Specified Low-Income Medicare Beneficiary (SLMB) program If you make less than $1,308 a month and have less than $7,970 in resources, you can qualify for SLMB. Married couples need to make less than $1,762 and have less than $11,960 in resources to qualify.

Full Answer

What is the low-income subsidy in Medicare?

The Low-Income Subsidy in Medicare helps people with Medicare pay for medications and lowers the cost of Medicare Part D prescription drug coverage. With the low-income subsidy, you get assistance paying for your Medicare Part D monthly premium, deductible, copayments, and coinsurance.

What is slmb (specified low-income Medicare beneficiary)?

One of these Medicare Savings Programs is called SLMB, or Specified Low-income Medicare Beneficiary, which we’ll review below. What does SLMB cover? SLMB benefits cover the cost of the monthly Medicare Part B premium.

What is Medicare's Limited Income newly eligible transition (net) program?

This section contains information on Medicare's Limited Income Newly Eligible Transition (NET) Program. Medicare's Limited Income NET Program, effective January 1, 2010, provides temporary Part D prescription drug coverage for low income Medicare beneficiaries not already in a Medicare drug plan including:

What is the limited income net program?

Medicare's Limited Income NET Program, effective January 1, 2010, provides temporary Part D prescription drug coverage for low income Medicare beneficiaries not already in a Medicare drug plan including: Full Benefit Dual Eligible and SSI-Only beneficiaries on a retroactive basis, up to 36 months in the past; and

What is the lowest income to qualify for Medicare?

In order to qualify for SLMB benefits you must meet the following income requirements, which can also be found on the Medicare Savings Programs page: Individual monthly income limit: $1,269. Married couple monthly income limit: $1,711. Individual resource limit: $7,730.

What is considered income for Medicare purposes?

Your adjusted gross income (AGI) on your federal tax return. Excluded foreign income. Nontaxable Social Security benefits (including tier 1 railroad retirement benefits)

At what income level do you not have to pay for Medicare?

To qualify, your monthly income cannot be higher than $1,208 for an individual or $1,622 for a married couple. Your resource limits are $7,280 for one person and $10,930 for a married couple.

What are the 3 qualifying factors for Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant).

What income is used to determine Medicare premiums 2021?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

Is Pension considered income for Medicare?

While Social Security benefits are subject to income taxes after retirement, pension payments, annuities, and the interest or dividends you receive from your savings or investments are not subject to Medicare or FICA taxes.

Can you be denied Medicare?

In all but four states, insurance companies can deny private Medigap insurance policies to seniors after their initial enrollment in Medicare because of a pre-existing medical condition, such as diabetes or heart disease, except under limited, qualifying circumstances, a Kaiser Family Foundation analysis finds.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

Can I get Medicare Part B for free?

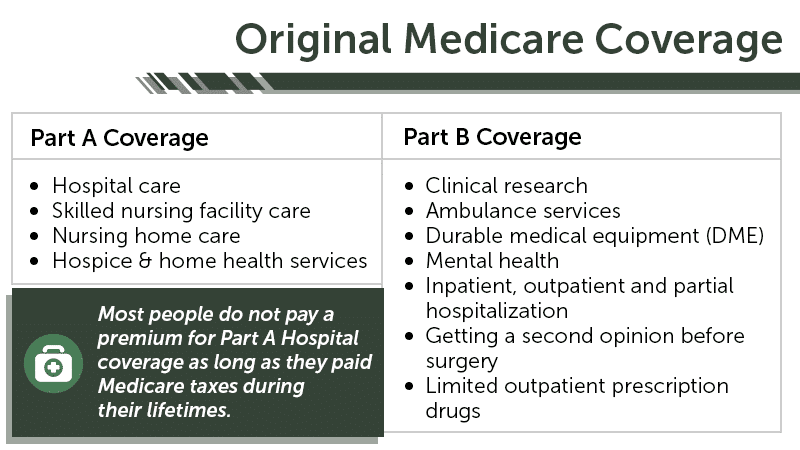

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Who qualifies for free Medicare Part A?

To be eligible for premium-free Part A on the basis of age: A person must be age 65 or older; and. Be eligible for monthly Social Security or Railroad Retirement Board (RRB) cash benefits.

How do I qualify for dual Medicare and Medicaid?

Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. To be considered dually eligible, persons must be enrolled in Medicare Part A (hospital insurance), and / or Medicare Part B (medical insurance).

Who is eligible for Medicare Part B?

You automatically qualify for Medicare Part B once you turn 65 years old. Although you'll need to wait to use your benefits until your 65th birthday, you can enroll: 3 months before your 65th birthday.

What is Medicare Extra Help?

Medicare Extra Help. A program that helps cover costs for Part D and prescription drugs. Social Security and Disability (SSDI) An overview of SSDI and how it works with Medicare enrollment. Medicare Savings Program. Learn about the different savings programs that can help cover your Medicare costs.

Why is physical health important?

Physical and mental health are critical to sustaining positive quality of life at any stage of health. Moreover, increasing affordability should not diminish the quality of care. You may qualify for programs that make quality health care affordable and within reach. If you want to learn how to qualify for low-income help with Medicare, ...

Is Medicare Supplement endorsed by the government?

Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money. If you’re looking for the government’s Medicare site, please navigate to www.medicare.gov.

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

What is SLMB in Medicare?

The Specified Low-Income Medicare Beneficiary (SLMB) program is a Medicare Savings Program (MSP) that pays for an enrollee’s Medicare Part B premiums. MSPs are federal programs that are administered by Medicaid in each state. As of 2020, most Medicare beneficiaries pay $144.90 a month for Part B.

How much does Medicare pay in 2020?

As of 2020, most Medicare beneficiaries pay $144.90 a month for Part B. SLMB enrollees no longer have this amount deducted from their Social Security benefit – amounting to an annual increase of over $1,738. Individuals who are approved for SLMB will receive three months of retroactive benefits.

How long does it take to get SLMB?

Individuals who are approved for SLMB will receive three months of retroactive benefits. It can take two to three months between being approved for MSP benefits and the time Part B premiums are no longer deducted from Social Security income.

Does SLMB pay for Part A?

Unlike the Qualified Medicare Beneficiary (QMB) program, SLMB does not pay for Parts A and B cost sharing (e.g. deductibles, co-pays and coinsurance) or for Part A premiums (if an enrollee owes them).

The parts of Medicare (A, B, C, D)

Things covered under part A include hospice care, inpatient hospital stays, home health care, and skilled nursing facility care. In 2019, Part A beneficiaries were subject to a $1,364 deductible per benefit period. Beneficiaries also require coinsurance for extended skilled nursing facility stays and inpatient hospital stays.

How does Medicare Work?

Any US citizen over the age of 65 or a permanent US resident for over five years is eligible for the medical insurance cover. You can also receive benefits if you have any disability or suffer from ESRD, regardless of your age or income.

Advantages of Medicare

Anyone over the age of 65 automatically qualifies for a free plan A. You are, however, required to pay a small out-of-pocket fee for plan B. This will cost you around $135.50 per month. When you compare this fee to the out-of-pocket costs like operations and prescriptions you would have incurred without the plan, your cost savings are enormous.

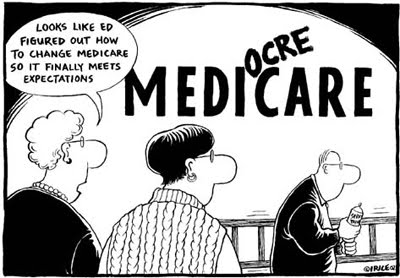

Gaps in Medi -healthcare Coverage

Although it provides financial cushioning against the costs of many healthcare services, it has relatively high cost-sharing requirements and deductibles. Moreover, it doesn’t limit out-of-pocket spending for beneficiaries covered under parts A and B. It’s also quite disadvantageous to older people and people with disabilities who require long-term services and support like eyeglasses, hearing aids, and dental services. For this reason, many beneficiaries covered under the original plan have some supplementary insurance policy that helps to cover some of the costs not covered by the original plan..

The Bottom Line

The creation of this healthcare program opened the doors for vulnerable members of our society to receive affordable medical care coverage. In 2019, there were 61.2 million people enrolled in the program. This number has risen considerably over the past one and a half years, with over 26 million people enrolled in an advantage plan.

What does SLMB cover?

SLMB benefits cover the cost of the monthly Medicare Part B premium. The standard Part B premium in 2021 is $148.50 per month and is required of all Medicare Part B beneficiaries.

How do you qualify for SLMB?

Each state Medicaid program has its own rules concerning qualification.

What other Medicare Savings Programs are there?

SLMB is just one of the available Medicare Savings Programs. Others include:

How do you apply for SLMB?

Contact your state Medicaid program for information and assistance with applying for the SLMB program.

Is there Medicaid assistance for Medicare Advantage beneficiaries?

Individuals who qualify for both Medicare and Medicaid are considered “dual eligible” and may qualify for a certain type of Medicare Advantage plan called a Special Needs Plan. And one particular type of Special Needs Plan is a Dual Eligible Special Needs Plan (D-SNP).