How high will Medicare costs rise under the trustees’ projections?

· In their annual report, Medicare's trustees said the program's trust fund that provides hospital care to the country's retirees — known as "Part A" — is expected to run out of money by 2030 ...

What is the long-term outlook for Medicare?

Each year the Trustees of the Social Security and Medicare trust funds report on the current and projected financial status of the two programs. This message summarizes the 2014 Annual Reports. Neither Medicare nor Social Security can sustain projected long-run pro-gram costs in full under currently scheduled financing, and legislative

What is the share of Medicare enrollees in private health plans?

The 2014 OASDI Trustees Report, officially called " The 2014 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds ," presents the current and projected financial status of the trust funds. The report is available in PDF, a printer-friendly format.

How many trustees does the Secretary of Social Security have?

The Social Security Act requires that the Board, among other duties, report annually to the Congress on the financial and actuarial status of the HI and SMI trust funds. The 2014 report is the 49th that the Board has submitted. The basis for the projections in …

How accurate are Social Security statements?

Unfortunately, your Social Security benefits estimate from the statements you can pull from the Social Security Administration is not the best source of information on what to expect in the future. The issue lies with the omissions that the Administration makes with their estimate methodology.

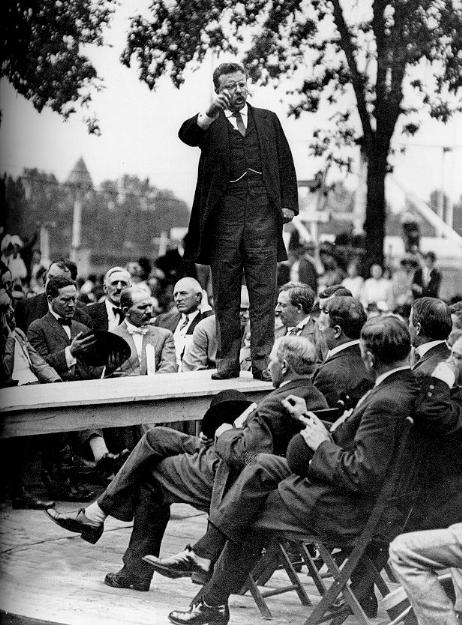

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

Does Social Security ever make mistakes?

What if my Social Security benefit is the wrong amount? Mistaken Social Security payments are rare, but with the Social Security Administration (SSA) delivering monthly benefits to nearly 70 million people, they do happen.

What was average Social Security check in 2014?

Sign up for the AARP Money Newsletter But on average, monthly retirement payments will rise from $1,275 to $1,294, an increase of $19, Social Security says. Disabled workers will receive an average of $17 more a month, while the average widowed mother with two children will see her benefits grow by $39 a month.

Who was the first president to dip into Social Security?

Which political party started taxing Social Security annuities? A3. The taxation of Social Security began in 1984 following passage of a set of Amendments in 1983, which were signed into law by President Reagan in April 1983.

How much has Congress borrowed from Social Security?

The total amount borrowed was $17.5 billion.

What is wrong with Social Security?

Social Security has a long-known basic math problem: more money will be going out than coming in. Roughly 10,000 baby boomers are retiring each day, with insufficient numbers of younger people entering the work force to pay into the system and support them.

Can you outlive your Social Security benefits?

Social Security provides an inflation-protected benefit that lasts as long as you live. Social Security benefits are based on how long you've worked, how much you've earned, and when you start receiving benefits. You can outlive your savings and investments, but you can never outlive your Social Security benefit.

Is it a mistake to take Social Security at 62?

The Mistake: Taking Social Security Too Early You can claim Social Security benefits as soon as you turn 62 years old. However, for everyone born after 1959, the reduction for claiming benefits at age 62 is 30 percent. The lower benefits are permanent: Your benefits won't go up once you reach full retirement age.

What is the average Social Security check at 62?

According to payout statistics from the Social Security Administration in June 2020, the average Social Security benefit at age 62 is $1,130.16 a month, or $13,561.92 a year.

What is the average Social Security check at age 65?

At age 65: $2,993. At age 66: $3,240. At age 70: $4,194.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

How many people received Social Security in 2013?

63.2 million people received benefits from programs administered by the Social Security Administration ( SSA) in 2013. 5.5 million people were newly awarded Social Security benefits in 2013. 65% of aged beneficiaries received at least half of their income from Social Security in 2012.

What percentage of Social Security income was in 1962?

In 1962, Social Security, earnings, income from assets, and government employee and private pensions made up only 85% of the aggregate total income of couples and nonmarried persons aged 65 or older, compared with 97% in 2012.

How many children are eligible for Oasdi?

More than 3.4 million children under age 18 and students aged 18–19 received OASDI benefits. Children of deceased workers had the highest average payments, in part because they are eligible to receive monthly benefits based on 75% of the worker's PIA, compared with 50% for children of retired or disabled workers.