When did Medicare take effect?

In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. In 1972, President Richard M. Nixon signed into the law the first major change to Medicare.

When was the first Medicare card issued?

A brief look at Medicare milestones. On July 30, 1965 President Lyndon B. Johnson made Medicare law by signing H.R. 6675 in Independence, Missouri. Former President Truman was issued the very first Medicare card during the ceremony.

Who were the first two beneficiaries of Medicare?

Harry Truman and his wife, Bess, were the first two Medicare beneficiaries. By early 2019, there were 60.6 million people receiving health coverage through Medicare. Medicare spending reached $705.9 billion in 2017, which was about 20 percent of total national health spending.

Who was the first US President to sign up for Medicare?

Photo: President Lyndon Johnson (left) signed Medicare into law on July 30, 1965, and made former President Harry S. Truman (right) the first enrollee. Standing behind the two are first ladies Lady Bird Johnson and Bess Truman.

What is the Medicare Medicaid and Schip Extension Act of 2007?

The MMSEA substantially expands the federal government's ability to seek reimbursement of past and future Medicare payments in covered claims, including liability claims.

What was adopted by Medicare in 2008?

adopted by Medicare in 2008 to reimburse hospitals for inpatient care provided to Medicare beneficiaries; expanded original DRG system (based on intensity of resources) to add two subclasses to each DRG that adjusts Medicare inpatient hospital reimbursement rates for severity of illness (SOI) (extent of physiological ...

When was the Medicare Severity DRG implemented by CMS?

The DRG pricing system uses the Centers for Medicare and Medicaid Services (CMS) DRG grouper developed for and used by Medicare, with enhancements for newborn DRGs and mental disease and disorder DRGs. The MS-DRG Grouper version 33 was implemented on October 1, 2015, and is effective through December 31, 2016.

When was the inpatient prospective payment system implemented?

October 1, 1983A report containing such a proposal was delivered to Congress in December 1982, and a prospective payment system (PPS) for Medicare inpatient hospital services was legislated in the spring of 1983. Implementation of PPS began on October 1, 1983.

What established the first Medicare prospective payment system?

the Social Security Amendments Act of 1983The PPS was established by the Centers for Medicare and Medicaid Services (CMS), as a result of the Social Security Amendments Act of 1983, specifically to address expensive hospital care. Regardless of services provided, payment was of an established fee.

Does Medicare pay for hospital acquired pressure ulcers?

Last year, the Centers for Medicare and Medicaid Services announced that it will cease reimbursement for hospital care of eight reasonably preventable conditions – including pressure ulcers, bed sore aka decubitus ulcers – in October 2008.

Why did CMS replaced DRGs with Medicare severity DRGs?

In 2007, CMS adopted the Medicare Severity DRG (MS-DRG) system to improve upon this initial framework and better differentiate each patient's severity of illness and associated care costs.

What are the 3 DRG options?

There are currently three major versions of the DRG in use: basic DRGs, All Patient DRGs, and All Patient Refined DRGs. The basic DRGs are used by the Centers for Medicare and Medicaid Services (CMS) for hospital payment for Medicare beneficiaries.

What are DRG codes used for?

DRG Codes (Diagnosis Related Group) Diagnosis-related group (DRG) is a system which classifies hospital cases according to certain groups,also referred to as DRGs, which are expected to have similar hospital resource use (cost). They have been used in the United States since 1983.

What is the Medicare inpatient prospective payment system?

A Prospective Payment System (PPS) is a method of reimbursement in which Medicare payment is made based on a predetermined, fixed amount. The payment amount for a particular service is derived based on the classification system of that service (for example, diagnosis-related groups for inpatient hospital services).

What federal law was enacted that fundamentally changed the reimbursement system from a retrospective to a prospective payment system?

The Balanced Budget Act of 1997 (BBA) (Public Law 105–33), which was enacted on August 5, 1997, significantly changed the way Medicare pays for home health services. Until the implementation of the HH PPS on October 1, 2000, HHAs received payment under a retrospective reimbursement system.

What changes did Medicare DRGs cause in hospital behavior?

What changes did Medicare DRGs cause in hospital behavior? They became concerned with reducing lengths of stay for aged patients and became concerned with physicians practice behaviors.

How much did Medicare pay in 2007?

A beneficiary who pays the highest income-related premium in 2007 would pay $1,936.80 per year in Part B premiums, but is estimated to receive an average of $4,363 in Medicare Part B benefits.

What was Medicare Part B premium in 2007?

The standard Medicare Part B monthly premium will be $93.50 in 2007, an increase of $5.00 or 5.6 percent from the current $88.50 Part B premium, considerably lower than was earlier projected. This premium is the smallest percent increase in the Part B premium since 2001 and less than half of the dollar increase in the premium for 2006.

What is Medicare Part B?

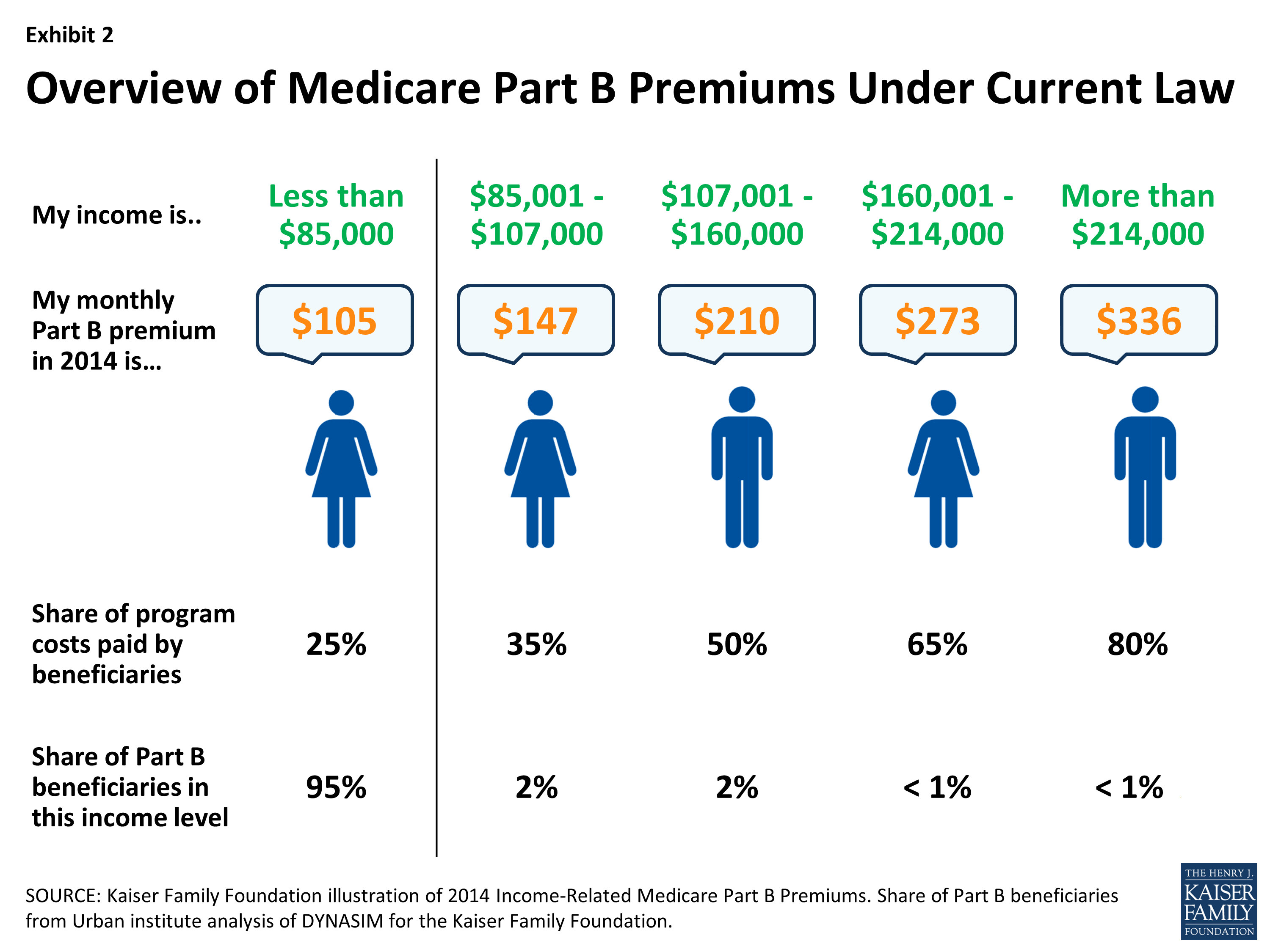

The law requires that the standard monthly premium for Medicare Part B must be sufficient to cover 25 percent of the program’s costs for aged beneficiaries, including the costs of maintaining a reserve against unexpected spending increases. The federal government pays the remaining 75 percent. Statutory formulas are also used to determine the Medicare Part B deductible, the Part A deductible for hospital stays, and other enrollee contributions.

What percentage of Medicare Part B premiums will be higher in 2007?

However, the assets needed to replenish the Part B account are significantly less than previously projected. In 2007, approximately 4 percent of Medicare Part B enrollees with higher incomes will pay a higher Part B premium based on their income.

How many beneficiaries can receive Medicare Part B?

In addition, more than one-fourth of beneficiaries can receive assistance that pays for their entire Part B premium. Growth in traditional fee-for-service Part B spending per capita, and not spending in the Medicare Advantage program, accounts for the bulk of the premium increase.

What is the 5.6 percent increase in Medicare Part B premiums?

The single most important factor driving the 5.6 percent Part B premium increase is the growth in traditional fee-for-service Part B spending per capita, as opposed to spending growth in Medicare Advantage.

How much is Medicare Advantage Part D 2007?

For 2007, the average Part D premium for Medicare Advantage plans will be around $11 less than for stand-alone Part D plans. Many MA plans also use a portion of the savings from Part A and B coverage to further reduce their Part D premiums.