Social Security and Medicare Tax 2019 Following adjustments to the federal tax code made in recent years, individuals can expect 6.2 percent of their pay up to a maximum income level of $132,900 to be directed toward Social Security, and 1.45 percent of their paycheck income to be routed to Medicare.

What percentage of gross wages is taken for Social Security?

There are actually two different rate components, broken out as follows: The Social Security (OASDI) withholding rate is gross pay times 6.2% up to the maximum pay level for that year. This is the employee's portion of the Social Security payment. You as the employer must pay 6.2% with no limit.

What percent of income goes to Social Security?

So if you are working a part time job in retirement, 6.2% is taken from that for social security, just as it was before retirement. About 6% of your income goes to FICA ( S.S.) and that covers your Medicare and s.s. retirement. Your employer also puts a percentage in.

What percentage of your paycheck is withheld for FICA?

It's the federal law that requires employers to pay and withhold certain taxes from the wages they pay employees. FICA mandates that three separate taxes be withheld from an employee's gross earnings: 6.2% Social Security tax, withheld from the first $142,800 an employee makes in 2021. 1.45% Medicare tax, withheld on all of an employee’s wages.

What percentage is taken out of paycheck?

How Much Is Typically Taken Out of a Paycheck for Taxes?

- Determining Federal Income Tax Withholding. The Internal Revenue Service expects taxpayers to pay taxes on wages at the time they’re earned. ...

- Social Security and Medicare Tax Withholding. ...

- Paycheck Deductions for $1,000 Paycheck. ...

- Penalties for Not Withholding Enough. ...

- 2018 Tax Law. ...

What is Social Security that comes out of paycheck?

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

What is Medicare that comes out of paycheck?

Medicare tax is deducted automatically from your paycheck to pay for Medicare Part A, which provides hospital insurance to seniors and people with disabilities. The total tax amount is split between employers and employees, each paying 1.45% of the employee's income.

Which type of tax is taken out of each paycheck and includes Medicare and Social Security taxes payroll sales Property Corporate income?

Payroll tax: Taxes taken from your paycheck, including Social Security and Medicare taxes.

Are Social Security and Medicare taxes deducted from Social Security payments?

FICA refers to the combined taxes withheld for Social Security and Medicare (FICA stands for the Federal Insurance Contributions Act). On your pay statement, Social Security taxes are referred to as OASDI, for Old Age Survivor and Disability Insurance.

Is Social Security tax and Medicare tax included in federal tax?

An employer's federal payroll tax responsibilities include withholding from an employee's compensation and paying an employer's contribution for Social Security and Medicare taxes under the Federal Insurance Contributions Act (FICA).

Why do I pay Social Security and Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

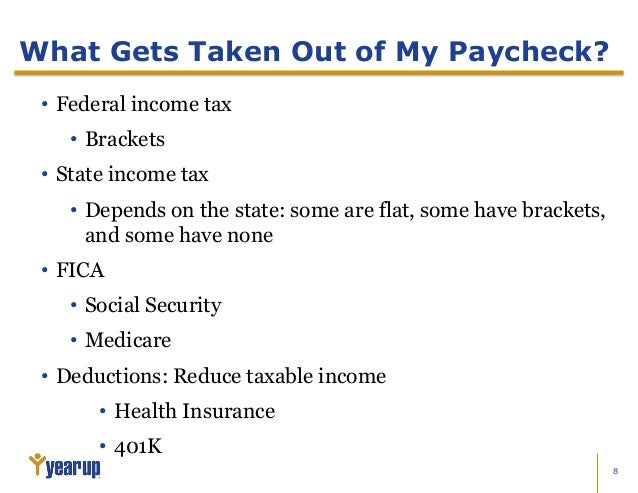

What are the 5 mandatory deductions from your paycheck?

What are payroll deductions?Income tax.Social security tax.401(k) contributions.Wage garnishments. ... Child support payments.

What are the 5 payroll taxes?

There are four basic types of payroll taxes: federal income, Social Security, Medicare, and federal unemployment. Employees must pay Social Security and Medicare taxes through payroll deductions, and most employers also deduct federal income tax payments.

Which deductions are commonly taken out of employee paychecks?

Mandatory payroll deductionsFICA tax. Federal Insurance Contributions Act (FICA) tax is made up of Social Security and Medicare taxes. ... Federal income tax. ... State and local taxes. ... Garnishments. ... Health insurance premiums. ... Retirement plans. ... Life insurance premiums. ... Job-related expenses.

Does Medicare count as federal withholding?

The Form is determining your taxes for 2018 and reducing them by the Federal withholding that will take place during the year. The Social security and Medicare you pay does not reduce your income tax liability for 2018.

Is Medicare a tax deduction?

Medicare expenses, including Medicare premiums, can be tax deductible. You can deduct all medical expenses that are more than 7.5 percent of your adjusted gross income.

How much taxes are taken out of a paycheck?

Overview of California TaxesGross Paycheck$3,146Federal Income15.22%$479State Income4.99%$157Local Income3.50%$110FICA and State Insurance Taxes7.80%$24623 more rows

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...