Plan N is the final Medicare Supplement plan available from AARP. It covers the following benefits: 100% of your coinsurance payments for inpatient hospital care (After you’ve used up your Part A benefits, Plan A will cover up to 365 additional days.) * Certain Part B copays do not qualify for coverage under Plan N.

Does AARP offer the best Medicare supplemental insurance?

Plan N is one of the newest Medicare plans. AARP (Insured by UnitedHealthcare Insurance Company) offers it some areas (see above) because it helps seniors fill the gaps in their original Medicare benefits in a unique way. Unlike Plan F and Plan G, with a Medicare Plan N policy, you'll make a copayment of up to $20 for some doctor visits and up to $50 for emergency room care …

Is AARP a Medicare Advantage plan?

Dec 04, 2021 · Hospital Services for Medicare Part A: Covers the Part A deductible of $1,556 for the first 60 days, $389 per day for days 61 to 90, and $778 per day for days 91 and beyond while using 60 lifetime reserve days. Once lifetime reserve days have been used, 100% of eligible costs are covered for 365 days more.

How much does AARP Medicare supplemental insurance cost?

What Does Plan N Cover? Plan N covers the following: Part A deductibles; Part B copayments or coinsurance, except for a copayment of $20 for some office visits and a $50 copayment for emergency room visits that do not result in a hospital admission; Part A copayments and additional 365 day of hospitalization after Medicare Part A benefits are used up;

What are the basic benefits in a Medicare supplement plan?

Jan 04, 2022 · AARP Medicare Supplement Plan N. Plan N is the final Medicare Supplement plan available from AARP. It covers the following benefits: 100% of your coinsurance payments for inpatient hospital care (After you’ve used up your Part A benefits, Plan A will cover up to 365 additional days.) 100% of your coinsurance or copayments for hospice care

What is difference between Plan G and N?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

What is United Healthcare Plan N?

Like the other nine Medigap plans, Plan N is a privately administered type of Medicare supplement insurance. It's designed to help you cover specific out-of-pocket costs for your healthcare that Medicare Part A and Medicare Part B don't cover.

Does AARP Medicare Supplement Plan N cover dental?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing.May 12, 2020

What is the difference between Medigap Plan D and Plan N?

The benefits of Medigap Plan N are similar to Plan D's policy, the sole exception being how it covers Medicare Part B coinsurance costs. Under Medigap Plan N, 100% of the Part B coinsurance costs are covered, except up to a $20 copayment for office visits and up to $50 for emergency room visits.

Does Plan N have a deductible?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor's office and emergency room visits.Nov 23, 2021

What does a plan n cover?

Plan N covers the following benefits: Medicare Part A hospital coinsurance and other costs up to an additional 365 days after Original Medicare benefits are exhausted. Medicare Part A hospice care coinsurance or copayment. Medicare Part A deductible.

Is Plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

What are the copays for Plan N?

With Plan N, you are responsible for copayments up to $20 when you visit the doctor's office (or up to $50 for emergency room visits). You are also responsible for any excess charges, the additional amount a doctor may charge for services above what Medicare covers.Oct 1, 2021

Can I switch from Plan N to Plan G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

Does Medicare Supplement Plan N cover Part A deductible?

Similar to Medicare Supplement Plan G in many ways, Medicare Supplement Plan N offers major cost-sharing benefits to policyholders. These benefits include: Medicare Part A coinsurance. Medicare Part A deductible.Mar 2, 2022

Can you switch from Plan N to Plan G without underwriting?

You can change Medigap carriers, while keeping the same level of coverage, during the months surrounding your Medigap anniversary. For example, you can switch from a Plan G to a Plan G without underwriting, but not from a Plan G to a Plan N.Jan 30, 2021

Does Medigap cover Part A deductible?

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles. These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia.

What are the features of Medicare Supplement plans?

Helps cover some out-of-pocket costs that Original Medicare doesn’t pay.See any doctor who accepts Medicare patients.No referrals needed to see a s...

What Medicare Supplement plans are available?

Medicare Supplement plans are often called “Medigap.” There are ten standardized Medicare Supplement plans.Each plan has a letter assigned to it. E...

What does each Medicare Supplement plan cover?

Each of the Medicare Supplement plans offers a varying level of coverage. See what plans match up with the coverage you want.

What are the benefits of AARP?

Benefits of AARP Medicare Plans 1 Coverage provided for anywhere in the U.S. 2 You can use any doctor who accepts Medicare, including your current doctor 3 No referrals are necessary 4 Your policy can’t be canceled, or your premium increased, because of health problems 5 A supplement plan can be combined with Medicare Part D to help lower your prescription drug costs 1

What is Plan K for Medicare?

Plan K. Plan K is similar to Plan C, but it pays only 50% rather than 100% of certain costs. Hospital Services for Medicare Part A: Plan K pays only 50%—or $742—of the $1,484 Part A deductible. Regarding care at a skilled nursing facility, it pays up to $92.75, instead of $185.50, per day for days 21 to 100.

How much is Medicare Part A deductible?

Plan A. Hospital Services for Medicare Part A: With Plan A, you are responsible for the Part A deductible of $1,484 for the first 60 days of hospitalization. This plan includes semiprivate room and board and general nursing costs. For days 61 to 90, the plan pays the $371 per day that Medicare does not cover.

How much does Medicare pay for hospitalization?

Hospital Services for Medicare Part A: Plan B pays the $1,484 deductible for Part A for the first 60 days of hospitalization. It then acts like Plan A. For days 61 to 90, Plan B pays the $371 per day that Medicare doesn't cover. For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days.

Does Plan G cover Part B?

Plan G. Plan G does not cover one item Plan C covers, but it does cover one item Plan C doesn't cover: Plan G does not cover the Part B deductible of $203. However, like Plan F, it covers 100% of Part B excess medical expense charges above the Medicare-approved amounts. 6 .

How much does Plan B pay?

For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days. After the lifetime reserve days are used, Plan B continues to pay 100% of Medicare-eligible expenses for an additional 365 days. After that period, you are responsible for all costs. If you have been in the hospital for at least three days ...

Is UnitedHealthcare part of AARP?

Here is a brief overview of the AARP Medical Supplement Plans offered by UnitedHealthcare, which is part of UnitedHealth Group Inc. Note that specific coverage, co-insurance, co-payments, and deductibles may vary by state.

Do I Have to Enroll in Part B?

AARP Medigap plans require you to enroll in Part B. The Part B premium for most people is $135.50 per month in 2019.

What About Medicare Advantage?

Medicare Advantage Plans are covered by Part C of the Medicare statute. They are not Medigap plans; rather, they are a replacement for Original Medicare, Parts A and B.

Does Plan N Have an Out-of-pocket Limit?

No. Only Medigap plans K and L have out-of-pocket limits. (Original Medicare has no out-of-pocket limit also. Medicare Advantage plans do have such limits.)

Can I Use Any Doctor or Hospital?

All Medigap policies allow you to use any doctor or hospital that accepts Medicare patients. Medicare Advantage plans usually restrict you to health care providers within their network.

Does AARP Have to Issue Me a Policy for Plan N?

That depends on whether you enroll during your initial enrollment period, which runs for six months from the time you are enrolled in Part B. During this period, AARP has to issue the policy and may not charge a higher premium for health conditions you may have. After this period, you may be refused a policy and/or the costs may be higher.

What is Changing in 2020?

Starting in 2020, Medigap plans are not allowed to cover the Part B deductible. (It’s $183 in 2019.) If you have a plan that covers the deductible that you enrolled in before 2020, you can keep that plan, and your part B deductible will be covered.

Now That I Know All This, What Should I Do?

Medicare can be complicated, and it does not cover everything. Talking to a professional insurance agent can help you determine what choice is best for your individual situation. Go to MedicareHealthInsuranceFacts.com or call (877) 829-1109 to discuss your options with a licenses insurance agent.

What is Medicare Supplement?

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as "Medigap", are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits.

How long does Medicare cover hospital coinsurance?

Part A coinsurance, and most plans include a benefit for the Part A deductible (which could be one of the largest out-of-pocket expenses if you need to spend time in a hospital.) Hospital coverage up to an additional 365 days after Medicare benefits are used up. Part A hospice/respite care coinsurance or copayment.

Does AARP endorse agents?

AARP does not employ or endorse agents, brokers or producers. AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products. AARP® Medicare Supplement Insurance Plans.

What is AARP insurance?

AARP is a nonprofit, membership organization. It offers medical supplement insurance plans through the United Healthcare insurance company. The plans, also known as Medigap, help people pay for out-of-pocket medical expenses that original Medicare does not cover. This article looks at the various AARP medical supplement insurance plans.

How much does AARP cost?

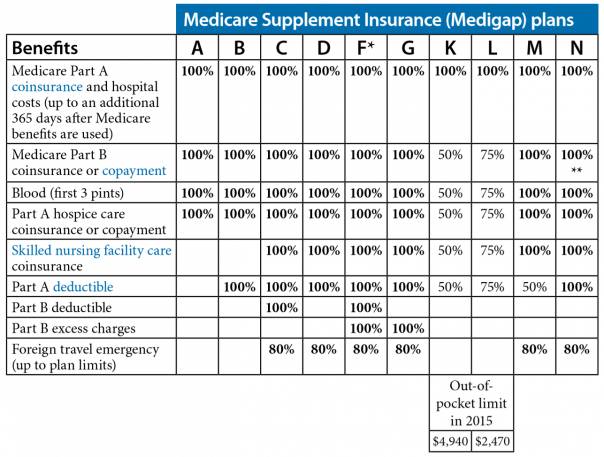

AARP membership $12 the first year, and then $16 annually. When someone has an AARP Medigap plan, they can use any Medicare-approved doctor or healthcare provider across the U.S. Medicare standardizes the coverage for each Medigap plan. The table below shows some of the benefits covered through the AARP Medigap plans.

How does Medigap work?

The premiums for AARP Medigap plans vary depending on a person’s location, and on the method a company uses to set prices. The three systems include: 1 community rated, where everyone who has the policy pays the same premium, regardless of their age 2 issue-age rated, where the premium is based on a person’s age when they first get a policy, but does not increase because of age 3 attained-age rated, where the premium is age-related and may increase as a person gets older

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

Does Medicare cover copays?

Original Medicare pays a proportion of covered healthcare costs. However, Medicare beneficiaries must also pay copays, coinsurance, and an annual deductible. Private insurance companies sell supplement insurance plans, known as Medigap, to fill these payment gaps. However, Medigap policies do not cover all healthcare costs.

What states have Medigap plans?

Each plan of the same letter must offer the same benefits across all the states, with the exception of Massachusetts, Minnesota, and Wisconsin. However, costs can vary from state to state, and between the different insurance companies.

Does Medicare cover hearing aids?

Typically, they do not include services such as long-term care, vision or dental care, or private-duty nursing. They also may not cover hearing aids or eyeglasses. Depending on where a person lives and when they became eligible for Medicare, they can choose from up to 10 different Medigap policies.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N coverage is one of 10 federally standardized options to help fill “gaps” in original Medicare coverage. It’s an option for people who want broad coverage but, to lower their premiums, are willing to pay for some copays and a small annual deductible.

How many Medigap plans are there?

There are 10 different Medigap Plans (A, B, C, D, F, G, K, L, M, N) which all feature different coverage and have different premiums. This selection allows you to choose coverage based on your needs and budget.

Does Medicare Part D cover dental?

If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan. You can have either a Medicare Advantage plan or a Medigap Plan; you can’t have both.

Is Medigap standardized?

Standardization. Medigap plans are standardized the same way in 47 of the 50 states. If you live in Massachusetts, Minnesota, or Wisconsin, Medigap policies (including Medicare Supplement Plan N coverage) are standardized differently.