Full Answer

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Which Medicare supplement plan should I Choose?

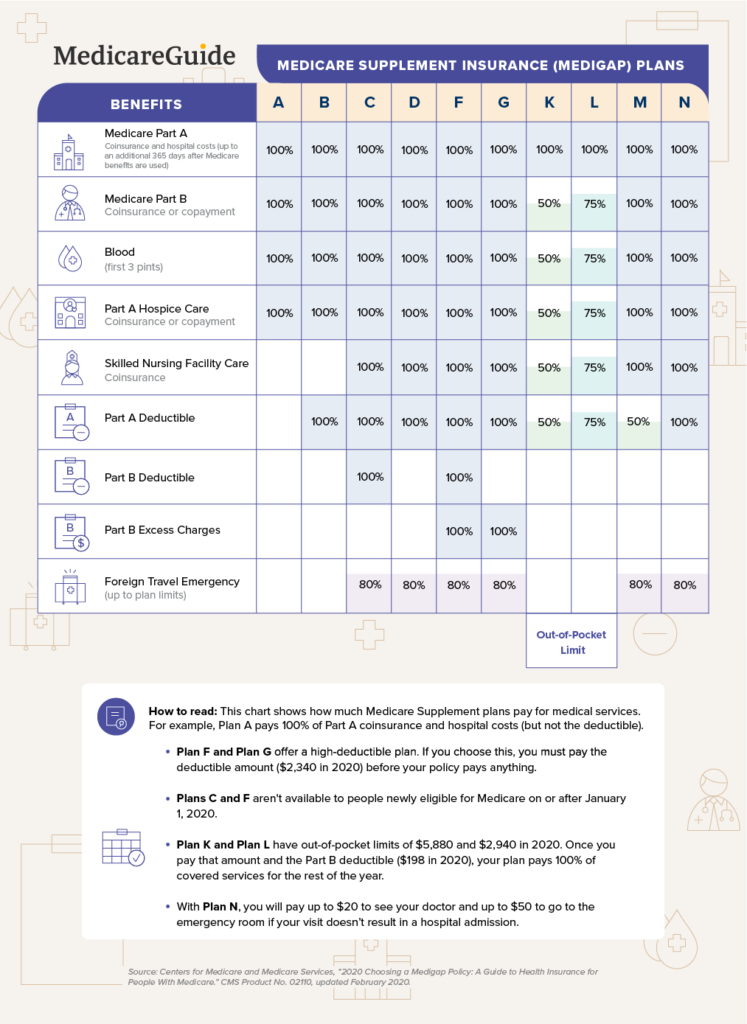

Some people also refer to these plans as Medigap. As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

What is the best Medicare supplement insurance plan?

- United Healthcare: 26%

- Humana: 18%

- BCBS plans: 15%

- CVS (Aetna): 11%

- Kaiser Permanente: 7%

- Centene: 4%

- Cigna: 2%

- Other companies: 18%

What are the best Medicare plans?

... Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers. Sign up today for a FREE virtual event and let Silver Supplements Solutions help you understand your best option for your own peace of mind!

How much do Medicare Supplement plans usually cost?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

How much does Medicare Part B cost in Iowa?

$170.10 per monthPart B costs $170.10 per month but can be more if you have higher income. There are 64 Medicare Advantage Plans in the state that are an alternative to Original Medicare. Learn more about your Medicare options in Iowa.

What is the most basic Medicare Supplement plan?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

What is the monthly premium for plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

Why are Medigap policies so expensive?

Younger buyers may find Medicare Supplement insurance plans that are rated this way very affordable. Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors.

What is the cost of Medicare Part B for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How much does Social Security deduct for Medicare?

If your 2020 income was $91,000 to $408,999, your premium will be $544.30. With an income of $409,000 or more, you'll need to pay $578.30....Medicare Part B.Income on Individual Tax ReturnIncome on Joint Tax ReturnMonthly Premium$114,001 to $142,000$228,001 to $284,000$340.205 more rows•Feb 24, 2022

Is Medicare premium based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What does plan G pay for?

Medicare Supplement Plan G covers your percentage of any medical benefit that Original Medicare covers, except for the outpatient deductible. So, it helps to pay for inpatient hospital costs, such as the first three pints of blood, skilled nursing facility care, and hospice care.

Do all Medicare Supplement plans pay the same?

Medicare Supplement insurance plans are sold by private insurance companies and can help you pay for out-of-pocket costs for services covered under Original Medicare. Different Medicare Supplement insurance plans pay for different amounts of those costs, such as copayments, coinsurance, and deductibles.

What is the lowest Medicare premium in Iowa?

Medicare Part D Plans in Iowa. The lowest premium plan in Iowa is about $13 a month. And the highest costing plan is over $190 a month. One of the largest Medicare Part D insurers in Iowa is Aetna. Not having a drug plan could result in a penalty. The late enrollment penalty will occur when you finally choose a Part D plan.

How long does it take to enroll in Medigap?

Well, when you enroll in Medigap during this 6-month enrollment period, you avoid the hassle of underwriting and pre-existing condition waiting periods. But, with Medicare Supplement plans, you can sign up any time.

Does Iowa have Medicare Supplement?

Medicare Supplement Plans in Iowa. In Iowa or any state, when you buy a Medicare Supplement plan, you protect yourself from the costs Medicare doesn’t cover. The benefits for each letter plan are the same between carriers. You’ll only need one Medigap policy.

Do you need one Medicare Supplement plan?

You’ll only need one Medigap policy. Medicare Supplement plans have a premium in addition to your Medicare premium, but Medigap is worth it. If you want a lower premium, Medicare Select plans have the same benefits as standard Medigap, except there are provider network and service areas.

What Are Medicare Supplement Plans in Iowa?

Medicare is a health insurance program for Iowans age 65 and older as well as younger people who have a disability or who have specific health conditions like end-stage renal disease. While Medicare offers a lot of benefits, it also has significant out-of-pocket costs such as deductibles, coinsurance and copayments.

When Can You Enroll in a Medigap Policy?

You can apply for a Medicare Supplement plan at any time. However, if you apply outside of your Medigap Open Enrollment Period or if you don’t have guaranteed issue rights, insurance companies can use your medical history to decide whether to accept your application or charge you a higher monthly premium.

What Are the Most Popular Medicare Supplement Plans?

The three most popular Medigap policies in Iowa in are Plans F, G and N.

How Do You Choose a Medicare Supplement Plan?

The first step to choosing an Iowa Medicare Supplement plan is to decide which lettered plan (s) you prefer. Next, visit the Medicare Plan Finder to find insurance companies licensed to sell those plans in Iowa.

How Much Do Medigap Policies Cost?

Iowa Medigap policy prices vary depending on your age, gender and whether you use tobacco.

What If You Want to Change Your Medigap Policy?

You can apply for a different Medigap plan at any time. Keep in mind that unless you have guaranteed issue rights, insurance companies can decline your application or charge you more based on your health.

What Are Alternatives to Medicare Supplement Plans?

Medicare Advantage plans are an alternative to Medicare Supplements. Medicare Advantage plans are a bundled alternative to Original Medicare that replaces Medicare Part A and B benefits. Most also offer Part D benefits, and many offer other types of coverage, including dental, vision, and hearing care.

How old do you have to be to get medicare in Iowa?

You can enroll in Medicare, a federal insurance program, once you reach 65 years old.

How much does Medicare pay?

Medicare typically pays 80% of the negotiated rate for covered services, leaving you with a sometimes hefty copay. Medicare Supplement Insurance Plans, or Medigap, may cover that 20%, reducing your out-of-pocket costs at the time of service.

What is a Medigap plan?

Medigap plans are designed to fill in coverage gaps in Original Medicare and are not compatible with Advantage Plans. Some examples of coverage gaps might include the 20% coinsurance or any health services provided overseas.

What is legal aid in Iowa?

These services include low- and no-cost legal advice and information about various public benefits programs, including what to expect from Medicare. If you have a dispute with Medicare or a health care provider, Legal Aid may be able to help. Guardianships, wills, trusts, financial planning, and long-term care are just some of the issues that Legal Aid regularly handles.

Do insurance counselors get paid?

Insurance counselors are trained to compare different Medicare coverage options and provide unbiased information to you. There is no cost for insurance counseling services, and counsel ors do not receive any compensation from the plans they suggest.

Is health insurance a complex topic?

Health insurance is a complex topic with many factors that can impact total costs, making it challenging for first-time enrollees. Iowans who seek assistance with the process have access to several statewide counseling programs that offer unbiased help from trained experts.

Does Iowa have a Shiip counselor?

Each AAA location offers SHIIP counseling along with a variety of other senior-centered services. Caregivers can find a wealth of information and support resources available, and you may be able to schedule an in-person or telephone session to discuss various health insurance options with a SHIIP counselor or make an appointment with a social worker.

What are the Top 5 Medicare Supplement Plans in Iowa?

Each Medigap policy offers the same set of basic benefits. From there, plan options vary. Here’s an overview of the top five plans in Iowa.

What is the Best Supplemental Insurance to go with Medicare?

The best Medigap plan is one that balances coverage and cost specific to your health care needs. Here are a few guidelines to keep in mind as you compare plans.

What is the Average Cost for a Medicare Supplement Plan in Iowa for 2021?

The cost of a Medicare Supplement plan in Iowa varies based on age, demographics, insurance carrier, and zip code. The average cost of a Medigap policy in Iowa is $137. Here’s what a 65-year-old female, nonsmoker, living in Dubuque (zip code 52001) might pay:

Common Iowa Medicare Supplement Plan Questions

Private insurance companies sell Medigap policies. Three consistently rank high in terms of service, pricing, and AM Best financial ratings:

Ready to learn more?

My Medigap Plans is a rapidly growing resource for Medicare beneficiaries. We specialize in educating consumers on their options and guiding them through the process of plan selection. We work closely with some of the nations top rated carriers such as Aetna, Cigna and Mutual of Omaha.

Medicare Supplement Insurance in Iowa

Medicare Supplement Insurance in Iowa is health insurance that covers medical expenses and health care related supplies.

What is the best Medicare Supplement plan in Iowa for 2022?

There are 5 plans that are the best supplemental insurance in Iowa and they are: Medicare Plan F, G, N, High Deductible Plan F, and High Deductible Plan G.

How much does a Medigap plan cost in Iowa?

The average cost will depend on the insurer because their pricing will be based on community ratings, issue age, and attained age,

When can I apply for a Medicare Supplement plan?

You can apply within the 6 month Medigap Open Enrollment period. This will be the best time to gain Medicare benefits because during this period pricing and plan options from a Medicare insurance company are better. For age specifics, see below.

When can I apply for a Iowa Medicare Supplement plan?

Changing Medigap plans can be done at any point. However, when applying outside the initial enrollment period, you could be denied coverage or have your rates increased due to a health condition or medical issues.

Ready to Learn More?

We help educate Medicare beneficiaries on their Medigap options and help them go through the process of reviewing and comparing plans. We work with most of the nations top-rated Medigap carriers such as Aetna, Cigna, Mutual of Omaha and Florida Blue Medicare plans.

Iowa State Links

Also known as Medigap, Medicare Supplement insurance pays coinsurance, deductibles, co-payments and other expenses that Medicare beneficiaries are supposed to pay.

How long does Iowa Medigap last?

Be aware that this window only lasts for 6 months after your Part B effective date.

Does Iowa Medicare cover outpatient coinsurance?

Iowa Medicare Supplement plans can also cover the 20% outpatient coinsurance that Medicare does not pay for you. This kind of coverage lets you focus on getting well.

Does Iowa require Medicare Supplement?

Iowa does not require Medicare supplement companies to offer Medigap plans to people under 65. Most insurance companies don’t, so Medicare Advantage plans are a good fit for people under 65.

Does Iowa have Medicare Advantage?

Many insurance companies are offering Medicare Advantage plans in Iowa. When you enroll in a Medicare Advantage plan, you will get your care from the plan’s network of providers. These private plans will pay instead of Medicare. However, they cover all the same Medicare Part A and B services, plus extra benefits usually.

What is Medicare Supplement Insurance?

Buying Medicare supplement insurance is a way to protect yourself from some of the costs not covered by Medicare. It is also called “Medigap” or “Med Supp” insurance. There are 10 standardized Medicare supplement plans identified by the letters "A" through "N." Plans F and G are also available as a high deductible plans.

Is Medicare a good plan?

Medicare is a good start to maintaining health care coverage, but it’s just a start. SHIIP-SMP can help you sort through dozens of supplemental coverage plans. Below you'll find a number of resources to help you. I am turning 65 and going on Medicare.

Types of Medigap Plans

There are 10 general categories of Medigap plans, and each category is identified by a single letter between A and N. Regardless of the issuer, all plans offer the same base of benefits.

Popular Medigap Plans

Medigap plans vary in popularity, with Plans F, G and N often being the most popular among Medicare beneficiaries. This trio of plans typically comes with lower premiums, making them a viable choice for seniors living on a fixed income. However, they usually have a high deductible, which must be met before you’re eligible for reimbursement.

Medigap Availability by Issuer

Although insurance companies that issue Medigap plans may each have a different selection of plans, every insurer that offers these plans is required to sell plans A, C and F. Because benefits are standardized by plan type, the main difference between companies is the premium, so you can shop around for the best price.

Guaranteed Issue Rights

If you don’t enroll in a Medigap plan during the formal open enrollment period, federal law may still protect your right to purchase a policy in certain circumstances.