What Does Medicare Cover in 2021 Medicare includes coverage for inpatient and outpatient services. Including hospital visits, doctor visits, preventive services, medical equipment, lab tests, and more. You need to buy a separate policy for medications.

What services are covered by Medicare?

Feb 01, 2022 · Medicare includes coverage for inpatient and outpatient services. Including hospital visits, doctor visits, preventive services, medical equipment, lab tests, and more. You need to buy a separate policy for medications. Further, many people buy a Medigap or Advantage plans to lower costs.

What items are covered by Medicare?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a …

How much will Medicare cost this year?

Jan 06, 2022 · One of the most basic coverages provided under Medicare Part A is inpatient care in a hospital or rehabilitation facility. It also provides coverages related to inpatient mental health care, if this type of treatment is needed. A few of the inpatient expenses covered by Medicare Part A include: General nursing staff.

What procedures are covered by Medicare?

Does Medicare go up in 2021? ... How many days can you stay in hospital with Medicare? Original Medicare covers up to 90 days in a hospital per benefit period and offers an additional 60 days of coverage with a high coinsurance. These 60 reserve days are available to you only once during your lifetime. However, you can apply the days toward ...

What will Medicare pay 2021?

What are the major changes to Medicare for 2021?

Is Medicare changing in 2021?

How do I get my $144 back from Medicare?

Is Medicare Part B going up 2022?

How much is Medicare going up next year?

What is the Part A deductible for 2021?

What big changes are coming to Medicare?

- Increased eligibility. One of President Biden's campaign goals was to lower the age of Medicare eligibility from 65 to 60. ...

- Expanded income brackets. ...

- More Special Enrollment Periods (SEPs) ...

- Additional coverage.

Why do doctors not like Medicare Advantage plans?

Is there really a $16728 Social Security bonus?

How can I increase my Social Security benefits after retirement?

- Work for 35 Years. ...

- Wait Until at Least Full Retirement Age. ...

- Sign Up for Spousal Benefits. ...

- Receive a Dependent Benefit. ...

- Monitor Your Earnings. ...

- Avoid a Tax-Bracket Bump. ...

- Apply for Survivor Benefits. ...

- Check for Mistakes.

Is Social Security giving extra money this month?

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What is Medicare Part B?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

How many days of home health care is covered by Medicare?

Medicare covers up to 100 days of part-time daily care or intermittent care if medically necessary. You must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care. If you don’t qualify for home health care coverage under Part A, you might have Medicare coverage under Part B.

What is Medicare Part A?

Under Medicare Part A, hospital care as well as some nursing home, rehabilitation, mental health, and hospice care are generally covered. However, you may have to meet certain qualifications. Inpatient hospital care. Medicare Part A covers general nursing services, a semi-private room, meals, medical supplies, and certain medications.

What is skilled nursing in Medicare?

Skilled nursing facility care. Medicare covers room, board, and a range of skilled nursing services provided in a skilled nursing facility . This may include certain medications, tube feedings, and wound care, among other approved services.

What are the different parts of Medicare?

Here’s a quick rundown of the “parts” of Medicare, and the choices you may have about your Medicare coverage. Medicare Part A and Part B make up Original Medicare. Many people are automatically enrolled in Part A and Part B. You may be automatically enrolled if you’re receiving Social Security retirement or disability benefits when you qualify ...

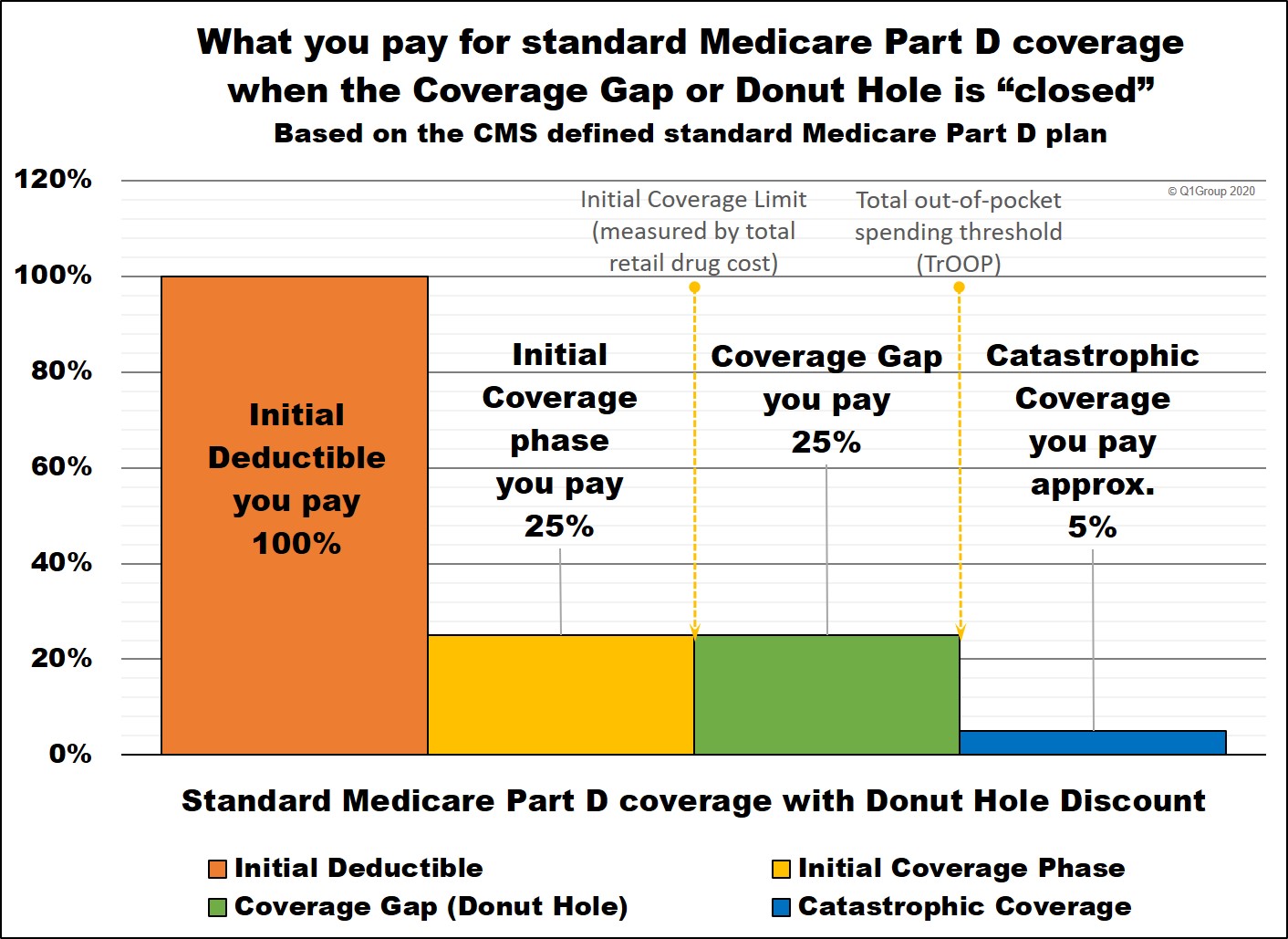

Is Medicare Part D a stand alone plan?

As a stand-alone Medicare Part D prescription drug plan, for those enrolled in Medicare Part A and/or Part B. As part of a Medicare Advantage Prescription Drug plan. As with other Medicare coverage, you may need to pay coinsurance or copayments – and possibly monthly premiums and annual deductibles.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage plans must offer you at least the same level of Medicare coverage as Part A and Part B. Frequently, Medicare Advantage plans combine Medicare coverage for prescription drugs along with medical benefits. Some Medicare Advantage plans offer additional benefits to standard Medicare coverage.

Does Medicare pay for hospital care?

Usually Medicare Part A doesn’t pay the full cost of your hospital-related care. You will likely have to pay your share of the Medicare-approved amount for services Medicare covers. The portions you pay are deductibles and coinsurance or copayments. Also, there are time limits – after a certain amount of time as an inpatient within one year, you may have to pay all costs. Learn more about Medicare costs.

When does Medicare coverage start?

That takes place yearly from January 1st through March 31st. Coverage begins July 1st of the same year you enroll. The Annual Election Period runs from October 15th-December 7th of every year. That is only for those currently enrolled in Medicare.

When was Medicare updated?

Medicare Coverage. Home / Original Medicare / Medicare Coverage. Updated on April 7, 2021. When you understand your Medicare coverage, you have more control over your healthcare benefits. Medicare is a federal health insurance coverage formed in 1965. It covers people 65 and over; but, people with disabilities may qualify before 65.

How long does Medicare cover under 65?

Medicare coverage requirements for those under 65 include: Entitled to Social Security benefits for a total of 24 months. Currently receiving a disability pension from the Railroad Retirement Board. Diagnosed with Lou Gehrig’s disease (which would qualify you immediately)

What happens if you contribute to HSA after Medicare?

When you contribute to your HSA after your Medicare coverage begins, you might receive a tax penalty.

What age do you have to be to get Medicare?

Medicare Coverage Age. Turning 65 means you’re eligible for Medicare coverage. If you’ve been collecting Social Security Disability Insurance for over 24 months, you may be Medicare-eligible before 65. At the beginning of the 25th month, you’re automatically enrolled in Medicare.

What are the conditions that women on Medicare have?

A few of these conditions include hypertension, osteoporosis, and arthritis.

What is covered by Part A?

Part A covers inpatient care, but not long-term care or custodial care.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

Medicare Part A Coverage

Medicare.gov explains that Medicare Part A is often referred to as “Hospital Insurance.” Rightfully so, as this is the part of Medicare that covers expenses related to hospital, nursing facility care, hospice, and home health care.

Medicare Part B Coverage

Part B is the “Medical Insurance” piece of Medicare and covers most preventative services fully. It also provides at least partial coverage for medically necessary services and supplies needed to diagnose and/or treat existing conditions. Part B also pays a set amount toward other expenses, such as:

Medicare Part C Coverage

As an alternative to purchasing Part A and Part B, some participants receive Medicare benefits through Part C, which is commonly known as Medicare Advantage. Instead of the federal government providing healthcare coverage, Medicare Advantage’s benefits are offered through private insurance companies that have been pre-approved by Medicare.

Medicare Part D Coverage

Part D refers to the prescription drug coverage portion of Medicare and each plan has its own set of covered drugs. Additionally, each drug is placed in a designated tier within that plan, which ultimately determines the copayment and/or coinsurance cost of the drug.

Medicare Supplement (Medigap) Coverage

Medicare Supplement policies, also known as Medigap, are designed to help cover expenses not covered under Original Medicare Parts A and B.

What Medicare Does Not Cover

Medicare as a whole covers a wide variety of physical and mental health services—whether in whole or in part—but there are some expenses it will not pay toward. Among them are:

What is Medicare Supplement 2021?

Premiums for Medicare supplement (Medigap) in 2021. Medigap is also known as Medicare supplemental insurance. It is sold by private insurers. Medigap helps cover some of the out-of-pocket costs you may incur, such as premiums, copays, and coinsurance.

What is the Medicare deductible for 2021?

Here is a rundown of the standard Medicare deductibles in 2021: Part A: $1,484 per benefit period. Part B: $203 for the year. Part D: varies by plan, but maxes out at $445 for the year.

How much is Part B insurance in 2021?

Part B has a standard monthly premium that most beneficiaries are responsible for. In 2021, this monthly cost is $148.50. This is an increase of $3.90 over 2020. You may pay less than the standard monthly premium if it is higherthan your Social Security cost of living adjustment.

What is the coinsurance for 2021?

Coinsurance. Coinsurance is the portion of each medical bill that you are responsible for. For 2021, Part A coinsurance for hospital stays starts at day 61. From day 61 to 90, your coinsurance is $371 per day of each benefit period.

How much will Medicare Advantage pay in 2021?

Medicare Advantage subscribers cannot purchase Part D. Part D premiums vary by plan. In 2021, you can expect to pay around $33.06 each month.

What is Medicare Part B?

Medicare Part B is the part of original Medicare that covers outpatient care, including wellness visits and preventive treatments, such as the flu vaccine. It also covers emergency room visits and services, even though emergency rooms are in hospitals. Part B pays for 80 percent of the Medicare-approved cost for these services.

Does Medicare increase copays?

Takeaway. If you’re on Medicare and planning your annual budget, you’ll have to factor in higher out-of-pocket expenses. Some costs associated with each Medicare part, such as copays, deductibles, and premiums, are increased annually by the federal government.

What is Medicare Cost Plan?

A Medicare Cost Plan with prescription medicine benefits. The premium you pay for one of these plans includes prescription drug coverage. You need to decide whether to get Part D coverage as soon as you're eligible. If you wait, you may have to pay a penalty for joining late.

What is Medicare Part A?

Also called hospital insurance, Medicare Part A covers the cost if you are admitted to a hospital, skilled nursing facility, or hospice. It also covers some home health services. Most people are enrolled automatically in Part A when they reach age 65.

How many parts does Medicare have?

If you’re eligible for Medicare and ready to explore your options, the first step is to get to know its four parts. Each part represents a different kind of coverage.

What is deductible in Medicare?

A deductible, which is a set amount you pay each year before Part B starts paying for any of your care. Twenty percent of the Medicare-approved amount for some types of care. These are doctor's appointments, physical therapy, diabetes supplies, durable medical equipment like commode chairs, wheelchairs, and other care.

What is Part A deductible?

This is how much you have to spend before Medicare starts to pay its part. Coinsurance. This is the part of the costs for hospital care you may be required to pay after you've met your deductible.

Do you have to follow Medicare rules?

When you have Medicare Advantage, you have to follow all of the plan's rules. For instance, you need to use doctors in the plan’s network.

Does Medicare Advantage cover dental?

You may also get coverage for dental, hearing, vision, and wellness programs. When you have Medicare Advantage, you have to follow all of the plan's rules. For instance, you need to use doctors in the plan’s network.

Health

- Heres a quick overview of Medicare and what it covers. Original Medicare is the health insurance program created and administered by the federal government.

Services

- Medicare Part A generally covers medically necessary services such as: Medicare Part B generally covers the following services:

Content

- Before going into what Medicare Part C covers, heres a quick rundown on what Part C is. Medicare Part C, commonly known as Medicare Advantage, provides an alternative way to receive your Original Medicare (Part A and Part B) coverage. Medicare Advantage plans are offered by private insurance companies that have contracts with Medicare. So, Medicare Advantage plans …

Benefits

- Many Medicare Advantage plans cover prescription drugs. They may include additional benefits, such as routine vision, hearing, and dental services. Not every Medicare Advantage plan covers prescription medications, but the ones that do are called Medicare Advantage Prescription Drug plans (sometimes abbreviated as MA-PDs). If you enroll in a Medica...

Definition

- Medicare Part D covers prescription drugs through private insurance companies contracted with Medicare. Medicare Part D prescription drug coverage is available not only from Medicare Advantage Prescription Drug plans (described above), but also from stand-alone Medicare Part D Prescription Drug Plans.

Use

- Each Medicare Prescription Drug Plan has a formulary, which is a list of prescription medications covered by that plan. Formularies include medications from all the therapeutic drug categories and typically include brand name and generic prescription drugs. Formularies and costs vary by plan, so it may be a good idea to compare the plans available where you live to identify the one t…

Cost

- If you enroll in a Medicare Prescription Drug Plan, you may have to pay a monthly premium in addition to your Medicare Part B coverage. You may be able to buy a Medicare Supplement (Medigap) plan to help pay for Medicare Part A and Part B out-of-pocket costs. Different Medicare Supplement plans pay for different amounts of those costs, such as copayments, coinsurance, a…

Scope

- While Medicare covers many medical services, it doesnt cover everything. You may be surprised to learn that Original Medicare (Part A and Part B) doesnt cover long-term care when the focus is on daily living activities (custodial care) rather than skilled care. Here are some examples of services and items Original Medicare doesnt typically cover: