Yes, Medicare generally pays 80% of the cost of CGM accessories and supplies. Under the guidelines, Medicare Part B covers: Patch refills based on the recommended replacement schedule. For example, if you use a CGM that requires a new patch every 14 days, Medicare will pay for two patches every 28 days.

How often does Medicare pay for CGM patches?

For example, if you use a CGM that requires a new patch every 14 days, Medicare will pay for two patches every 28 days. Medicare Part D may also cover: If your doctor determines that testing more often is medically necessary, Medicare may pay for additional test strips and lancets.

Does Medicare cover continuous glucose monitors?

Medicare covers therapeutic continuous glucose monitors and related supplies instead of blood sugar monitors for making diabetes treatment decisions, like changes in diet and insulin dosage.

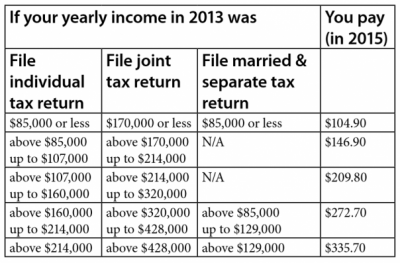

How much does Medicare Part C cost?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) The Part C monthly Premium varies by plan. Compare costs for specific Part C plans.

How much is the monthly premium for Medicare Part A?

Monthly Premium. : Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $422 each month in 2018 ($437 in 2019). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $422 ($437 in 2019).

How much does CGM cost with Medicare?

Those covered by Medicare for Dexcom typically pay approximately 20% of the costs of CGM themselves, or roughly $50 per month. (This additional amount may be covered by secondary insurance.) Medicare will typically cover the remaining 80%.

How much does CGM cost per month?

Average monthly cost of CGM When comparing out-of-pocket prices without insurance factored in, CGM systems supplies can range from roughly $160 per month all the way up to $500 per month (based on retail prices provided by manufacturers online).

Does Medicare pay for glucose monitoring systems?

Medicare also covers therapeutic continuous glucose monitors (CGMs) approved for use in place of blood sugar monitors for making diabetes treatment decisions (like, changes in diet and insulin dosage) and related supplies.

How much does dexcom G6 cost per month?

Dexcom G6 Subscription costs $299 each month and is billed automatically to your credit card. By signing up for a year's worth of CGM supplies, you receive four free transmitters over the 12 months.

What is the monthly cost of FreeStyle Libre?

Most commercially insured patients end up paying between $0 to $60 per month for FreeStyle Libre 2 sensors,§1 and no more than $65 for a FreeStyle Libre 2 reader.

How much does FreeStyle Libre cost out-of-pocket?

How much does the Freestyle Libre cost? You do need a prescription in order to purchase the Freestyle Libre 14 day system—and the sensors can often be pricey. The out-of-pocket price is around $129.99, but you can save with a SingleCare savings card.

How much does dexcom G6 cost with Medicare?

A: According to Dexcom's Medicare FAQ page, those covered by Medicare can expect to pay 20% of the costs of their G5 CGM, which is roughly $50 per month. (This may be covered by secondary insurance.) Medicare will cover the remaining 80%. We assume the pricing will remain the same for G6, once it is approved.

Does Medicare Part B cover CGM?

Supply allowance for therapeutic continuous glucose monitor (CGM), includes all supplies and accessories. Medicare Part B covers the same type of blood glucose testing supplies for people with diabetes whether or not they use insulin.

How do I pay for Medicare FreeStyle Libre?

For Medicare to cover the cost of FreeStyle Libre, you must:Continue to pay your Part B premium.Have already paid your Part B deductible.Receive a prescription for the device from a physician who accepts Medicare.Buy the CGM from a supplier who accepts Medicare.Cover whatever portion of the costs that Medicare doesn't.

What brand of glucose meter is covered by Medicare 2021?

A2: Starting January 1, 2021, covered meters include: OneTouch Verio Reflect ®, OneTouch Verio Flex®, OneTouch Verio® and OneTouch Ultra 2®.

How much is a year supply of Dexcom G6?

a total of $1,200 for Dexcom G6 transmitters (each lasts 90 days, so 4 transmitters per year) a total of $4,800 for a box of 3 Dexcom G6 sensors (each sensor lasts 10 days) estimated total: $6,000 per year, or $500 a month.

What is the difference between Dexcom and FreeStyle Libre?

The Dexcom G6 takes 2 hours to start tracking your blood sugar, the FreeStyle Libre 14 Day system takes 12 hours, and the FreeStyle Libre 2 takes 1 hour. But once the sensors are applied, a Dexcom G6 sensor will last for 10 days, and a FreeStyle Libre sensor (both models) will last 14 days.

What age do you have to be to get Medicare Advantage?

Medicare is a health insurance program that is nationally funded. The requirements to enroll in Medicare are 1: Over age 65. (Or) Under 65 with specific disabilities. (Or) Living with end-stage renal disease.

What age do you have to be to enroll in Medicare?

The requirements to enroll in Medicare are 1: Over age 65. (Or) Under 65 with specific disabilities. (Or) Living with end-stage renal disease. Medicare Advantage plans are plans which are offered through private companies who contract with Medicare. Therefore, they may not have the same requirements and coverage as traditional Medicare2.

What is the gold standard for measuring blood sugar?

If you have diabetes, or are actively trying to avoid developing it, you’ve probably heard of a blood test called the A1C. The hemoglobin A1C test is the gold standard for measuring blood sugar because it tracks glucose over 2 to 3 months. Bladder Pads vs. Period Pads: The Dry Facts. Jun 17, 2021.

Does Medicare cover CGM?

Good news! Medicare covers continuous glucose monitors (CGM). So, if you have Medicare and have spoken to your doctor about a CGM, you may be able to receive them as a covered benefit.

Does Medicare Cover Continuous Glucose Monitors?

Yes, Medicare typically covers the cost of continuous glucose monitors (CGMs). The devices are considered durable medical equipment under Medicare Part B. As a result, you will usually be responsible for only 20% of the cost of a CGM. Medicare pays for the rest.

What Are Continuous Glucose Monitors?

Continuous glucose monitors are devices that let you check your blood sugar without having to collect a blood sample each time. To use one, you insert a patch into the skin on the back of your arm. Sensors in the device track your blood sugar levels continuously. When you want to see your number, you hold a receiver up to the patch.

Can I Stop Doing Finger Sticks If I Use a CGM?

With a CGM, you will still need to perform finger sticks occasionally. Traditional diabetes testing strips are used to calibrate continuous glucose monitors. You may also need to verify unusual readings with a traditional glucose monitor.

Will Medicare Cover a CGM If I Use My Smartphone to Check My Numbers?

A smartphone is not considered durable medical equipment. As a result, Medicare Part B won't cover a CGM unless you use a receiver to check your levels. You can use your smartphone to review data and trends or to send your results to your doctor.

Does Medicare Pay for a CGM Device?

Provided you buy the CGM from an approved supplier and meet eligibility requirements, Medicare will usually pay for 80% of the cost of a CGM receiver through Part B coverage.

Does Medicare Pay for CGM Accessories and Supplies?

Yes, Medicare generally pays 80% of the cost of CGM accessories and supplies. Under the guidelines, Medicare Part B covers:

How Much Do CGMs Cost?

The average retail prices for CGMs vary by model. GoodRx reports that the Dexcom G6 retails for a little over $400, and the retail price of the FreeStyle Libre 2 is around $130. In addition to the cost of the device, you'll need to pay for accessories and supplies.

Does Medicare Cover Continuous Glucose Monitors

Original Medicare covers continuous glucose monitors through Part B of Medicare. In most cases, Medicare covers the monthly supplies for a monitor, which is a combination of sensors, transmitters and batteries depending on the brand. Although devices are covered, beneficiaries may have to pay copays or deductibles.

Therapeutic Continuous Glucose Monitors

Medicare covers therapeutic continuous glucose monitors and related supplies instead of blood sugar monitors for making diabetes treatment decisions, like changes in diet and insulin dosage.

What Are The Qualifications For Medicare Coverage For Cgms

Under the guidelines established by Medicare, the following statements must apply to you to qualify for coverage for a CGM:

What Is The Average Cost Of A Cgm Device

The out of pocket costs of CGM devices can be significant, much more than traditional blood glucose monitoring systems. Depending on what model and features you need, you will have to get prescriptions for several different items and purchase them at a retail pharmacy if you dont have insurance coverage.

Medicare To Cover Therapeutic Cgm Sets Criteria

For Medicare patients on continuous glucose monitoring , the news is good. The Centers for Medicare and Medicaid Services will cover therapeutic continuous glucose monitoring , and have set the criteria that must be met. In the past, it has not been covered.

Medicare And Cgm Coverage

When the food and drug administration gave the green light for people to make dosing decisions based on CGM results, Medicare began covering CGMs. The decision was put into effect in January 2017. The coverage ruling saves people between $2,500 to $4,000 a year who might otherwise purchase the equipment out of pocket.

What Are The Benefits Of The Freestyle Libre

Compared to traditional glucose monitors, the FreeStyle Libre offers numerous advantages, such as:

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.