AARP Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Is AARP a Medicare program?

May 02, 2022 · Medical Services for Medicare Part B: Covers the $233 Part B deductible, then covers about 20% of the healthcare costs left over after Medicare pays about 80%. Covers the …

Does AARP offer health insurance for under 65?

Nov 03, 2019 · Plan B is one notch above the coverage in Plan A. Basic coverage includes Part A coinsurance and hospital costs for up to 365 additional days after Original Medicare benefits …

What is Medicare AARP plan?

En español | Medicare Part B covers doctors’ services, including those provided in the hospital. It also covers outpatient care and preventive care, including tests, screenings, laboratory work …

What is AARP health plan?

Apr 12, 2022 · The primary goal of a Medicare Supplement insurance (Medigap) plan is to help cover some of the out-of-pocket costs of Original Medicare (Parts A & B). As a general rule, the …

What expenses will Medicare Part B pay for?

- Clinical research.

- Ambulance services.

- Durable medical equipment (DME)

- Mental health. Inpatient. Outpatient. Partial hospitalization.

- Limited outpatient prescription drugs.

What does Medicare Part B entitle you to?

Part B helps cover medically necessary services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B also covers many preventive services. Part B coverage is your choice. However, you need to have Part B if you want to buy Part A.

Does AARP Plan B cover Medicare deductible?

Plan B covers each of the benefits offered under Plan A. Additionally, it covers 100% of your Medicare Part A deductible. In 2020, the Part A deductible is $1,408.Jan 4, 2022

Does Medicare Part B cover 80 %?

Does Medicare Part B pay for prescriptions?

Can I get Medicare Part B for free?

Does AARP Medicare Supplement Plan F cover dental?

What is the deductible for AARP plan G?

What is AARP supplement F?

Does Medicare Part B cover doctor visits?

What is the Medicare Part B premium for 2022?

Does Medicare cover dental?

What are the features of Medicare Supplement plans?

Helps cover some out-of-pocket costs that Original Medicare doesn’t pay.See any doctor who accepts Medicare patients.No referrals needed to see a s...

What Medicare Supplement plans are available?

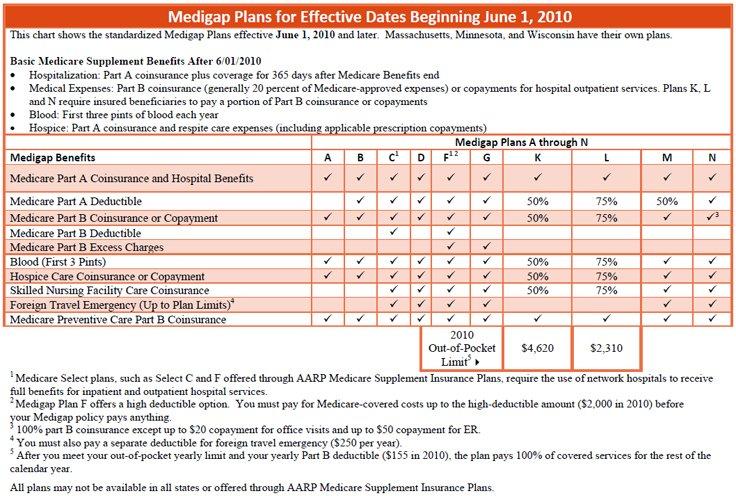

Medicare Supplement plans are often called “Medigap.” There are ten standardized Medicare Supplement plans.Each plan has a letter assigned to it. E...

What does each Medicare Supplement plan cover?

Each of the Medicare Supplement plans offers a varying level of coverage. See what plans match up with the coverage you want.

What is Plan B coverage?

Plan B Coverage. Plan B is one notch above the coverage in Plan A. Basic coverage includes Part A coinsurance and hospital costs for up to 365 additional days after Original Medicare benefits have been exhausted.

What is Medicare Supplement Insurance?

Medicare supplement insurance plans, otherwise known as Medigap policies, are designed to help with some of the cost exposure inherent in Original Medicare, such as copayments, coinsurance and deductibles. Some of these policies cover deductibles as well.

How long is the Medicare Supplement enrollment period?

When you are 65 years of age and enrolled in Medicare Part B, you enter your Medicare Supplement Initial Enrollment Period. This is a 6-month period when you have a guaranteed issue right to purchase any Medicare Supplement plan sold in your state.

Do private insurance companies have to include Medigap?

These regulations require that if a private insurance company elects to offer Medigap policies, they must include plan A in their offering because it is the standard plan for basic coverage. Plan B Coverage.

Does Medicare Advantage include Part D?

Additionally, unlike some Medicare Advantage plans, supplement plans do not include Part D. Therefore, a premium would also be due to the insurance company carrying your drug coverage. It is possible that the company in which you are enrolled for supplement insurance also offers Part D.

Does Plan B cover deductible?

Also, Plan A covers Part B coinsurance or copayments, the first three pints of blood annually, Part A hospice care coinsurance or copayments and skilled nursing facility care coinsurance. Where Plan B becomes advantageous is that it also covers the Part A deductible, which, in 2020, is projected to rise to $1,420.

What is covered by Medicare Part B?

En español | Medicare Part B covers doctors’ services , including those provided in the hospital. It also covers out patient care and preventive care, including tests, screenings, laboratory work and outpatient care in the hospital. Some medical equipment and supplies, such as wheelchairs and oxygen are also covered.

How old do you have to be to get a Part B?

To qualify for Part B benefits, you need to be: a green card holder age 65 or older who has been married for at least one year to a U.S. citizen or green card holder — provided that your spouse is at least 62 and is fully insured (that is, has earned 40 work credits through paying Medicare payroll taxes at work); or.

Do you have to pay Medicare premiums?

You must pay the required monthly premiums — either the standard premium that is set each year by law, or more if your income is over a certain level. However, if your income is low you can apply to your state for assistance under a Medicare Savings Program; if you qualify, the state pays your Part B premiums.

How does Medicare Supplement work?

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as "Medigap", are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits. The basic benefit structure for each plan is the same, no matter which insurance company is selling it to you. Note: The letters assigned to Medicare Supplement plans are not the same things as the parts of Medicare. For example, Medicare Supplement Plan A is not the same as Medicare Part A (hospital insurance).

What is the GRP number for Medicare?

Policy form No. GRP 79171 GPS-1 (G-36000-4). In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease. Not connected with or endorsed by the U.S. Government or the federal Medicare program. This is a solicitation of insurance.

Does AARP endorse agents?

AARP does not employ or endorse agents, brokers or producers. AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products. AARP® Medicare Supplement Insurance Plans.

Does Medicare Supplement work with Medicare?

Medicare Supplement insurance plans work with Original Medicare (Parts A & B) to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

Does Part A coinsurance include deductible?

Part A coinsurance, and most plans include a benefit for the Part A deductible (which could be one of the largest out-of-pocket expenses if you need to spend time in a hospital.)

Do you have to be an AARP member to enroll in Medicare Supplement Plan?

You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

What is Medicare Advantage?

It consists of a variety of private health plans, known as Medicare Advantage plans ( mainly HMOs and PPOs) that cover Part A, Part B and (often) Part D services in one package. (See "Figuring Out Your Choices.") Part D helps pay the cost of prescription drugs that you use at home, plus insulin supplies and some vaccines.

What is Part A insurance?

Part A helps pay the costs of a stay in a hospital or skilled nursing facility, home health care, hospice care, and medicines administered to inpatients.

Do doctors accept Medicare?

Most doctors accept Medicare patients, but some don't. Be aware that a physician who has opted out of Medicare cannot bill Medicare for treating you, and you will be responsible for the whole cost. It’s also important to find out whether a doctor accepts Medicare “assignment,” which means that he or she has agreed to the Medicare-approved amount as payment in full, or whether the doctor can charge you up to 15 percent above this amount. (See related article “Seeing a Doctor 'on Assignment.'")#N#If you need to find a primary care doctor or specialist who accepts Medicare, go to the physician database on Medicare's website or call Medicare at 1-800-633-4227.

Does Medicare cover vision?

(See"Figuring Out Your Choices.") Medicare covers most services deemed "medically necessary," but it doesn't cover everything. Except in limited circumstances, it doesn't cover routine vision, ...

Can you go out of network with Medicare Advantage?

Note that the above information applies if you’re in the traditional Medicare program. if you enroll in a Medicare Advantage HMO, you must generally go to doctors who are in the plan’s provider network and service area. Medicare Advantage PPOs also have provider networks but allow you to go out of network for higher copays.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is AARP insurance?

AARP is a nonprofit, membership organization. It offers medical supplement insurance plans through the United Healthcare insurance company. The plans, also known as Medigap, help people pay for out-of-pocket medical expenses that original Medicare does not cover. This article looks at the various AARP medical supplement insurance plans.

How many Medigap plans does United Healthcare offer?

AARP members can choose from 8 standardized Medigap plans offered through United Healthcare. These plans are A, B, C, F, G, K, L, and N. Although all 50 states have at least one of these plans, people may not find all 8 plans offered in their state. A person can use this online tool to find a plan in their state.

How much does it cost to become a Medigap member?

For an individual to qualify for a Medigap plan with the AARP, they must become a member. AARP membership $12 the first year, and then $16 annually.

What is the process of underwriting for Medigap?

Insurance companies use a process called medical underwriting to decide if they will accept an application for Medigap and to determine the cost. During open enrollment, a person with health issues can enroll in any Medigap policy in their state for the same price as someone in good health.

What is the out of pocket limit for a plan K?

In 2021, Plan K’s out-of-pocket limit is $6,220, and the out-of-pocket limit for Plan L is $3,110.

Does Medicare cover Medigap?

Medicare standardizes the coverage for each Medigap plan. The table below shows some of the benefits covered through the AARP Medigap plans. A person can check the complete coverage details for all AARP plans online. Benefit. Coverage 100%.

What Are Medicare Supplement Plans?

These plans are sold by private insurance companies, like AARP. There are a total of 10 Medicare Supplement plans available on the market. Named A–N, each of these plans offers a different set of benefits. The benefits offered by these plans are standardized by the federal government.

How Can I Purchase a Medicare Supplement Plan?

To purchase a Medicare Supplement plan, you must be enrolled in Original Medicare. The best time to enroll is during your Medigap Open Enrollment Period. This six-month period begins when you enroll in Medicare Part B.

AARP Medicare Supplement Plans in 2020

AARP offers the following eight Medicare Supplement plans, each of which are insured by UnitedHealthcare:

Moving Forward With AARP Medicare Plans

AARP offers many options for Medicare health insurance. As you get close to entering Medicare, reach out to an independent professional to compare quotes on AARP Medicare plans. Find out which ones are available in your area, and also get help finding the one that best fits your needs.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap, provides coverage for out-of-pocket costs that are required by Original Medicare (Medicare Part A and Part B) such as deductibles, copayments and coinsurance.

How old do you have to be to get Medicare Supplement?

You must be enrolled in Medicare Part A and Part B before you can apply for Medicare Supplement Insurance Plan G. And you must be at least 65 years old to purchase Medigap in some but not all states. Lastly, you must live in the area that is serviced by the plan. While Medigap can be used anywhere that Original Medicare is accepted, it can only be purchased in the county or zip code in which you reside.

How long does Medicare open enrollment last?

This period begins the month you are 65 years old and enrolled in both Medicare Part A and Part B. Your Medigap Open Enrollment Period lasts for six months.

What is the most popular Medicare plan?

Currently, Plan F is the most popular plan in terms of enrollment as it is the Medigap plan with the most coverage. However, Plan F is only available to beneficiaries who became eligible for Medicare prior to January 1, 2020. Anyone who became eligible for Medicare on or after that date may not purchase Plan F.

How many versions of Medigap Plan G are there?

There are two version of Medigap Plan G: a standard version and a high-deductible version.

Which Medicare plan has the most coverage?

After Plan F, the plan with the most coverage is Plan G. So that leaves Plan G as the best Medicare Supplement Insurance plan for incoming Medicare beneficiaries.

What differentiates one Plan G from another?

The only thing that differentiates one Plan G from another is the cost and any extra incentives the carrier may offer in exchange for your enrollment – such as SilverSneakers membership or discounts for multiple policyholders form the same house – which some insurance companies may offer.