What happens if a Medicare beneficiary has other health insurance?

When a Medicare beneficiary has other insurance (like employer group health coverage), rules dictate which payer is responsible for paying first. Please review the Reporting Other Health Insurance page for information on how and when to report other health plan coverage to CMS.

What is a Medicare beneficiary?

A Medicare beneficiary is someone aged 65 years or older who is entitled to health services under a federal health insurance plan.

What happens if Medicare denies my claim?

If Medicare denies payment, you’re responsible for paying, but since a claim was submitted, you can appeal to Medicare.

What happens if Medicare does not pay for home health care?

When the home health agency believes that Medicare may not pay for certain home health items and services or all of your home health care, the agency should give you an “Advance Beneficiary Notice of Noncoverage.”. See page 23 for more information on the “Advance Beneficiary Notice of Noncoverage.” 26 2How do I appeal if I have Original Medicare?

What are some problems with Medicare?

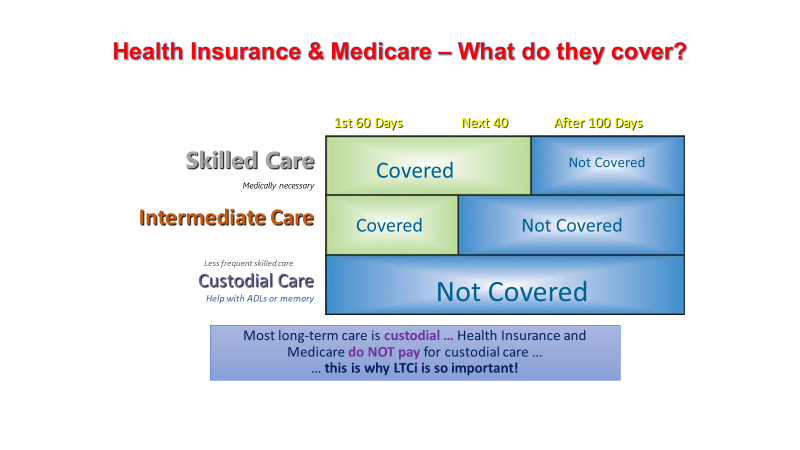

"Medicare is not complete coverage. It doesn't include dental, vision and hearing. It doesn't cover long-term care. There can be high out-of-pocket costs if you don't have supplemental coverage, and supplemental coverage in Medicare is complicated," said Roberts, who wrote an editorial that accompanied the new study.

What provides information for Medicare beneficiaries?

Beneficiaries and their representatives can request specific case status information by contacting the Benefits Coordination & Recovery Center (BCRC) Monday through Friday, from 8:00 a.m. to 8:00 p.m., Eastern Time, except holidays, at toll-free lines: 1-855-798-2627 (TTY/TDD: 1-855-797-2627 for the hearing and speech ...

Does Medicare cover beneficiaries?

The Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. In 2017, 7.7 million people (more than one out of eight people with Medicare) were in the QMB program.

What does beneficiary mean in Medicare?

Beneficiary means a person who is entitled to Medicare benefits and/or has been determined to be eligible for Medicaid. CMP stands for competitive medical plan. Conditions of participation includes requirements for participation as the latter term is used in part 483 of this chapter.

What are 3 rights everyone on Medicare has?

— Call your plan if you have a Medicare Advantage Plan, other Medicare health plan, or a Medicare Prescription Drug Plan. Have access to doctors, specialists, and hospitals. can understand, and participate in treatment decisions. You have the right to participate fully in all your health care decisions.

Which of the following is not true about Medicare?

Which of the following is not true about Medicare? Medicare is not the program that provides benefits for low income people _ that is Medicaid. The correct answer is: It provides coverage for people with limited incomes.

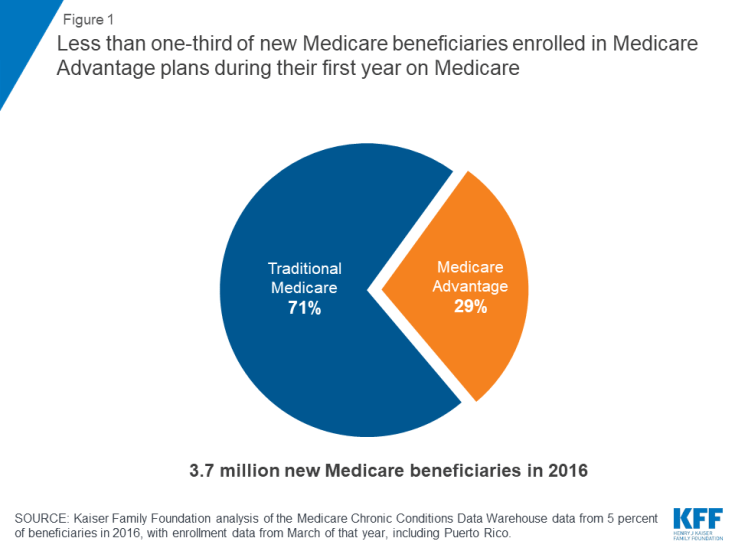

What was the purpose of offering Medicare Advantage to Medicare beneficiaries?

While original Medicare has plenty to offer, a market for high-performing, quality private health plans has emerged, giving insurers an incentive to provide optimal, reasonably priced coverage in the form of Medicare Advantage (MA) plans.

What is Medicare responsibility?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Are beneficiaries?

A beneficiary is the person or entity you name in a life insurance policy to receive the death benefit.

What are health care beneficiaries?

a person who receives benefits under health care insurance through the medicare or medicaid program.

What is the meaning of beneficiary details?

Description. A beneficiary in the broadest sense is a natural person or other legal entity who receives money or other benefits from a benefactor. For example, the beneficiary of a life insurance policy is the person who receives the payment of the amount of insurance after the death of the insured.

How many Medicare beneficiaries are there?

Description: The number of people enrolled in Medicare varied by state. There were a total of 64.4 million Medicare beneficiaries in 2019.

What is Medicare beneficiary?

A Medicare beneficiary is someone aged 65 years or older who is entitled to health services under a federal health insurance plan. Although Medicare beneficiaries are typically seniors, those who are younger than 65 years of age can still qualify for Medicare benefits if they meet certain qualifications, such as being a recipient ...

What are the benefits of Medicare?

There are four kinds of Medicare coverage that a Medicare beneficiary can avail themselves of: 1 Medicare A: U.S. citizens are automatically eligible for this coverage when they turn 65. There is no premium for this plan and it covers most of the cost of hospitalization. 2 Medicare B: To qualify for this plan, the beneficiary must pay a premium. It will pay for outpatient treatment, doctor's services, and prescribed drugs. 3 Medicare C: Medicare C plans are offered through private insurance companies that are approved by the Medicare program. Some Medicare C plans provide vision and dental care. 4 Medicare D: Like Medicare C, this plan is offered through approved private insurance companies. It provides coverage for prescriptive drugs.

Does Medicare B cover outpatient care?

There is no premium for this plan and it covers most of the cost of hospitalization. Medicare B: To qualify for this plan, the beneficiary must pay a premium. It will pay for outpatient treatment, doctor's services, and prescribed drugs.

What happens when Medicare beneficiaries have other health insurance?

When a Medicare beneficiary has other insurance (like employer group health coverage), rules dictate which payer is responsible for paying first. Please review the Reporting Other Health Insurance page for information on how and when to report other health plan coverage to CMS.

What is Medicare for seniors?

Medicare is a health insurance program designed to assist the nation's elderly to meet hospital, medical, and other health costs. Medicare is available to most individuals 65 years of age and older.

How long does it take for Medicare to pay a claim?

When a Medicare beneficiary is involved in a no-fault, liability, or workers’ compensation case, his/her doctor or other provider may bill Medicare if the insurance company responsible for paying primary does not pay the claim promptly (usually within 120 days).

Does Medicare pay a conditional payment?

In these cases, Medicare may make a conditional payment to pay the bill. These payments are "conditional" because if the beneficiary receives an insurance or workers’ compensation settlement, judgment, award, or other payment, Medicare is entitled to be repaid for the items and services it paid.

How many people are confused by Medicare?

More than two-thirds of Medicare beneficiaries find their insurance confusing and difficult to understand, according to a recent survey by MedicareAdvantage.com, which also revealed that many don't grasp basic insurance terminology.

How many seniors are on Medicare?

"And when you consider that over 62.6 million Americans are enrolled in Medicare, there could be as many as 43 million seniors – including your parents, your grandparents, or even yourself – who fail to receive the best care for their needs simply by not fully understanding their own coverage," Worstell said in the study.

What percent of Medicare beneficiaries have no supplemental coverage?

Only 23 percent of Original Medicare beneficiaries have no supplemental coverage (either from Medicaid, an employer-sponsored plan, or Medigap). Louise Norris. January 10, 2020. facebook2.

What percentage of Medicare beneficiaries receive employer or union-sponsored benefits?

So for low-income Medicare beneficiaries, public programs are available to fill in the gaps in Medicare coverage. And 30 percent of Medicare beneficiaries receive employer or union-sponsored benefits that supplement Medicare. But what about the rest of the population?

How much does Medicare pay for hemodialysis?

Medicare Part B currently pays an average of about $235 per treatment for hemodialysis. That’s the 80 percent that Medicare pays, and the patient is responsible for the other 20 percent. Without supplemental insurance, that works out to a patient responsibility of about $60 per session.

Does Medicare have a cap on out of pocket costs?

There are certainly people who contend that even though Original Medicare has no cap on out-of-pocket costs, it is still plenty of coverage – and for the average enrollee, that’s probably true. But the purpose of insurance is to protect us against significant losses.

Is an MRI affordable with Medicare?

So although it’s true that normal-length hospital stays, regular office visits, and the odd MRI would be affordable for most people with just Original Medicare, there are certainly medical conditions that would be difficult for the average person to finance without supplemental coverage.

Can you get generic Medicare if you never get seriously ill?

If you never get seriously ill, and if you only ever need the occasional generic prescription, you’ll be fine with Original Medicare alone. But who among us can accurately predict whether or not a catastrophic medical condition will befall us at some point in the future?

How many Medicare beneficiaries have employer sponsored retirement?

Employer-sponsored Retiree Health Coverage. In total, 14.3 million of Medicare beneficiaries – a quarter (26%) Medicare beneficiaries overall — also had some form of employer-sponsored retiree health coverage in 2018. Of the total number of beneficiaries with retiree health coverage, nearly 10 million beneficiaries have retiree coverage ...

What is Medicare Advantage?

Medicare Advantage plans provide all benefits covered by Medicare Parts A and B, often provide supplemental benefits, such as dental and vision, and typically provide the Part D prescription drug benefit. Many traditional Medicare beneficiaries also rely on other sources of coverage to supplement their Medicare benefits.

How many people are covered by Medicare Supplement?

Medicare supplement insurance, also known as Medigap, provided supplemental coverage to 2 in 10 (21%) Medicare beneficiaries overall, or 34% of those in traditional Medicare (roughly 11 million beneficiaries) in 2018. As with other forms of supplemental insurance, the share of beneficiaries with Medigap varies by state.

How is supplemental coverage determined?

Sources of supplemental coverage are determined based on the source of coverage held for the most months of Medicare enrollment in 2018. The analysis excludes beneficiaries who were enrolled in Part A only or Part B only for most of their Medicare enrollment in 2018 (n=4.7 million) and beneficiaries who had Medicare as a secondary payer ...

Does Medicare have supplemental coverage?

No Supplemental Coverage. In 2018, 5.6 million Medicare beneficiaries in traditional Medicare– 1 in 10 beneficiaries overall (10%) or nearly 1 in 5 of those with traditional Medicare (17%) had no source of supplemental coverage. Beneficiaries in traditional Medicare with no supplemental coverage are fully exposed to Medicare’s cost-sharing ...

Does Medigap increase with age?

While Medigap limits the financial exposure of Medicare beneficiaries and provides protection against catastrophic expenses for services covered under Parts A and B, Medigap premiums can be costly and can rise with age, depending on the state in which they are regulated.

Does Medicare Part B cover Part B?

As of January 1, 2020, Medigap policies are prohibited from covering the full Medicare Part B deductible for newly-eligible enrollees; however, older beneficiaries who are already enrolled are permitted to keep this coverage.

What is the late enrollment penalty for Medicare Part B?

The late enrollment penalty for Medicare Part B is 10% of the cost of the Part B premium for each 12-month period that you were eligible for Medicare, but didn’t sign up.

What is Medicare Supplement Plan?

A Medigap plan helps pay for Medicare deductibles, coinsurance, copays and other out-of-pocket costs you face when you get Medicare-covered services.

Can not enrolling in Medicare leave holes in your pocket?

Not enrolling in the right Medicare plan for your needs can not only leave holes in your coverage , it can leave you with serious holes in your pocket as well. For example, if you wear hearing aids, try to enroll in a Medicare Advantage (Medicare Part C) plan that covers them.

Do you pay a premium for Medicare if you don't sign up?

Most people don’t pay a premium for Medicare Part A, but if you don’t qualify for premium-free Part A and don’t sign up when you’re first eligible, your monthly Part A premiums may go up by 10%. Plus, you’ll have to pay the penalty for twice the number of years you were eligible for Part A, but didn’t sign up.

Does Medicare have a network?

And private Medicare plans typically operate with a network of participating providers, much like employer-sponsored health insurance plans. If you get medical care outside of that network, you can find yourself responsible for a much higher percentage – or even the entire cost – of those services.

What is the ABN for Medicare?

If you have Original Medicare and your doctor, other health care provider, or supplier thinks that Medicare probably (or certainly) won’t pay for items or services, he or she may give you a written notice called an ABN (Form CMS-R-131).

What is a home health change of care notice?

The “Home Health Change of Care Notice” is a written notice that your home health agency should give you when your home health plan of care is changing because of one of these:

What to do if you are not satisfied with the IRE decision?

If you’re not satisfied with the IRE’s reconsideration decision, you may request a decision by OMHA, based on a hearing before an Administrative Law Judge (ALJ) or, in certain circumstances, a review of the appeal record by an ALJ or an attorney adjudicator.

Does CMS exclude or deny benefits?

The Centers for Medicare & Medicaid Services (CMS) doesn’t exclude, deny benefits to, or otherwise discriminate against any person on the basis of race, color, national origin, disability, sex, or age in admission to, participation in, or receipt of the services and benefits under any of its programs and activities, whether carried out by CMS directly or through a contractor or any other entity with which CMS arranges to carry out its programs and activities.

Do doctors have to give advance notice of non-coverage?

Doctors, other health care providers, and suppliers don’t have to (but still may) give you an “Advance Beneficiary Notice of Noncoverage” for services that Medicare generally doesn’t cover, like:

When Original Medicare Might Be Sufficient

Most Don’T Rely on Original Medicare Alone

- So for low-income Medicare beneficiaries, public programs are available to fill in the gaps in Medicare coverage. And 30%of Medicare beneficiaries receive employer or union-sponsored benefits that supplement Medicare. But what about the rest of the population? Is Original Medicare enough coverage on its own? Most Medicare beneficiaries don’t think so: Only 19% of …

Preventing Major Expenses

- There are certainly people who contendthat even though Original Medicare has no cap on out-of-pocket costs, it is still plenty of coverage – and for the average enrollee, that’s probably true. But the purpose of insurance is to protect us against significant losses. Although most hospitalizations last less than a week, my father was hospitalized for 136 days in 2004. With a si…

Feeling Lucky?

- If you never get seriously ill, and if you only ever need the occasional generic prescription, you’ll be fine with Original Medicare alone. But who among us can accurately predict whether or not a catastrophic medical condition will befall us at some point in the future? Although Original Medicare provides a solid insurance base, the lack of prescription coverage or an out-of-pocket …