Founded in 1977, UnitedHealthcare is the insurance arm of UnitedHealth Group. In 1997, it partnered with AARP, one of America’s largest advocacy groups for people over 50 years old. Together, they offer Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Is there such a thing as Medicare Part G?

So there is no such thing as Medicare Part G! All Supplement insurances, on the other hand, are called Plans. So instead of saying Medicare Part G say Plan G, and you’ll be using the correct wording. Hope that helps you! Not connected with or endorsed by the United States government or the federal Medicare program.

What are the best Medicare supplement plan G Companies?

Best Medicare Supplement Plan G Companies of 2020 1 Aetna: Best for Price Transparency 2 Mutual of Omaha: Best for Educational Tools 3 Bankers Fidelity: Best for Easy Application 4 Humana: Best for Discounts 5 UnitedHealthcare/AARP: Best for Comparison Tools 6 Cigna: Best Extras/Perks 7 State Farm: Best Agent Network

What states does Aetna Medicare supplement plan G cover?

Aetna was founded in 1853 and was acquired by CVS Health Corporation in 2018. It offers Medicare Supplement Plan G in 22 states, excluding Alaska, Connecticut, Hawaii, Maine, Massachusetts, Minnesota, New York, Vermont, Washington, and Wisconsin.

What is Medicare Part G Plan F?

Medicare Plan G – Part G. Medicare Plan G coverage is very similar to Plan F. It offers great value for beneficiaries who are willing to pay a small annual deductible. After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance.

Is Medicare G the best plan?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

Can you still get Medicare Plan G?

You can buy MedSup Plan G — and every other MedSup plan — from any insurance company that's licensed in your state to sell Medicare Supplement coverage. Remember, all Plan G policies must provide the same benefits or coverages. Just like all Plan F policies must provide the same benefits or coverages.

Who is the largest Medicare Supplement provider?

UnitedHealthcareAARP's Medicare Supplement Insurance plans are insured exclusively by UnitedHealthcare, which is the largest provider of Medicare Supplement Insurance. AARP/UnitedHealthcare Medigap plans have low complaint rates when compared to most competitors.

How much is the G plan for Medicare?

Annual premiums for Medicare Plan G typically cost between $1,500 and $2,000. Some insurance companies offer extra perks and benefits for vision and dental care with Medicare Plan G.

Does AARP Offer Plan G?

AARP also offers a high-deductible version of Plan G. This option will require you to pay a deductible of $2,340 before the plan begins to assist with costs. Once you've met your deductible, the plan will pay 100% of covered costs for the remainder of the year. This plan does not cover your Part B deductible.

What is the monthly premium for Plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

What are the top 3 most popular Medicare supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Which Medicare company is best?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCMS ratingBlue Cross Blue Shield5.03.8Cigna4.53.8United Healthcare4.03.8Aetna3.53.61 more row•Jun 8, 2022

Who has the cheapest Medicare supplement insurance?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022.

How much does AARP Medicare Supplement Plan G cost?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan G (our recommendation for best overall plan)$193Plan G (1)$173Plan K$70Plan L$1366 more rows•Jan 24, 2022

Does Plan G have a deductible?

In 2022, some states also offer a high-deductible Plan G, which provides the same benefits, after a deductible of $2,490 is paid.

Does Medicare Plan G have a maximum out-of-pocket?

Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year. If you are interested in an out-of-pocket limit, consider Plan K or Plan L. Plan G is most similar in coverage to Plan F.

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

Why do seniors choose Medicare Supplement Plan G?

Many seniors choose Medicare Supplement Plan G insurance because of its cost-effectiveness and overall coverage. But the entire process of finding a provider can be confusing and overwhelming, so we’re here to help.

How many people are on Medicare Supplement 2020?

Almost 57 million Americans were enrolled in Original Medicare and Medicare Supplement plans as of 2020. 1 Medicare Supplement Plans, also known as Medigap plans, are popular because they pay the portions of your medical bills that Original Medicare doesn’t pay, such as copays or deductibles for Part A or Part B.

When is Medicare open enrollment 2020?

Remember: during Medicare Open Enrollment, which in 2020 extends from September 7 through October 15, anyone eligible may enroll in Medicare and pick any supplemental insurance they may need.

How much is the 2020 Plan B deductible?

However, that payment does count toward the Plan G deductible as well. The Plan B deductible for 2020 is $203, so you’ll have to pay at least this much, but that means you can subtract that amount from your expected Plan G deductible as well.

Does Cigna have a Medicare Supplemental Plan G?

Cigna’s Medicare Supplemental Plan G options each have their own page, which breaks down the coverage into a lot of detail with plenty of explanation. You don’t have to enter your ZIP code or any other personal information.

Is Plan F closed for 2020?

The most popular Supplemental Plan was Plan F, but as of January 1, 2020, Plan F is closed to new enrollees. However, if you were eligible to sign up for Medicare before January 1, 2020, you can still enroll in a Supplement Plan F.

Does Medicare cover Part A and Part B copays?

Plan G coverage includes excess charges that are left over from the 80% that Original Medicare does not cover, including Part A and Part B copays and Part A’s deductible. The other big difference: Plan G does not cover the Part B deductible, which needs to be met.

How much does Medicare cost for a 65 year old man?

According to Medicare’s Plan Finder Website, here are some of the average costs for a 65-year old man who doesn’t smoke: New York City: Plan G is $268 to $545; High-deductible Plan G: $69 to $91. Tampa, Florida: Plan G is $176 to $263; High-deductible Plan G: $52 to $92.

What is the deductible for Medicare 2020?

For 2020, the deductible for the high-deductible plan was $2,340. After you reach this amount, your Plan G benefits kick in. The high-deductible plan has trade-offs compared with a traditional plan.

How long has Aetna been in business?

As an insurance provider, Aetna has been in business since 1853 and has more than 22 million members in its health and benefit plans. The company's long track record and both traditional and high-deductible benefit offerings earned Aetna a spot on our best Medicare Supplement Plan list.

Does Aetna offer a discount on Medicare?

Aetna offers a household discount when you and another member of your household (such as a partner or spouse), subscribe to Aetna’s Medicare Supplement Plans.

Does Aetna offer Medicare Supplement?

Aetna doesn’t offer Medicare Supplement Plans in all states. You can’t purchase its plans in Alaska, Connecticut, the District of Columbia, Hawaii, Maine, Massachusetts, New York, and Washington. It also doesn't offer high-deductible Plan G in all areas.

Is Plan G the most comprehensive plan?

However, as of January 1, 2020, Medicare no longer allows insurers to sell Plan F to new Medicare subscribers. As a result, Plan G is now the most comprehensive coverage, offering eight of the nine benefits available through Medigap.

Is Plan G standardized?

Because Plan G coverage is standardized, the true differences are in cost and company. Some companies will offer discounts on their website for varying factors, including if members of your household sign up for a plan or if you pay via automatic bank draft.

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

Why is Medicare Supplement G more expensive than Plan N?

Medicare Supplement G usually costs more than Plan N, because it covers more. People seem to like the security and peace of mind that a comprehensive policy like Plan G seems to offer. Want to know which companies offer the best Medicare Plan G policies. Read our Plan G Reviews here or attend one of our free New to Medicare webinars ...

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

What is a small deductible for Medicare?

Medigap Plan G: A Small Deductible = Big Savings. Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, ...

What is Plan G?

After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

Does Medicare pay for inpatient hospital?

So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, durable medical equipment, x-rays, ambulance, surgeries and much more. Medicare pays first, then Plan G pays all the rest after you pay ...

Is there such a thing as Medicare Part G?

Only Original Medicare itself has Parts and there are only four parts – A, B, C and D. So there is no such thing as Medicare Part G! All Supplement insurances, on the other hand, are called Plans. So instead of saying Medicare Part G say Plan G, and you’ll be using the correct wording. Hope that helps you!

What is Medicare Part G?

Medicare Part G, also known as Plan G, is the most popular Medicare Supplement Plan available out of the 10 plans. Now with Medicare Plan F no longer available to people new to Medicare, Plan G has taken its place as the plan with the most coverage.

What is the Medicare plan G number?

Check the rates now for Plan G and do the math to see how much you can save. Or even easier, just call us now! Our number is 1-888-891-0229. In just a matter of minutes we’ll tell how how much you can save, and which company offers the lowest premiums for Medicare Plan G.

How much does Medicare Part B pay?

This is an amount currently close to $200 that you must pay in the form of your doctor’s bills. Once this deductible is met, Medicare Part B will begin paying 80% of your medical bills from doctors. You are responsible for paying the remaining 20% however. With Medicare Supplement Plan G, you’ll be paying nothing more than ...

Why is it important to sign up for Medicare Supplement Plan G?

Like Plan F and its poor value problem, you can also sign up for some Medicare Supplement Plan G policies that cost too much money, simply because you didn’t allow us to check the rates for you.

Which is better, Medicare Supplement Plan N or G?

Another plan rising in popularity is Medicare Supplement Plan N. With lower premiums than Plan G, Medigap Plan N is something you should certainly consider. Although Plan G is still the most popular, Plan N offers a great alternative for people who are extremely healthy and want to save money on their monthly premiums.

What is Medicare Part A coinsurance?

Medicare Part A copayments– Helping you pay for hospital stays and minimizing your out-of-pocket costs for common medical care.

What is the difference between Plan F and Plan G in 2021?

That is the only difference between Plan F and Plan G. In 2021 that deductible is $203. The issue is the fact that Plan F likely costs far more than $203 per year than Plan G to have.

What factors affect Medicare premiums?

In the case of Medicare Supplement plans, many factors affect what you’ll pay each month. Demographic information – such as age , location, and tobacco use – affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board. Each of the top 10 Medicare Supplement carriers on the list above is ...

Is Medicare competitive in 2021?

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability. There are many top-rated medicare supplement companies to choose from in 2021, and when you use our agents, you get your cake and eat it too! When you enroll in a policy through us, you get the benefits ...

Does Cigna have the same coverage as Plan G?

So, Plan G with Mutual of Omaha offers the same coverage as Plan G with Medico. Plan N with Cigna has the same coverage as Plan N with UnitedHealthcare. Additionally, all Medicare Supplement plans allow you to go to any doctor accepting Medicare assignment – which is the majority of doctors, coast-to-coast.

What is Medicare Plan G?

Medicare Plan G is a Medigap Supplement Insurance plan to help pay expenses from Medicare Part A and Part B. It is also called Medigap Plan G. A person is eligible to enroll during the Open Enrollment Period. However, if they delay enrolling in Medicare Plan G until after the Open Enrollment Period, the insurer may deny them a policy.

Who is eligible for Medicare?

People who are 65 years of age or older are eligible for Medicare coverage. Some people who are younger and have a disability are also eligible. In this article, learn about Medicare Plan G, who is eligible, coverage, costs, and enrollment.

How much is the annual deductible for Medicare?

The annual deductible for the high-deductible plan is $2,370. Not every state offers a high-deductible plan. A person pays the premiums for Medicare Plan G to the private insurance company where they buy the policy. They pay the premiums for Medicare Part A and B to Medicare.

When does Medigap open enrollment end?

Everyone is eligible for all Medigap policies during the Medigap Open Enrollment Period, which starts in the month when a person turns 65 years of age and ends after 6 months. To qualify, the individual must also have enrolled in Medicare Part B.

Which states do not have to offer Medicare?

They do not offer all plans in all states and do not have to provide Medicare Plan G. Wisconsin, Minnesota, and Massachusetts standardize their Medigap plans in different ways.

Does Medicare cover travel expenses?

Medicare Part A and Part B do not cover medical expenses if a person is traveling outside of the U.S. However, Medicare Plan G will cover foreign travel expenses up to the plan limit. People should check the limit in their individual policy.

Does Medicare Plan G cover hospital expenses?

Although insurance companies may offer additional benefits in different states, Medicare Plan G must cover standard medical expenses: Part A hospital and coinsurance costs up to an additional 365 days after the end of Medicare benefits. Part A hospice coinsurance or copayments. Part A deductible.

Who sells Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are sold by dozens of private insurance companies all over the U.S. When shopping for coverage, it’s important to find the right plan for your unique needs and also to find the right insurance company. Different companies may sell Medigap plans that have different prices and terms, ...

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

What is Medico insurance?

Medico Insurance Company. Medico sells Medicare Supplement Insurance in 25 states and offers several popular Medigap plans, such as Plan A, Plan F, Plan G and Plan N. Medico offers a number of plan discounts for things like automatic premium withdrawal, being a non-smoker or living with another person over the age of 18.

What is the number 13 Cigna?

Cigna. Cigna is ranked number 13 on the Fortune 500 list. 2. Depending on your location, the Medicare Supplement Insurance plans you may be able to apply for from Cigna* may include: Plan G. Plan N.

Is Wellcare the same as Medigap?

It’s important to keep in mind that although each company’s plan selection and pricing may differ, the coverage included in each type of Medigap plan remains the same, no matter where you purchase it.

Does Mutual of Omaha offer Medicare Supplement?

Mutual of O maha Medicare Supplement Insurance plans come with an Additional Benefit Rider that may include services such as discounts on fitness programs, hearing care and vision care. Mutual of Omaha offers several types of Medigap plans. Depending on where you live, you may be able to apply for Mutual of Omaha Medicare Supplement Insurance ...

Is Wellcare a Fortune company?

In 2020, WellCare was named one of Fortune Magazine’s “Most Admired Companies,” and the company boasts a number of community-based programs designed to help members navigate their local social support network and connect to community resources. 4

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. These can include prescriptions, doctor visits, vision and dental care, and more.

How long do you have to switch back to Medicare Advantage?

If you’re unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance.

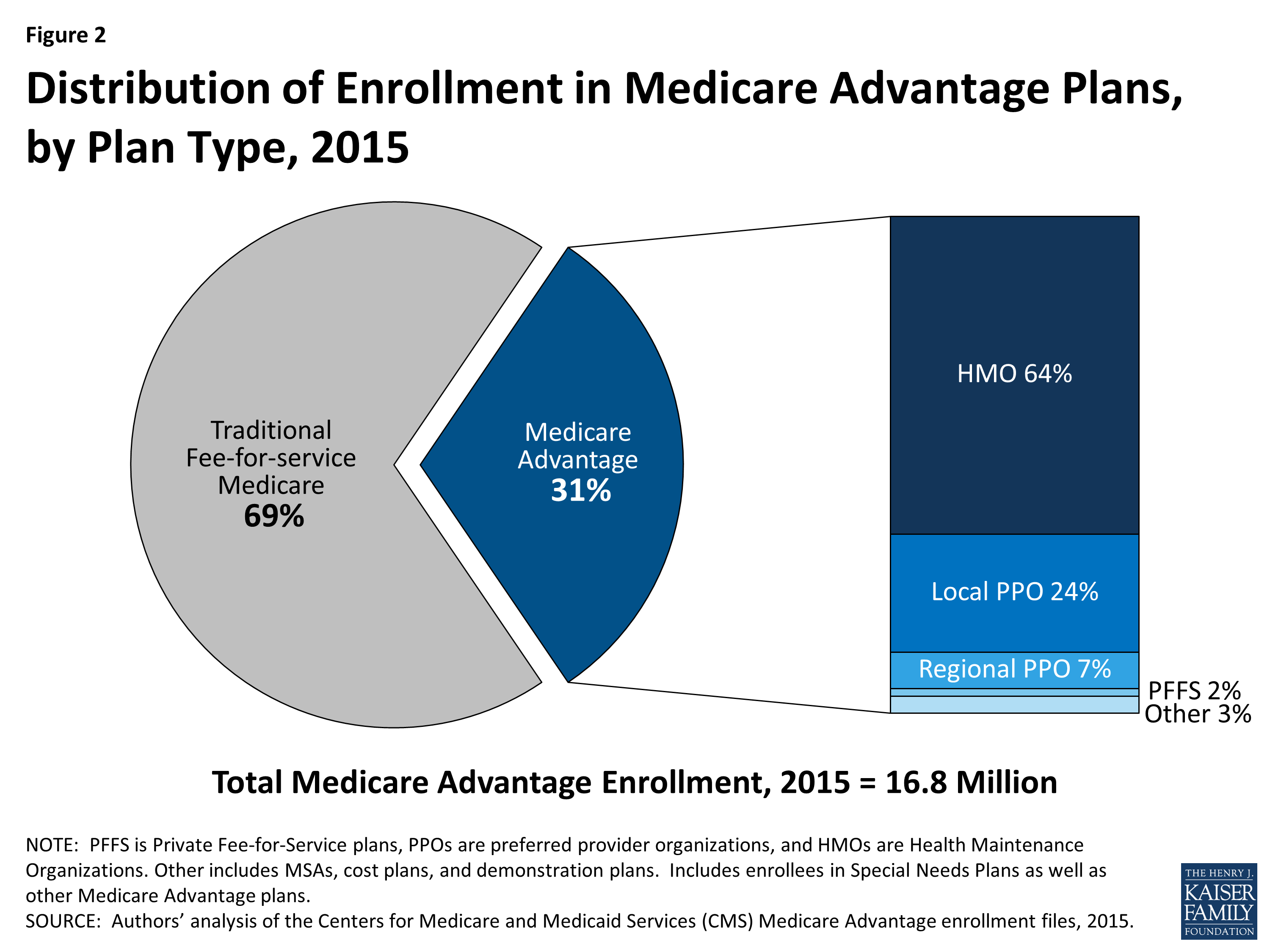

Is Medicare Advantage the same as Medigap?

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

Do all Medicare Supplement plans have the same benefits?

No matter which insurance company offers a particular Medicare Supplement plan, all plans with the same letter cover the same basic benefits. For instance, all Plan C policies have the same basic benefits no matter which company sells the plan.

Does Cigna cover Part B?

Warning. As of Jan. 1, 2020, Medicare Supplement plans sold to new Medicare recipients aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on Jan. 1, 2020. Medicare Supplement plans don't cover the costs ...

Does Medicare Supplement cover out of pocket costs?

As the cost of healthcare continues to increase, so do the out-of-pocket costs for services that are not covered by Original Medicare. Because it can be difficult to predict your exact health care needs and costs, Medicare Supplement plans are used to cover many of the services you may need.

Does Aetna offer Medicare Supplement?

Aetna stands out because it offers several Medicare Supplement plans, including Parts A, B, C, D, F, G, and N, with each plan’s information and coverage clearly laid out on the company website. Consumers are supplied with ample details to really understand the options before making a decision.

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.