- Both Plan F and Plan N are popular, comprehensive plans.

- Plan N benefits are almost the same as Plan F benefits.

- Plan N can be significantly less expensive than Plan F, without giving up, in many cases, a lot of benefits.

- You will need to do some homework to determine which plan is better for you, or if you should buy a supplement plan at all.

What are the best Medicare supplement plans?

- Medicare Supplement Insurance helps you manage out-of-pocket costs for covered services

- Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share

- Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

Will plan F premiums increase?

Those who are already enrolled in a Plan F will have no problem as this will be allowed to continue. Thus, Medigap Plan G is at present the most popular among the Medigap plans since it offers almost the same coverage as Plan F, except for the Part B deductible, which costs $233 in 2022.

What does Blue Cross Medicare supplement plan F cover?

Blue Cross Medicare Supplement Plan F pays the Medicare Part A hospital deductible and coinsurance, the Part B deductible, and excess charges. Additionally, it covers foreign travel agency care and skilled nursing facility coinsurance, explains BlueCross BlueShield of Illinois.

Is plan N better than plan F?

Plan N premiums are typically lower than Plan F premiums, meaning, you spend less out of pocket monthly with Plan N than you will with Plan F. However, Plan F covers more out-of-pocket expenses. If you know that you will have many medical expenses throughout the year, Plan F may be a better choice.

What is plan N on Medicare?

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B. It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums. This makes it an attractive option to many people.

What is the difference between plan F G and N?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

Can I switch from plan N to plan F?

Medicare Supplement Plan N's coverage is very similar to Plan F's, and you can use your Plan N anywhere that you can use your Plan F.

What is the deductible for Medicare Plan N?

What does Plan N cover? Plan N covers the Medicare Part A deductible of $1,556, coinsurance for Parts A and B, three pints of blood and 80% of medical costs incurred during foreign travel. Plan N does not provide coverage for the Medicare Part B deductible ($233 in 2022).

What is Medicare Plan F?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

Is Medicare Plan F being discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.

Is plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Should I switch from F to G?

When it comes to coverage, Medicare Supplement Plan F will give you the most coverage since it's a first-dollar coverage plan and leaves you with zero out-of-pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Medicare Supplement Plan G may be better for you.

Does Medicare Plan N cover prescriptions?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What’S Covered on Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dol...

What’S Covered Under Medigap Plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductibl...

What’S Covered Under Medigap Plan N?

This is another fast-selling plan because it offers a good balance between protection against catastrophic out-of-pocket expenses and affordable pr...

When Comparing Medicare Plan F vs Plan G vs Plan N

Be sure to give some thought to the type of coverage you think you’ll want over the long term. Here’s why:In most cases, you do not have a guarante...

What is the difference between Medicare Supplement Plan F and Plan N?

What are the Benefits of Medicare Supplement Plan F and Plan N? One of the most important factors to consider when comparing Plan F to Plan N is the difference in coverage that they offer. Simply put, Medicare Supplement Plan F offers more protection than Medicare Supplement Plan N.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F is often referred to as the “full coverage plan” because after Original Medicare pays its portion of your medical bill, Plan F pays the rest . People that choose this plan take ease knowing that as long as they follow Medicare’s guidelines, they won’t have any out-of-pocket bills for their medical services.

What is the deductible for Medicare Part B in 2021?

The Medicare Part B deductible ($203 in 2021) Medicare Part A and B coinsurance and copayments. Excess charges. Foreign travel emergency services. Plan F’s coverage can make tracking monthly expenses more manageable if you need to stick to a budget, or if you like to know what to expect.

Does Plan N cover emergency room visits?

While Plan N’s coverage includes most of the same benefits as Plan F, there are three gaps that could leave you paying out-of-pocket. The three costs that Plan N doesn’t cover (that Plan F does) are: Copayments: These can be up to $20 for some office visits, or $50 for emergency room visits. The emergency room copayment is only charged ...

Is Plan N cheaper than Plan F?

Because Plan N offers less coverage than Plan F, its premiums are typically lower than that of Plan F’s. However, if you see the doctor frequently, the costs of the copays can add up. With the out-of-pocket costs of Plan N, you could wind up paying more in total than if you had Plan F.

Which is better, Plan N or Plan F?

If you know that you will have many medical expenses throughout the year, Plan F may be a better choice. If you expect your medical costs to be on the low side but want to make sure you have peace of mind in case of medical emergencies, Plan N may be a better choice.

What is Medicare Plan N?

Medicare Plan F and Medicare Plan N are two kinds of Medigap plans. Medigap is also known as Medicare Supplement Insurance. Medigap is supplemental insurance that you may be able to buy from a private insurer. Medigap covers some of the expenses that original Medicare doesn’t, such as deductibles, copays, and coinsurance.

Why is Medigap Plan N so popular?

Medigap Plan N is popular because its monthly premiums are relatively low, compared to some other Medigap plans. However, these monthly premiums vary widely. You can shop for and compare Medigap Plan N plans here. Medigap Plan N covers: Part A coinsurance and deductible.

How many Medigap plans are there?

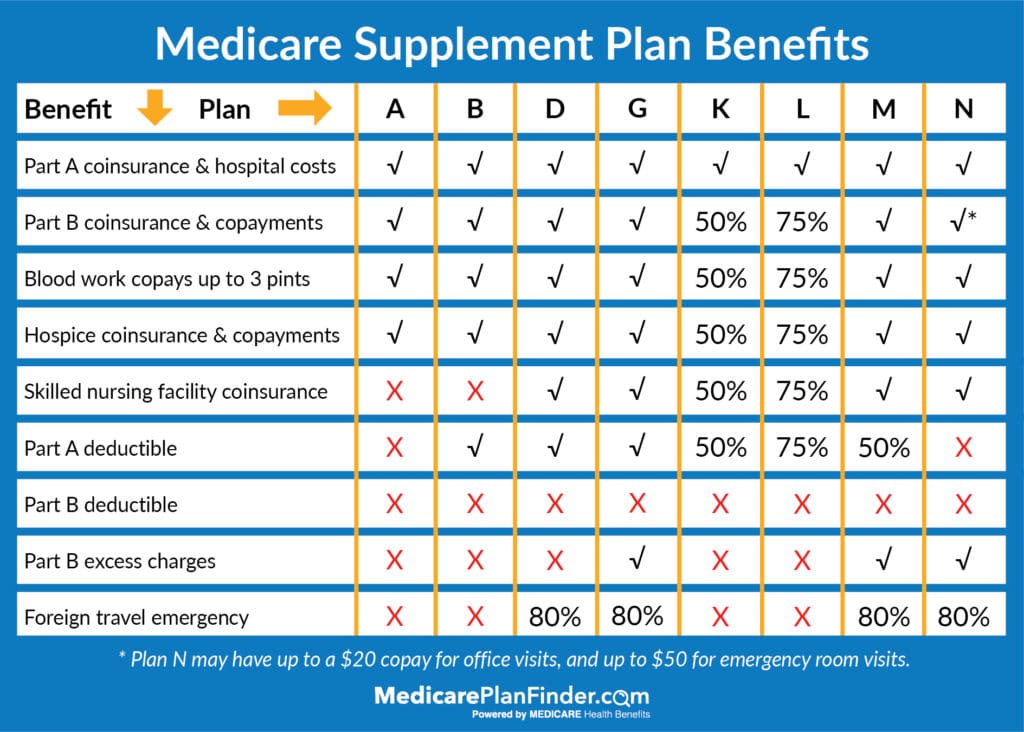

There are 10 Medigap plans to choose from, although not every plan is available in every area. Out-of-pocket gaps can add up.

When will Medicare stop allowing Plan F?

Plan F is no longer available to people who are new to Medicare unless you turned age 65 before January 1, 2020. If you already have Plan F, you are able to keep it.

Does Medigap cover copays?

Medigap plans can cover all or some of the remaining 20 percent . Medigap plans have different premium costs, depending upon which one you choose. They all offer the same basic benefits, although some plans provide more coverage than others. In general, Medigap plans cover all or a percentage of: copays. coinsurance.

Is Plan F available for 2020?

Two popular plans are Plan F and Plan N. Plan F is a full coverage option that is popular, but as of January 1, 2020, it was no longer available to most new beneficiaries. Not everyone is eligible for both plans. The information on this website may assist you in making personal decisions about insurance, but it is not intended to provide advice ...

What is Medicare plan N and F?

Other options. Summary. Medicare plans N and F are both supplement insurance policies offering similar benefits. Also known as Medigap, the plans pay for some coverage gaps in original Medicare left by out-of-pocket expenses.

How many Medicare supplement plans are there?

The Medicare Part B premium is still payable to Medicare. Currently, 10 different Medicare supplement plans are available. Letters of the alphabet indicate different plans.

What is Medicare Advantage Plan?

A Medicare Advantage plan replaces original Medicare and bundles together all the services covered in parts A and B, and often, Part D. As with Medigap plans, private insurance companies that Medicare has approved administer Medicare Advantage plans.

What to consider when choosing a Medigap plan?

When choosing the right Medigap plan, an individual may like to consider budget, health conditions, and medical requirements. A side-by-side comparison of Medicare Plan N and Plan F may help a person determine the best plan for their needs. Plan Benefits. Plan N. Plan F.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What does the letter of the alphabet mean for Medicare?

Letters of the alphabet indicate different plans. The federal government sets standards for Medicare supplement plans in most states meaning that regardless of the location, the same lettered plan must offer the same benefits. All states are standardized in the same way, except for: Wisconsin. Minnesota.

Does Medicare cover Plan N?

Medicare Plan N offers similar coverage to Plan F with a few exceptions. Healthcare providers may charge up to 15% more than Medicare allows. Medicare will cover the costs up to the approved amount, and some supplement plans cover the remaining excess amount. Medicare Plan N does not cover these excess charges.

What is the difference between Medicare Supplements Plan F and Plan G?

The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise they function just the same. There is one important feature that Medicare Supplements Plan F and G have over all the other Medigap plans.

What is a Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dollar coverage means that both your Part A and Part B deductibles are covered by the plan, so you pay nothing before your Medicare benefits kick in.

What happens if you don't have Medicare?

When you see a provider that doesn’t participate with Medicare, he can charge up to 15% more than the standard Medicare rate for your services. You will pay this money out of pocket unless you have Medigap Plan F or Plan G. It’s definitely something to consider if provider choice is important to you.

How many Medigap plans are there?

There are currently 10 different Medigap plans that are standard across most states. (Massachusetts, Minnesota, and Wisconsin have their own plan standards.) What this means for consumers, however, is that Plan A offered by Company X in Anaheim is exactly the same as Plan A offered by Company Y in Boise.

Which is the most comprehensive Medicare plan?

The most comprehensive plan currently available is Medigap Plan F. It covers all of the gaps in Medicare. The next most comprehensive plan is Plan G, which covers nearly as much, with the Part B deductible being the only difference. Finally, Plan N is probably the third most popular plan because it operates similar to Plan G except ...

How much does a 66 year old spend on Medicare?

The average 66-year-old couple spends about 57% of their Social Security benefits on health care, according to a 2016 study. Learn Medicare for Free: Enroll in 6-Day Medicare Mini Course.

Is Medigap Plan G the same as Plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deduct ible, which is $203 in 2021. Medigap Plan G is now the most popular plan among beneficiaries new to Medicare.

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

Do you have to pay a deductible on a Plan G or F?

Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F. However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost.

What does Plan N cover?

Plan N doesn’t cover: 1 Excess Charges: This an additional cost that some providers charge. Most healthcare providers that accept Medicare also accept Medicare assignment, which is the cost that Medicare states they’ll pay for a given service. If the provider wants to be paid more, they can bill you for excess charges, which can only be up to an additional 15% of the original cost. 2 Copayments: With Plan N, you’ll be responsible for copays of up to $20 for some office visits, or up to $50 if you go to the emergency room but aren’t admitted as an inpatient.

What does Medicare Supplement Plan G cover?

Medicare Supplement Plan G and Plan N both cover many of the larger costs leftover from your Original Medicare coverage. For instance, they both cover: Neither Plan G nor Plan N cover the Part B deductible, which is $203 in 2021. Medicare Part B covers your outpatient services, like visits to your doctor’s office.

What is the deductible for Medicare Part A in 2021?

Medicare Part A deductible ($1,484 in 2021) Foreign travel emergency. Neither Plan G nor Plan N cover the Part B deductible, which is $203 in 2021. Medicare Part B covers your outpatient services, like visits to your doctor’s office.

Does Medicare Supplement cover gaps?

Medicare Supplement insurance can help you cover the gaps in Medicare, but many people have difficulty deciding which plan is right for them. If you’re unsure which plan to choose, you aren’t alone. Fortunately, Medicare Supplement Plan G and Medicare Supplement Plan N, two of the most popular plans, are relatively simple to compare.

Does Plan N cover excess charges?

Plan N doesn’t cover: Excess Charges: This an additional cost that some providers charge. Most healthcare providers that accept Medicare also accept Medicare assignment, which is the cost that Medicare states they’ll pay for a given service.

Is Plan G or N better for copays?

If you visit the doctor regularly or prefer not to have to budget for copays, Plan G may be the best option for you. Plan N may be a good fit if you’d like to save money on premiums, you’re in great health, and rarely need to visit the doctor.

Is Plan G more expensive than Plan N?

In addition to the differences in coverage between Plan N and Plan G, the cost of the plans tends to vary as well. Premiums for each plan can vary by the carrier that offers it, but Plan G is typically more expensive than Plan N because it offers a higher level of coverage. However, while Plan G usually has higher premiums, ...