Also called hospital insurance, Medicare Part A covers the cost if you are admitted to a hospital, skilled nursing facility, or hospice. It also covers some home health services.

Full Answer

Who has to pay for part a Medicare?

Generally, you pay a monthly premium for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, ... Days 1-60: $0 after you pay your Part A deductible Days 61-90: $389 each day Days 91-150: $778 each day while using your 60 lifetime reserve days

Will I have to pay for part an of Medicare?

Apr 16, 2021 · What does Medicare Part A cover? Medicare Part A (hospital insurance) helps cover a variety of services, including the following: Inpatient hospital care: May include semi-private rooms, meals, nursing services, and prescription drugs needed for your treatment.Medicare Part A hospital coverage may include inpatient care you receive in long …

Is there a deductible for Medicare Part A?

For a qualifying inpatient stay, Medicare Part A covers 100 percent of hospital-specific costs for the first 60 days of the stay — after you pay the deductible for that benefit period. Part A doesn’t completely cover Days 61-90 or the 60 “lifetime reserve days” you can use after Day 90. After 60 days, you must pay coinsurance that Part ...

What is the difference between Medicare Part an and Part B?

What does Medicare Part A pay for This is an important question, because Part A covers hospital costs. These costs can really add up, so it's good you're Medicare Part A pays Medicare-approved hospital costs. Learn what Part A pays for, and the out-of-pocket costs you can expect.

Does Medicare Part A cover 100 percent?

What does Medicare Part A typically cover?

What does Medicare Part A reimburse for?

How do I get my $144 back from Medicare?

What is not covered by Medicare Part A?

Is Medicare Part A free at age 65?

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Who pays for Part A Medicare?

Who is eligible for Medicare Part B reimbursement?

Is there really a $16728 Social Security bonus?

Why is my Part B premium so high?

Is Medicare Part A and B free?

What Is Medicare Part A Coverage?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided i...

What Does Medicare Part A Cover?

Medicare Part A (hospital insurance) helps cover a variety of services, including the following: 1. Inpatient hospital care: May include semi-priva...

What Are My Medicare Part A Costs?

Many people get Medicare Part A without a premium if they’ve worked the required amount of time under Medicare-covered employment, generally 10 yea...

When Do I Sign Up For Medicare Part A?

Some people are automatically enrolled in Medicare Part A, while you may need to manually sign up for it in other cases.Automatic enrollment in Med...

How Do I Sign Up For Medicare Part A?

If you need to manually enroll in Medicare Part A, you can do so through Social Security or the Railroad Retirement Board (RRB). You can sign up in...

How much does Part A cost?

You usually don't pay a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working.

Premium-free Part A

You usually don't pay a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

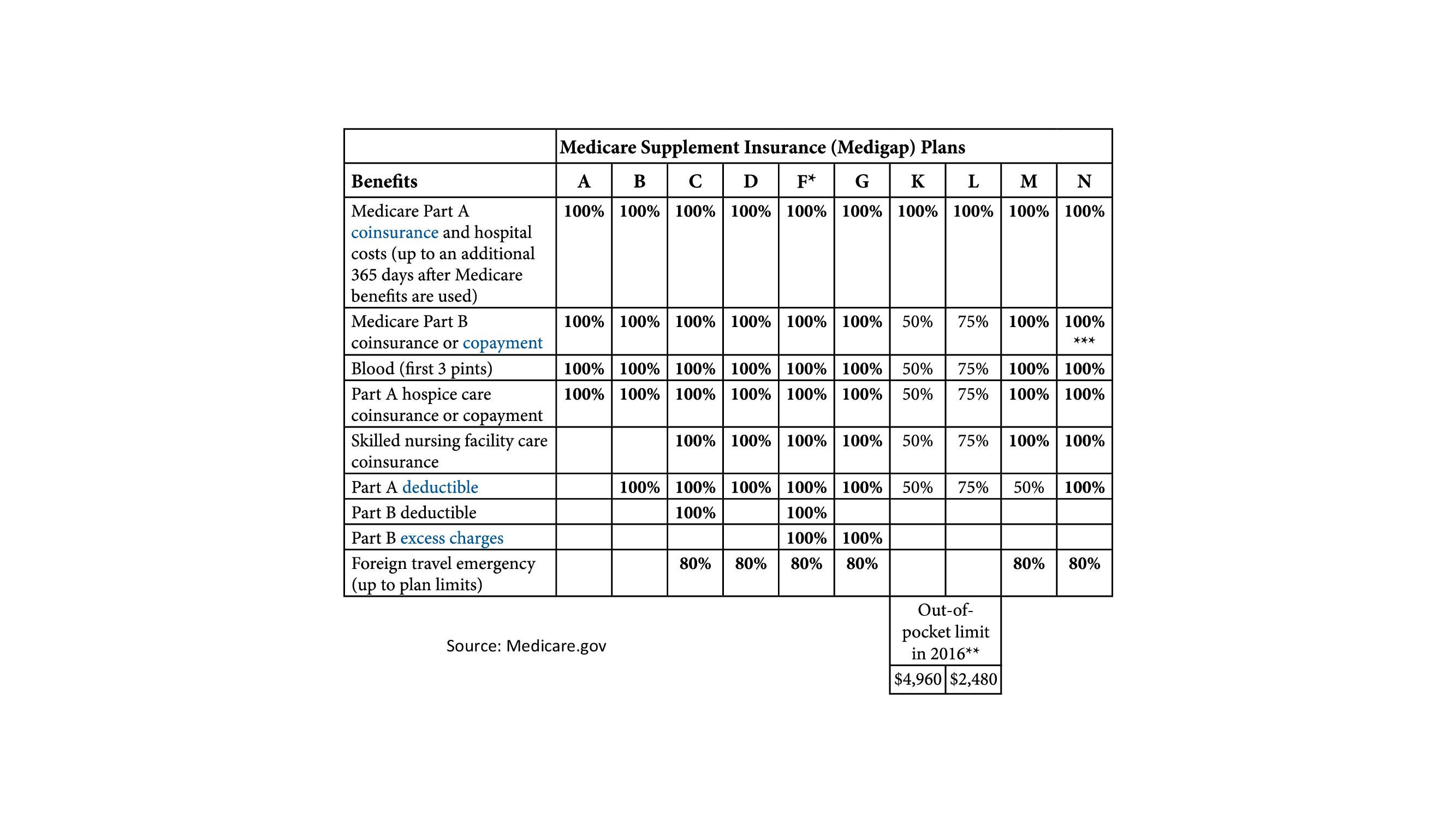

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is Medicare Part A coverage?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided in the U.S. without a break for at least five years. You’re eligible if you’re 65 and older or under age 65 with certain disabilities.

What does Medicare Part A cover?

Medicare Part A (hospital insurance) helps cover a variety of services, including the following:

What are my Medicare Part A costs?

Many people get Medicare Part A without a premium if they’ve worked the required amount of time under Medicare-covered employment, generally 10 years or 40 quarters and paid Medicare taxes while working (see below for more information). However, your Part A coverage may still include other costs, even after Medicare has paid its share.

When do I sign up for Medicare Part A?

Some people are automatically enrolled in Medicare Part A, while you may need to manually sign up for it in other cases.

How do I sign up for Medicare Part A?

If you need to manually enroll in Medicare Part A, you can do so through Social Security or the Railroad Retirement Board (RRB). You can sign up in a few different ways:

Medicare Coverage Basics

Becoming eligible for Medicare can be daunting. But don't worry, we're here to help you understand Medicare in 15 minutes or less.

Key Takeaways

Medicare Part A Medicare Part A, also called "hospital insurance," covers the care you receive while admitted to the hospital, skilled nursing facility or other inpatient services. Medicare Part A is part of Original Medicare. provides coverage to U.S. citizens age 65 and older for inpatient stays in hospitals and similar medical facilities.

What is Covered Under Medicare A?

Medicare Part A is commonly referred to as “hospital insurance” because its primary function is to help older adults manage the cost of hospital bills. Medicare Part A covers some expenses you incur at what you think of as a traditional hospital, but it also covers similar inpatient services in semi-private rooms at similar facilities, including:

What is Not Covered Under Medicare Part A?

Even in the case of an inpatient stay that Medicare Part A covers, Part A won’t cover:

Does Medicare Part A Cover 100 Percent?

For a qualifying inpatient stay, Medicare Part A covers 100 percent of hospital-specific costs for the first 60 days of the stay — after you pay the deductible for that benefit period. Part A doesn’t completely cover Days 61-90 or the 60 “lifetime reserve days” you can use after Day 90.

Medicare Part A Costs & Enrollment

Now that you know all about Medicare Part A coverage, it’s time to learn more about Part A costs and enrollment.

FAQs

If you, like most people, don’t have to pay a monthly premium for Part A, there is no downside to enrolling when you become eligible at age 65. You don’t have to pay a premium if you have paid Medicare taxes for at least 10 years.

Is my test, item, or service covered?

Find out if your test, item or service is covered. Medicare coverage for many tests, items, and services depends on where you live. This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

Your Medicare coverage choices

Learn about the 2 main ways to get your Medicare coverage — Original Medicare or a Medicare Advantage Plan (Part C).

What Part A covers

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

What Part B covers

Learn about what Medicare Part B (Medical Insurance) covers, including doctor and other health care providers' services and outpatient care. Part B also covers durable medical equipment, home health care, and some preventive services.

What Medicare health plans cover

Medicare health plans include Medicare Advantage, Medical Savings Account (MSA), Medicare Cost plans, PACE, MTM

What's not covered by Part A & Part B

Learn about what items and services aren't covered by Medicare Part A or Part B. You'll have to pay for the items and services yourself unless you have other insurance. If you have a Medicare health plan, your plan may cover them.

Medicare Part A will pay for most of the costs of your hospital stay, after you pay the Part A deductible

Medicare Part A will pay for most of the costs of your hospital stay, after you pay the Part A deductible.

What Medicare Part A Covers

When you are admitted to a hospital or skilled nursing facility, Medicare Part A hospital insurance will cover the following for a certain amount of time:

How Much Medicare Pays for You to Stay in a Hospital

Medicare Part A pays only certain amounts of a hospital bill for any one spell of illness. (And for each spell of illness, you must pay a deductible before Medicare will pay anything. In 2020, the hospital insurance deductible is $1,408.)

What Constitutes One Spell of Illness

A spell of illness, called a "benefit period," refers to the time you are treated in a hospital or skilled nursing facility, or some combination of the two. The benefit period begins the day you enter the hospital or skilled nursing facility as an inpatient and continues until you have been out for 60 consecutive days.

Skilled Nursing Facilities and Home Health Care

Under some circumstances, Medicare will cover some of the cost of inpatient treatment in a skilled nursing facility or visits from a home health care agency.

Psychiatric Hospitals

Medicare Part A hospital insurance covers a total of 190 days in a lifetime for inpatient care in a specialty psychiatric hospital (meaning one that accepts patients only for mental health care, not just a general hospital).

Medicare Part A Premiums

Most people don't pay premiums for Part A, but if you didn't work for 10 years (40 quarters) in a job paying Medicare taxes, you may have to pay a monthly premium. For the 2020 Part A premiums, see Nolo's 2020 Medicare cost update.

What Does Medicare Part A Not Cover

Its also important to know that Medicare Part A doesnt cover all hospital costs. Here are a few things that Part A wont cover:

What Is Part B Cost Sharing

Medicare Part B comes with an annual deductible of $233 for 2022. After you meet the deductible for the year, you typically pay 20% of the Medicare-approved amount for doctor services and other Medicare benefits. This holds true if you go to a provider that accepts assignment. This means that the provider will accept the Medicare payment amount.

How Medicare Part D Works

Meredith Mangan is the senior insurance editor for The Balance. She brings to the job 15 years of experience in finance, media, and financial markets. Prior to her editing career, Meredith was a licensed financial advisor and a licensed insurance agent in accident and health, variable, and life contracts.

Costs Not Covered By Medicare

Even if your outpatient procedure is paid for by Medicare, you might still owe some money as a co-payment or as a deductible. In these cases, you must pay any balance you owe before Medicare can assist with the rest of the bill.

When Should You Apply For Medicare Part A

If you wont get Medicare Part A premium-free, try to sign up for it when youre first eligible, as you could face a late enrollment penalty. Your initial enrollment period begins when you become eligible for Medicare. You can also join during the Medicare open enrollment period, which runs annually from October 15 through December 7.

Ways To Find Out If Medicare Covers What You Need

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that’s usually covered but your provider thinks that Medicare won’t cover it in your situation. If so, you’ll have to read and sign a notice.

What Does Prolia Do

Throughout your life, your body breaks down existing bone and builds new bone in its place to keep your skeleton strong. Osteoclasts are the cells that drive the process. As you age, the bone-building process slows down while the work of osteoclasts continues at the same pace. This leads to a loss of bone density.