- Medicare Part A: Usually free

- Medicare Part B: $170.10 per month deducted from Social Security

- Medicare Part C: $33 average cost paid to insurance company

How much does Medicare Part C cost?

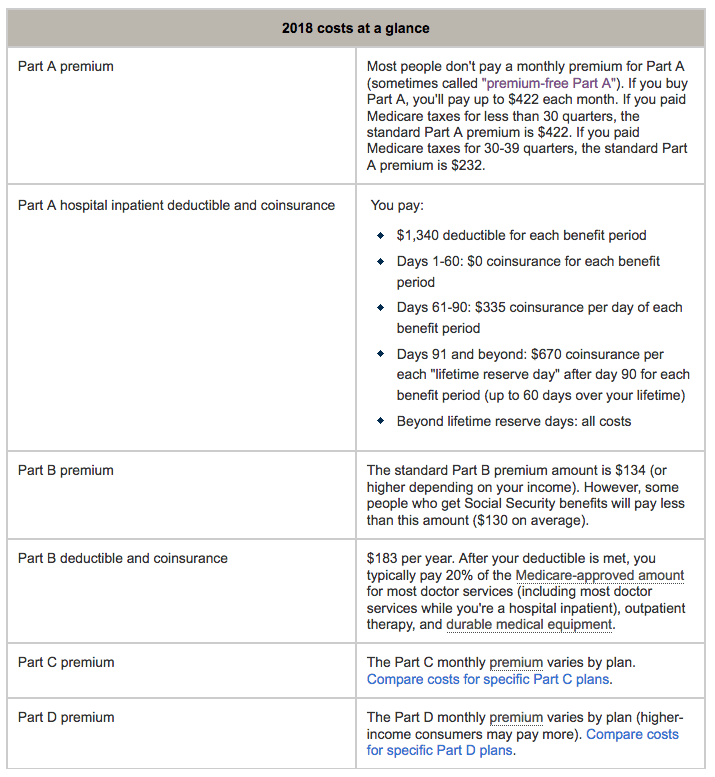

In general, costs break down as follows: Under Medicare Part C, you must qualify for Part A and Part B, which means that you must at least pay a Part B premium. The cutoff amount for the standard premium is an income of $85,000 or less per year. The deductible is $183 per year in 2017, which may rise in 2018.

What to know about Medicare Part C eligibility?

What to Know About Medicare Part C Eligibility 1 Disability eligibility. If you’ve received monthly Social Security or Railroad Retirement Board (RRB) disability benefits for 24 months, you’re eligible for Original Medicare. 2 Illness eligibility. ESRD (end stage renal disease). ... 3 Checking for eligibility. ... 4 Takeaway. ...

How do Medicare Part C plans work?

1 Medicare Part C plans are run by private insurance companies and work similarly to other private health insurance plans 2 Plans often cover more benefits than traditional Medicare plans, including vision, dental, hearing, and prescription drug coverage 3 Plans put an annual cap on out-of-pocket expenses, unlike standard Medicare More items...

What services does Medicare Part C cover?

The law requires that Medicare Part C cover emergency care and other urgent care. Medicare Advantage plans also cover almost all of the services Original Medicare covers. That includes hospital care and other inpatient care that you can get through Medicare Part A.

What is the average cost for Medicare Part C?

Currently insured? For 2022, a Medicare Part C plan costs an average of $33 per month. These bundled plans combine benefits for hospital care, medical treatment, doctor visits, prescription drugs and frequently, add-on coverage for dental, vision and hearing.

What is the advantage of having Medicare Part C?

Medicare Advantage (Part C) has more coverage for routine healthcare that you use every day. Medicare Advantage plans may include: Routine dental care including X-rays, exams, and dentures. Vision care including glasses and contacts.

What is the best Medicare Part C?

Best Medicare Part C Providers:Best Overall for Medicare Part C: Humana.Cheapest for Medicare Part C: Aetna.Best Coverage: Highmark.Best for Extras: Blue Care Network.

Does Medicare Part C have copays?

Medicare Part C Copays Copays are a flat fee for medical services. Some Medicare Part C plans may have a higher copay for healthcare providers not in their plan (i.e., out of network). Once you calculate the added benefits of a Medicare Part C plan, you may see the value that comes with this type of coverage.

Does Medicare Part C cover the 20%?

Medicare Part C covers all of the same Part A and B services that you get from Medicare. You will have both hospital and outpatient benefits. However, instead of paying deductibles and 20% of your medical services, you will pay the plan's copays.

What is not covered under Medicare Part C?

Although insurers are allowed to cover more services than Original Medicare does, not all Part C plans pay for routine dental care, hearing aids, or routine vision care. If you are in need of inpatient care, Medicare Part C may not cover the cost of a private room, unless it's deemed medically necessary.

Is Medicare Part C necessary?

Do you need Medicare Part C? These plans are optional, but if you need more than just basic hospital and medical insurance, Medicare Part C might be a good option for you.

Is Medicare Part C being discontinued?

Starting on January 1, 2020, Plan C was discontinued. You can keep Plan C if you already have it. You can still enroll in Plan C if you were eligible for Medicare on or before December 31, 2019. Congress has ruled that the Plan B deductible can no longer be covered by Medigap plans.

Does Medicare Part C cover prescription drugs?

Unlike Original Medicare, Medicare Part C generally offers coverage for prescription drugs you take at home. The exact prescription drugs that are covered are listed in the plan's formulary. Formularies may vary from plan to plan.

Is Medicare Part C deducted from Social Security?

Beneficiaries may elect deduction of Medicare Part C (Medicare Advantage) from their Social Security benefit. Some Medicare Advantage plans include a reduction in the Part B premium. Social Security takes that reduction into account, as soon as we are notified of the reduction by CMS.

Is Medicare Part C deductible on taxes?

Part B premiums are tax deductible as long as you meet the income rules. Part C premiums. You can deduct Part C premiums if you meet the income rules.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

How does Medicare Part C work?

Medicare Part C is a bundled insurance plan that can provide coverage for hospital services, medical care, prescription drugs and more. The Medicar...

Why are some Medicare Part C plans free?

Some Medicare Part C plans are available for $0 because of the behind-the-scenes pricing structures set by the government contracts. What happens i...

Why do you need Medicare Part C?

Medicare Part C is an optional way that you can unify coverage from Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). M...

Who is eligible for Medicare Part C?

All those who are eligible for Original Medicare are also eligible for a Medicare Part C (Medicare Advantage) plan. You can join a Medicare Advanta...

How does Medicare work?

Medicare gives the plan an amount each year for your health care, and the plan deposits a portion of this money into your account. The amount deposited is less than your deductible amount, so you will have to pay out-of-pocket before your coverage begins.

When does Medicare 7 month period end?

When you first become eligible for Medicare (the 7-month period begins 3 months before the month you turn age 65, includes the month you turn age 65, and ends 3 months after the month you turn age 65).

What is Medicare Advantage Plan?

A Medicare Advantage Plan (like an HMO or PPO) is a health coverage choice for Medicare beneficiaries. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, the plan will provide all of your Part A (Hospital Insurance) and Part B ...

What is a PPO in Medicare?

Your costs may be lower than in Original Medicare. Preferred Provider Organizations (PPO) – A type of Medicare Advantage Plan in which you pay less if you use doctors, hospitals, and providers that belong to the network. You can use doctors, hospitals, and providers outside of the network for an additional cost.

When does Medicare Advantage return to original plan?

Medicare Advantage enrollees have an annual opportunity to prospectively disenroll from any Medicare Advantage plan and return to Original Medicare between January 1 and February 14 of every year. This is known as the Medicare Advantage Disenrollment Period (MADP).

Does Medicare Advantage include all or part of the premium?

Your Medicare Advantage plan premium may also include all or part of the premium for Medicare prescription drug coverage (Part D). If you have limited income and resources, you may qualify for the following: Extra Help paying for your Part D premium and other prescription drug coverage costs.

Does Medicare cover dental insurance?

They may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage. In addition to your Part B premium, you usually pay one monthly premium for the services provided.

How much is Medicare Part B premium?

For 2020, the Centers for Medicare and Medicaid Services announced that the standard monthly premium for Medicare Part B enrollees is $144.60. Medicare Part C works differently than Original Medicare. Medicare Advantage plans are offered by private companies approved by Medicare.

What is a copayment after deductible?

Once you reach your deductible, you may have a copayment or coinsurance. Copayment Your copayment is how much you pay for covered health services after you reach your deductible. For example, you may have a $20 copay for doctor visits. Once you reach your deductible, you’ll pay only $20 every time you see a doctor.

What is a Medicare deductible?

Deductible Your deductible is how much you have to pay before your Medicare Advantage plan begins to pay for covered services. For example, if you have a $2,000 deductible, you pay for the first $2,000 in covered services yourself. Once you reach your deductible, you typically only pay your copayment or coinsurance for covered services, ...

What happens when you reach your deductible?

Once you reach your deductible, you typically only pay your copayment or coinsurance for covered services, and your insurance pays for the rest of the cost. In general, the lower your deductible, the higher your premium will be. Once you reach your deductible, you may have a copayment or coinsurance. Copayment Your copayment is how much you pay ...

How much does Medicare cost in 2020?

According to the Kaiser Family Foundation, the average monthly premium for enrollees of Medicare Part C plans was $25 for 2020. With Medicare Advantage plans, Medicare pays a fixed amount toward your care each month to the private companies providing Medicare Part C plans. While the average cost for Medicare Part C is $25 per month, ...

Is Medicare Part C run by the government?

Medicare Part C isn’t run by the government, so you’ll have to pay for Medicare Advantage plans. iStock. Medicare Advantage plans, often called Medicare Part C, are an alternative option to Original Medicare. Instead of having to get separate Part A (hospital insurance), Part B (medical insurance), and prescription drug coverage, ...

Can you bundle Medicare Advantage plans?

Instead of having to get separate Part A (hospital insurance), Part B (medical insurance), and prescription drug coverage, Medicare Advantage plans allow you to bundle your coverage together into one simple insurance plan. However, Medicare Part C isn’t run by the government, so you’ll have to pay for Medicare Advantage plans.

What is Medicare Part C?

Medicare Part C (also called Medicare Advantage) is a Medicare plan that unifies multiple types of insurance coverage including hospitals, medical care and prescription drugs.

What's the average cost of Medicare Part C?

For 2022, the average cost of a Medicare Part C plan with prescription drug coverage is $33 per month.

What else do you pay for when you have Medicare Part C?

When considering your Medicare expenses, there are two costs to consider in addition to your monthly premium.

What does Medicare Part C cover?

A Medicare Part C plan will cover the same medical services as Original Medicare. That means plans will cover doctors, hospital care and many other types of health services. Coverage includes:

What are the advantages and disadvantages of Medicare Part C?

The structure and benefits of plans mean that Medicare Part C has both advantages and disadvantages when you’re considering what type of coverage is best for you.

Medicare Part C plans

Medicare Part C plan availability will change from location to location, and several providers only operate in select states or service areas. When choosing a Medicare plan, the first step is to find out what providers and plan options are available to you.

How do you sign up for Medicare Part C?

You can sign up or change your Medicare Part C plan during one of the Medicare enrollment periods.

What are the added costs of Medicare Part C?

The added costs of Medicare Part C are in proportion to the extras that you receive for a private health insurance plan. Most plans include prescription drug coverage, vision and dental, as well as wellness programs and hearing care.

What is Medicare Part C?

Medicare Part C, which is also called Medicare Advantage, is a combination of A and B with various extras depending on plan type. Part C is sold through private companies, but it’s also partially sponsored by the government.

How much is Medicare Part B 2020?

Medicare Part B has a standard monthly premium of $144.60 for new enrollees in 2020, with a yearly deductible of $198. These amounts increase to $148.50 and $203, respectively, in 2021.

How much does Medicare Advantage cost in 2021?

With Medicare Advantage, you pay a Part B premium and a premium for your Medicare Advantage plan. Premiums for Medicare Advantage average less than $30 in 2021. And as we said earlier, there are Medicare Advantage with zero dollar premiums, meaning you’ll pay nothing on top of your Part B premium for this coverage.

What changes did the Affordable Care Act make to Medicare?

In 2014, the Affordable Care Act changed the healthcare system in America and also changed small parts of Medicare. The only real change that most people noticed is that now Medicare and Medicare Advantage plans must include preventive care and cannot reject anyone for pre-existing conditions.

How long do you have to be in Medicare for the first time?

Enroll in a Medicare Advantage plan for the first time. During the 7-month period surrounding your 65 th birthday (three months before you turn 65, the month you turn 65, and three months after you turn 65) Under 65 and disabled. Enroll in a Medicare Advantage plan for the first time.

Which is better, Medicare Part D or Medicare Part C?

Medicare Part D is prescription drug coverage. Medicare Part C is one of the better plans to go with if you’re in need of healthcare and want a more affordable, government-sponsored option that provides more than what Original Medicare offers. There are various plans that qualify as Medicare Advantage.

What is the maximum out of pocket amount for Medicare Part C?

If you have Medicare Part C, for services that Medicare Parts A and B cover, the maximum out-of pocket limit is $7,550 per year in 2021 if you go to in-network care providers. The limit is $11,300 per year for combined in-network and out-of-network costs.

How many parts does Medicare have?

Unlike traditional health insurance plans, Medicare is divided into four parts that each cover different services. If you’re already claiming Social Security benefits, then you will be automatically enrolled in Medicare Part A and Medicare Part B once you turn 65. These two parts are known as Original Medicare .

What are the benefits of a Medicare plan?

Plans often cover more benefits than traditional Medicare plans, including vision, dental, hearing, and prescription drug coverage. Plans put an annual cap on out-of-pocket expenses, unlike standard Medicare. Plans restrict you to a much smaller, local network of available doctors and health care providers.

How much is Medicare Part B in 2021?

The Medicare Part B premium is typically $148.50 a month in 2021, but it may be higher if you earn a higher income. Beyond that, prices can vary greatly by plan. Medicare Advantage premiums average $33 in 2020, according to data from the CMS compiled by Policygenius. At the same time, premiums can reach up to $481.

What is Medicare for older people?

Medicare is a federal health insurance program that primarily serves Americans age 65 and older. It’s also available to younger individuals with certain disabilities or health conditions. Medicare consists of multiple parts, which each cover different types of health services.

What is a copay?

A copay is a flat fee that you pay whenever you receive certain services. For example, a hospital stay for a surgery could come with a copay of $100 per day. If you stay three days, you will end up paying $300 in copays plus other costs the visit incurs.

What is MSA in Medicare?

MSAs are a bit different from the types of plans above. An MSA works very similarly to a high-deductible health plan (HDHP) paired with a health savings account (HSA). With an MSA plan, Medicare will deposit money into an account that you can then use to pay for your health care services. Your insurance will not start to pay for your medical expenses until you spend enough to hit your deductible.

What is Medicare Part C?

How Part C works. Takeaway. Medicare Part C, also called Medicare Advantage, is an insurance option for people who are eligible for Medicare. These plans are offered through private insurance companies. You don’t need to buy a Medicare Part C plan. It’s an alternative to original Medicare that offers additional items and services.

How old do you have to be to get Medicare?

To enroll in original Medicare (to be eligible for Part C), in general, you must qualify by: Age. You must be at least age 65 or older and a U.S. citizen or legal permanent resident for a minimum of 5 contiguous years. Disability.

When is Medicare open enrollment?

Finally, there’s also the Medicare Advantage open enrollment period. This is from January 1 to March 31 each year. However, this period only lets you make changes to your plan if you’re already enrolled in a Medicare Advantage plan.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

Can I qualify for QI if I have medicaid?

You can’t qualify for the QI program if you have Medicaid. If you have a monthly income of less than $1,456 or a joint monthly income of less than $1,960, you are eligible to apply for the QI program. You’ll need to have less than $7,860 in resources. Married couples need to have less than $11,800 in resources.