Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

...

How Much Do Medigap Policies Cost?

| Plan Type | Premium Range |

|---|---|

| Plan F | $108-$308 |

| Plan G | $87-$290 |

| Plan N | $68-$274 |

How does Medicare supplement plan G work in North Carolina?

North Carolina is one of the states that legislatively mandates eligibility to individuals eligible for Medicare due to disability. North Carolina G.S. 58-54-45 guarantees that individuals under the age of 65 who qualify for Medicare are eligible to purchase a Medigap policy A, D, and G effective January 1, 2020.

What is the best Medicare supplement insurance plan in North Carolina?

Medigap Plan G in North Carolina covers the same basic benefits regardless of which insurance company sells the policy. Those benefits are: Medicare Part A coinsurance. Hospital costs for another 365 days after your Medicare benefits are used up. Medicare Part B copayment or coinsurance. First 3 pints of blood.

Does North Carolina have a Medicare guarantee for individuals with disabilities?

What Medicare Pays What Medigap Pays What You Pay; Days 1-60: All but $1260: $1260 (Part A Deductible) $0: Days 61-90: All but $315 per day: $315 per day: $0: Days 91-150 (while using your 60 lifetime reserve days) All but $630 per day: $630 per day: $0: Additional 365 Days: $0: 100% of Medicare-approved expenses: $0 of Medicare-approved expenses: After the Additional 365 …

How does open enrollment work for Medicare Supplement Insurance in North Carolina?

3 rows · · Plan Type: Premium Cost: Medicare Supplement Plan F: $120-$348: Medicare Supplement ...

How much are Plan G premiums?

Medicare Plan G is the most comprehensive coverage you can buy if you became eligible for Medicare after December 31, 2019. Plan G has essentially the same benefits as Plan F, except for the Part B deductible. Annual premiums for Medicare Plan G typically cost between $1,500 and $2,000.

How much a month is Plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

What does AARP plan G cost?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan G (1)$173Plan K$70Plan L$136Plan N$1676 more rows•Jan 24, 2022

What is the deductible for Plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses.

What is the plan g deductible for 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the out-of-pocket maximum for Medigap Plan G?

Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year. If you are interested in an out-of-pocket limit, consider Plan K or Plan L. Plan G is most similar in coverage to Plan F.

What is the deductible for United Healthcare Plan G?

The standard version of Plan G has no deductible, which means your Plan G coverage will begin with the very first dollar spent on covered care. The high-deductible version features a deductible of $2,370 (in 2021) that must be met before the plan coverage kicks in.

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.

Does Plan G have a deductible?

Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F.

Is Medicare G the best plan?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

Does Plan G cover prescriptions?

Medicare Supplement plans, including Plan G, do not cover the cost of prescription medications. To tap into this coverage, you'll need to add a Medicare Part D prescription drug policy to your Original Medicare plan.

Are all Plan G Medicare supplements the same?

Because all Medicare Supplement Plan G policies provide the exact same coverage or benefits. This is what people mean when they say these plans are “standardized.” That said, not all Plan G policies cost the same. Insurance companies are free to charge what they want for them, and so they do.

Is Medicare G the best plan?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

What is the deductible for Plan G?

Plan G covers nearly all out-of-pocket costs for services and treatment once you pay the Medicare Part B $233 deductible. This means you pay no copays or coinsurance. If you don't need that level of coverage, though, you might want a plan with less coverage.

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.

Does Plan G cover prescriptions?

Medicare Supplement plans, including Plan G, do not cover the cost of prescription medications. To tap into this coverage, you'll need to add a Medicare Part D prescription drug policy to your Original Medicare plan.

North Carolina Medicare Supplement Plan G Costs, Coverage and Benefits

Medicare Supplement Plan G in North Carolina frequently referred to as Medigap Plan G, might be the best Medicare Supplement insurance plan for beneficiaries who want broad plan benefits but who are willing to pay a little bit out-of-pocket. Plan G in North Carolina ranks as the second most popular plan behind Medicare Plan F.

How Does Medicare Plan G in North Carolina fill in the gaps of Original Medicare?

A Medigap policy covers medical expenses left over after Medicare Part A and Part B pays its portion. After you pay your Part B deductible, Medigap plans pay the rest of your out-of-pocket medical expenses. You are not responsible for submitting any insurance claims. Here’s how it works:

Medicare Supplement Plan G Rates in North Carolina

Medigap plans are standardized, which means Medigap Plan G in North Carolina is the same as in Mississippi. Choosing the best Medicare Supplement Plan G involves a comparison of the pricing method each insurer uses to set its Medicare Supplement Plan G rates in North Carolina.

Our Best Rated Companies Offering Medicare Supplement Plan G in North Carolina

At My Medigap Plans, we have connections with a network of insurance companies offering Plan G. However, from both an insurance agency and a client perspective, our insurance agents have come to prefer the following three companies as the best Medicare Supplement Plan G carriers in North Carolina to work with:

Medicare Supplement Plan G in North Carolina vs Medicare Plan F

Plan F and Plan G are the two most popular Medicare Supplement plans. Here’s how they compare:

Medicare Supplement Plan G in North Carolina vs Medicare Plan N

Plan N benefits come in a close second to Plan G benefits. It’s important to compare the benefits to find out which plan is best for your health needs:

Does Medigap Plan G in North Carolina cover Prescription Drugs?

Medicare Supplement plans don’t cover prescription drugs. To get drug coverage, you will need to buy a Medicare Part D Drug Plan from a private insurance company. If you don’t enroll in a Medicare Part D Drug Plan when you first become eligible, you can be penalized later on when you do enroll.

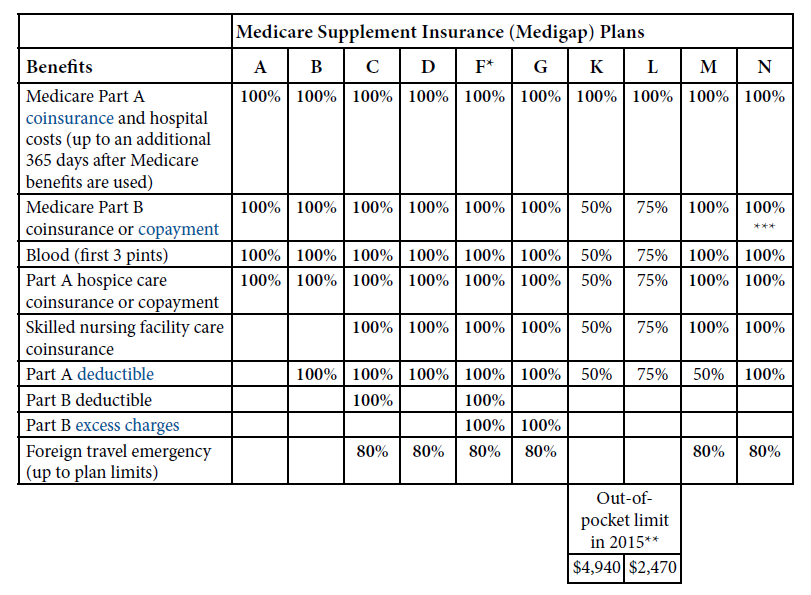

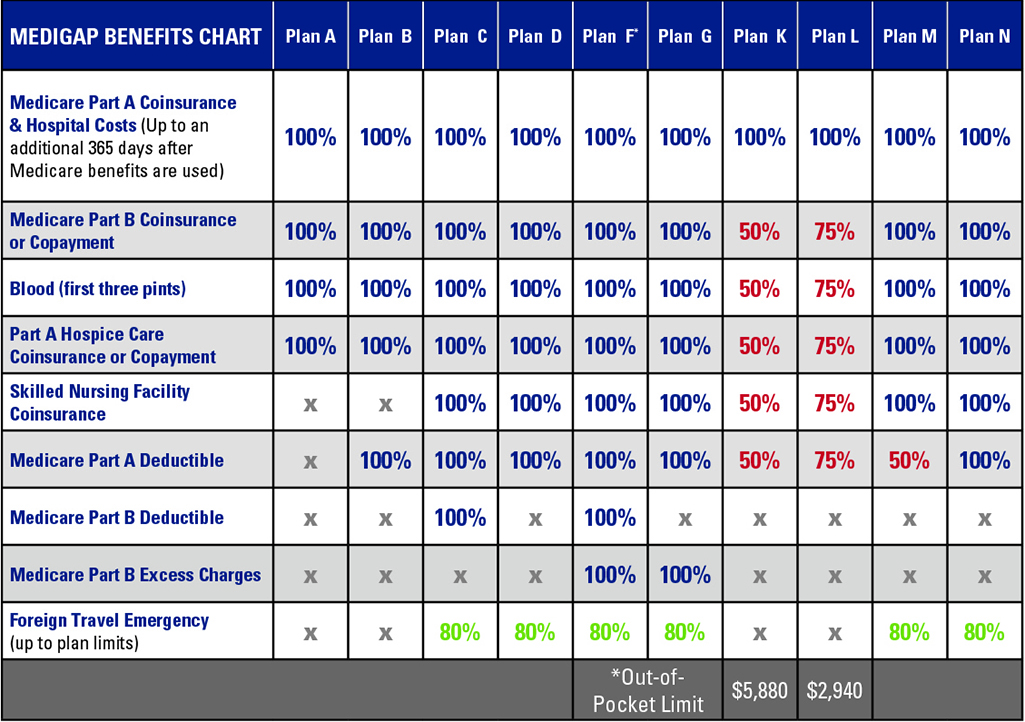

Plan Benefits

Medigap Plan G is among the Medigap Plans with the broadest benefits. Only Plan F offers more standard benefits. Plan G’s only major area where it lacks coverage is the Medicare Part B deductible. Plan G enrollees are still obligated to pay this deductible on their own.

Physician Finder

HealthPocket.com is a free information source. We receive our data from government, non-profit and private sources, and you should confirm key provisions of your coverage with your selected health plan. Our website is not a health insurance agency and not affiliated with and does not represent or endorse any health plan.

Is Medicare Supplement available in North Carolina?

But, Medigap isn’t the only option in North Carolina. Beneficiaries can opt for a Medicare Advantage plan if that’s their preference. Although, most people will have more peace of mind with Medigap. Below we’ll discuss the different options for those in North Carolina and in the end you can choose the best for you.

How many Medicare Part D plans are there in North Carolina?

North Carolina Medicare Part D Plans. There are 28 Part D options in the state of North Carolina. You don’t have to be a specific age to enroll in Part D, as long as you’re Medicare-eligible. No matter which state you live in, you’ll want to enroll in Part D as soon as you’re eligible.

How many people in North Carolina have Medicare?

Almost 2 million people in North Carolina have Medicare. Your situation will determine if Medigap or Medicare Advantage coverage is more beneficial. Then, there are some people that just have Medicare. The downside to only Medicare is the lack of Maximum Out of Pocket coverage; so, there is no limit to the amount of money you’ll spend on care.

Does North Carolina have Medicare Advantage?

And, just about 36% of beneficiaries in North Carolina have a Medicare Advantage policy. While none of the options are 5-star plans, there are plenty of 4.5-star plans throughout the state; including plans by top carriers like Aetna and Humana. There are advantages and disadvantages to Part C plans, so before you jump into a policy read ...

When is the best time to enroll in Medigap?

The best time to enroll in Medigap is during your Open Enrollment Period; this is when no matter what your health looks like, your policy is approved. If you miss the Open Enrollment Period, no worries, you can sign up for Medigap at any time.

Is Medigap Plan A only for 65?

Traditionally, Medigap Plan A and F would be the only options for those under 65. But, Plan F going away, Plan G becomes the default policy available to those newly eligible.

Is Plan F still available?

Plan F is still available for those not newly eligible. And, while these plans are available to those under 65, they are very costly. The premiums are well above $300 each month for someone under 65. You pay more because insurance companies know that someone on disability Medicare is likely to have higher claims.

What is Medicare Supplement in North Carolina?

Medicare Supplement plans in North Carolina help Medicare beneficiaries control the ever-rising cost of health care. Medicare Supplemental Insurance, also called Medigap health plans, pays for out-of-pocket costs such as deductibles and copays that the federal Medicare program doesn’t cover.

Is there an open enrollment period for Medicare Supplement?

Under federal law, there is no annual open enrollment period for Medicare Supplement plans like there is for prescription drug plans and Medicare Advantage plans. There are, however, a few times other than your Medigap Open Enrollment Period that you can join a Medicare Supplement plan without penalty:

What is Medicare Supplemental Insurance?

Medicare Supplemental Insurance, also called Medigap health plans, pays for out-of-pocket costs such as deductibles and copays that the federal Medicare program doesn’t cover. Medicare enrollees buy Medicare Supplement plans in North Carolina through a private insurance company. Insurance agents sometimes refer to an insurance carrier ...

How many Medicare Supplement Plans are there in North Carolina?

There are 10 Medicare Supplement Plans in North Carolina to choose from. Medicare Supplement plans do not use a network, go wherever Original Medicare is excepted. Any North Carolina resident who will soon be enrolled in Medicare Part A and Medicare Part B should take a moment to compare the best Medicare Supplement insurance plans in North ...

What is the difference between Medicare Plan N and Plan G?

With Medicare Plan N, you pay lower premiums but incur more out-of-pocket expenses. Plan N is similar to Plan G but requires a $20 copay for doctor’s appointments and up to $50 for emergency room visits. The ER fee is waived if doctors admit the patient.

Is Plan F deductible?

The high deductible version of Plan F is only available to those enrolled in Medicare before Jan. 1, 2020. 5. Best for lowest premiums: High Deductible Plan G. Get the benefits of Plan G, but by paying a high deductible, you will have lower monthly premiums. Unlike Plan F, Plan G doesn’t cover the Medicare Part B deductible.

Does Plan G cover Medicare Part B?

Get the benefits of Plan G, but by paying a high deductible, you will have lower monthly premiums. Unlike Plan F, Plan G doesn’t cover the Medicare Part B deductible. You will have to reach a high deductible of $2,370 in 2021 before the plan pays your Medicare out-of-pocket costs.

When is the open enrollment period for Medicare Advantage?

Those are two separate timelines and products. The U.S. government has set Oct. 15 to Dec. 7 as the open enrollment period when you can freely change your Medicare Advantage plan.

What is Plan F?

Plan F offers the most comprehensive coverage of all Medigap plans sold by private insurance companies. Under the high deductible plan, Medicare will pay its share, then you will pay out-of-pocket expenses up to your deducible amount.