How much money has been spent on Medicare since 1970?

In 1970, some 7.5 billion U.S. dollars were spent on the Medicare program in the United States. Fifty years later, this figure stood at 925.8 billion U.S. dollars. This statistic depicts total Medicare spending from 1970 to 2020. Medicare is the federal health insurance program in the U.S. for the elderly and those with disabilities.

How much does Medicare spend on hospital costs?

Medicare finances an array of health services. Hospital expenses are the largest single component of Medicare’s spending, accounting for 40 percent of the program’s spending. That is not surprising, as hospitalizations are associated with high-cost health episodes.

When did Medicare come into effect?

Medicare as we know it came into operation on 1 February 1984, following the passage in September 1983 of the Health Legislation Amendment Act 1983, including amendments to the Health Insurance Act 1973, the National Health Act 1953 and the Health Insurance Commission Act 1973.

What are some interesting facts about Medicare?

Key Facts 1 Medicare is the second largest program in the federal budget. ... 2 Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending. 3 In 2019, Medicare provided benefits to 19 percent of the population. ... More items...

What was the total Medicare expenditures per enrollee in the year 2004?

in 2004 and 2005, total annual medical payments per Medicare beneficiary • in California averaged $11,326, of which $1,330 (11 percent) came out of the beneficiaries' own pockets.

How much did healthcare cost in 2000?

$1,369.7Healthcare Costs by YearYearNational Health Spending (Billions)Percent Growth2000$1,369.77.1%2001$1,486.88.5%2002$1,629.29.6%2003$1,768.28.5%52 more rows

What was the total amount spent on Medicare and health?

Historical NHE, 2020: Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE. Private health insurance spending declined 1.2% to $1,151.4 billion in 2020, or 28 percent of total NHE.

What were the hospital care expenditures in 2013?

In 2013 US health care spending increased 3.6 percent to $2.9 trillion, or $9,255 per person. The share of gross domestic product devoted to health care spending has remained at 17.4 percent since 2009.

When did American healthcare become so expensive?

How Health Care Became So Expensive Health care spending in the United States more than tripled between 1990 and 2007. This 3-part series explores the rising costs, and why our care hasn't necessarily gotten better.

Why has Medicare become more expensive?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Is Medicare underfunded?

Politicians promised you benefits, but never funded them.

How much of US GDP is spent on healthcare?

19.7%In 2020, U.S. national health expenditure as a share of its gross domestic product (GDP) reached an all time high of 19.7%. The United States has the highest health spending based on GDP share among developed countries. Both public and private health spending in the U.S. is much higher than other developed countries.

How much does the US government spend on Medicare per year?

Medicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

How have healthcare costs changed in the past decades?

Total national health expenditures, US $ per capita, 1970-2020. On a per capita basis, health spending has increased sharply in the last five decades, from $353 per person in 1970 to $12,531 in 2020. In constant 2020 dollars, the increase was from $1,875 in 1970 to $12,531 in 2020.

How has government spending on health care changed since 1960?

U.S. health care expenditures have steadily increased as a share of gross domestic product (GDP) over the last half century, increasing from 5.0 percent of GDP in 1960 to 17.4 percent in 2013.

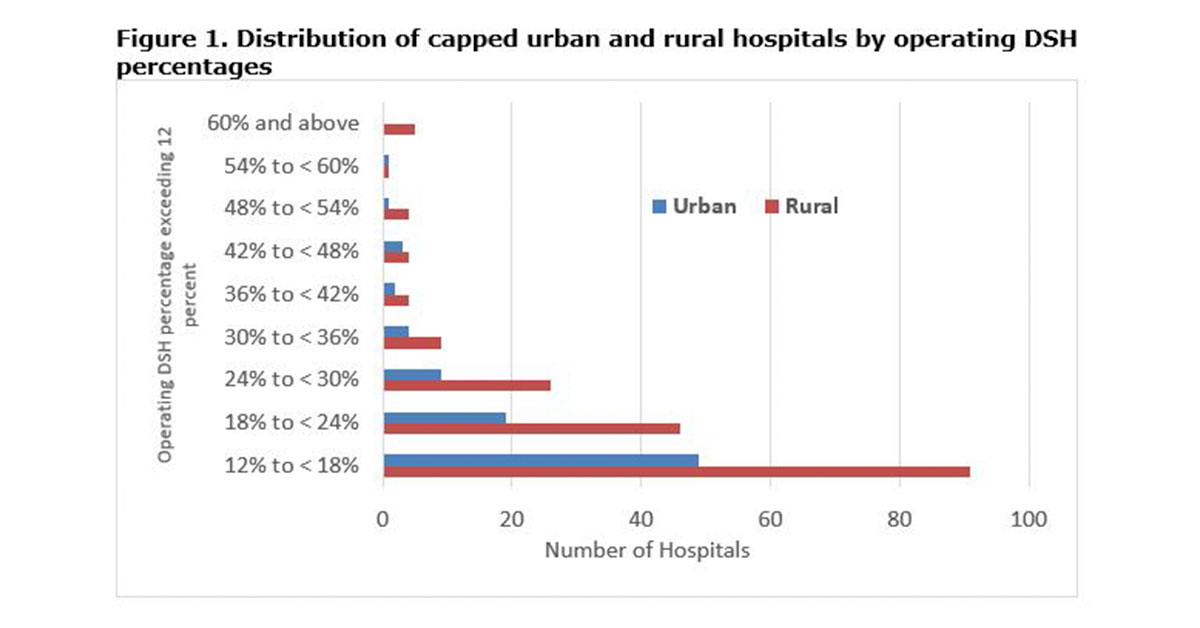

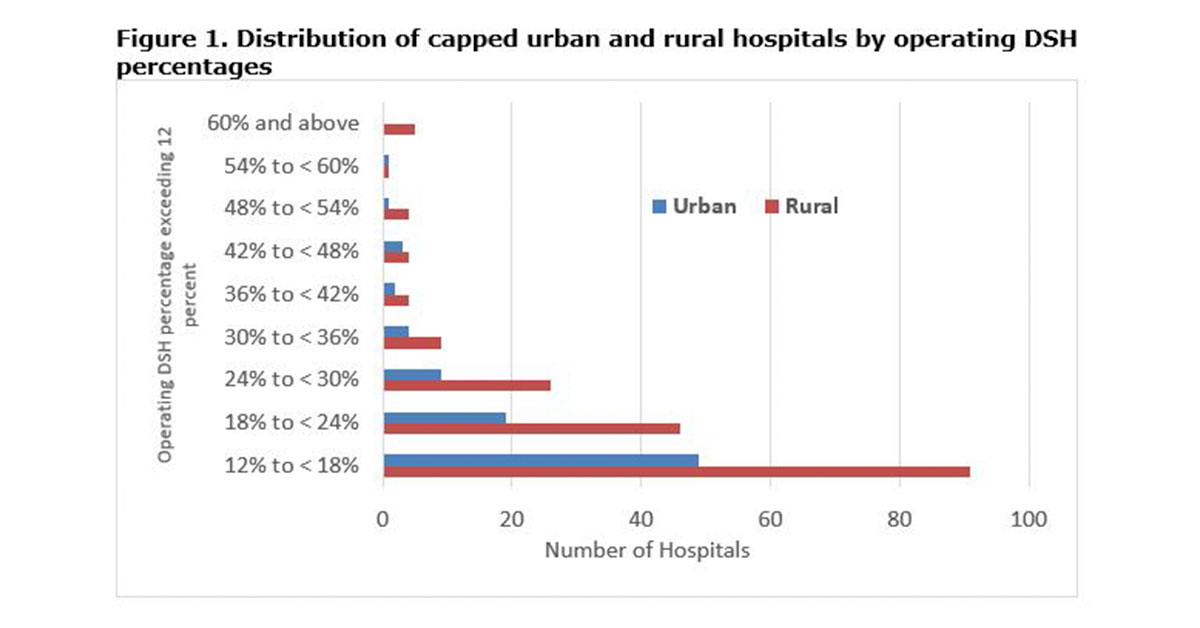

Which racial ethnic group has the highest rate of uninsurance?

HispanicPeople of color were at much higher risk of being uninsured compared to White people, with Hispanic and AIAN people at the highest risk of lacking coverage (Figure 1).

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How is Medicare Financed?

Medicare is funded primarily from general revenues (43 percent), payroll taxes (36 percent), and beneficiary premiums (15 percent) (Figure 7) .

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

Why is Medicare spending so slow?

Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care and reduce costs, including accountable care organizations (ACOs), medical homes, bundled payments, and value-based purchasing initiatives. The BCA lowered Medicare spending through sequestration that reduced payments to providers and plans by 2 percent beginning in 2013.

What is the average annual growth rate for Medicare?

Average annual growth in total Medicare spending is projected to be higher between 2018 and 2028 than between 2010 and 2018 (7.9 percent versus 4.4 percent) (Figure 4).

What is excess health care cost?

Over the next 30 years, CBO projects that “excess” health care cost growth—defined as the extent to which the growth of health care costs per beneficiary, adjusted for demographic changes, exceeds the per person growth of potential GDP (the maximum sustainable output of the economy)—will account for half of the increase in spending on the nation’s major health care programs (Medicare, Medicaid, and subsidies for ACA Marketplace coverage), and the aging of the population will account for the other half.

How much did hospital expenditures grow in 2019?

Hospital expenditures grew 6.2% to $1,192.0 billion in 2019, faster than the 4.2% growth in 2018. Physician and clinical services expenditures grew 4.6% to $772.1 billion in 2019, a faster growth than the 4.0% in 2018. Prescription drug spending increased 5.7% to $369.7 billion in 2019, faster than the 3.8% growth in 2018.

How much did Utah spend on health care in 2014?

In 2014, per capita personal health care spending ranged from $5,982 in Utah to $11,064 in Alaska. Per capita spending in Alaska was 38 percent higher than the national average ($8,045) while spending in Utah was about 26 percent lower; they have been the lowest and highest, respectively, since 2012.

What was the per person spending for 2014?

In 2014, per person spending for male children (0-18) was 9 percent more than females. However, for the working age and elderly groups, per person spending for females was 26 and 7 percent more than for males. For further detail see health expenditures by age in downloads below.

How much did prescription drug spending increase in 2019?

Prescription drug spending increased 5.7% to $369.7 billion in 2019, faster than the 3.8% growth in 2018. The largest shares of total health spending were sponsored by the federal government (29.0 percent) and the households (28.4 percent). The private business share of health spending accounted for 19.1 percent of total health care spending, ...

What percentage of the population was children in 2014?

In 2014, children accounted for approximately 24 percent of the population and about 11 percent of all PHC spending.

How much did Medicaid spend in 2019?

Medicaid spending grew 2.9% to $613.5 billion in 2019, or 16 percent of total NHE. Private health insurance spending grew 3.7% to $1,195.1 billion in 2019, or 31 percent of total NHE. Out of pocket spending grew 4.6% to $406.5 billion in 2019, or 11 percent of total NHE.

Which region has the lowest health care spending per capita?

In contrast, the Rocky Mountain and Southwest regions had the lowest levels of total personal health care spending per capita ($6,814 and $6,978, respectively) with average spending roughly 15 percent lower than the national average.

What percentage of Medicare is hospital expenditure?

Hospital expenses are the largest single component of Medicare’s spending, accounting for 40 percent of the program’s spending. That is not surprising, as hospitalizations are associated with high-cost health episodes. However, the share of spending devoted to hospital care has declined since the program's inception.

How much of Medicare was financed by payroll taxes in 1970?

In 1970, payroll taxes financed 65 percent of Medicare spending.

What Are the Components of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts":

How Much Does Medicare Cost and What Does It Cover?

Medicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

What percentage of GDP will Medicare be in 2049?

In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2019 to 6.1 percent of GDP by 2049. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

What percentage of Medicare is paid to MA?

Based on a federal annual report, KFF performed an analysis to reveal the proportion of expenditure for Original Medicare, Medicare Advantage (MA) and Part D (drug coverage) from 2008 to 2018. A graphic depiction on the KFF website illustrates the change in spending of Medicare options. Part D benefit payments, which include stand-alone and MA drug plans, grew from 11% to 13% of total expenditure. Payments to MA plans for parts A and B went from 21% to 32%. During the same time period, the percentage of traditional Medicare payments decreased from 68% to 55%.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

Is Medicare a concern?

With the aging population, there is concern about Medicare costs. Then again, the cost of healthcare for the uninsured is a prime topic for discussion as well.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

How much did the Commonwealth spend on Medicare in 2002?

The latest Department of Health and Ageing's Annual Report shows Commonwealth expenditure on Medicare for 2002-03 totalled $19.930 billion.

Why did Medicare increase in 2000?

In early 2000, a Medicare levy increase for individuals with a taxable income above $50 000 for 2000-2001 only, was proposed in order to provide funding for Australia's role in East Timor. At the time the Federal government argued that this extra levy was necessary to keep the budget in surplus.

How was Medibank funded?

The original legislation proposed financing the program through a taxpayer levy of 1.35 per cent on taxable income, with exemptions for low income earners. However the Senate rejected the bills dealing with financing of the program in August 1974 and again in December 1974. Consequently, the final program was funded entirely from general revenue. The cost of Medibank in its first year (1975-76) was $1.647 billion, according to Scotton (1977). The hospital side of Medibank involved free treatment for public patients in public hospitals, and subsidies to private hospitals to enable them to reduce their fees. Benefits for public hospitals were provided through hospital agreements with state governments, under which the federal government made grants equal to 50 per cent of net operating public hospital costs.

How much did Medibank cost in 1975?

The cost of Medibank in its first year (1975-76) was $1.647 billion, according to Scotton (1977). The hospital side of Medibank involved free treatment for public patients in public hospitals, and subsidies to private hospitals to enable them to reduce their fees.

What were the changes in 1976?

Other significant changes in 1976 included the federal government declaring the hospital agreements with the states invalid, and the subsequent introduction of new hospital agreements under which the federal government provided 50 per cent funding for approved net operating costs. Also in 1976 legislation was passed allowing the Health Insurance Commission (HIC) to enter the private health insurance business. This led to the establishment of Medibank Private on 1 October 1976.

When did the Medibank program start?

The Medibank program had only a few months of operation before the dismissal of the Whitlam Government on 11 November 1975, and the subsequent election of the Liberal-National Coalition under Fraser in December 1975. Following the election, a Medibank Review Committee was established in January 1976. The Committee's findings were not made public but the new program was announced in a Ministerial Statement to Parliament on 20 May 1976. 'Medibank Mark II' was launched on 1 October 1976 and included a 2.5 per cent levy on income, with the option of taking out private health insurance instead of paying the levy.

What was the purpose of Medibank?

Bill Hayden on 29 November 1973, the purpose of Medibank was to provide the 'most equitable and efficient means of providing health insurance coverage for all Australians'.

How much did Medicare cost in 2015?

In FY 2015, gross current law spending on Medicare benefits will total $605.9 billion. Medicare will provide health insurance to 55 million individuals who are 65 or older, disabled, or have end-stage renal disease (ESRD).

Which bill included multiple provisions that affect Medicare?

The Pathway for SGR Reform Act of 2013, passed along side with the Bipartisan Budget Act of 2013, included multiple provisions that affect Medicare.

What is the Medicare Part B deductible?

Modify Part B Deductible for New Enrollees: Beneficiaries who are enrolled in Medicare Part B are required to pay an annual deductible ($147 in calendar year 2014). This deductible helps to share responsibility for payment of Medicare services between Medicare and beneficiaries. To strengthen program financing and encourage beneficiaries to seek high-value health care services, this proposal would apply a $25 increase to the Part B deductible in 2018, 2020, and 2022 respectively for new beneficiaries beginning in 2018. Current beneficiaries or near retirees would not be subject to the revised deductible.

3.4 billion in savings over 10 years]

What percentage of Medicare beneficiaries are covered by Part B?

Part B coverage is voluntary, and about 92 percent of all Medicare beneficiaries are enrolled in Part B. Approximately 25 percent of Part B costs are financed by beneficiary premiums, with the remaining 75 percent covered by general revenues.

What is Medicare Shared Savings Program?

Medicare Shared Savings Program (MSSP): This initiative is a feeforservice program established by the Affordable Care Act designed to improve beneficiary outcomes and increase value of care. ACOs that meet certain quality objectives and reduce overall expenditures get to share in the savings with Medicare and may also be subject to losses. Since the first cohort of ACOs entered the program in 2012, 343 MSSP ACOs have been established. In the first year of the program, Medicare ACOs generated interim shared savings totaling $128 million for the Medicare trust fund. Fiftyfour ACOs had lower expenditures than projected, and 29 will share interim savings.

What is the Medicare sequestration for 2023?

Modifications to Medicare sequestration for fiscal year 2023 : The Bipartisan Budget Act of 2013 extended the sequestration of Medicare provider payments along with the sequestration of other non-exempt mandatory programs through FY 2023. An additional provision in the Pathway for SGR Reform Act of 2013 accelerates FY 2023 savings from sequestration by applying a higher percentage Medicare reduction to the first six months. (Savings: $2.1 billion from acceleration of Medicare spending reductions in FY 2023)

What is Medicare 1/?

1/ Represents all spending on Medicare benefits by either the Federal government or other beneficiary premiums. Includes Medicare Health Information Technology Incentives.

Summary

- Medicare, the federal health insurance program for nearly 60 million people ages 65 and over and younger people with permanent disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the most recent historical and projected Medicare spending data published in the 2018 annual repor…

Health

- In 2017, Medicare spending accounted for 15 percent of the federal budget (Figure 1). Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2016, 29 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physician services.

Cost

- In 2017, Medicare benefit payments totaled $702 billion, up from $425 billion in 2007 (Figure 2). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased ...

Causes

- Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care …

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future increases in spending under Part B and …

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…