The 8 Best Medicare Advantage Companies

| Provider | Available Plans | Number of States Served | Medicare Supplement Plans Offered with M ... |

| UnitedHealthcare | EPO PPO HMO SNP PFFS/POS | 25 | B, C, D |

| Humana | HMO PPO PFFS SNP | 50 states, Washington, D.C., and Puerto ... | A, B, C |

| Aetna | HMO PPO POS EPO HDHP | 46 states and Washington, D.C. | Not Listed |

| Anthem | HMO PPO SNP | 14 states | A, B |

Full Answer

What are the best Medicare Advantage plans?

4 rows · January 2020 • Medicare plan coverage begins January 1. January 1 - March 31. The Medicare ...

What are the Medicare Advantage plans?

Jan 27, 2020 · January 27, 2020. Medicare Advantage plans are individual health care plans offered by private insurers that supplement your Original Medicare policy. They are required to include all of the benefits included in Original Medicare and may include additional benefits, such as vision and dental care, prescription drug coverage, and more.

How many Medicare Advantage plans are there?

Medicare Advantage (MA) plans must include the OTP benefit as of January 1, 2020 and contract with OTP providers in their service area, or agree to pay an OTP on a non-contract basis. In covering the OTP benefit, MA plans must use only Medicare-enrolled OTP providers. Regardless of whether an OTP is under contract with an MA plan or rendering services on a non-contract …

What are the best Medicare Advantage programs?

8 rows · These Medicare Advantage plans have become increasingly popular for seniors who want some ...

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What is the most widely accepted Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

How do I choose the best Medicare Advantage plan?

Factors to consider when choosing a Medicare Advantage plancosts that fit your budget and needs.a list of in-network providers that includes any doctor(s) that you would like to keep.coverage for services and medications that you know you'll need.Centers for Medicare & Medicaid Services (CMS) star rating.

Who is the best Medicare Advantage provider?

Best Medicare Advantage Plan Providers of 2022Best Reputation: Kaiser Foundation Health Plan.Best Customer Ratings: Highmark Blue Cross Blue Shield.Best for Extra Benefits: Aetna Medicare Advantage.Best for Large Network: Cigna-HealthSpring.Best for Promoting Health for Seniors: AARP/UnitedHealthcare.More items...

What is the difference between a Medicare supplement plan and a Medicare Advantage plan?

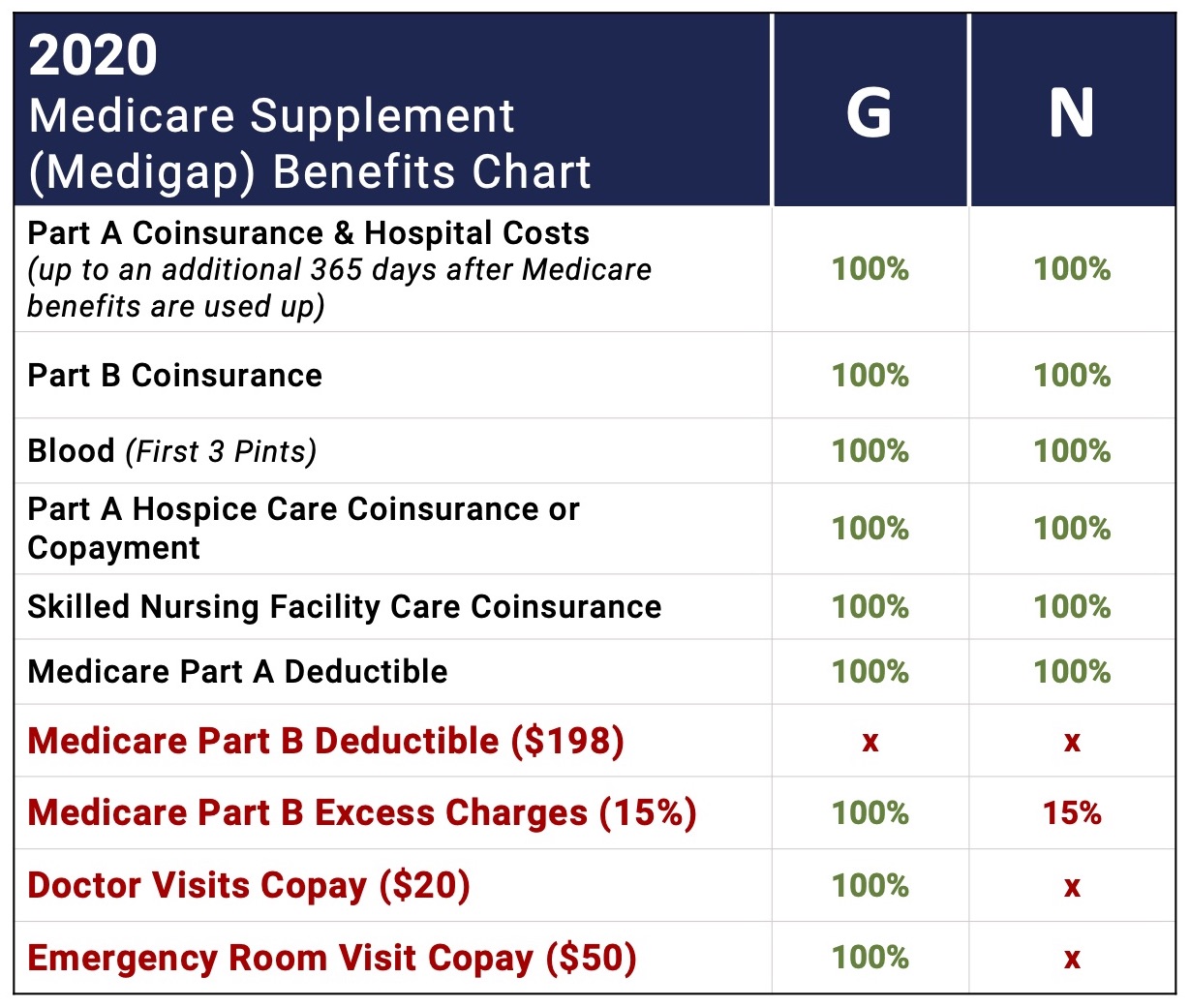

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Is Medicare Advantage too good to be true?

Medicare Advantage plans have serious disadvantages over original Medicare, according to a new report by the Medicare Rights Center, Too Good To Be True: The Fine Print in Medicare Private Health Care Benefits.May 10, 2007

Can I drop my Medicare Advantage plan and go back to original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Can I switch from original Medicare to Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Does a Medicare Advantage plan replace Medicare?

Medicare Advantage does not replace original Medicare. Instead, Medicare Advantage is an alternative to original Medicare. These two choices have differences which may make one a better choice for you.

HOW TO FIND PLANS

If you’re planning to enroll in Medicare Advantage, it’s important to find a plan that’s right for you. You may prefer to pay a high premium and have more comprehensive coverage, or a low premium and have higher out-of-pocket expenses. If you take any prescription drugs, you’ll need to make sure they’re included in the plan you sign up for.

CHANGES TO MEDICARE ADVANTAGE PLANS IN 2020

Many people choose a Medicare Advantage plan when they first become eligible for Medicare at age 65. If you haven’t signed up yet, or want to change your plan, you’ll have to wait for an Open Enrollment Period. These typically run from October 15th through December 7th and from January 1st through March 31st each year.

OVERVIEWS OF PLANS

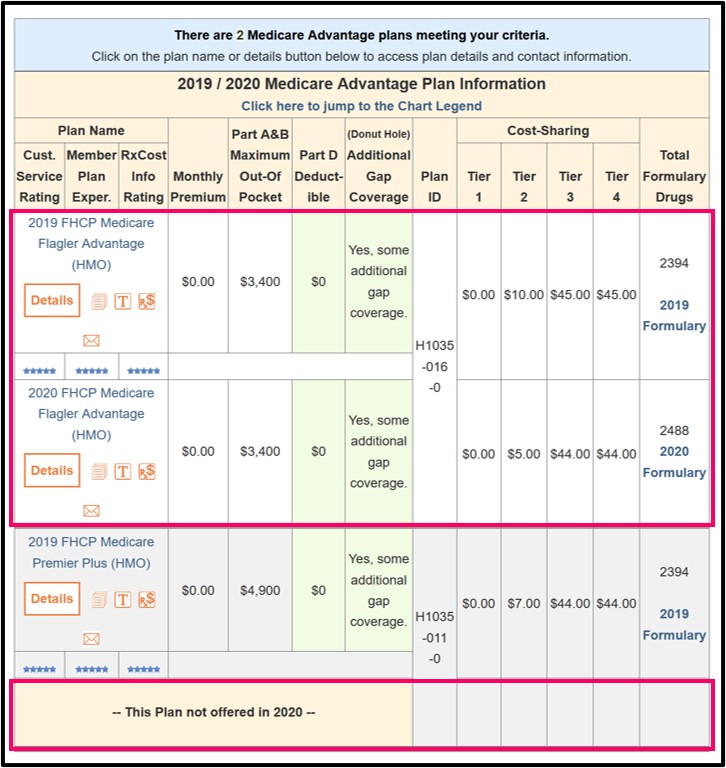

There are a lot of factors that go into choosing a Medicare Advantage plan, so let’s look at a few different plans to get an idea of your options. Remember, you can find plans that have premiums as low as $0, but you’ll want to look for hidden out-of-pocket costs.

CONCLUSION

Medicare Advantage plans offer a range of coverage options. If you’re in good health but want vision or dental coverage, then you may choose a different plan than someone who needs medical supplies or hearing aids.

What percentage of Medicare beneficiaries are in Miami-Dade County?

Within states, Medicare Advantage penetration varies widely across counties. For example, in Florida, 71 percent of all beneficiaries living in Miami-Dade County are enrolled in Medicare Advantage plans compared to only 14 percent of beneficiaries living in Monroe County (Key West).

How many people will be enrolled in Medicare Advantage in 2020?

Enrollment in Medicare Advantage has doubled over the past decade. In 2020, nearly four in ten (39%) of all Medicare beneficiaries – 24.1 million people out of 62.0 million Medicare beneficiaries overall – are enrolled in Medicare Advantage plans; this rate has steadily increased over time since the early 2000s.

When did CVS buy Aetna?

CVS Health purchased Aetna in 2018 and had the third largest growth in Medicare Advantage enrollment in 2020, increasing by about 396,000 beneficiaries between March 2019 and March 2020.

Does Medicare Advantage offer supplemental benefits?

Medicare Advantage plans may provide extra (“supplemental”) benefits that are not offered in traditional Medicare, and can use rebate dollars to help cover the cost of extra benefits. Plans can also charge additional premiums for such benefits. Beginning in 2019, Medicare Advantage plans have been able to offer additional supplemental benefits that were not offered in previous years. These supplemental benefits must still be considered “primarily health related” but CMS expanded this definition, so more items and services are available as supplemental benefits.

How much is the deductible for Medicare Advantage 2020?

In contrast, under traditional Medicare, when beneficiaries require an inpatient hospital stay, there is a deductible of $1,408 in 2020 (for one spell of illness) with no copayments until day 60 of an inpatient stay.

Does Medicare Advantage require prior authorization?

Medicare Advantage plans can require enrollees to receive prior authorization before a service will be covered, and nearly all Medicare Advantage enrollees (99%) are in plans that require prior authorization for some services in 2020. Prior authorization is most often required for relatively expensive services, such as inpatient hospital stays, skilled nursing facility stays, and Part B drugs, and is infrequently required for preventive services. The number of enrollees in plans that require prior authorization for one or more services increased from 2019 to 2020, from 79% in 2019 to 99% in 2020. In contrast to Medicare Advantage plans, traditional Medicare does not generally require prior authorization for services, and does not require step therapy for Part B drugs.

How much does Medicare Advantage pay in 2020?

However, 18 percent of beneficiaries in MA-PDs (2.8 million enrollees) pay at least $50 per month, including 6 percent who pay $100 or more per month, in addition to the monthly Part B premium. The MA-PD premium includes both the cost of Medicare-covered Part A and Part B benefits and Part D prescription drug coverage. Among MA-PD enrollees who pay a premium for their plan, the average premium is $63 per month. Altogether, including those who do not pay a premium, the average MA-PD enrollee pays $25 per month in 2020.

What is Medicare Advantage?

Medicare Advantage is a blanket term that describes many different kinds of services provided by private companies. As a rule, seniors in the United States are automatically enrolled in Medicare Part A (hospitalization services) when they turn 65. There is typically no charge for this part of Medicare.

How much does Medicare Advantage cost?

The Kaiser Family Foundation found that in 2019, prescription drug plans for Medicare Advantage recipients averaged $23 a month for those with HMOs. While local PPO premiums are $39 and regional PPOs charge an average of $44 a month for similar coverage.

When will Medicare be changed?

Big changes are underway in 2021 for people enrolled in Medicare Advantage plans. Reforms passed between 2015 and 2018 have changed the way costs are covered and bills are handled by the private companies that offer Advantage plans.

Does Aetna sell health insurance?

The company also sells insurance coverage to Americans overseas, including travel ers’ health insurance that can be exchanged in a limited number of foreign countries. Most Aetna customers who sign up for the company’s Medicare Advantage plans enroll in the HMO option.

What is a SNP plan?

Special Needs Plan (SNP) SNP plans provide targeted benefits for individuals with special needs. There are three categories of special needs patients who may be eligible for this coverage: SNPs are structured as coordinated care plans (CCPs) that meet Medicare guidelines.

Does Kaiser Permanente offer HMO?

Kaiser Foundation Health Plan members who qualify for a Medicare Advantage plan can get coverage at any Kaiser Permanente facility under the foundation’s flagship HMO option . The HMO option is by far the most popular plan type the foundation offers.

What is PFFS in Medicare?

PFFS plans are a diverse group of policies that generally provide much more flexibility in how benefits are structured. Like PPO plans, PFFS providers maintain a network of preferred practitioners who have agreed to treat plan members. And you are free to visit a provider outside of the network if you are willing to pay somewhat more. Unlike other kinds of Medicare Advantage plans, PFFS plans are not bound by Original Medicare guidelines. So the plan you choose might charge more or less than other Advantage plans. You are also allowed to buy standalone prescription coverage if you wish, which is not permitted with other types of coverage.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

What are the benefits of United Healthcare?

These are benefits that typically do not cost you anything extra and yet add a lot of value onto your plan. They give you access to gyms, healthy living plans, professional medical diagnosis and counselling over the phone and lots more.

Does United Healthcare have a 2020 plan?

United Healthcare Medicare Plans 2020. As you grow older, your coverage needs change. What worked well for you before and covered you adequately may no longer do so. If you have an Original Medicare plan but are not getting enough coverage for your needs, then you should consider some of the health insurance plans out there.

Does United Healthcare offer Medicare Supplements?

United Healthcare sells both Medicare Advantage and Medicare Supplements. It offers these at its own prices, which differ from those of the competition. These plans require a basic Medicare plan, and they provide you with coverage that will help to protect you and keep you from paying so much out of pocket.