A Medicare beneficiary is someone aged 65 years or older who is entitled to health services under a federal health insurance plan.

How does Medicare define income?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

What is Medicare?

Medicare is the federal health insurance program for: 1 People who are 65 or older 2 Certain younger people with disabilities 3 People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Who is automatically entitled to Medicare?

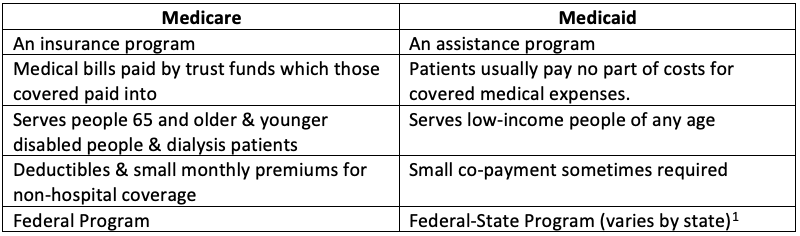

En español | Nobody is automatically entitled to Medicare, the federal government's health insurance for senior and disabled people that has been around for more than 50 years. President Lyndon Johnson signed the law that led to both Medicare and Medicaid, the federal health plan for the poor, on July 30, 1965.

What does Medicare mean on my paycheck?

What Does Medicare Mean on my Paycheck? When Medicare was enacted as a federal law in 1965, the funds to support the program became a payroll tax on earned income. The payroll taxes required for the Federal Insurance Compensation Act (FICA) are to support both your Social Security and Medicare benefits programs.

What are the 3 qualifying factors for Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant).

How does Medicare determine?

Most of Medicare Part B – about 7% – is funded through U.S. income tax revenue. But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income.

What does Medicare provide for people?

What Part A covers. Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

What diagnosis qualifies for Medicare?

Medicare is available for certain people with disabilities who are under age 65. These individuals must have received Social Security Disability benefits for 24 months or have End Stage Renal Disease (ESRD) or Amyotropic Lateral Sclerosis (ALS, also known as Lou Gehrig's disease).

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

At what income does Medicare cost increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

Does Medicare pay for everything?

Original Medicare (Parts A & B) covers many medical and hospital services. But it doesn't cover everything.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Does Medicare Part B cover 100 percent?

Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

How much money can you have in the bank with Social Security disability?

The SSDI program does not limit the amount of cash, assets, or resources an applicant owns. An SSDI applicant can own two houses, five cars, and have $1,000,000 in the bank. And the SSDI program doesn't have a limit to the amount of unearned income someone can bring in; for instance, dividends from investments.

Who is not eligible for Medicare Part A?

Why might a person not be eligible for Medicare Part A? A person must be 65 or older to qualify for Medicare Part A. Unless they meet other requirements, such as a qualifying disability, they cannot get Medicare Part A benefits before this age. Some people may be 65 but ineligible for premium-free Medicare Part A.

What is the eligibility criteria for Medicaid?

Medicaid beneficiaries generally must be residents of the state in which they are receiving Medicaid. They must be either citizens of the United States or certain qualified non-citizens, such as lawful permanent residents. In addition, some eligibility groups are limited by age, or by pregnancy or parenting status.

What is assignment in Medicare?

Assignment. An agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance. Top of page.

What is an ABN in Medicare?

Advance Beneficiary Notice of Noncoverage (ABN) In Original Medicare, a notice that a doctor, supplier, or provider gives a person with Medicare before furnishing an item or service if the doctor, supplier, or provider believes that Medicare may deny payment.

Can you appeal a Medicare plan?

Your request to change the amount you must pay for a health care service, supply, item or prescription drug. You can also appeal if Medicare or your plan stops providing or paying for all or part of a service, supply, item, or prescription drug you think you still need.

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

What is Medicare beneficiary?

A Medicare beneficiary is someone aged 65 years or older who is entitled to health services under a federal health insurance plan. Although Medicare beneficiaries are typically seniors, those who are younger than 65 years of age can still qualify for Medicare benefits if they meet certain qualifications, such as being a recipient ...

What are the benefits of Medicare?

There are four kinds of Medicare coverage that a Medicare beneficiary can avail themselves of: 1 Medicare A: U.S. citizens are automatically eligible for this coverage when they turn 65. There is no premium for this plan and it covers most of the cost of hospitalization. 2 Medicare B: To qualify for this plan, the beneficiary must pay a premium. It will pay for outpatient treatment, doctor's services, and prescribed drugs. 3 Medicare C: Medicare C plans are offered through private insurance companies that are approved by the Medicare program. Some Medicare C plans provide vision and dental care. 4 Medicare D: Like Medicare C, this plan is offered through approved private insurance companies. It provides coverage for prescriptive drugs.

Does Medicare B cover outpatient care?

There is no premium for this plan and it covers most of the cost of hospitalization. Medicare B: To qualify for this plan, the beneficiary must pay a premium. It will pay for outpatient treatment, doctor's services, and prescribed drugs.

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.

How old do you have to be to get Medicare?

citizen or have been a legal resident for at least five years, you can get full Medicare benefits at age 65 or older. You just have to buy into them by: Paying premiums for Part A, the hospital insurance.

How long do you have to live to qualify for Medicare?

You qualify for full Medicare benefits if: You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and. You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.

How much will Medicare premiums be in 2021?

If you have 30 to 39 credits, you pay less — $259 a month in 2021. If you continue working until you gain 40 credits, you will no longer pay these premiums. Paying the same monthly premiums for Part B, which covers doctor visits and other outpatient services, as other enrollees pay.

How long do you have to be on disability to receive Social Security?

You have been entitled to Social Security disability benefits for at least 24 months (that need not be consecutive); or. You receive a disability pension from the Railroad Retirement Board and meet certain conditions; or.