Medicare Part A In 2018 Original Medicare comprises Parts A and B. Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice Hospice care is a type of care and philosophy of care that focuses on the palliation of a chronically ill, terminally ill or seriously ill patient's pain and symptoms, and attending to their emotional and spiritual needs. In Western society, the concept of hospice has been evolving in Europe since the 11…Hospice

What is Medicare Part A in 2018?

· Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017.

What do Medicare health plans cover?

Medicare Part A In 2018 Original Medicare comprises Parts A and B. Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare.

What is the Medicare Part a hospital deductible for 2018?

Medicare provides a lifetime reserve of 60 days that you can use for stays of longer than 90 days, and you'll pay a daily copayment of $670 for days used in 2018. Skilled nursing costs have...

How much do Medicare Advantage plans cost in 2018?

Medicare covers medical services and supplies in hospitals, doctors’ offices, and other health care settings. Services are either covered under Part A or Part B. Coverage Plans must cover …

What was Medicare deductible for 2018?

The Medicare Part B deductible, which covers physician and outpatient services, will remain at $183 for 2018.

How do you find out what is covered by Medicare?

For general information on what Medicare covers, visit Medicare.gov, or call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048.

What services Medicare does not cover?

Some of the items and services Medicare doesn't cover include:Long-Term Care. ... Most dental care.Eye exams related to prescribing glasses.Dentures.Cosmetic surgery.Acupuncture.Hearing aids and exams for fitting them.Routine foot care.

What is the 2019 Medicare deductible?

(Note: Most Medicare beneficiaries are exempt from paying the Medicare Part A premium since they or their spouse paid into Medicare while working.) The 2019 Part A deductible is $1,364 — $24 more than in 2018.

Is surgery covered by Medicare?

Yes. Medicare covers most medically necessary surgeries, and you can find a list of these on the Medicare Benefits Schedule (MBS). Since surgeries happen mainly in hospitals, Medicare will cover 100% of all costs related to the surgery if you have it done in a public hospital.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Does Medicare pay for everything?

Original Medicare (Parts A & B) covers many medical and hospital services. But it doesn't cover everything.

Does Medicare cover 100% of costs?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Does Medicare cover eye exams?

Eye exams (routine) Medicare doesn't cover eye exams (sometimes called “eye refractions”) for eyeglasses or contact lenses. You pay 100% for eye exams for eyeglasses or contact lenses.

What is the maximum out of pocket expense with Medicare?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

Can you deduct Medicare Part B premiums from your taxes?

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums (including premiums for Medicare Part B – and Part A, for people who have to pay a premium for it – Medigap, Medicare Advantage plans, and Part D) from their federal taxes, and this includes Medicare premiums for their spouse.

What are the annual premiums for Part B coverage in 2019 and 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019.

How Much Do Medicare Part A Premiums and Deductibles Cost?

For most people, Medicare Part A coverage comes without any monthly premium. As long as you paid Medicare payroll taxes during your career or you'r...

What Does Medicare Part A Cover?

Medicare Part A covers two basic categories of expenses: hospital costs and expenses for a skilled nursing facility outside of a hospital. If you n...

How Much Are Copayments Under Part A?

Medicare doesn't charge copayments on all Part A expenses. For the first 60 days of a hospital stay, you won't owe a copayment. After that, Medicar...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A annual inpatient hospital deductible ...

How much is the Part B premium in 2018?

The 30 percent of all Part B enrollees who are not subject to the “hold harmless” provision will pay the full premium of $134 per month in 2018. Part B enrollees who were held harmless in 2016 ...

What is the deductible for Medicare Part B?

The annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B ...

What is the Medicare Part B premium?

Medicare Part B Premiums/Deductibles. Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017.

How much is Medicare Part A deductible?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

When did Medicare Part A and B premiums come out?

2018 Medicare Parts A & B Premiums and Deductibles. On November 17, 2017 , the Centers for Medicare & Medicaid Services (CMS) released the 2018 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

How much will Social Security increase in 2018?

After several years of no or very small increases, Social Security benefits will increase by 2.0 percent in 2018 due to the Cost of Living adjustment.

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

What is the donut hole in Medicare?

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

Does Medicare Part B have higher income?

Of course, higher-income enrollees are subject to even higher rates for Medicare Part B. If you earn above the standard income threshold, then you’ll be charged an “Income-Related Monthly Adjustment Amount” (IRMAA) along with the standard premium. When determining income, Medicare uses income information from the IRS, which dates two years back. In 2018, income determinations will be based on what you earned in 2016.

Find out more about your Medicare hospital benefits

Older Americans rely on Medicare for much of their healthcare, but it can be hard to understand Medicare's rules. With participants having to juggle how Medicare Parts A, B, C, and D all fit together, you can easily get confused about how much each part of your Medicare coverage costs and what you're getting for your hard-earned money.

How much do Medicare Part A premiums and deductibles cost?

For most people, Medicare Part A coverage comes without any monthly premium. As long as you paid Medicare payroll taxes during your career or you're married to someone who paid those taxes, then you'll likely qualify for Part A at no cost.

What does Medicare Part A cover?

Medicare Part A covers two basic categories of expenses: hospital costs and expenses for a skilled nursing facility outside of a hospital.

How much are copayments under Part A?

Medicare doesn't charge copayments on all Part A expenses. For the first 60 days of a hospital stay, you won't owe a copayment. After that, Medicare charges $335 per day in 2018 for days 61 to 90 of the stay.

What does Medicare cover in hospital?

Hospital care (inpatient care) . Medicare covers semi-private rooms, meals, general nursing, and drugs as part of your inpatient treatment, and other hospital services and supplies. This includes care you get in acute care hospitals, . critical access hospitals, .

When will Medicare change coverage?

Change your Medicare health or prescription drug coverage for 2018, if you decide to. January 1, 2018 . New coverage begins if you made a change. New costs and benefit changes also begin if you keep your existing Medicare health or prescription drug coverage and your plan makes changes.

What is a Medigap policy?

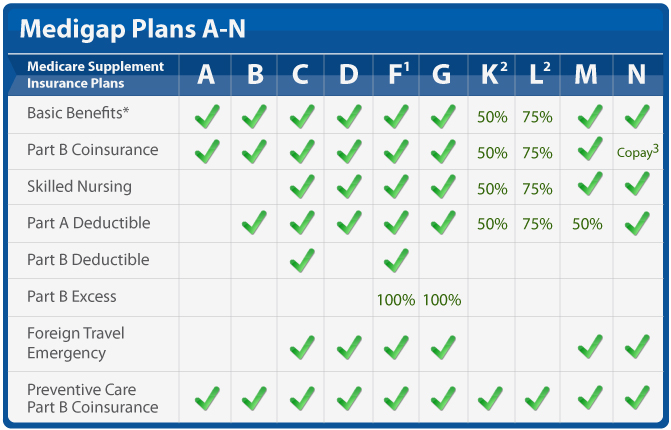

a Medigap policy to help pay your out-of-pocket costs in Original Medicare, like your

When will Medicare cards be mailed?

Cards will be mailed between April 2018 – April 2019. You asked, and we listened. You’re getting a new Medicare card! Between April 2018 and April 2019, we’ll be removing Social Security Numbers from Medicare cards and mailing each person a new card.

How many choices are there for Medicare?

There are 2 main choices for how you get your Medicare coverage. These choices will be explained in more detail on the next page and throughout this book.

Does Medicare cover CPAP machine?

If you had a CPAP machine before you got Medicare, Medicare may cover rental or a replacement CPAP machine and/or CPAP accessories if you meet certain requirements. If you live in certain areas of the country, you may have to use specific suppliers for Medicare to pay for a CPAP machine and/or accessories.

Does Medicare change your card number?

You’ll get a new Medicare Number that’s unique to you, and it will only be used for your Medicare coverage. The new card won’t change your coverage or benefits. You’ll get more information from Medicare when your new card is mailed.

What is Medicare Part A?

Under Medicare Part A, hospital care as well as some nursing home, rehabilitation, mental health, and hospice care are generally covered. However, you may have to meet certain qualifications. Inpatient hospital care. Medicare Part A covers general nursing services, a semi-private room, meals, medical supplies, and certain medications.

What are the different parts of Medicare?

Here’s a quick rundown of the “parts” of Medicare, and the choices you may have about your Medicare coverage. Medicare Part A and Part B make up Original Medicare. Many people are automatically enrolled in Part A and Part B. You may be automatically enrolled if you’re receiving Social Security retirement or disability benefits when you qualify ...

What is skilled nursing in Medicare?

Skilled nursing facility care. Medicare covers room, board, and a range of skilled nursing services provided in a skilled nursing facility . This may include certain medications, tube feedings, and wound care, among other approved services.

How many days of home health care is covered by Medicare?

Medicare covers up to 100 days of part-time daily care or intermittent care if medically necessary. You must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care. If you don’t qualify for home health care coverage under Part A, you might have Medicare coverage under Part B.

Is Medicare Part D a stand alone plan?

As a stand-alone Medicare Part D prescription drug plan, for those enrolled in Medicare Part A and/or Part B. As part of a Medicare Advantage Prescription Drug plan. As with other Medicare coverage, you may need to pay coinsurance or copayments – and possibly monthly premiums and annual deductibles.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage plans must offer you at least the same level of Medicare coverage as Part A and Part B. Frequently, Medicare Advantage plans combine Medicare coverage for prescription drugs along with medical benefits. Some Medicare Advantage plans offer additional benefits to standard Medicare coverage.

Does Medicare pay for hospital care?

Usually Medicare Part A doesn’t pay the full cost of your hospital-related care. You will likely have to pay your share of the Medicare-approved amount for services Medicare covers. The portions you pay are deductibles and coinsurance or copayments. Also, there are time limits – after a certain amount of time as an inpatient within one year, you may have to pay all costs. Learn more about Medicare costs.

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What does Medicare cover?

Medicare coverage: what costs does Original Medicare cover? Here’s a look at the health-care costs that Original Medicare (Part A and Part B) may cover. If you’re an inpatient in the hospital: Part A (hospital insurance) typically covers health-care costs such as your care and medical services. You’ll usually need to pay a deductible ($1,484 per ...

What type of insurance is used for Medicare Part A and B?

This type of insurance works alongside your Original Medicare coverage. Medicare Supplement insurance plans typically help pay for your Medicare Part A and Part B out-of-pocket costs, such as deductibles, coinsurance, and copayments.

How long does Medicare pay for hospital visits?

Remember those Part A costs you have to pay when you’ve been a hospital inpatient longer than 90 days? Medicare Supplement insurance plans typically pay up to 365 days of hospital costs when your Part A benefits are used up. (Under Medicare Supplement Plan N, you might have to pay a copayment up to $20 for some office visits, and up to $50 for emergency room visits if they don’t result in hospital admission.) Learn more about Medicare Supplement insurance plans.

How much is a deductible for 2021?

You’ll usually need to pay a deductible ($1,484 per benefit period* in 2021). You pay coinsurance or copayment amounts in some cases, especially if you’re an inpatient for more than 60 days in one benefit period. Your copayment for days 61-90 is $371 for each benefit period in 2021.

What are the benefits of Medicare Advantage?

Most Medicare Advantage plans include prescription drug coverage, and many plans offer extra benefits. Routine vision and dental services and acupuncture are examples of some of the benefits a Medicare Advantage plan might offer.

How much is coinsurance for Medicare?

For example, if the Medicare-approved amount for a doctor visit is $85, your coinsurance would be around $17, if you’ve already paid your Part B deductible.

What does Part B cover?

Part B typically covers certain disease and cancer screenings for diseases. Part B may also help pay for certain medical equipment and supplies.