The better plan depends on your circumstances. Medicare Supplement Plan F offers one additional benefit, coverage for the Part B deductible. However, extra coverage does come with a higher price.

What is the difference between Medicare Part A and Part B?

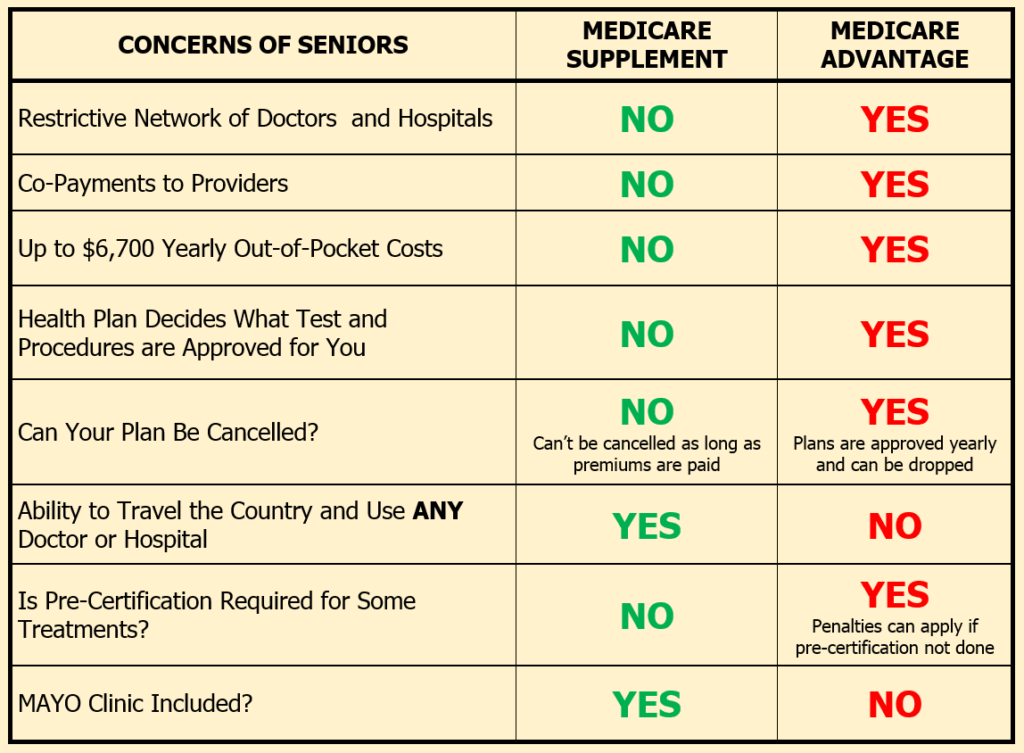

Both original Medicare and Advantage plans have pros and cons. Part A and Part B allow a person to choose any healthcare provider, but the out-of-pocket costs may be higher. Conversely, Advantage plans require an individual to choose from in-network providers, but they may involve lower out-of-pocket costs.

What is Medicare Part F and how does it work?

What Is Medicare Part F? Medicare Part F actually doesn’t exist. When people begin talking about “Part F” or “Part G,” they have likely confused Medigap Plans with the parts of the Medicare program itself. This is simply due to similar wording, with Medicare supplement insurance (Medigap) policies offering Plan A, B, C, D, F, G, K, L, M and N.

Do Medicare Part A and Part B premiums increase every year?

The premiums for Part A and Part B can potentially increase every year. Part B also includes a deductible, which is $233 per year in 2022. After you meet your Part B deductible, you typically pay 20 percent of the Medicare-approved amount for most covered services.

How do I compare Medicare supplement plans F and G?

Or call (888) 815-3313 – TTY 711 to compare Medicare Supplement Plans F and G over the phone and get answers and guidance from an experienced licensed sales agent.

What is the advantage of Medicare Plan F?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

Is Medicare getting rid of plan F?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.

What is the premium for Medicare Plan F?

Premium costs for Medigap Plan F can range from as low as $150.00 per month to as high as $400.00 per month or more. Factors that determine your cost include your ZIP Code, gender, age, tobacco use, and more.

Does plan F cover prescriptions?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.

Does plan F pay Part B premium?

Both Plan F and Plan G cover Medicare Part B excess charges, by the way. They're the only two Medicare Supplement policies that pay these fees.

Can I keep my plan F after 2020?

If you already have Medicare Supplement Plan F (or Plan C, which also covers the Part B deductible), you can generally keep it. If you were eligible for Medicare before January 1, 2020, you may be able to buy Medicare Supplement Plan F or Plan C.

What is the most popular Medigap plan for 2021?

Plans F and GMedigap Plans F and G are the most popular Medicare Supplement plans in 2021. Learn more about other popular plans like Plan N and compare your Medigap plan options.

Does Medicare Part F cover shingles vaccine?

Does Medicare Supplement Cover Shingles Vaccine? Medicare Supplement (Medigap) plans only cover what Original Medicare covers, so, no, Medigap does not cover the shingles vaccine.

What is the deductible for plan F in 2022?

$2,490There isn't much point in comparing costs here—Plan F has a $0 deductible at the regular level. The High Deductible Plan F has a deductible of $2,490 in 2022, but because you have to pay more out-of-pocket, the premiums for this plan tend to be significantly lower.

Will plan F be available in 2022?

Previously, anyone enrolled in original Medicare could purchase Medigap Plan F. However, this plan is now being phased out. As of January 1, 2020, Medigap Plan F is only available to those who were eligible for Medicare before 2020.

Who is eligible for plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.

Can I keep my plan F after 2020?

If you already have Medicare Supplement Plan F (or Plan C, which also covers the Part B deductible), you can generally keep it. If you were eligible for Medicare before January 1, 2020, you may be able to buy Medicare Supplement Plan F or Plan C.

Can I switch from Medicare Plan F to Plan G?

Switching from Plan F to Plan G If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance.

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

What is the difference between Plan F and Plan G in Medicare?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and...

Can I still get Plan F?

People who were eligible for Medicare prior to 2020 will continue to have the option to buy Plan F. This is regardless if you enrolled in Medicare...

What is the average cost for Medicare Plan F?

Medicare Plan F cost varies by several factors. Costs for Medicare Plan F vary by area, gender, zip code, and tobacco status. In many areas, we fin...

What is Medicare Plan F Coverage?

It covers all of your cost-sharing for Medicare Part A and B services. Medicare must approve and pay for the service before your Medicare Plan F po...

Does Medicare Plan F cover prescription drugs?

All Medigap plans cover medications administered in the hospital or in a clinical setting. However, Medigap plans do not cover retail prescriptions...

Does Medigap Plan F cover dental, vision and hearing benefits?

No Medigap plan covers routine dental, vision or hearing services either. However, there are many great standalone plans that you can enroll in to...

Does Medicare Plan F cover chiropractic?

Yes, Medicare covers 80% of adjustments, and Plan F pays the other 20%. Medicare does not cover other services provided by chiropractors though, su...

What is the most popular Medicare Supplement plan?

The best Medigap plans in 2022 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no...

What are the top 10 Medicare Supplement insurance companies in 2022?

This absolutely varies by region. Since Medicare Supplement insurance plans are standardized, you don’t have to worry about benefits being differen...

Should I switch from Plan F to Plan G?

This depends on what your Plan F premium is and where you live (you may have to answer health questions). However, you get lower premiums for Plan...

What is Medicare Part B?

Medicare Part B helps to pay for outpatient services, like primary care. This includes your doctor office visits, lab tests, preventative care, dialogistic imaging and so on. As you can see, many of these things may take place during a hospital stay, which is why both Part A and Part B are always recommended.

What is a donut hole?

The donut hole is a coverage gap after you’ve spent a certain amount on covered prescriptions in your Part D plan. It begins once you reach a certain amount of out of pocket expenses on drugs. After you reach this number, you’re responsible for no more than 25% of the plan’s cost for name brand prescription drugs.

What are the different parts of Medicare?

This is true for other parts and plans as well. In all, there are four parts that make up Medicare coverage: Part A, Part B , Part C and Part D.

How much does Medicare pay for Part B?

It’s important to note that you pay a premium each month for Part B. Also, after your deductible is met, you typically pay 20% of the Medicare-approved amount for Part B services.

How many pints of blood do you need for a hospice?

Some hospice, home healthcare, or stays in a skilled nursing facility. Blood transfusions in the event that you require more than 3 pints of blood in an emergency. As long as you have worked for 10 years in the United States or are married to someone who has done so, Part A coverage is generally free.

Is Part D a prescription drug?

That’s why Part D is often called prescription drug coverage . However, unlike Medicare Part A and Part B, which you must enroll in at the Social Security office, you will sign up for optional Part D coverage from a private insurance provider in your area.

Does Medicare Part F exist?

Medicare Part F actually doesn’t exist. When people begin talking about “Part F” or “Part G,” they have likely confused Medigap Plans with the parts of the Medicare program itself. This is simply due to similar wording, with Medicare supplement insurance (Medigap) policies offering Plan A, B, C, D, F, G, K, L, M and N.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

What is the most comprehensive Medicare plan?

If you became eligible for Medicare on or after January 1, 2020, you’ll find that Plan G is the most comprehensive Medigap plan available to you. (In recent years, Plan G has been the second most popular Medicare Supplement plan, and you can read more on that below.) A Medigap plan, or Medicare Supplement, pays after Medicare to help cover your ...

Why is Medicare Plan F so popular?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

What is the best Medigap plan for 2021?

The best Medigap plans in 2021 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no longer available to new enrollees. Get a quote for both and see which ones offer you the best annual savings.

What happens if you don't have a Supplement?

You would also pay 20% of expensive procedures like surgery because Part B only pays 80%.

How much does it cost to have Gracie's surgery?

The total cost for Gracie’s surgery, hospital stay and follow-up care is $70,000.

Does Medicare Supplement Plan F replace Part B?

Medigap plans do not replace your Medicare Part B. You must be enrolled in both Part A and Part B first, then you are eligible to enroll in Medicare Supplement Plan F.

How much is Medicare deductible for 2021?

Medicare charges a hefty deductible each time you are admitted to the hospital. It changes every year, but for 2021 the deductible is $1,484. You can buy a supplemental or Medigap policy to cover that deductible and some out-of-pocket costs for the other parts of Medicare.

What is Medicare Advantage?

Medicare Advantage is the private health insurance alternative to the federally run original Medicare. Think of Advantage as a kind of one-stop shopping choice that combines various parts of Medicare into one plan.

How much is Part B insurance for 2021?

The federal government sets the Part B monthly premium, which is $148.50 for 2021. It may be higher if your income is more than $88,000. You’ll also be subject to an annual deductible, set at $203 for 2021. And you’ll have to pay 20 percent of the bills for doctor visits and other outpatient services.

Does Medicare cover telehealth?

In response to the coronavirus outbreak, Medicare has temporarily expanded coverage of telehealth services . Beneficiaries can use a variety of devices — from phones to tablets to computers — to communicate with their providers.

When is open enrollment for Medicare 2021?

The next open enrollment will be from Oct. 15 to Dec. 7 , 2021, and any changes you make will take effect in January 2022. Editor’s note: This article has been updated with new information for 2021.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage plans also fold in prescription drug coverage. Not all of these plans cover the same extra benefits, so make sure to read the plan descriptions carefully. Medicare Advantage plans generally are either health maintenance organizations (HMOs) or preferred provider organizations (PPOs).

Does Medicare cover wheelchair ramps?

In addition, in recent years the Centers for Medicare and Medicaid Services, which sets the rules for Medicare, has allowed Medicare Advantage plans to cover such extras as wheelchair ramps and shower grips for your home, meal delivery and transportation to and from doctors’ offices.

Do you have to pay a deductible on a Plan G or F?

Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F. However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost.

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

Why is Medigap Plan N so popular?

Medigap Plan N is popular because its monthly premiums are relatively low, compared to some other Medigap plans. However, these monthly premiums vary widely. You can shop for and compare Medigap Plan N plans here. Medigap Plan N covers: Part A coinsurance and deductible.

What is Medicare Plan N?

Medicare Plan F and Medicare Plan N are two kinds of Medigap plans. Medigap is also known as Medicare Supplement Insurance. Medigap is supplemental insurance that you may be able to buy from a private insurer. Medigap covers some of the expenses that original Medicare doesn’t, such as deductibles, copays, and coinsurance.

How many Medigap plans are there?

There are 10 Medigap plans to choose from, although not every plan is available in every area. Out-of-pocket gaps can add up.

When is the best time to enroll in Medigap?

If you are age 65 or older , the best time to enroll in a Medigap plan is during the Medicare Supplement open enrollment period or your Initial enrollment period. During this time frame, you cannot be turned down for Medigap coverage or charged more, even if you have a medical condition.

When will Medicare stop allowing Plan F?

Plan F is no longer available to people who are new to Medicare unless you turned age 65 before January 1, 2020. If you already have Plan F, you are able to keep it.

Is Medigap Plan F deductible?

Plan F’s monthly premiums vary. There is also a high-deductible version of Plan F, which has lower monthly premiums.

Does Medigap cover copays?

Medigap plans can cover all or some of the remaining 20 percent . Medigap plans have different premium costs, depending upon which one you choose. They all offer the same basic benefits, although some plans provide more coverage than others. In general, Medigap plans cover all or a percentage of: copays. coinsurance.

How long does Medicare Part A last?

This 7-month period begins three months before you turn 65, includes the month of your birthday and continues on for three more months. You may apply for Medicare Part A and B during this time. You may also be able to sign up during a Special Enrollment Period if you qualify based on certain specific circumstances .

How much is Medicare Part A deductible?

Medicare Part A also includes a deductible of $1,484 per benefit period (in 2021), which is not annual. This means that you could potentially be required to pay the Part A deductible more than once in a year.

What does Medicare Part A cover?

Some of the items and services that Medicare Part A covers while you’re admitted as an inpatient can include: Meals. Nursing care. A semi-private room. Drugs that are used as part of your inpatient treatment. Part A covers skilled nursing care you receive in a skilled nursing facility (SNF).

How much is the Part B premium for 2021?

Individuals with a reported 2019 income of less than $88,000 per year and couples with a combined income of less than $176,000 per year pay the standard Part B premium of $148.50 per month in 2021.

What is Grief Counseling?

Grief counseling. Short term respite care. Prescription drugs that are used to control your symptoms or relieve pain. Check with your doctor to learn more about how Medicare Part A may or may not cover your services.

How old do you have to be to qualify for Medicare?

In order to be eligible for Medicare Part A and/or Part B, you must meet each of the following eligibility requirements: You are at least 65 years old OR have a qualifying disability. You are a U.S. citizen OR a permanent legal resident of at least five consecutive years.

What is Part B based on?

Part B premiums are based on your reported modified adjusted gross income (MAGI) from two years prior if you're a higher income earner. So your 2021 Part B premiums may be based on your reported income from 2019.

What percentage of Medicare does Part B cover?

For other costs like copays and coinsurance, you’ll pay 20 percent of the Medicare-approved rate until you reach your deductible. Part B only covers services approved by Medicare and does not include extras like vision, hearing, or dental coverage.

What is Medicare Part B?

Medicare Part B is offered by the U.S. government to help cover the costs of doctor visits and outpatient services. Medicare Part C is offered by private companies. It includes Medicare Part B along with Part A and often Part D. Medicare Part C can also include services not offered by Medicare, such as vision and dental.

What are the different parts of Medicare?

The four parts of Medicare are: Part A: hospital services. Part B: outpatient services. Part C: Medicare Advantage. Part D: prescription drugs. Part B is a portion of your healthcare ...

Does Medicare Advantage have a deductible?

Your Medicare Advantage plan’s premiums, deductibles, and services can change annually. A Part C plan will bundle all of your part A and part B coverage, along with several extra services, into an all-in-one plan.

What is Medicare Part C?

Medicare Part C, also called Medicare Advantage, is an alternative to original Medicare. It is an all-in-one bundle that includes medical insurance, hospital insurance, and prescription drug coverage. Medicare Part D offers only prescription drug coverage. Below, we examine the differences between Medicare Part B and Part C in terms ...

What happens if you don't receive Social Security?

If a person meets the age requirement but does not receive Social Security benefits, they will not automatically get Medicare and will need to sign up for it.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

Does Medicare pay for Part A?

A person with Plan B also has Plan A, but most people with original Medicare do not pay a Part A monthly premium. However, a $1,484 deductible is payable for Part A hospital inpatient services for each benefit period, together with coinsurance that varies from $0 to $742.

Does Medicare Part A cover dental care?

As original Medicare comprises Part A and Part B, a person who enrolls in Part B is automatically enrolled in Part A, which covers inpatient hospital care, hospice care, skilled nursing facility care, lab tests, and home health care. Medicare Part A and Part B do not cover the following: prescription drugs. dental care.

Does Medicare have a monthly premium?

Every year, each Medicare plan sets out the amount it will charge for premiums, deductibles, and services. The amount varies among plans, and some plans offer zero premiums. Also, because a person must have enrolled in Medicare Part A and Part B to qualify for Medicare Advantage, they must pay the Part B monthly premium.