Why do I have to pay Medicare levy?

- Low cost cover to avoid the Medicare Levy Surcharge. If you're ready to save, check out some policies in this table. ...

- Medicare Levy Surcharge 2021 income thresholds. Note: The family income threshold is increased by $1,500 for each MLS dependent child after the first child.

- Find hospital insurance and avoid the MLS. ...

Does everyone pay the same Medicare levy?

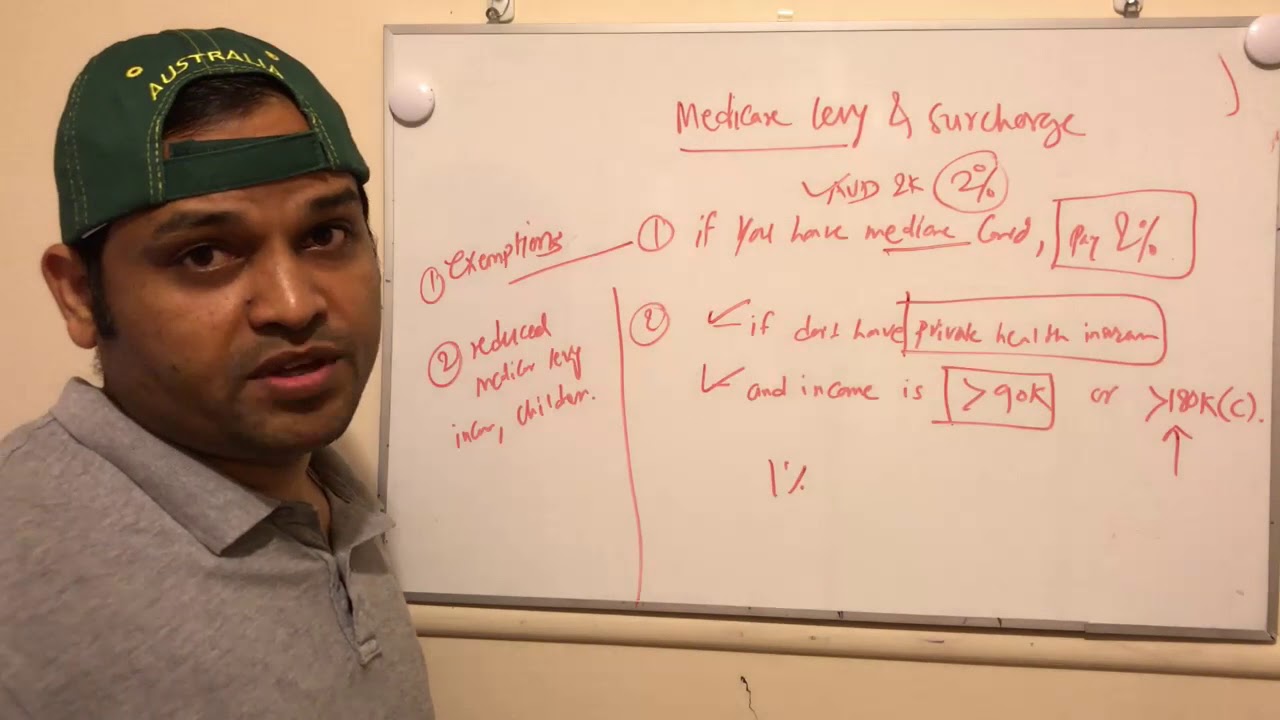

Not everyone is required to pay the Medicare levy surcharge, but if you’re single and earning more than $90,000 or part of a family earning $180,000, you may be charged.

How much is the Medicare levy surcharge?

the Medicare levy surcharge. You may pay these each year as part of your income tax. The levy is about 2% of your taxable income. You pay the levy on top of the tax you pay on your taxable income. Your Medicare levy may reduce if your taxable income is below a certain amount. In some cases, you may not have to pay this levy at all.

Do you pay Medicare levy with private health insurance?

your income is above a certain amount. If you have a private health insurance policy, you may be able to get the private health insurance rebate. The Medicare levy is in addition to the tax you pay. You may have to pay the Medicare levy surcharge if you, your spouse and dependant children don’t have an appropriate level of private health insurance.

How much is Medicare levy?

Medicare levy The levy is about 2% of your taxable income. You pay the levy on top of the tax you pay on your taxable income. Your Medicare levy may reduce if your taxable income is below a certain amount.

What is the Medicare levy?

What is the Medicare levy? Most taxpayers pay a levy of 2% of their taxable income to help fund the Medicare service1. The levy is an additional charge to the tax you pay on your taxable income.

Does everyone pay Medicare levy?

Not everyone is required to pay the Medicare levy surcharge, but if you're single and earning more than $90,000 or part of a family earning $180,000, you may be charged.

How do I avoid Medicare levy?

How to avoid the Medicare Levy Surcharge. In order to avoid the surcharge, you must have the appropriate level of cover. For singles, that means a policy with an excess of $500 or less. For couples or families, it means an excess of $1,000 or less.

What is the Medicare Levy?

The Medicare Levy is a 2% tax on your income to help fund Medicare, Australia's public health system. It is seperate to the income tax you also pay...

Who pays the Medicare Levy?

Australian taxpayers help to pay for Medicare from their income tax. If you meet certain medical requirements, or if you aren't entitled to Medicar...

Do seniors pay the Medicare Levy?

It depends on your circumstances. Anyone with a taxable income that exceeds the minimum threshold of $36,705 has to pay pay the levy. But the thres...

What is the Medicare levy?

The Medicare levy is a tax most Australian workers pay to help fund Medicare. The levy is usually two per cent of your taxable income. However, low...

What’s the purpose of the Medicare levy?

The purpose of the Medicare levy is to provide funding for Medicare – which is accessed by both public and private patients. Medicare allows Austra...

Who has to pay the Medicare levy?

Everyone with a taxable income over $27,997 (or over $44,272 if you’re entitled to the seniors and pensioners tax offset) is required to pay the fu...

How much is the Medicare levy?

The Medicare levy is a percentage of your taxable income. As such, there’s no universal amount that every Australian pays. The more income you gene...

Who’s exempt from paying the Medicare levy tax?

Some people are exempt from paying the Medicare levy if they meet requirements set up by the ATO. If you’re eligible, you can claim an exemption wh...

Will taking out private health insurance exempt me from paying the Medicare levy?

No, taking out private health insurance or hospital cover doesn’t exempt anyone from paying the Medicare levy. If you earn over the threshold, you...

How is the Medicare levy different from the Medicare levy surcharge?

While the Medicare levy is a tax most income earners pay, the Medicare levy surcharge (MLS) is an additional tax of up to 1.5% that only people on...

What is Medicare tax?

Medicare Levy vs the Medicare Levy Surcharge? The Medicare Levy is a 2% tax that goes towards funding the public health system. You pay a Medicare Levy in addition to the tax you pay on your taxable income. Most of us have to pay it unless we earn less than $22,801 a year. The Medicare Levy Surcharge, on the other hand, ...

How much is Medicare tax?

The Medicare Levy is a 2% tax that goes towards funding the public health system. You pay a Medicare Levy in addition to the tax you pay on your taxable income. Most of us have to pay it unless we earn less than $22,801 a year.

What is the Medicare tax rate for 2019?

The Medicare Levy is a flat 2% income tax for any earning above the threshold. The 2019-20 upper threshold is $28,501 per year. For example, if you earned $75,000 your Medicare Levy would be $1,500. You will only have to pay part of the Medicare Levy if your taxable income is between $22,801 and $28,501 ...

How much does Medicare tax in Australia?

The Medicare Levy is charged at 2% of your annual income and goes towards funding Australia's public health system, Medicare. You usually need to pay the full 2% if you earn over $28,501, though you might be entitled to a reduction if you earn less or are a senior citizen.

Does Medicare cover everything?

Unfortunately, Medicare doesn't cover everything – but private health insurance can help fill in the gaps. It can cover you for things like ambulance transportation, dental and optical, and often gives you access to treatment quicker than the public system.

What is Medicare levied on?

The Medicare Levy Surcharge is different to the Medicare Levy. It is a charge levied on medium and high income earners who do not have private hospital cover. It ranges from 1-1.5% of your annual income. Please click here to read more about the Medicare Levy Surcharge. Popular Articles.

What is Medicare entitlement statement?

This is a statement the Department of Human Services issues to people who are not entitled to received Medicare benefits based on their visa type. You can apply for a statement if you fit any one of the following categories:

How much Medicare does a part time employee pay?

Using some very simple numbers: A part-time or casual employee who earned $20,000 pays zero Medicare Levy. An employee earning $50,000 in the last tax year pays $1,000. An employee earning $100,000 pays $2,000 in Medicare Levy. These amounts are all in addition to your regular income taxes based on your tax bracket.

What is Medicare surcharge?

The Medicare Levy Surcharge (MLS) is a levy paid by Australian tax payers who do not have private hospital cover and who earn above a certain income. The surcharge aims to encourage individuals to take out private hospital cover, and where possible, to use the private system to reduce the demand on the public Medicare system.

What is the taxable income for MLS?

a single person with an annual taxable income for MLS purposes greater than $90,000; or. a family or couple with a combined taxable income for MLS purposes greater than $180,000. The family income threshold increases by $1,500 for each dependent child after the first; and do not have an approved hospital cover with a registered health insurer.

What is general treatment cover?

General treatment cover without hospital cover; Overseas Visitors Cover or Overseas Student Health Cover; or. Cover held with non-registered insurers, such as international insurers. I have reciprocal Medicare benefits and earn over the surcharge threshold.

What is the maximum amount of hospital insurance?

From 1 April 2019, the maximum permitted excesses for private hospital insurance is $750 for singles and $1,500 for couples/families (i.e. if multiple hospital claims are made in a single year, the excess paid by you cannot exceed $750/$1,500). The following types of health insurance do not provide an exemption:

What is the Medicare levy?

The Medicare levy is a tax most Australian workers pay to help fund Medicare. The levy is usually two per cent of your taxable income. However, low-income earners may pay a reduced rate, or you may be exempt completely due to your personal circumstances.

Who has to pay the Medicare levy?

Everyone with a taxable income over $27,997 (or over $44,272 if you’re entitled to the seniors and pensioners tax offset) is required to pay the full two per cent Medicare levy tax fee each financial year. 1

How much is the Medicare levy?

The Medicare levy is a percentage of your taxable income. As such, there’s no universal amount that every Australian pays. The more income you generate, the higher your Medicare levy fee will be – but the rate stays at two per cent for all people earning over the $27,997 threshold.

Frequently Asked Questions

No, taking out private health insurance or hospital cover doesn’t exempt anyone from paying the Medicare levy. If you earn over the threshold, you must pay the Medicare levy regardless of whether you hold private health insurance. You’re only exempt if you meet the criteria set up by the ATO.

Do I have to pay MLS?

If you make more than $90k as a single person or more than $180k as a couple, Australian law requires you to pay the MLS. However, if you have a private hospital cover, you are exempt from paying the MLS. The good news is that the money paid as MLS annually can be sufficient or even exceed the amount you need to buy a basic private hospital cover.

Medical levy surcharge thresholds

The threshold for MLS is $90k for singles, and $180k, meaning anything above that will attract a surcharge. According to the Australian Tax Offices, an income of $90k to 105k for singles and $180k to 210k for couples attracts an MLS rate of 1.0%.

Who is exempt from MLS?

You may be exempt from paying a part of or all the Medicare Levy Surcharge under certain circumstances that include:

Why take a private hospital cover?

Besides helping you avoid paying the MLS, taking a private hospital cover comes with its benefits. First, after your waiting period is over, your insurer covers part of the treatment costs listed in your contract with the option of being treated in a private hospital.

Wrapping up

Medicare Levy Surcharge is an important cover for any Australian taxpayer. Besides providing health insurance, it helps reduce the amount of tax you pay, especially if your income level is above the threshold.

How much is Medicare levied?

Whereas the Medicare Levy Surcharge (MLS), which is between 1% to 1.5% of your taxable income, is usually only paid by people who do not have a hospital policy from a registered private health insurer.

When do you have to apply for Medicare levy?

To avoid paying the Medicare levy surcharge, you’ll generally need to apply for an eligible Hospital policy before the first of July. To find the right Hospital plan for your requirements, call us at 1300 795 560 to speak with a specialist or fill in the quote form below.

What is MLS tax?

The MLS is an extra health insurance tax you pay in addition to your Medicare Levy and depending on your income, your MLS rate might be 1%, 1.25% or 1.5%. Your taxable income includes: Your personal exertion income which you earn by working, Monies for which family trust distribution tax has been paid, and.

What is an exemption category for Centrelink?

Exemption category. Receive a sickness allowance from Centrelink. Circumstance / Condition. All your dependents (incl. spouse) is in one of the exemption categories or paid the Medicare Levy. At least one dependent is not in the exemption category and doesn’t have to pay the Medicare Levy. Exemption category.

How much is a hospital policy excess?

For a plan to be sufficient, the hospital policy excess, also known as co-payment, must be equal to or less than $500 for single policies and $1000 for a couple/family policy. Extras cover only will not exempt you from paying the surcharge.

Can foreign residents receive Medicare?

Foreign residents, or. Not entitled to receive Medicare benefits, or. Meet specific medical requirements. You might be wholly or partly exempt from the Medicare tax if you experienced one of the exemption categories for all or part of the year, while also meeting one of the circumstances in the right-hand column.

Do I have to pay Medicare surcharge if I have private insurance?

Do I have to pay Medicare levy surcharge if I have private health insurance? No, typically if you’ve purchased and maintained an eligible Hospital policy you won’t need to pay the Medicare levy surcharge. However, if you cancel your policy or it lapses, then you may need to pay the surchage.

Incentive Payments

Eligible professionals who participate in the eRx Incentive Program by reporting on their adoption and use of a qualified eRx system that has the functionalities required by CMS may qualify for an incentive payment.

2014 eRx Payment Adjustment

A quick reference guide for understanding the 2014 eRx Payment Adjustment Feedback Report has been posted in the "Downloads"section below.

2013 eRx Payment Adjustment

This Fact Sheet provides step-by-step guidance for requesting an informal review of 2013 eRx Incentive Program results during the informal review period, January 1, 2015 through February 28, 2015. To review this document click on the following link: 2013 eRx Informal Review Made Simple (PDF) (PDF).

2012 eRx Incentive Program

This Fact Sheet provides step-by-step guidance for those eligible professionals and eRx GPROs who wish to request an informal review of 2012 eRx Incentive Program results during the 2013 calendar year.

.jpg)