Why is my Medicare so expensive?

In 2022, you pay $0 for the first 20 days of each benefit period $194.50 per day for days 21–100 of each benefit period All costs for each day after day 100 of the benefit period. Medicare Part B (Medical Insurance) Costs. Part B monthly premium. Most people pay the standard Part B monthly premium amount ($170.10 in 2022).

How much will Medicare cost this year?

Nov 12, 2021 · Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021.

How much is monthly premium for Medicare?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A.

How much will my Medicare premiums be?

If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274.

What is the estimated Medicare cost for 2022?

$170.10 per monthFor most people, the cost of Medicare Part B for 2022 is $170.10 per month. This rate is adjusted based on income, and those earning more than $91,000 will pay higher premiums. For high-earners, the cost of Medicare Part B is based on your adjusted gross income (AGI) from your previous year's taxes.Mar 18, 2022

What is the monthly cost for Medicare Part B in 2022?

$170.10 forThe standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What will 2022 Medicare deductible be?

The annual deductible for Medicare Part B will increase by $30 in 2022 to $233, while the standard monthly premium for Medicare Part B will increase by $21.60 to $170.10, CMS announced.Nov 15, 2021

Are Medicare premiums going down in 2022?

In 2021, the Part B premium increased by only $3 a month, but Congress directed CMS to begin paying that reduced premium back, starting in 2022.Jan 25, 2022

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

Will Social Security get a raise in 2022?

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022. Read more about the Social Security Cost-of-Living adjustment for 2022. The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $147,000.

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

Why did my Medicare premium increase for 2022?

CMS explained that the increase for 2022 was due in part to the potential costs associated with the new Alzheimer's drug, Aduhelm (aducanumab), manufactured by Biogen, which had an initial annual price tag of $56,000.Jan 12, 2022

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Is Medicare B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

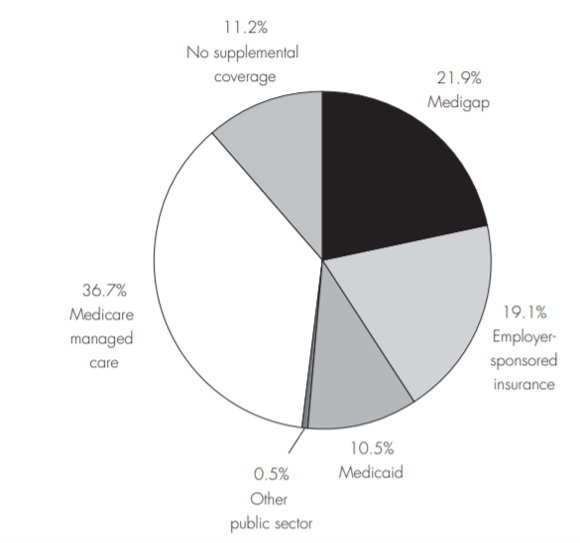

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What will Medicare Part A cost in 2021?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities.

What is the cost of Medicare Part B for 2021?

Medicare Part B covers medical insurance benefits and includes monthly premiums, an annual deductible, coinsurance and other potential costs.

How much does Medicare Advantage cost per month?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1

What is the average cost of Medicare Part D prescription drug plans?

In 2021, the average monthly premium for a Medicare Part D plan is $41.64 per month. 1

What is the average cost of Medicare Supplement Insurance (Medigap)?

The average premium paid for a Medicare Supplement Insurance (Medigap) plan in 2019 was $125.93 per month. 3

Compare Medicare Advantage plan costs in your area

A licensed insurance agent can help you compare the Medicare Advantage plans that are available where you live. You can compare benefits, coverage and the costs of each plan and then choose the right fit for your needs.

Medicare costs

Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include:

How do I make my Medicare payments?

If you’re on federal retirement benefits, your Medicare Part B premiums get deducted from your Social Security checks. You can elect to get your Medicare Part D premiums deducted from your benefit checks, too. Contact your insurer.

How much does Medicare Part A cost in 2022?

Premiums for Medicare Part A are $0 if you’re getting or are eligible for federal retirement benefits. It’s also premium-free if you’re under 65 and receiving Social Security disability benefits for 24 months, or are diagnosed with end-stage kidney disease.

How much does Medicare Part B cost in 2022?

The premium for Medicare Part B in 2022 is $170.10 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $578.30 — depending on your income. The higher your income, the higher your premium.

How much does Medicare Part C cost in 2022?

The premium for Medicare Part C — also called Medicare Advantage — depends on your plan and the insurer, since these health plans are provided by private insurance companies.

How much does Medicare Part D cost in 2022?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Late enrollment penalty

You will have to pay penalties for some parts of Medicare if you don’t sign up when you’re first eligible and don’t have a particular set of circumstances — like leaving your workplace coverage.