The AARP recommends the use of various medical alert systems, though it does not endorse specific companies. The group leaves seniors to decide which device they want to use based on their own individual needs. And for AARP members, there are often discounts given on these systems.

Full Answer

Is AARP Medicare Advantage a replacement plan?

Before you choose a Medicare plan, think about your options carefully. Read through the information that is available on all the plans. Talk to your doctor and friends who have Medicare. Compare the costs, benefits and quality of the plans you are considering.

What is the best Medicare supplement plan?

Jan 24, 2022 · In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it's $209 for those aged 85. For Plan K, our recommendation for a cheap Medicare Supplement plan, the monthly costs range from $58 to $98.

What are the advantages of AARP?

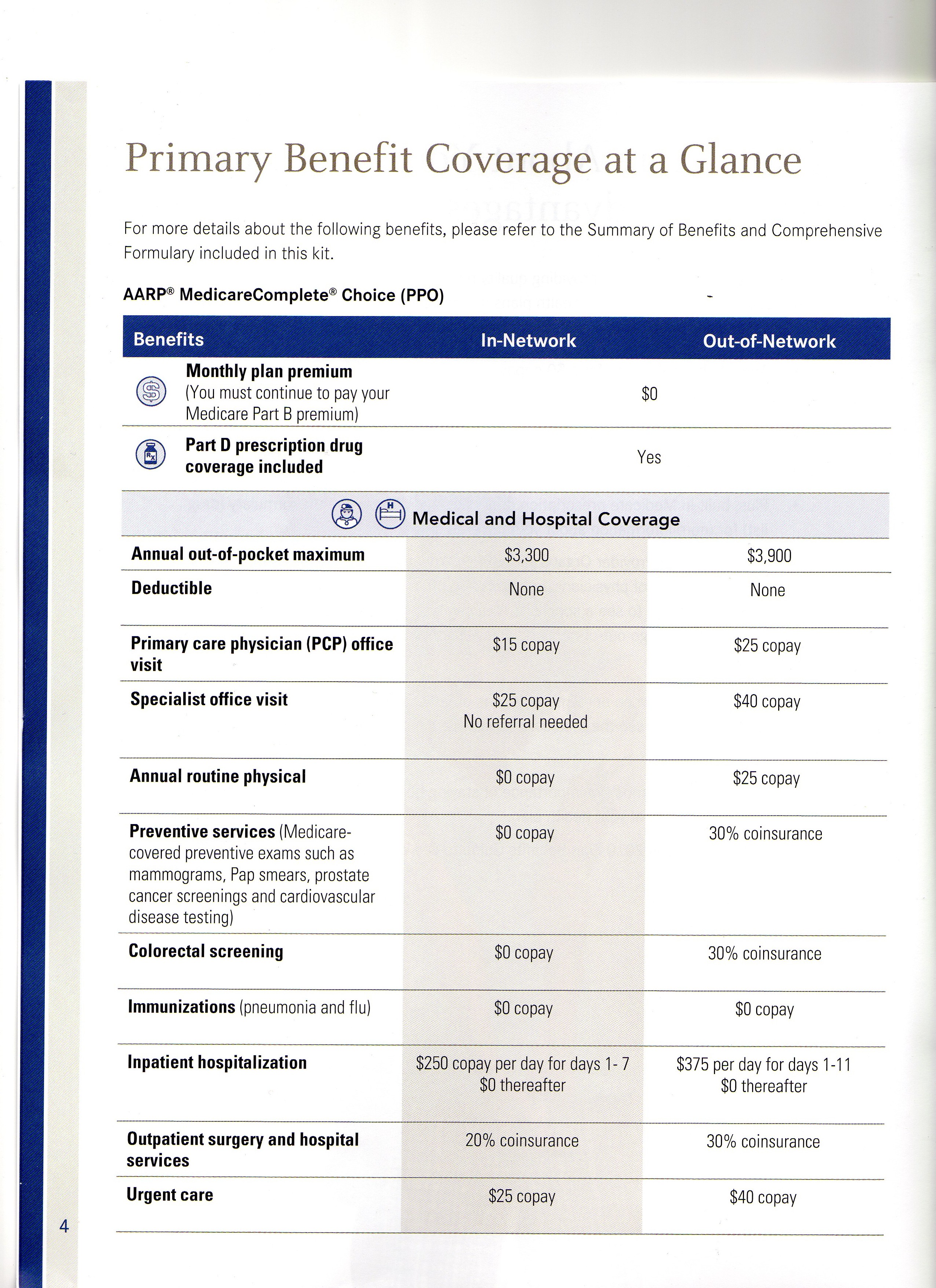

Medicare Advantage plans cannot charge you higher premiums, deductibles or copays on the basis of your current state of health or preexisting medical conditions. Note that Medicare supplemental insurance (Medigap) does not work with Medicare Advantage plans, and therefore you pay any out-of-pocket expenses (copays, deductibles) yourself.

What does AARP Medicare supplement plan I cover?

Apr 12, 2022 · AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products. AARP ® Medicare Supplement Insurance Plans. AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

Is AARP good for Medicare?

They're some of the best Medicare Supplement plans available, and they're also the most popular plans, with about 32% of Medicare Supplement subscribers having an AARP/UnitedHealthcare plan. Insurance policyholders must be AARP members, and you can join during your insurance application if you're not already a member.Jan 24, 2022

Are AARP Medigap plans good all over the country?

Because Medicare Supplement insurance is standardized among nearly all U.S. states, these features and benefits of specific AARP Medicare Supplement plans are the same as with any other carrier. You can receive care anywhere in the United States.Oct 21, 2020

How do I know which Medicare plan is best for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

Which Medicare Supplement plan is the most popular?

Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible — $233 for 2022 — before insurance benefits will begin to pay for your health care. Plan G is the most popular Medicare Supplement for new enrollees.Mar 16, 2022

Why does AARP recommend UnitedHealthcare?

From our long-standing relationship with AARP to our strength, stability, and decades of service, UnitedHealthcare helps make it easier for Medicare beneficiaries to live a happier, healthier life.

Does UnitedHealthcare plan G have a deductible?

The standard version of Plan G has no deductible, which means your Plan G coverage will begin with the very first dollar spent on covered care. The high-deductible version features a deductible of $2,370 (in 2021) that must be met before the plan coverage kicks in.Sep 21, 2021

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Is there a site that compares Medicare plans?

Plan Finder makes it easy to view, filter and compare these benefits. For the most complete and detailed information, you should contact the plans you're interested in directly. Contact information is available in Plan Finder. Learn more about Medicare coverage options before you see plans.Oct 15, 2019

What does Medicare Part D include?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan's list of covered drugs is called a “formulary,” and each plan has its own formulary.

What is the most popular Medigap plan for 2021?

Medigap Plans F and G are the most popular Medicare Supplement plans in 2021.Oct 6, 2021

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

What is the average cost of a Medicare Supplement plan?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

Is AARP supplemental insurance good?

A supplemental insurance plan from AARP/UnitedHealthcare is a good value. It can help you reduce your out-of-pocket costs for medical care, and it...

Is AARP the same as UnitedHealthcare?

An AARP Medicare policy gives you insurance through UnitedHealthcare. There is a business agreement between the two companies where AARP provides m...

Does AARP pay the Medicare deductible?

Deductible coverage will vary based on the plan you choose. The Medicare Part A deductible is fully covered by Medigap Plan B, D, G and N, and it's...

What is AARP Medicare Supplement Plan F?

Medicare Supplement Plan F has the highest enrollment and very strong coverage, but it's only available to those who were eligible for Medicare bef...

What are the features of Medicare Supplement plans?

Helps cover some out-of-pocket costs that Original Medicare doesn’t pay.See any doctor who accepts Medicare patients.No referrals needed to see a s...

What Medicare Supplement plans are available?

Medicare Supplement plans are often called “Medigap.” There are ten standardized Medicare Supplement plans.Each plan has a letter assigned to it. E...

What does each Medicare Supplement plan cover?

Each of the Medicare Supplement plans offers a varying level of coverage. See what plans match up with the coverage you want.

Our thoughts: Why we recommend AARP Medicare Supplement

Medicare Supplement Insurance (also called Medigap) plans from AARP/UnitedHealthcare are a good choice for most people. The customer service rating is not as strong as that of some other companies. However, the wide range of policy selections makes it easy to choose the best plan for you, and the AARP endorsement can give you peace of mind.

How do AARP Medicare Supplement plans work?

When you buy an AARP Medicare Supplement Insurance plan, you’re actually getting a policy from UnitedHealthcare. As part of the business agreement, AARP endorses and does marketing for select UnitedHealthcare plans, and in turn, AARP gets an estimated 4.95% fee for each plan sold.

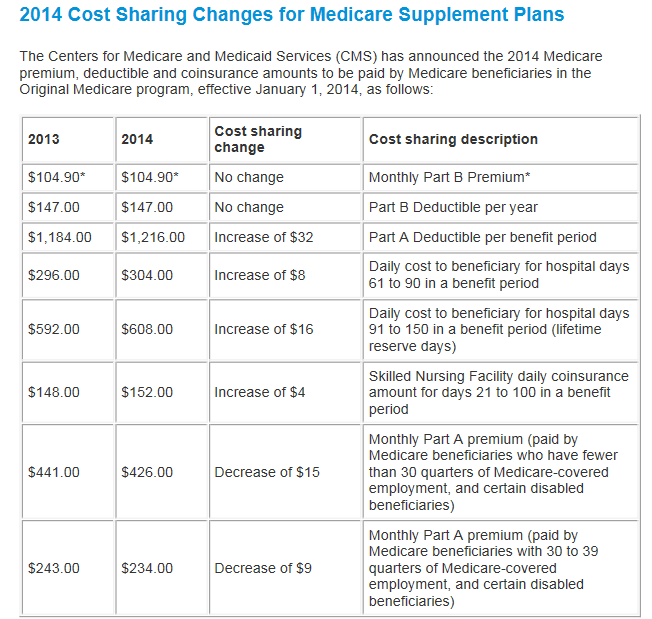

Medigap costs vary by state

Costs for supplemental plans vary widely. To a large degree, this is due to state differences in pricing regulations.

How AARP Medigap costs compare to other insurance companies

Because of the variable plan structures, it can be difficult to compare costs, and the most accurate comparison will be based on insurance quotes for your location and situation . In states where prices change as you age, the different formulas for price increases can affect your total lifetime costs.

Customer reviews and satisfaction

AARP/UnitedHealthcare has mediocre customer reviews with several metrics indicating user complaints and frustrations.

Frequently asked questions

A supplemental insurance plan from AARP/UnitedHealthcare is a good value. It can help you reduce your out-of-pocket costs for medical care, and it includes discounts on vision, dental, hearing, gym membership and more.

Sources and methodology

The above comparisons are based on plan coverage levels, policy details, third-party rankings and sample cost data for 2021. Price quotes for a female nonsmoker were analyzed based on age, location and provider.

What is Medicare Advantage Part C?

En español | The Medicare Advantage program (Part C) gives people an alternative way of receiving their Medicare benefits. The program consists of many different health plans (typically HMOs and PPOs) that are regulated by Medicare but run by private insurance companies.

Does Medicare have a monthly premium?

Plans usually charge monthly premiums ( in addition to the Part B premium), although some plans in some areas are available with zero premiums. These plans must offer the same Part A and Part B benefits that Original Medicare provides, and most plans include Part D prescription drug coverage in their benefit packages.

What is Medicare Supplement?

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as "Medigap", are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits.

How long does Medicare cover hospital coinsurance?

Part A coinsurance, and most plans include a benefit for the Part A deductible (which could be one of the largest out-of-pocket expenses if you need to spend time in a hospital.) Hospital coverage up to an additional 365 days after Medicare benefits are used up. Part A hospice/respite care coinsurance or copayment.

Does AARP endorse agents?

AARP does not employ or endorse agents, brokers or producers. AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products. AARP® Medicare Supplement Insurance Plans.