Full Answer

What do you pay in a Medicare Advantage plan?

- Complete a new Medicare enrollment (unless you are in your initial or special enrollment period)

- Switch from Original Medicare to Medicare Advantage

- Enroll in a stand-alone Part D prescription drug plan (unless you are moving to Original Medicare from Medicare Advantage)

How do I choose the best Medicare Advantage plan?

- Do your important physicians participate in any Medicare Advantage plans or do they only accept Original Medicare?

- What insurance is accepted by your preferred hospitals?

- Do you travel out of the area frequently? ...

- What is your risk tolerance? ...

- How about peace of mind? ...

Which Medicare Advantage plan is the best?

What to know about Medicare in Maryland

- The average monthly premium in 2022 for a Medicare Advantage plan in Maryland is $45.97. (It was $46.52 in 2021.)

- There are 49 Medicare Advantage plans available in Maryland in 2022. (This number is up from 41 plans in 2021.)

- All Medicare-eligible people in Maryland have access to a $0-premium Medicare Advantage plan.

How much is the average Medicare Advantage plan?

The average that you have to pay for a Medicare advantage plan is 21.22$ dollars per month. You may need to pay 19 dollars per month in the year 2022. However, as it is average, some premiums may cost $100, and some premiums may be $0. The average of these charges varies depending upon the different plans.

How much should I expect to pay for a Medicare Advantage plan?

The average premium for a Medicare Advantage plan in 2021 was $21.22 per month. For 2022 it will be $19 per month. Although this is the average, some premiums cost $0, and others cost well over $100. For more resources to help guide you through the complex world of medical insurance, visit our Medicare hub.

Is Medicare Advantage more expensive than Medicare?

Medicare spending for Medicare Advantage enrollees was $321 higher per person in 2019 than if enrollees had instead been covered by traditional Medicare. The Medicare Advantage spending amount includes the cost of extra benefits, funded by rebates, not available to traditional Medicare beneficiaries.

What are the disadvantages of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Do Medicare Advantage plans have no out-of-pocket costs?

So what's the catch? Of course, no Medicare Advantage plan is really $0 cost. You may still pay deductibles and copays for covered services and you'll still have to pay the Part B premium. But depending on your own personal healthcare needs, a Medicare Advantage plan may be worth it for the added benefits.

How much are Medicare premiums for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Do Medicare Advantage plans have a deductible?

Medicare plans have deductibles just like individual or employer health insurance plans do. Both Original Medicare and, typically, Medicare Advantage Plans, require you to meet a deductible—an amount you pay for healthcare or for prescriptions—before your healthcare plan begins to pay.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Jun 22, 2022

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Does Medicare Advantage pay Part B premium?

Medicare Advantage (MA) plans cover the benefits associated with both Medicare Part A and Part B (except for hospice care, which Part A covers) and may come with a monthly premium for coverage; however, you must also continue to pay your Part B premium.

Do I need Medicare Part D if I have an advantage plan?

Nearly 90% of Medicare Advantage plans include Medicare Part D, but you can also purchase Part D separately if you have an Advantage plan that does not include it. About a third of Medicare beneficiaries had Medicare Advantage plans in 2019.

What is Medicare Advantage?

The amount you are required to pay for each health care visit or service. Medicare Advantage plans typically include cost-sharing measures such as copayments and coinsurance, and the amounts of these costs can correlate with that of the premium. The type of plan.

What to look for when shopping for Medicare Advantage?

When you are shopping for a Medicare Advantage plan, you may consider features such as a plan’s range of benefits and possible network rules. But above all else, perhaps the biggest thing you might consider is the cost of a plan. When it comes to Original Medicare (Medicare Part A and Part B), the cost of premiums is standardized across the board.

What is a Medicare Savings Account?

A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible.

How to save money on medicaid?

Saving money with Medicare Advantage 1 If you qualify for Medicaid, your Medicaid benefits can be used to help pay your Medicare Advantage premiums. 2 A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible. 3 If your Medicare Advantage plan includes a doctor and/or pharmacy network, you can save a considerable amount of money by staying within that network when receiving services. 4 Some Medicare Advantage plans may include extra health perks such as gym memberships. There is even the possibility of Medicare Advantage plans soon covering expenses like the cost of air conditioners, home-delivered meals and transportation.

How much does vision insurance cost?

Vision insurance can typically cost around $20 per month or less. 3. Hearing plans. Unlike dental and vision insurance, hearing insurance plans are not a common insurance product. Some hearing aid companies may offer extended warranties, but the warranties apply only to the hearing aid product itself.

Which state has the lowest Medicare premium?

A closer look at 2021 data also reveals: Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug (MAPD) plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

Does Medicare Advantage cover dental?

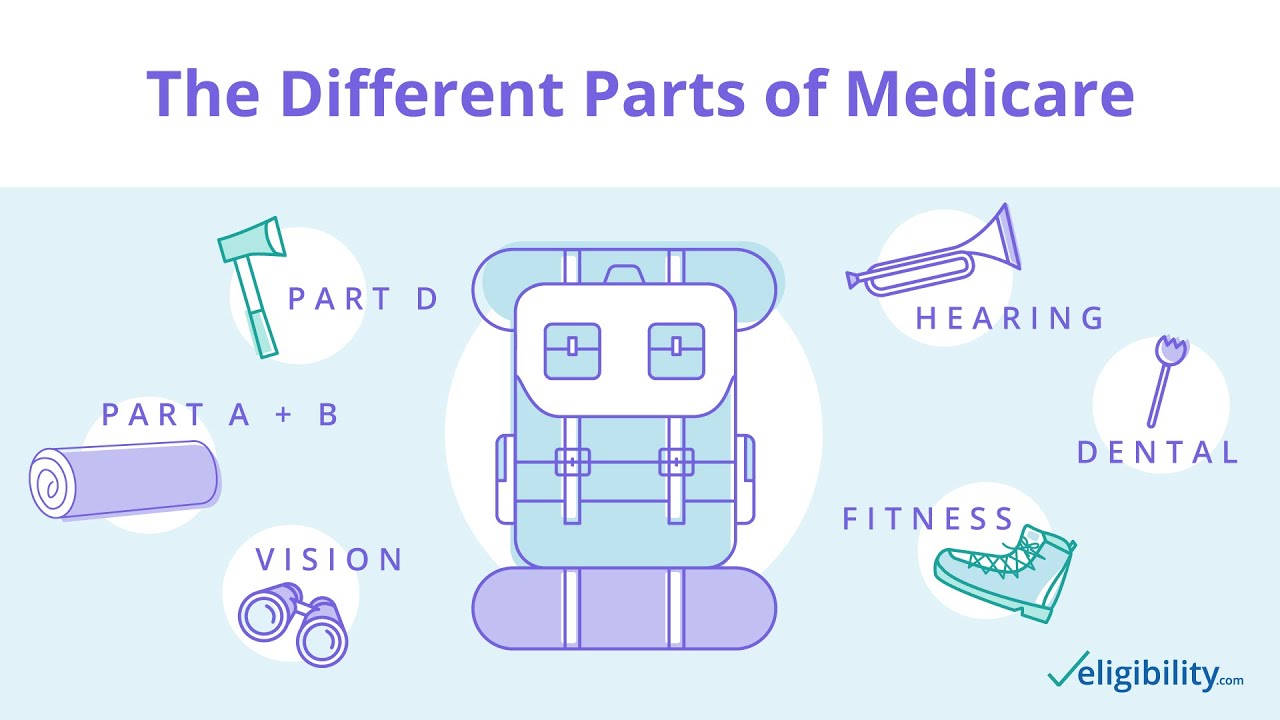

While a Medicare Advantage plan by law must cover the same benefits as Medicare Part A and Medicare Part B , benefits like prescription drugs, dental, vision and hearing can be covered at varying degrees (or not at all).

How much does Medicare Advantage pay?

According to the Kaiser Family Foundation, a non-profit organization that focuses on health issues in the U.S., 60% of Medicare Advantage enrollees pay only their Part B premium each month. Another 17% pay $20-49 a month in addition to Part B, while 12% pay $50-99 monthly.

What is Medicare Advantage?

Medicare Advantage plans, also called Medicare Part C, are offered by private insurers working in conjunction with the U.S. Centers for Medicare and Medicaid Services. They are required to offer at least the same coverage as Original Medicare, which consists of Part A (hospital and skilled nursing care, hospice, and home health care) and Part B (many outpatient services, as well as ambulance, clinical research, and mental health costs). You may also purchase optional Part D, prescription drug coverage, separate from your Original Medicare plan.

What is a copay?

A copayment is simply the amount you pay when you visit a doctor, pick up your medications, or are involved in any other health care transaction. With your drugs, there may be different levels of pricing, with generic drugs having one copay, and more expensive medications costing more.

What are the four types of Medicare benefits?

The four plan types are: Qualified Medicare Beneficiary Program, if your individual income is $1,084 or less per month and you have less than $7,860 in resources (resources include money in checking or savings account, stocks, and bonds)..

How many types of Medicare are there?

There are four different types of plan, and you may qualify if you have low monthly income and/or are a working disabled person under the age of 65. These plans generally pay for Medicare Part A and B premiums, and may help with deductibles, coinsurance, and copayments. The four plan types are:

What is a coinsurance deductible?

There’s one more term you should be aware of, and that’s your deductible. A deductible is the amount that you have to pay before any Medicare payments kick in.

Does Medicare Advantage cost more?

In some cases, you may find that Medicare Advantage offers you more services and coverage for less money than Original Medicare.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

What is Medicare Advantage?

Most Medicare Advantage Plans offer coverage for things that aren't covered by Original Medicare, like vision, hearing, dental, and wellness programs (like gym memberships). Plans can also cover more extra benefits than they have in the past, including services like transportation to doctor visits, over-the-counter drugs, adult day-care services, ...

What happens if you have a Medicare Advantage Plan?

If you have a Medicare Advantage Plan, you have the right to an organization determination to see if a service, drug, or supply is covered. Contact your plan to get one and follow the instructions to file a timely appeal. You also may get plan directed care.

How much is Medicare Advantage 2021?

In addition to your Part B premium, you usually pay a monthly premium for the Medicare Advantage Plan. In 2021, the standard Part B premium amount is $148.50 (or higher depending on your income). If you need a service that the plan says isn't medically necessary, you may have to pay all the costs of the service.

What is Medicare health care?

Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine. under Medicare. If you're not sure whether a service is covered, check with your provider before you get the service.

Is Medicare Advantage covered for emergency care?

In all types of Medicare Advantage Plans, you're always covered for emergency and. Care that you get outside of your Medicare health plan's service area for a sudden illness or injury that needs medical care right away but isn’t life threatening.

Does Medicare cover hospice?

Medicare Advantage Plans must cover all of the services that Original Medicare covers. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies. In all types of Medicare Advantage Plans, you're always covered for emergency and Urgently needed care.