2016 Medicare costs

| Medicare costs | 2015 | 2016 |

| Part A monthly premium | Up to $407 | Up to $411 |

| Part A inpatient hospital stay deductibl ... | $1,260 | $1,288 |

| Part A inpatient hospital stay co-insura ... | Days 61-90: $315 per day Days 91+: $630 ... | Days 61-90: $322 per day Days 91+: $644 ... |

| Part A skilled nursing facility co-insur ... | Days 21-100: $157.50 per day | Days 21-100: $161 per day |

Full Answer

How much does Medicare cost at age 65?

Aug 25, 2016 · If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90. Your 2016 monthly premium is typically $121.80 if any of the following is true for you: You enrolled in Medicare Part B in 2016 for the first time. You don’t receive Social Security benefits. You get a bill for the Part B premium.

How much does Medicare cost per month?

5 rows · Dec 16, 2020 · Most Medicare Part A costs will increase in 2016. The Part A costs that will increase ...

What is the monthly premium for Medicare Part B?

4 rows · Nov 10, 2015 · As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in ...

Who is eligible for Medicare Part B reimbursement?

Jan 16, 2016 · You get up to 60 over the course of your lifetime, and the copayment is $644 per day in 2016. Skilled nursing costs are handled differently. …

What was Medicare premiums in 2016?

| How Much You'll Pay for Medicare Part B in 2016 | ||

|---|---|---|

| Single Filer Income | Joint Filer Income | 2016 Monthly Premium |

| Up to $85,000 | Up to $170,000 | $121.80 or $104.90* |

| $85,001 - $107,000 | $170,001 - $214,000 | $170.50 |

| $107,001 - $160,000 | $214,001 - $320,000 | $243.60 |

What was the monthly cost of Medicare in 2017?

What was the cost of Medicare Part B in 2015?

What were Medicare premiums in 2015?

| If Your Yearly Income is | ||

|---|---|---|

| $85,000 or below | $170,000 or below | $104.90* |

| $85,001 - $107,000 | $170,001 - $214,000 | $146.90* |

| $107,001 - $160,000 | $214,001 - $320,000 | $209.80* |

| $160,001 - $214,000 | $320,001 - $428,000 | $272.70* |

What were Medicare premiums in 2018?

What is the Medicare Part B deductible 2018?

What was the Medicare Part B premium for 2014?

What was Medicare premium in 2013?

What are the Medicare income limits for 2022?

| If your yearly income in 2020 (for what you pay in 2022) was | You pay each month (in 2022) | |

|---|---|---|

| File individual tax return | File joint tax return | |

| $91,000 or less | $182,000 or less | $170.10 |

| above $91,000 up to $114,000 | above $182,000 up to $228,000 | $238.10 |

| above $114,000 up to $142,000 | above $228,000 up to $284,000 | $340.20 |

How much is Medicare Part B?

The Medicare Part B premium will remain the same at $104.90 per month for most individuals. The Social Security Administration recently announced that there will be no cost of living increase for 2016.

Do Part B beneficiaries have to pay higher premiums?

Some Part B beneficiaries will have to pay slightly higher premiums. These beneficiaries include those not collecting Social Security benefits, those who are enrolling in Part B in 2016 for the first time, dual-eligible beneficiaries, and those who pay an additional income-related premium.

Will Medicare Part B be held harmless?

Due to this, most Part B beneficiaries will be “held harmless” from premium increases in 2016, according to the CMS release. “Our goal is to keep Medicare Part B premiums affordable,” said Andy Slavitt, CMS Acting Administrator.

Will Medicare increase in 2016?

Medicare beneficiar ies will face higher Medicare costs in 2016. Several costs, including the Part A deductible, the Part A inpatient hospital stay co-insurance, and the Part B deductible will increase in 2016, according to a Centers for Medicare & Medicaid Services (CMS) news release .

Does Medicare Supplement cover out of pocket expenses?

Medicare Supplement insurance policies (also called Medigap plans) will cover some of the 2016 Medicare costs. Each Medigap plan covers different benefits. The table below shows which Medigap plans will cover certain Medicare out-of-pocket costs in 2016.

What is the Medicare deductible for 2016?

The Medicare Part A annual deductible that beneficiaries pay when admitted to the hospital will be $1,288.00 in 2016, a small increase from $1,260.00 in 2015. The Part A deductible covers beneficiaries' share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. The daily coinsurance amounts will be $322 for the 61 st through 90 th day of hospitalization in a benefit period and $644 for lifetime reserve days. For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 in a benefit period will be $161.00 in 2016 ($157.50 in 2015).

How much is Medicare Part B in 2016?

As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90. Beneficiaries not subject to the “hold harmless” provision will pay $121.80, as calculated reflecting the provisions of the Bipartisan Budget Act signed ...

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not pay a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the “hold-harmless” provision are those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2016, dual eligible beneficiaries who have their premiums paid by Medicaid, and beneficiaries who pay an additional income-related premium.

What is included in a Medicare wellness visit?

This service includes a review of your medical history, as well as height, weight, and blood pressure measurements and a calculation of your body mass index. You also get a vision test, a review of risk for depression, and a written plan covering needed screenings, shots, and other preventive services as part of this visit. Subsequently, yearly wellness visits provide updated information to assess your health.

Why do retirees need Medicare?

Retirees rely on Medicare to help them with their healthcare expenses, but getting a better understanding of how the program's different components can be challenging. Medicare Part B plays a key role in the everyday aspects of healthcare, and below, you'll learn more of the specifics of how much Part B costs and what it covers. ...

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What percentage of Medicare is paid to MA?

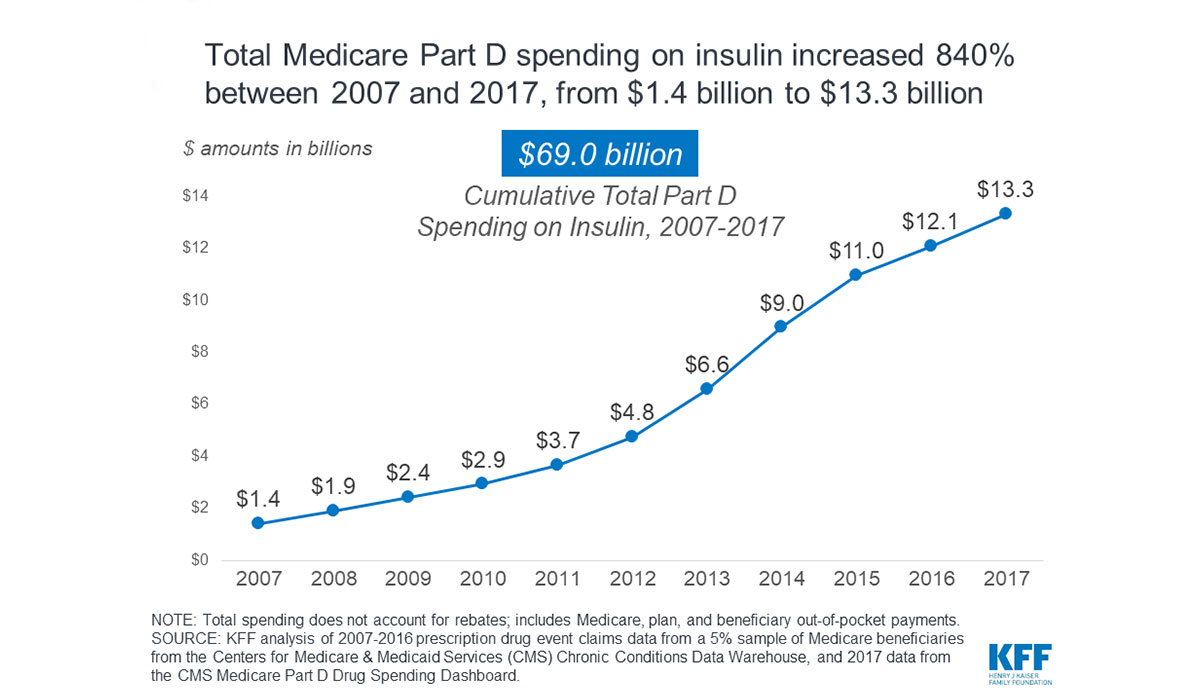

Based on a federal annual report, KFF performed an analysis to reveal the proportion of expenditure for Original Medicare, Medicare Advantage (MA) and Part D (drug coverage) from 2008 to 2018. A graphic depiction on the KFF website illustrates the change in spending of Medicare options. Part D benefit payments, which include stand-alone and MA drug plans, grew from 11% to 13% of total expenditure. Payments to MA plans for parts A and B went from 21% to 32%. During the same time period, the percentage of traditional Medicare payments decreased from 68% to 55%.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

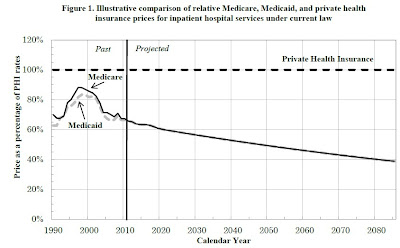

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Is Medicare a concern?

With the aging population, there is concern about Medicare costs. Then again, the cost of healthcare for the uninsured is a prime topic for discussion as well.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

What does Medicare cost?

How much does Medicare cost? The cost of Original Medicare includes premiums, deductibles, and coinsurance for Medicare Part A and Part B. Furthermore, you may have Medicare Part D prescription drug costs. Discover all your 2022 Medicare costs.

Hospital Coinsurance Costs

The coinsurance of Medicare Part A is $0 for the first 60 days of inpatient hospitalization. However, coinsurance costs for days 61 thru 90 is $389 per day in 2022. In other words, the coinsurance costs for these 30 days is $11,670. Discover all Part A hospital costs in 2022.

Skilled Nursing Costs

Skilled Nursing Facility coinsurance costs is $0 in 2021 for the first 20 days. However, coinsurance costs for days 21 to 100 is $194 per day. Your share of Medicare costs during these 80 days in a skilled nursing facility totals $15,520.

How Much Will Medicare Cost You?

Please use the Medicare Part B Premiums for 2021 chart to determine your monthly cost. The annual Part B deductible is $233 in 2022. After you pay the deductible, you may owe 20% coinsurance.

Ready to Get Started?

Get FREE Medicare help today! please enter your information and a licensed agent will contact you.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.