/cdn.vox-cdn.com/uploads/chorus_image/image/46195986/shutterstock_227132044.0.0.jpg)

Medicare’s share of the payment would be limited to 80 percent of the cost of the least expensive drug in the category, with beneficiaries paying the remaining amount. This would mean that beneficiaries treated with the least expensive drug would pay 20 percent of the payment to providers.

How much does Medicare cost per month?

2 at 13-14. The reimbursement is thus based on the payment amount for the least costly alternative. The Medicare Program Integrity Manual extends this concept to non-durable medical equipment, mandating that contractors “shall implement the new Least Costly Alternative (LCA) determinations through an LCD.

How much do you pay for Medicare after deductible?

Nov 16, 2021 · There are different brackets for married couples who file taxes separately. If this is your filing situation, you’ll pay the following amounts for Part B: …

How much can you pay out-of-pocket for Medicare?

You’ll pay $233, before Original Medicare starts to pay. You pay this deductible once each year. Costs for services (coinsurance) You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

What is the income limit to receive Medicare?

If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. Part A hospital inpatient deductible and coinsurance: You pay: $1,556 deductible for each benefit period

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.

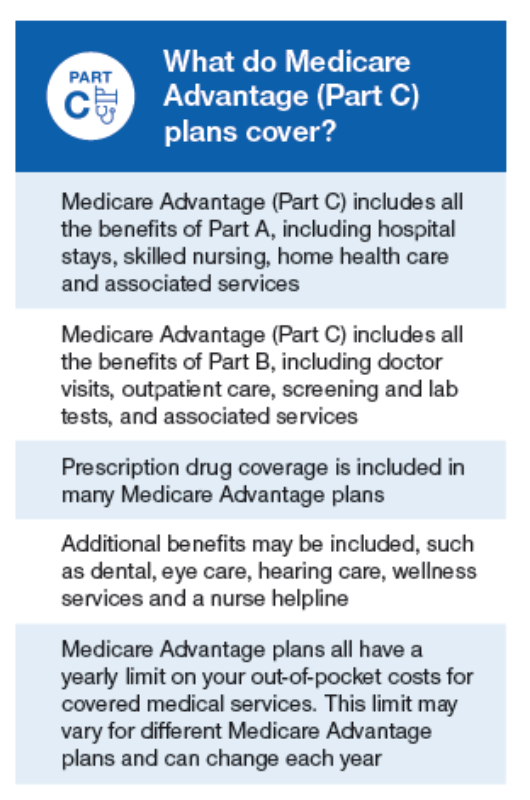

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How many hours per night do you need to use a PAP?

Adherence to therapy is using the PAP at a minimum of 4 hours per night on 70 percent of nights during a consecutive 30-day period anytime during the trial period. If patient fails the initial three-month trial period, then they need to re-qualify for a PAP device and then follow the initial coverage criteria.

What is a specialty walker?

3. Specialty walker(HD – multiple braking system, variable wheel resistance walker) – patient meets criteria for a walker but cannot use standard due to severe neurologic disorder or other condition causing restricted use of one hand (obesity alone is not sufficient reason). 4.

Is a bedside commode covered by a medical record?

Commodes are not covered if they are placed over the toilet in the bathroom. Medical need must be documented in patient’s medical record.

Can you use oxygen with PAP?

Concurrent use of oxygen with PAP therapy. If a patient requires simultaneous use of home oxygen therapy and a PAP device, documentation by the treating practitioner in the medical record must clearly demonstrate that the requirements for coverage outlined in both the PAP and Oxygen policy have been met.

Does Medicare cover electric beds?

Medicare does not cover full electric beds. •Semi-electric beds are considered for coverage if one of the above criteria is met AND •If the patient requires frequent changes in body position such as to alleviate pain, prevent aspiration or a respiratory issue. Detailed Written Order requirements:

What is a PAP device?

Oxygen, Positive Airway Pressure (PAP) devices and Negative Pressure Wound Therapy (NPWT), and some other items (such as nebulizers, beds, and wheelchairs) require documentation that the patient had an in-person, face-to-face examination by the treating practitioner prior to delivery of the applicable DME item (s).

Is a bedside commode covered by a medical record?

Commodes are not covered if they are placed over the toilet in the bathroom. Medical need must be documented in patient’s medical record.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

How to know if you are enrolled in Medicare Supplement?

If you've already shopped for Medicare Supplement Plans, you know the drill when using the Medicare-Plans site: enter your zip code, birth date, gender, indicate if you're already enrolled in Medicare Part A and/or B, and then your name and email address. On the final page, you're asked for your street address and phone number - and then there's the disclaimer that you're consenting to texts, calls, emails, and postal mail from their "marketing and remarketing network, and up to eight insurance companies or their affiliates". Worthy to note.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

How many states does United Medicare Advisors work in?

While this is fairly common in today's internet age, it's still something to note. Another fact is that United Medicare Advisors is active in 44 states, leaving out Alaska, California, Hawaii, Massachusetts, New York and Rhode Island. If you live in one of those states, you should keep reading further in our reviews.

Who are United Medicare Advisors?

United Medicare Advisors specializes in Medicare and related supplemental plans, giving you unbiased information and access to many different insurance companies. In business since 2009, they have enrolled hundreds of thousands of Medicare Supplement policies across the country. They work with over 20 carriers, including some of the major names in the industry (such as Aetna, Mutual of Omaha, and Humana).

How long has Aetna been around?

Aetna. Aetna has been around for a LONG time: over 160 years, as a matter of fact. And, as the insurer most often quoted during our process of finding Medicare Supplement Plans, Aetna is an obvious company to consider for your coverage needs.

What is Medicare Part A?

Medicare is a public health insurance program designed for individuals age 65 and over and people with disabilities. The program covers hospitalization and other medical costs at free or reduced rates. The hospitalization portion, Medicare Part A, usually begins automatically at age 65. Other Medicare benefits require you to enroll.

What happens if you don't sign up for Medicare?

If you choose not to sign up for Medicare Part A when you become eligible, a penalty may be assessed. This penalty depends on why you chose not to sign up. If you simply chose not to sign up when you were first eligible, your monthly premium — if you have to pay one — will increase by 10 percent for twice the number of years that you went without signing up . For example, if you waited two years to sign up, you will pay the late enrollment penalty for 4 years after signing up.

Is there a penalty for not signing up for Medicare Part B?

If you choose not to sign up for Medicare Part B when you first become eligible, you could face a penalty that will last much longer than the penalty for Part A.

Does Medicare Advantage have penalties?

Medicare Part C (Medicare Advantage) is optional and does not have penalties on its own, but penalties may be included for late enrollment in the parts of Medicare included within your Medicare Advantage plan.

Is Medicare mandatory at 65?

While Medicare isn’t necessarily mandatory, it is automatically offered in some situations, and may take some effort to opt out of.

Overview

Past Use of The LCA Policy in Medicare Part B

- The LCA policy has previously been used to pay for drugs to treat prostate cancer, respiratory disease, and chronic renal failure.5Under the LCA policy, Medicare would not pay the additional cost of a more expensive drug when a clinically comparable, lower-cost drug was available; however, a beneficiary could continue treatment with a higher-priced drug by choosing to pay th…

How LCA Could Work

- Under an LCA policy, the amount that Medicare pays for any drug would be based on the price of the least costly drug among clinically comparable products grouped into an LCA category. However, different policy choices would affect the total payment that providers receive for administering Part B drugs: Unique ASP approach: Total payment (Medicare and a beneficiary’s …

Barriers to Implementation

- Medicare is required by law to pay providers for Part B medications at 106 percent of the ASP. Therefore, Congress would need to pass legislation to give CMS the authority to use an LCA approach for setting new Part B drug payment rates. If Congress authorized an LCA approach, CMS would then need to develop a transparent, public process to determine whether different p…

Effects on Drug Spending

- Studies have estimated cost savings for Medicare if LCA policies were applied to drugs covered under Part B, and the examples below help to illustrate how these savings would occur. The Pew Charitable Trusts takes no position on the benefits or risks associated with these specific drugs.

Stakeholder Perspectives

- In addition to the HHS OIG recommendation that CMS consider seeking legislative authority to implement LCA policies, members of the Medicare Payment Advisory Commission (MedPAC)—an independent congressional agency advising Congress on matters affecting Medicare—have supported their use.10However, MedPAC has not issued a formal recommendation to Congress …

Conclusion

- Evidence suggests that using an LCA policy for some medications would significantly reduce pharmaceutical costs in Medicare Part B. If Congress gave Medicare the authority to pay for drugs based on the price of the LCA, then CMS would need to adopt a transparent process to ensure that high-quality evidence is used to inform pricing policies. An LCA approach is not appropriate …

Endnotes

- Hays v. Sebelius, https://www.cadc.uscourts.gov/internet/opinions.nsf/ 7ED0A2CCC27AD83085257807005999C4/$file/08-5508-1221815.pdf.

- The average sales price (ASP) of a drug is the weighted average of all nonfederal sales to drug wholesalers net of rebates and other discounts. Additional information on ASP can be found in Section...

- Hays v. Sebelius, https://www.cadc.uscourts.gov/internet/opinions.nsf/ 7ED0A2CCC27AD83085257807005999C4/$file/08-5508-1221815.pdf.

- The average sales price (ASP) of a drug is the weighted average of all nonfederal sales to drug wholesalers net of rebates and other discounts. Additional information on ASP can be found in Section...

- Medicare Part B uses a buy-and-bill system to pay for drugs. Providers purchase drugs from drug companies and/or wholesalers and then bill Medicare after treating patients. Furthermore, in 2016, Me...

- Department of Health and Human Services, “Least Costly Alternative Policies: Impact on Prostate Cancer Drugs Covered Under Medicare Part B” (2012), http://oig.hhs.gov/oei/reports…