- You must be enrolled in BOTH Parts A and B at the time of application.

- You must be age 65 or older (in several states, some Plans are offered to those under 65 who are on disability).

- You must reside in the state in which the Supplement Plan is offered at the time of application.

Full Answer

Which insurance company is best for a Medicare supplement?

Sep 16, 2018 · Not every state offers Medicare Supplement plans to beneficiaries under 65 (see the section below for more information on Medicare Supplement eligibility if you’re under 65). In addition, keep in mind that Medicare Supplement plans don’t include prescription drug benefits (Medicare Part D). In the past, some Medicare Supplement plans may have included this …

Who has the best Medicare supplement?

Eligibility for Medicare Supplement Insurance has several requirements based on your time of enrollment: You must be enrolled in BOTH Parts A and B at the time of application. You must be age 65 or older (in several states, some Plans are offered to …

What are the top 5 Medicare supplement plans?

To be eligible for a Medicare Supplement insurance plan, first enroll in Medicare. Medicare Part A and Part B are generally available to citizens of the USA or permanent legal residents for at least five continuous years who have any one of the following qualifications: Aged 65 and older

What is the best supplemental insurance to have with Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance). You are eligible for premium-free Part A if you are age 65 or older ...

What are the criterias of a Medicare supplement plan?

You must be enrolled in BOTH Parts A and B at the time of application. You must be age 65 or older (in several states, some Plans are offered to those under 65 who are on disability). You must reside in the state in which the Supplement Plan is offered at the time of application.Jan 28, 2022

Can you be denied a Medicare supplement plan?

Within that time, companies must sell you a Medigap policy at the best available rate, no matter what health issues you have. You cannot be denied coverage.

What is the difference between a Medicare Supplement and a Medicare Advantage Plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Is Medicare supplemental insurance based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What pre-existing conditions are not covered?

Health insurers can no longer charge more or deny coverage to you or your child because of a pre-existing health condition like asthma, diabetes, or cancer, as well as pregnancy. They cannot limit benefits for that condition either.

Can I be turned down for Medicare Part D?

A. You cannot be refused Medicare prescription drug coverage because of the state of your health, no matter how many medications you take or have taken in the past, or how expensive they are. Nor can you be asked to pay more than other people because of your medical history.Dec 15, 2008

Can I change from Medicare Supplement to Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

Does Medicare look at your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

What is the least expensive Medicare supplement plan?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.Mar 16, 2022

How much does Medicare take out of Social Security?

What are the Medicare Part B premiums for each income group? In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

When Am I Eligible For Medicare Supplement Coverage?

Because Medicare Supplement policies complement your Original Medicare coverage, you must be enrolled in Part A and Part B to be eligible for this...

How Can Enrollment Periods Affect My Eligibility For Medicare Supplement Plans?

The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period—for most people, this per...

Am I Eligible For A Medicare Supplement Plan If I’M Under Age 65?

Federal law does not require insurance companies to sell Medicare Supplement policies to people under 65, but many states do have this requirement....

Am I Eligible For A Medicare Supplement Plan If I Have A Medicare Advantage Plan?

Medicare Supplement policies don’t work with Medicare Advantage plans. If you decide to switch from Original Medicare to a Medicare Advantage plan,...

Am I Eligible For A Medicare Supplement Plan If I Have Coverage Through Medicaid?

While some beneficiaries may be eligible for both Medicare and Medicaid benefits (also known as “dual eligibles”), Medicaid typically doesn’t work...

How old do you have to be to get Medicare Supplement?

You must be age 65 or older (in several states, some Plans are offered to those under 65 who are on disability). You must reside in the state in which ...

What is Medicare Supplement Plan?

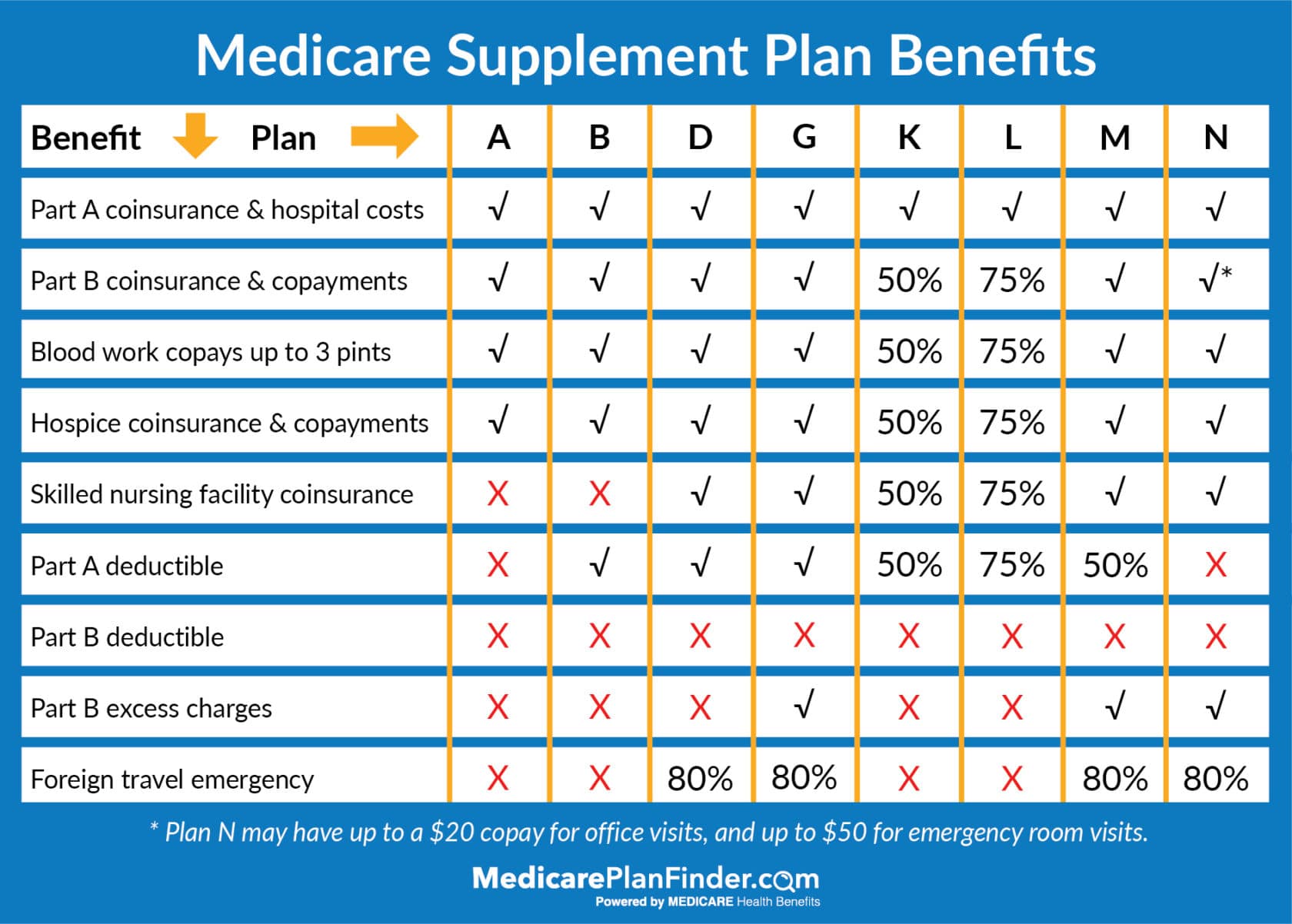

A Medicare Supplement Plan (also called a Medigap plan) can help pay Medicare Part A and Part B costs, such as deductibles, copayments, and coinsurance. If you’re eligible for a Medicare Supplement Plan, enrollment is a good idea, as these plans take much of the worry out of escalating medical costs by having no cap on the coverage they offer.

How long do you have to wait to buy a Medigap policy?

Under certain circumstances, there is a waiting period of up to six-months for pre-existing conditions for Medigap policies purchased during the OEP.

When does Medigap OEP start?

If you delay Part B coverage, your Medigap OEP will be the six-month period beginning on the first day of the month you enroll in Part B. Example 1: If you turn 65 on May 1 and your Part B begins May 1, your Medigap OEP begins May 1 and runs through October 31. Example 2: If you turn 65 on May 1, 2020 but wait until your Employer Group Coverage ...

When do you join a Medicare Advantage Plan?

You joined a Medicare Advantage Plan when you first became eligible for Medicare and disenrolled within 12 months, or your previous Medigap policy, Medicare Advantage Plan, or PACE program ends its coverage or committed fraud. If you have a Medicare Advantage Plan, Medicare SELECT policy, or PACE program and you move out of the plan’s service area, ...

When is the best time to buy a Medigap policy?

The best time to buy a Medigap policy is during your Medigap Open Enrollment Period. OEP is the six-month period that begins on the first day of the month in which you’re 65, or older, and enrolled in Medicare Part B. If you delay Part B coverage, your Medigap OEP will be the six-month period beginning on the first day of ...

What is a pre-existing condition?

Medicare defines a pre-existing condition as a health problem you have before the date a new insurance policy starts. In some cases, the Medigap insurance company can refuse to issue the policy based on pre-existing conditions.

What is Medicare Supplement?

Medicare Supplement insurance plans are intended to work with Original Medicare (Medicare Part A and Part B). To be eligible for a Medicare Supplement insurance plan, first enroll in Medicare. Medicare Part A and Part B are generally available to citizens of the USA or permanent legal residents for at least five continuous years who have any one of the following qualifications:

Who sells Medicare Supplement insurance?

Medicare Supplement insurance plans are sold by private health insurance companies, but unlike some other health plans sold by private insurers, Medicare Supplement insurance plans may have eligibility requirements in some situations.

How long is the Medicare Supplement open enrollment period?

This period lasts for six months and begins on the first day of the month in which you are both 65 or older and enrolled in Medicare Part B.

How long do you have to be on disability to get Medicare?

Generally you’re eligible for Medicare after receiving disability benefits for 24 months in a row. Diagnosed with Lou Gehrig’s disease (ALS).

When do you have to be enrolled in Medicare Part A?

Diagnosed with Lou Gehrig’s disease (ALS). You may be automatically enrolled in Medicare Part A when you turn 65 and it’s premium-free for most people who have worked 10 years or more and paid Medicare taxes. In most cases, you’re also automatically enrolled in Medicare Part B, but pay a monthly premium for it.

Does Medicare cover Medicare Supplement?

Medicare does not cover any Medicare Supplement premium costs. Here are some reasons you may be turned down from a Medicare Supplement insurance plan or pay a higher premium: You have Medicare but you’re under 65. You’re 65 but haven’t enrolled in Medicare Part B. You have a health problem and your Medicare Supplement Open Enrollment Period has ...

Medicare Supplement Eligibility

In order to be approved for a Medicare Supplement plan, you will have to pass health underwriting questions. These questions will be different for each company. Some common criteria we see are:

Exceptions

New To Medicare Part B: When you start Medicare Part B you get a 7-month window where you can enroll in a supplement plan with no health questions. For people with pre-existing conditions, this is their only chance to get a Medicare Supplement plan.

How old do you have to be to get Medicare Supplement?

In most states you need to be 65 years or older; however, insurance carriers in a few states offer at least one Medicare Supplement to Medicare beneficiaries under 65 years. Anyone who is at least 65 years old and enrolled in Medicare Parts A & B is eligible for Medigap.

When do seniors have to enroll in Medicare Supplement?

Many seniors will have automatic enrollment in Part A when turning 65. In some cases, beneficiaries automatically enroll in Part B. Once you’ve acquired Original Medicare, you can use your Medicare Supplement Open Enrollment Period to select a Medicare Supplement policy. The best part, when you enroll during this period, ...

What insurance does Medicare offer to people under 65?

The policy that is usually available to Medicare beneficiaries under 65 is Medigap Plan A. Insurance companies know that beneficiaries under 65, receiving Medicare are likely on disability. Those on disability are a higher risk for claims because they need more ...

How old do you have to be to get medicare in 2021?

You also must be enrolled in Part A and Part B. In most states you need to be 65 years or older; however, insurance carriers in a few states offer at least one Medicare Supplement ...

How long does Medigap coverage last?

The best part, when you enroll during this period, there’s no medical underwriting. This only happens once in a beneficiary’s lifetime and lasts for 6 months. Those new to Medicare have the best opportunity when it comes to Medigap eligibility. Taking advantage of top-quality coverage at the lowest price is the opportunity every beneficiary has ...

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Can Medicare Advantage plan beneficiaries switch to Medigap?

Medicare Advantage plan beneficiaries can switch to Medigap if they increased the copayments or premium by 15 percent or more, stopped offering the plan, ends their relationship with your provider, or reduced benefits.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

How old do you have to be to get Medicare?

If you are age 65 or older, you are generally eligible to receive Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) if you are a United States citizen or a permanent legal resident who has lived in the U.S. for at least five years in a row.

When do you get Medicare Part A and Part B?

If you meet Medicare eligibility requirements and you have received Social Security benefits for at least four months prior to turning age 65, you will typically get Medicare Part A and Part B automatically the first day of the month you turn age 65.

What happens if you refuse Medicare Part B?

If you refuse it, you don’t lose your Medicare Part B eligibility. However, you may have to wait for a valid enrollment period before you can enroll . You may also have to pay a late enrollment penalty for as long as you have Medicare Part B coverage.

How long do you have to work to pay Medicare?

You or your spouse worked long enough (40 quarters or 10 years) while paying Medicare taxes. You or your spouse had Medicare-covered government employment or retiree who has paid Medicare payroll taxes while working but has not paid into Social Security. Normally, you pay a monthly premium for Medicare Part B, no matter how many years you’ve worked.

Is Medicare available to everyone?

Medicare coverage is not available to everyone. To receive benefits under this federal insurance program, you have to meet Medicare eligibility requirements. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

What is Medicare Supplement Plan F?

Licensed Insurance Agent and Medicare Expert Writer. July 29, 2020. Medicare Plan F covers more expenses than other supplement plans, and it's one of just two plans that pay for the Part B deductible. It also covers the Part B excess charge, a benefit that’s just as rare.

When will Medicare change to plan F?

The rules for who can enroll in Medigap plan F have changed starting January 1, 2020. If you're newly eligible for Medicare in 2020, skip ahead to find out how this update will affect you.

What is a plan F?

Plan F is one of two Medicare Supplement plans that covers Part B excess charges (what some doctors charge above what Medicare pays for a service). Plan C is the other. Like many other Medigap policies, Plan F also covers Part B copayments and the deductible.

How much does Plan F cost in 2020?

This plan covers everything a regular Plan F does, but in 2020, you’ll be responsible for paying the first $2,340 (up from $2,300 in 2019) of costs out of your own pocket before coverage kicks in. In return, you could pay lower premiums each month.

What is covered by Plan F?

Plan F also covers many Part A expenses, such as coinsurance for hospital stays, a skilled nursing facility, and hospice care. You’ll also have coverage for the first three pints of blood, should you ever need a transfusion. After that, Part A takes over to pay for additional blood.

Is Medigap Plan F available?

Medigap Plan F will have limited availability. Beginning in 2020, Plans F and C, which cover the Part B deductible, are no longer available to people newly eligible to Medicare after January 1, 2020. If you became eligible for Medicare in 2019 or earlier, however, you can still enroll in Plan F in 2020 and beyond.

Why did John choose Plan F?

He’s choosing Plan F because he needs regular kidney dialysis, as well as physical therapy for an old shoulder injury. He has a wife and helps care for two teenage grandchildren, so John needs fixed health care costs each month.