How much will my Medicare Part a premium be in 2019?

Oct 12, 2018 · The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,364 in 2019, an increase of $24 from $1,340 in 2018. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

How much does Medicare cost per month?

For 2019, you're responsible for the first $1,364 of your Part A expenses as a deductible before Medicare starts making payments on your behalf. As …

How much does Medicare Part a cost in 2020?

If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. How it changed from 2018 The 2019 Part A premiums increased a little over 3 percent from 2018. 2019 Medicare Part B premium

How much does Medicare Part B cost in 2019?

Feb 19, 2021 · If you do have to pay a premium for Part A, your premium could be as high as $437 per month in 2019.If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. 2019 Part A deductible

Do I have to pay for Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

How much does Medicare Part A cost for most beneficiaries?

Part A premiums If you don't qualify for premium-free Part A, you can buy Part A. People who buy Part A will pay a premium of either $274 or $499 each month in 2022 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B.

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

Which Medicare Parts require additional premiums from beneficiaries?

Medicare Advantage plan enrollees generally pay the monthly Part B premium and many also pay an additional premium directly to their plan. Medicare Advantage plans are required to place a limit on beneficiaries' out-of-pocket expenses for Medicare Part A and Part B covered services ($6,700 in 2015).20 Mar 2015

Does Medicare Part A cover everything?

Medicare Part A is critical for helping older Americans pay for healthcare, but it doesn't cover everything. Knowing the premiums, deductible, and copayments you might owe is essential in order to make sure you have the financial resources to cover your share of your healthcare costs.

Does Medicare pay for nursing care?

In general , if you have costs related to a hospital or a skilled nursing facility, then Medicare Part A will help pay for most of the costs involved. Medically necessary hospital stays will include a semiprivate room, meals, prescription drugs, and other treatment and medical services as well as support from nursing staff and doctors. For coverage to get triggered, your doctor must affirm that you need a two-day hospital stay. As long as you're expected to improve, then long-term stays in hospitals and hospital-provided nursing care remain covered, subject to maximum limits.

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Follow @DanCaplinger

How much is Medicare premium per month?

If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. How it changed from 2018. The 2019 Part A premiums increased a little over 3 percent from 2018.

How much is Medicare Part C?

Plan premiums will vary by provider, plan and location. The Centers for Medicare and Medicaid Services (CMS) reports that the average Medicare Advantage plan premium in 2019 will be $28.00 per month.

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

Is Medicare Part B optional?

Medicare Part B is optional. You will likely be automatically enrolled in Part B (with the option to drop it) if you are automatically enrolled in Medicare Part A.

What is the Medicare Part B premium?

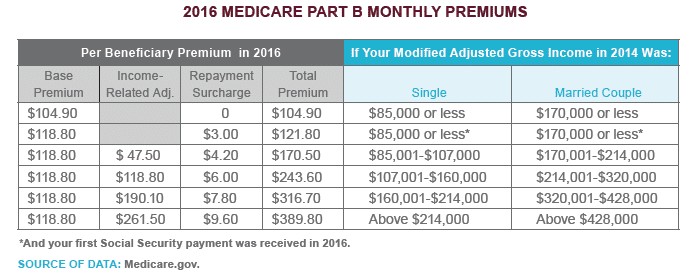

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

What is the COLA for 2019?

The COLA in 2019 is 2.8 percent. An additional income bracket was added in 2019. In 2020, the IRMAA will be indexed to inflation for the first time since 2010. It’s expected that the income thresholds that determine when someone pays a Medicare IRMAA will rise slightly in 2020.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

How much is Medicare Part A deductible?

The Part A deductible is $1,364 per benefit period in 2019.

What is Medicare Part A?

When you are admitted for inpatient care at a hospital, skilled nursing facility and certain other types of inpatient facilities, Medicare Part A helps cover the costs of your qualified care. Part A includes several different costs, such premiums, a deductible and coinsurance.

What happens if you don't sign up for Medicare Part B?

If you don't sign up for Medicare Part B when you're first eligible, you will typically be required to pay a late enrollment penalty. The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How long do you have to work to get Medicare Part A?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters). Those 40 quarters do not have to be consecutive.

What is the late enrollment penalty for Medicare Part B?

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium. You are responsible for paying this penalty for as long as you remain enrolled in Medicare Part B.

What can I do to compare Medicare Supplement plans?

They can help you find a plan that fits your coverage needs as well as your budget.

How much does Medicare pay for respite care?

Medicare Part A requires a copayment for prescription drugs used during hospice care. You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A also requires a coinsurance payment of $170.50 per day in 2019 for inpatient skilled nursing facility stays longer than 20 days.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board.

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.