Medicare Part B generally pays 80% of approved costs of covered services, and you pay the other 20%. Some services, like flu shots, may cost you nothing. Most people pay a monthly premium for Medicare Part B. The standard premium is $144.60 in 2020.

Full Answer

How much is Medicare Plan B?

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services.

How much does Medicare Part B costs?

and Part B which covers doctor’s visits and other medical services, and costs $170.10 per month for most enrollees in 2021. Everyone is eligible for Medicare at age 65, even if your full Social ...

Does everyone pay the same for Medicare Part B?

Most beneficiaries pay the same amount for Medicare Part B. However, those in a higher-income bracket do pay more as well as those in a lower income bracket may get assistance with paying their Part B premium. No, eligibility for Part B is not based on income. How much is taken out of your Social Security check for Medicare?

How much will you pay for Medicare Part B?

The standard Part B premium in 2021 is $148.50 per month, though you could potentially pay more, depending on your income. Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior.

What does Medicare A and B provide?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers.

Does Medicare Part B pay everything?

What Medicare Part B Covers. Medicare Part B offers comprehensive coverage for outpatient services, durable medical equipment, and doctor visits. The two main types of coverage this part of Medicare includes are medically necessary and preventive.

What does Medicare type a cover?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

What expenses will Medicare Part B pay for?

Part B covers things like:Clinical research.Ambulance services.Durable medical equipment (DME)Mental health. Inpatient. Outpatient. Partial hospitalization.Limited outpatient prescription drugs.

What services does Medicare Part B not cover?

But there are still some services that Part B does not pay for. If you're enrolled in the original Medicare program, these gaps in coverage include: Routine services for vision, hearing and dental care — for example, checkups, eyeglasses, hearing aids, dental extractions and dentures.

What is not covered by Medicare Part A?

A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care. A television or telephone in your room, and personal items like razors or slipper socks, unless the hospital or skilled nursing facility provides these to all patients at no additional charge.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is covered by Medicare Part C?

Medicare Part C outpatient coveragedoctor's appointments, including specialists.emergency ambulance transportation.durable medical equipment like wheelchairs and home oxygen equipment.emergency room care.laboratory testing, such as blood tests and urinalysis.occupational, physical, and speech therapy.More items...

Does Medicare Part B cover doctor visits?

Medicare Part B pays for outpatient medical care, such as doctor visits, some home health services, some laboratory tests, some medications, and some medical equipment.

Does Medicare Part A cover emergency room visits?

Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

Does Medicare cover eye exams?

Medicare doesn't cover eye exams (sometimes called “eye refractions”) for eyeglasses or contact lenses. You pay 100% for eye exams for eyeglasses or contact lenses.

Is Medicare Part B premium automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Why is Medicare Part B so high?

According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Why is my Medicare Part B premium so high?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

What is the difference between Medicare A and B?

If you're wondering what Medicare Part A covers and what Part B covers: Medicare Part A generally helps pay your costs as a hospital inpatient. Medicare Part B may help pay for doctor visits, preventive services, lab tests, medical equipment and supplies, and more.

What Is Original Medicare Part A and B?

Part A and Part B are often referred to as “Original Medicare.” Original Medicare is one of your health coverage choices as part of the Medicare program managed by the federal government. Unless you choose a Medicare health plan, you will be enrolled in Original Medicare. You can go to any doctor, supplier, hospital, or other facility that is enrolled in Medicare and accepting new Medicare patients. It is fee-for-service coverage, meaning that, generally, there is a cost for each service.

What is not covered by Original Medicare?

Original Medicare doesn’t cover everything. If you need certain services that Medicare does not cover, you will have to pay out–of-pocket unless you have other insurance to help cover the costs. Even if Medicare covers a service or item, you generally have to pay deductibles, coinsurance, and copayments.

What is the number to call for Medicare Advantage?

Some of these services not covered by Original Medicare may be covered by a Medicare Advantage Plan (like an HMO or PPO). To find out if Medicare covers a service you need, visit medicare.gov and select “What Medicare Covers,” or call 1-800-MEDICARE (1-800-633-4227). TTY users should call 1-877-486-2048, 24 hours a day/7 days a week.

How to get a quote for Medicare?

Get an online quote at Medicare.org for Medicare plans that fit your healthcare needs today! Or call (888) 815-3313 – TTY 711 to get answers and guidance over the phone from an experienced licensed sales agent.

What is fee for service?

It is fee-for-service coverage, meaning that, generally, there is a cost for each service. You generally pay a set amount for your health care (deductible) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (coinsurance / copayment) for covered services and supplies. You usually pay a monthly premium for Part B.

Do you pay Medicare premiums if you are on Medicare?

You usually do not pay a monthly premium for Part A coverage if you or your spouse paid Medicare taxes while working. For Part B, most people pay a standard monthly premium, but some people may pay a higher Part B premium based on their income.

Does Medicare cover dental care?

Items and services that Medicare does not cover include, but are not limited to, cosmetic surgery, health care you get while traveling outside of the United States (except in limited cases), hearing aids and exams for fitting hearing aids, long-term care, most eyeglasses, routine dental care, dentures, and acupuncture.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.

What services does Medicare cover?

Dentures. Cosmetic surgery. Acupuncture. Hearing aids and exams for fitting them. Routine foot care. Find out if Medicare covers a test, item, or service you need. If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them.

Does Medicare cover everything?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: Long-Term Care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for long term care?

Medicare and most health insurance plans don’t pay for long-term care. (also called. custodial care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

What is Medicare Part A and Part B?

Medicare Part A and Part B are designed to cover inpatient and outpatient expenses. Part A is designed specifically for inpatient stays in hospitals, skilled nursing facilities, and hospice care.

How much is Part B medical insurance?

Part B medical insurance is associated with monthly premium payments, an annual deductible, and coinsurance payments for services. In 2020, the base monthly premium payment is $144.60. This amount applies to anyone making less than $87,000 annually as an individual or $174,000 for those filing jointly. If you exceed these numbers, your premium ...

How much is Medicare Part B 2020?

In addition to the premium payments, Medicare Part B also requires an annual deductible to be met. In 2020, the deductible is set to $198. You will need to pay this amount completely out of pocket before Medicare will begin covering your services.

How much coinsurance do you pay for Medicare?

Once you have met your deductible, you will then pay a coinsurance of 20 percent of the Medicare-approved amount. This amount is pre-set by Medicare and sets a limit as to the maximum amount they will pay for a service.

What is covered under Part B?

Injections, physical therapy, or other modalities are also often covered under Part B as they are used to treat a condition. Durable medical equipment required after an injury, procedure, or diagnosis is also covered.

Does Part B cover hearing aids?

Part B does not provide any coverage related to vision, dental, or hearing care. This means that you will not receive any reimbursement for routine dental checkups, fillings, or dentures; routine vision care, including eye exams, glasses, or contacts; or hearing appointments and hearing aids. Part B also does not cover elective procedures, massage ...

What is Medicare Part A?

Medicare Part A is part of Original Medicare.

How Much Does Medicare Part A Cost?

The cost of Medicare Part A premiums depends on whether you or your spouse paid income taxes, and for how long. Most individuals won’t pay a Part A premium. Here are some essential facts about Part A and what it costs.

What is Medicare Part A coinsurance?

You’re responsible for a daily coinsurance. Coinsurance is the percentage of your medical costs that you pay after you meet your deductible.

How much does Medicare Part A coinsurance increase?

Part A coinsurance increases when your length of stay in a facility increases: 0 to 60 days. 61 to 90 days. You have a lifetime limit of reserve days to use if your stay lasts longer than 90 days. Medicare Part A daily coinsurance rates: Days 0-60: $0. Days 61-90: $371 per day. Lifetime Reserve Days: $742 per day.

How does Medicare calculate Part A premium?

Medicare calculates Part A premium costs by how long you or your spouse have paid Medicare taxes.

What is Medicare Part A deductible?

Medicare Part A Deductible. Most Part A costs come from the inpatient. Inpatient refers to medical care that requires admission to the hospital, usually overnight. hospital deductible. Inpatient care provided at a hospital or skilled nursing facility.

What is premium insurance?

A premium is a fee you pay to your insurance company for health plan coverage. This is usually a monthly cost.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is Medicare Part B?

Medicare Part B covers medical insurance benefits and includes monthly premiums, an annual deductible, coinsurance and other potential costs.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

What will Medicare Part A cost in 2021?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities.

How much does Medicare Advantage cost per month?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1

What is the average cost of Medicare Part D prescription drug plans?

In 2021, the average monthly premium for a Medicare Part D plan is $41.64 per month. 1

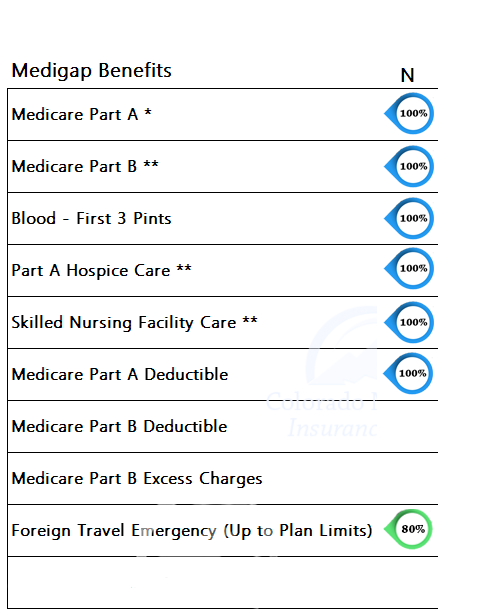

What is the average cost of Medicare Supplement Insurance (Medigap)?

The average premium paid for a Medicare Supplement Insurance (Medigap) plan in 2019 was $125.93 per month. 3

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.