Medicare will pay for an inpatient rehabilitation facility the same way it covers hospital stays. This means you are fully covered for 60 days. After 60 days, you will pay $341/day until you reach 90 days, and then $682/day until you reach 150 days.

Full Answer

How much does Medicare cost per month?

· How does Medicare cover hospital stays? When it comes to hospital stays, Medicare Part A (hospital insurance) generally covers much of the care you receive: As a hospital inpatient; In a skilled nursing facility (SNF) You generally have to pay the Part A deductible before Medicare starts covering your hospital stay. Some insurance plans have yearly deductibles – …

How long do you have to pay Medicare Part a deductible?

You’ll pay $233, before Original Medicare starts to pay. You pay this deductible once each year. Costs for services (coinsurance) You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How long does Medicare pay for rehab?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274.

Does Medicare pay for long-term care?

· After you pay this amount, Medicare starts covering the costs. Days 1 through 60. For the first 60 days that you’re an inpatient, you’ll pay …

How long does Medicare cover you for?

Medicare covers Medicare provides 60 lifetime reserve days of inpatient hospital coverage following a 90-day stay in the hospital. These lifetime reserve days can only be used once — if you use them, Medicare will not renew them. Very few people remain in a hospital for 150 consecutive days.

Does Medicare pay for everything?

Original Medicare (Parts A & B) covers many medical and hospital services. But it doesn't cover everything.

What things will Medicare pay for?

What Part A covers. Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

How many days will Medicare pay the full cost?

For days 1–20, Medicare pays the full cost for covered services. You pay nothing. For days 21–100, Medicare pays all but a daily coinsurance for covered services. You pay a daily coinsurance.

Does Medicare always pay 80 percent?

You will pay the Medicare Part B premium and share part of costs with Medicare for covered Part B health care services. Medicare Part B pays 80% of the cost for most outpatient care and services, and you pay 20%. For 2022, the standard monthly Part B premium is $170.10.

What medical expenses are not covered by Medicare?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

Does Medicare pay for surgery?

Does Medicare Cover Surgery? Medicare covers surgeries that are deemed medically necessary. This means that procedures like cosmetic surgeries typically aren't covered. Medicare Part A covers inpatient procedures, while Part B covers outpatient procedures.

Does Medicare cover dental?

Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Does Medicare pay for cataract surgery?

Medicare covers standard cataract surgery for people who are 65 or older. Original Medicare will even pay for corrective lenses if you have surgery to implant an IOL. Under your Medicare Part B benefits, Medicare will pay for one pair of prescription eyeglasses with standard frames or a set of contact lenses.

What happens when Medicare hospital days run out?

Medicare will stop paying for your inpatient-related hospital costs (such as room and board) if you run out of days during your benefit period. To be eligible for a new benefit period, and additional days of inpatient coverage, you must remain out of the hospital or SNF for 60 days in a row.

Does Medicare pay for hospital stays?

Medicare covers a hospital stay of up to 90 days, though a person may still need to pay coinsurance during this time. While Medicare does help fund longer stays, it may take the extra time from an individual's reserve days. Medicare provides 60 lifetime reserve days.

Does Medicare have a lifetime limit?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

How Does Medicare Cover Hospital Stays?

When it comes to hospital stays, Medicare Part A (hospital insurance) generally covers much of the care you receive: 1. As a hospital inpatient 2....

What’S A Benefit Period For A Hospital Stay Or SNF Stay?

A benefit period is a timespan that starts the day you’re admitted as an inpatient in a hospital or skilled nursing facility. It ends when you have...

What’S A Qualifying Hospital Stay?

A qualifying hospital stay is a requirement you have to meet before Medicare covers your stay in a skilled nursing facility (SNF), in most cases. G...

How Might A Medicare Supplement Plan Help With The Costs of My Hospital Stay?

Medicare Supplement insurance is available from private insurance companies. In most states, there are up to 10 different Medicare Supplement plans...

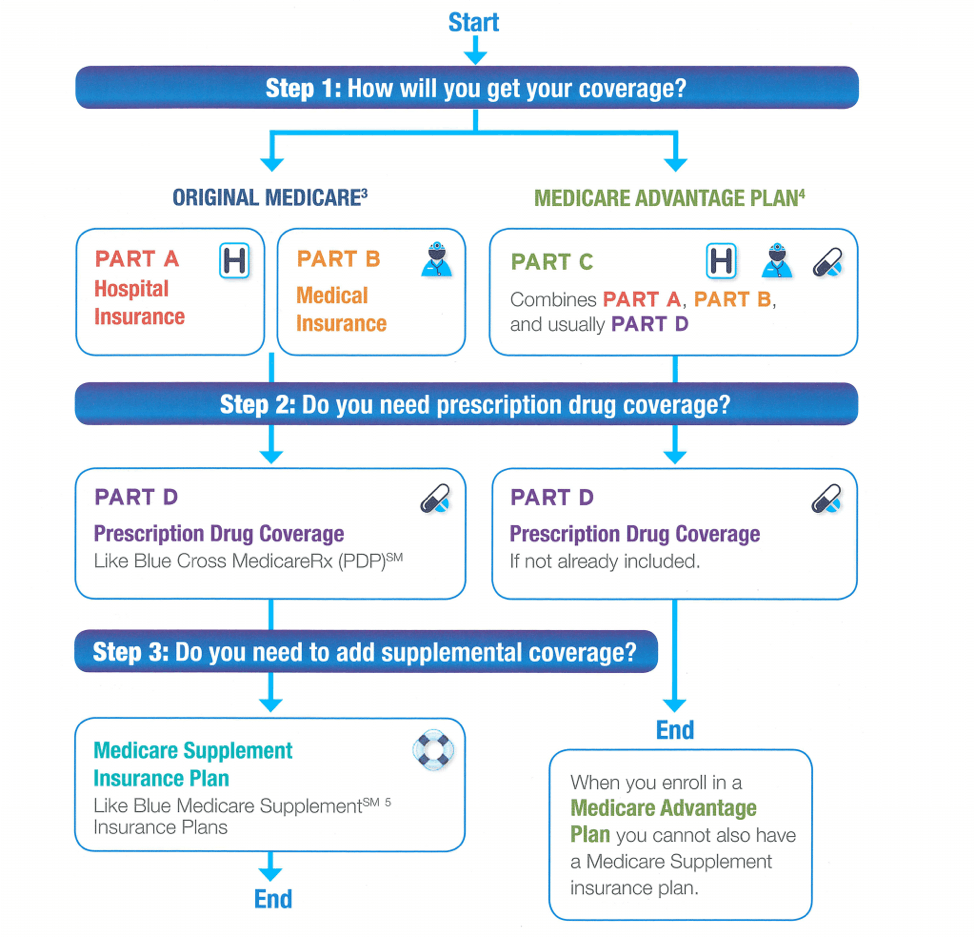

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Do you have to pay late enrollment penalty for Medicare?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

How long does Medicare Advantage last?

Takeaway. Medicare benefit periods usually involve Part A (hospital care). A period begins with an inpatient stay and ends after you’ve been out of the facility for at least 60 days.

What is Medicare benefit period?

Medicare benefit periods mostly pertain to Part A , which is the part of original Medicare that covers hospital and skilled nursing facility care. Medicare defines benefit periods to help you identify your portion of the costs. This amount is based on the length of your stay.

How long does Medicare benefit last after discharge?

Then, when you haven’t been in the hospital or a skilled nursing facility for at least 60 days after being discharged, the benefit period ends. Keep reading to learn more about Medicare benefit periods and how they affect the amount you’ll pay for inpatient care. Share on Pinterest.

What facilities does Medicare Part A cover?

Some of the facilities that Medicare Part A benefits apply to include: hospital. acute care or inpatient rehabilitation facility. skilled nursing facility. hospice. If you have Medicare Advantage (Part C) instead of original Medicare, your benefit periods may differ from those in Medicare Part A.

How much is Medicare deductible for 2021?

Here’s what you’ll pay in 2021: Initial deductible. Your deductible during each benefit period is $1,484. After you pay this amount, Medicare starts covering the costs. Days 1 through 60.

Does Medicare require post acute care?

Trusted Source. of people with Medicare require post-acute care after a hospital stay – for example, at a skilled nursing facility. Coinsurance costs work a little differently when you’re admitted to a skilled nursing facility. Here is the breakdown of those costs in 2021:

Is Medicare benefit period confusing?

Certainly, Medicare benefit periods can be confusing. If you have specific questions regarding Medicare Part A costs and how a service you need will be covered, you can contact these sources for help:

How long does Medicare cover SNF?

After day 100 of an inpatient SNF stay, you are responsible for all costs. Medicare Part A will also cover 90 days of inpatient hospital rehab with some coinsurance costs after you meet your Part A deductible. Beginning on day 91, you will begin to tap into your “lifetime reserve days.".

How long does Medicare cover inpatient rehab?

Medicare Part A will also cover 90 days of inpatient hospital rehab with some coinsurance costs after you meet your Part A deductible. Beginning on day 91, you will begin to tap into your “lifetime reserve days.". You may have to undergo some rehab in a hospital after a surgery, injury, stroke or other medical event.

Does Medicare cover rehab?

Learn how inpatient and outpatient rehab and therapy can be covered by Medicare. Medicare Part A (inpatient hospital insurance) and Part B (medical insurance) may both cover certain rehabilitation services in different ways.

Where does Medicare Part A rehab take place?

The rehab may take place in a designated section of a hospital or in a stand-alone rehabilitation facility. Medicare Part A provides coverage for inpatient care at a hospital, which may include both the initial treatment and any ensuing rehab you receive while still admitted as an inpatient. Before Medicare Part A begins to pay for your rehab, you ...

How much is Medicare Part A deductible for 2021?

In 2021, the Medicare Part A deductible is $1,484 per benefit period. A benefit period begins the day you are admitted to the hospital. Once you have reached the deductible, Medicare will then cover your stay in full for the first 60 days. You could potentially experience more than one benefit period in a year.

Does Medicare cover outpatient treatment?

Medicare Part B may cover outpatient treatment services as part of a partial hospitalization program (PHP), if your doctor certifies that you need at least 20 hours of therapeutic services per week.

Is Medicare Advantage the same as Original Medicare?

Medicare Advantage plans are required to provide the same benefits as Original Medicare. Many of these privately sold plans may also offer additional benefits not covered by Original Medicare, such as prescription drug coverage.

Does Medicare cover long term care?

Medicare Part D covers some prescription drugs. Medicare generally doesn’t cover long-term care except in certain circumstances. Medicare draws a line between medical care (which is generally covered) and what it calls “custodial care” which is generally not covered.

How much will Medicare pay for long term care in 2021?

In 2021 under Medicare Part A, you generally pay $0 coinsurance for the first 60 days of each benefit period, once you have paid your Part A deductible.

What is Medicare Part D?

Original Medicare (Part A and Part B) covers some hospital and medical costs. Medicare Part D covers some prescription drugs. Medicare generally doesn’t cover long-term care except in certain circumstances. Medicare draws a line between medical care (which is generally covered) and what it calls “custodial care” which is generally not covered. Custodial care includes help bathing, eating, going to the bathroom, and moving around. However, Medicare may cover long-term care that you receive in: 1 A long-term care hospital (generally you won’t pay more than you would pay for care in an acute care hospital) 2 Skilled nursing facility (Medicare covered services include a semi-private room, meals, skilled nursing care and medications) 3 Eligible home health services such as physical therapy and speech-language pathology 4 Hospice care including nursing care, prescription drugs, hospice aid and homemaker services

How much is the Medicare deductible for 2021?

The deductible is $1,484 in 2021. Feel free to click the Compare Plans button to see a list of plan options in your area you may qualify for.

Why do seniors need long term care?

Chronic conditions such as diabetes and high blood also make you more likely to need long-term care. Alzheimer’s and dementia are very common among seniors and may be another reason to need long-term care. According to the Alzheimer’s foundation, one in three seniors dies with Alzheimer’s or another dementia.

What is long term care hospital?

A long-term care hospital (generally you won’t pay more than you would pay for care in an acute care hospital) Skilled nursing facility (Medicare covered services include a semi-private room, meals, skilled nursing care and medications) Eligible home health services such as physical therapy and speech-language pathology.

How much does a coinsurance policy cost for 61-90?

For days 61-90, you pay $371 per day of each benefit period. For days 91 and beyond you pay $742 coinsurance per each “lifetime reserve day” after day 90 for each benefit period and you only have up to 60 days over your lifetime. Beyond the lifetime reserve days you pay all costs until a new benefit period begins.

How long does a person have to be on Medicare to get hospice?

Medicare recipients who have Original Medicare Part A, are eligible for the hospice benefit if they have certification from their physician that their life expectancy is no more than six months. Patients must also sign a statement saying they choose hospice care rather than curative treatment for their illness.

How long does hospice care last?

After the initial six-month period, hospice care can continue if the medical director, or a doctor of the hospice facility, re-certifies that the patient is terminally ill. Medicare gives coverage for hospice care in benefit periods. Initially, a patient can receive hospice care for two 90-day benefit periods.

Does Medicare cover hospice care?

In the United States, the Medicare provides coverage for hospice care that takes place at an inpatient facility or in the patient’s home. If you, a family member, or someone in your care is facing a terminal prognosis, you will need information on hospice care and your Medicare coverage. Medicare Coverage for Hospice Care.

Can hospice care be continued after six months?

That is not the case. After the initial six-month period, hospice care can continue if the medical director, or a doctor of the hospice facility, re-certifies that the patient is terminally ill. Medicare gives coverage for hospice care in benefit periods.

Can you change hospice providers one time?

For every benefit period of hospice care, the patient has the right to change hospice providers one time . If a patient no long needs hospice care because of improvement in health or remission, the patient can stop hospice care.

When was hospice first created?

Since 1967 when modern hospice care was first created, it has provided comfort and an improved quality of life for people who are facing the final phase of a life-limiting illness. For those who are no longer seeking curative treatment, hospice care provides pain and symptom relief, as well as emotional and spiritual support for ...

How long does Medicare continue to help you in rehab?

If your stay in rehab is continuous, and it runs over the allotted 90 days, Medicare may continue to assist with ...

How long does Medicare rehab last?

Standard Medicare rehab benefits run out after 90 days per benefit period. If you recover sufficiently to go home, but you need rehab again in the next benefit period, the clock starts over again and your services are billed in the same way they were the first time you went into rehab. If your stay in rehab is continuous, ...

How much does Medicare pay for rehab?

After you meet your deductible, Medicare can pay 100% of the cost for your first 60 days of care, followed by a 30-day period in which you are charged a $341 co-payment for each day of treatment.

Does Medicare cover skilled nursing?

Because skilled nursing is an inpatient service, most of your Medicare coverage comes through the Part A inpatient benefit. This coverage is automatically provided for eligible seniors, usually without a monthly premium. If you get Medicare benefits through a Medicare Advantage plan, your Part A benefits are included in your policy.

Do you have to pay Medicare premiums in 2021?

In 2021, this amounts to $1,484 that has to be paid before your Medicare benefits kick in ...

Does Medicare pay for inpatient rehab?

Once you transfer to rehab, Medicare Part A pays 100% of your post-deductible cost for the first 60 days. This pays for all of the inpatient services the SNF provides, though you may also get outpatient services that are billed to Part B. Be aware that you may have to pay up to 20% of all Part B services, such as transportation ...

Does Medicare Supplement cover out of pocket expenses?

A Medicare Supplement plan can pick up some or all of the deductible you would otherwise be charged, assist with some Part B expenses that apply to your treatment and potentially cover some additional out-of-pocket Medicare costs.

How long do you have to pay for a health insurance policy?

Most policies will also require you to pay out of pocket for a predetermined amount of time, usually between 30 and 90 days, before coverage kicks in.

What is covered by Medicare Advantage?

Some of the specific things covered by Medicare include: A semiprivate room. Meals. Skilled nursing care. Physical and occupational therapy. Medical social services. Medications. Medical supplies and equipment. However, if you have a Medicare Advantage Plan, it’s possible that the plan covers nursing home care.

Does Medicare cover nursing home care?

Medicare offers pretty limited coverage for nursing home care, but it can help offset the costs of a short-term stay or related medical services. If what Medicare offers isn’t enough, you have other options, though. Read on to see what Medicare can do for you and what your alternatives are if you need more help.

What is long term care insurance?

Similar to regular health insurance, long-term care insurance has you pay a premium in exchange for financial assistance should you ever need long-term care . This insurance can help prevent you from emptying your savings if you suddenly find yourself needing nursing home care.

Does nursing home insurance have a cap?

This insurance can help prevent you from emptying your savings if you suddenly find yourself need ing nursing home care. However, it’s important to note that these policies often have a daily or lifetime cap for the amount paid out . When you apply, you can choose an amount of coverage that works for you.

How long does functional mobility insurance last?

Most policies will also require you to pay out of pocket for a predetermined amount of time, usually between 30 and 90 days, before coverage kicks in.

Can you use your life insurance to pay for nursing home care?

According to Medicare.gov, some insurance companies even allow you to use your life insurance policy to help pay for long-term care.