverage gap?

A: Only the amount you and your Part D plan have paid for covered drugs determines when you reach the coverage gap. — Read Full Answer

When will Social Security automatically enroll you in Medicare?

A: It's easy if you receive Social Security retirement benefits: The Social Security Administration will automatically enroll you in Medicare when you turn 65. If you are under 65 and get disability benefits, the Social Security Administration will enroll you in Medicare after you have received benefits for 24 months. — Read Full Answer

What are the extra benefits that Medicare doesn't cover?

Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

What is Medicare Advantage?

Medicare Advantage is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D.

What is Medicare Supplemental Insurance?

Medicare Supplemental Insurance (Medigap): Extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare. Policies are standardized, and in most states named by letters, like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.

Is Medicare a federal or state program?

Medicaid is a joint federal and state program that provides health coverage for some people with limited income and resources. Medicaid offers benefits, like nursing home care, personal care services, and assistance paying for Medicare premiums and other costs.

What is Medicare Part D?

This plan provides prescription drug coverage for a monthly premium, which a person pays in addition to premiums for any other type of Medicare plan they have. A Part D plan’s coverage depends on its cost, drug formulary, and the insurance provider.

What is Medicare Supplement Insurance?

Medicare supplement insurance, commonly known as Medigap, covers some out-of-pocket expenses for people with Medicare Parts A and B. Medigap covers deductibles, co-payments, and coinsurance. A person must have Parts A and B to qualify for a Medicare supplement plan. Those enrolled in Medicare Advantage should not have a Medigap plan.

What is a formal contract for home health care?

A formal contract. If the person in need of care has sufficient resources, they may pay a family member to provide the same services as a home healthcare worker. They will need to draw up a formal agreement defining services, compensation, and employment terms, among other important factors.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

Does Medicare cover outpatient services?

Medicare does not typically cover 100% of medical costs, and most plans require that a person meets a deductible before Medicare pays for medical services. Part B also charges a 20% coinsurance on many outpatient services, such as doctor consultations and physical therapy.

Does Medicare have to approve Medicare Advantage plans?

Also known as Medicare Advantage, private insurers sell and administer these policies. However, Medicare must approve any Medicare Advantage plan before insurers can market them. These plans provide the same coverage as Parts A and B but may also include prescription drug coverage.

Is Medicare a high deductible plan?

The deductible depends on the individual plan, and a person must purchase Medicare Part D to receive prescription drug ...

What are the parts of Medicare?

Each part covers different healthcare services you might need. Currently, the four parts of Medicare are: Medicare Part A. Medicare Part A is hospital insurance. It covers you during short-term inpatient stays in hospitals and for services like hospice.

What is Medicare Part A?

Part A coverage. Medicare Part A covers the care you receive when you’re admitted to a facility like a hospital or hospice center. Part A will pick up all the costs while you’re there, including costs normally covered by parts B or D. Part A coverage includes: hospital stays and procedures. hospice care.

How long do you have to sign up for Medicare if you have delayed enrollment?

Special enrollment period. If you delayed Medicare enrollment for an approved reason, you can later enroll during a special enrollment period. You have 8 months from the end of your coverage or the end of your employment to sign up without penalty.

What is the maximum amount you can pay for Medicare in 2021?

In 2021, the out-of-pocket maximum for plans is $7,550. Note.

How many people are on medicare in 2018?

Medicare is a widely used program. In 2018, nearly 60,000 Americans were enrolled in Medicare. This number is projected to continue growing each year. Despite its popularity, Medicare can be a source of confusion for many people. Each part of Medicare covers different services and has different costs.

What age does Medicare cover?

Medicare is a health insurance program for people ages 65 and older , as well as those with certain health conditions and disabilities.

How old do you have to be to get Medicare?

You can enroll in Medicare when you meet one of these conditions: you’re turning 65 years old. you’ve been receiving Social Security Disability Insurance (SSDI) for 24 months at any age. you have a diagnosis of end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) at any age.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What are the factors to consider when shopping for Medicare Supplement Insurance?

Your unique health coverage needs and budget are important factors to consider as you shop for Medicare Supplement Insurance plans.

What is the maximum out of pocket for Medicare 2021?

The Plan K out-of-pocket maximum is $6,220 in 2021. The 2021 Plan L out-of-pocket spending limit is $3,110.