Medicare Supplement Plan F covers:

- Deductibles for Medicare Part A and Part B

- Medicare Part A and Part B coinsurance or copayments

- Medicare Part B excess charges

- Skilled nursing facility coinsurance

- Foreign travel emergency expenses up to plan limits

Full Answer

Who is eligible for Medicare Plan F?

Plan F covers that for you. Plan F also pays the 20% for a long list of other Part B services. This includes durable medical equipment, lab work, tests, mental health care, home health, chiropractic adjustments and much more.

How much is Medicare supplement plan F?

Nov 07, 2019 · Here’s an overview of what Medicare Supplement Plan F may cover and what your costs may be, as well as details on important changes related to this plan. Medicare Supplement Plan F benefits. As mentioned, Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings (Plans A-N; Plans E, H, I, and J are no longer sold). …

Is Medicare Plan F the best?

Apr 08, 2022 · The most comprehensive Medicare Supplement plan is called Plan F. 100% of your Medicare cost-sharing is covered by Medicare Supplement Plan F, so you don’t have to pay out-of-pocket expenses. What plan G does not cover? Dental care and other services that are not covered by Original Medicare are not covered by the Medigap Plan G.

Is Medicare supplement plan F the best?

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are …

What is Medicare Plan F coverage?

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are exhausted. Part A Hospice care coinsurance or copayment.

What are the benefits of Plan F?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.Aug 26, 2021

Does Plan F cover prescriptions?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.Dec 15, 2020

Why are they doing away with Medicare Plan F?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Has Medicare Plan F been discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.Nov 23, 2021

Does Medicare Plan F cover cataract surgery?

We recommend: Plan G for best overall coverage across all medical needs. Also good: Plan A, B, D, G, M and N pay 100% of Part B coinsurance, which is your portion of cataract procedure costs. Best plans if you're eligible: Plan C and Plan F pay 100% of the Medicare Part B coinsurance and the Part B deductible.Dec 9, 2021

Can I keep my plan F after 2020?

If you took Medicare Part A before January 1, 2020, you will be able to keep your Medicare Supplement Plan F. In order to keep your Plan F, you don't need to renew or re-enroll every year. As long as you pay your premiums on time, your coverage will continue.

Does Plan F cover excess charges?

Your Plan F coverage also covers excess charges. In fact, Plan G and Plan G are the only two plans that cover excess charges. Some doctors decide to charge 15% more than Medicare pays them. This “excess charge” is then your responsibility to pay.

Can you switch from Plan F to Plan G in 2021?

Can't I just move from a Medigap Plan F to a Plan G with the same insurance plan? Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch.Jan 14, 2022

Who is eligible for Plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.Oct 1, 2021

Who is eligible for Medicare Supplement Plan F?

Who Can Enroll in Plan F? Any Medicare beneficiary who was Medicare-eligible prior to January 1, 2020, can enroll in Plan F. If you are within the first six months of having enrolled in Medicare Part B, you are able to enroll in Plan F under the guarantee issue period.

What Does Plan F Cover at My Doctor’S Office?

All of your preventive care is covered 100% by Medicare Part B. This includes items like: 1. Your annual physicals, well-woman exams and vaccines 2...

What Does Plan F Cover at The Hospital?

Medicare Part A covers inpatient hospital services, skilled nursing, blood transfusions and home health services that occur in the hospital. Medica...

What’S Not Covered by Plan F?

The only things Plan F does NOT cover would be those things that Medicare itself also does not cover, such as: 1. Acupuncture, acupressure and othe...

Does Medicare Plan F Cover Prescriptions?

Medicare decides what is covered and what is not. Medicare Part B covers injectable or infusion drugs given in a clinical setting. If Medicare pays...

Am I Guaranteed to Be Approved For Plan F?

Not always. You will get ONE open enrollment window to choose your first Medicare supplement without health underwriting. This window starts on Par...

Do Different Insurance Companies Have Different Plan F Benefits?

Fortunately NO. We get questions all the time about this – for instance a caller may ask us whether an AARP Plan F is the same as a Mutual of Omaha...

What is Medicare Supplement Plan F?

Medicare Supplement (Medigap) plans may help with certain out-of-pocket health-care costs that Original Medicare doesn’t pay for, such as deductibles, copayments, and coinsurance. Of the 10 standardized plans that may be available in most states, Medicare Supplement Plan F offers the most comprehensive coverage.

When will Medicare stop covering Part B?

If you qualify for Medicare before January 1, 2020: You may be able to buy Medicare Supplement Plan F (or Plan C). You can typically keep your existing Plan F or Plan C. You can talk to your insurance company about how ...

How much is Medicare deductible for 2017?

In 2017, the deductible is $2,200 (note that this amount may change from year to year).

How long does Medicare Supplement last?

This is the six-month period that starts the first month when you’re enrolled in Part B and age 65 or older; during this period, you typically have a guaranteed right to enroll in any Medicare Supplement plan of your choice without medical underwriting.

Does Medicare cover Part A coinsurance?

Medigap Plan F may cover: Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers. * May be covered if your foreign travel emergency care starts during the first 60 days after leaving the United States and Medicare doesn’t otherwise cover the care.

Is Medicare Supplement Plan F the most comprehensive?

Because Medicare Supplement Plan F offers the most comprehensive coverage of the standardized lettered plans offered in most states, premium costs tend to be higher than other plans. Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan.

What is Plan F for Medicare?

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are exhausted. Part A Hospice care coinsurance or copayment.

What does Plan F cover?

Plan F also covers the Medicare Part B expenses. Part B covers doctor visits and related charges covered under Medicare for providers. Like Part A, Part B only covers 80% of the Medicare-approved expenses. It leaves the remaining 20% on the Part B participant.

What is Plan F?

Plan F covers the Medicare-approved expenses not covered under Medicare Part A (deductibles, coinsurances, and copays). Part A is the hospitalization component of Original Medicare and covers Medicare expenses typically associated with a hospital stay.

How long does Medicare cover skilled nursing?

Medicare limits this benefit to the first 100 days of a stay in a skilled nursing facility.

Why is Plan F standardized?

They did this with the specific goal of making shopping for a plan more manageable. No matter which company provides Plan F, they all must pay for Medicare approved expenses.

What is the 80% travel insurance?

This plan coverage also includes 80% of approved costs associated with foreign travel emergencies, which is vital for the many seniors who enjoy taking cruises or other trips outside the United States. There are plan limits, but this coverage can help offset charges associated with becoming sick or injured while traveling outside of the U.S.

Does Plan F cover Medicare Part B?

It leaves the remaining 20% on the Part B participant. Plan F covers Medicare Part B approved services at the doctor’s office, such as: Plan F is one of only two Medicare Supplement plans that cover the Medicare Part B excess charges (the other being Plan G).

What is Medicare Supplement Plan F?

In short, Medicare Supplement Plan F – also called Medigap Plan F – is the only type of Medigap plan that covers all of the benefits that can be offered by one of the 10 standardized Medicare Supplement Insurance plans that are available in most states . It’s important to note Plan F is no longer available to Medicare beneficiaries who first became ...

What is the maximum amount of foreign emergency care covered by Medicare Supplement Plan F?

But Medicare Supplement Plan F covers 80% of the cost of foreign emergency care, which is the maximum allowed for any Medigap plan.

What is a PDP plan?

Enroll in a Medicare Part D prescription drug plan (PDP). These plans cover prescription drug costs and can be used alongside Medicare Part A and/or Part B and a Medicare Supplement plan.

What is Medicare Part B coinsurance?

Medicare Part B Coinsurance. After first satisfying an annual deductible, Medicare Part B beneficiaries are typically responsible for coinsurance payments for 20% of the remaining cost balance for covered care.

How much is Medicare Part A coinsurance for 2021?

But beginning with day 61, Medicare Part A requires a daily coinsurance of $371 per day in 2021. And beginning on day 91, that daily coinsurance goes up to $742 per day.

How much coinsurance is required for skilled nursing?

But daily coinsurance payments of $185.50 are required for days 21 through 100 in 2021, and you’re responsible for all costs beyond 100 days.

What is Medicare Advantage?

Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage. Medicare Advantage plans are required to cover everything that Medicare Part A and Part B cover, and most plans also cover prescription drugs. Enroll in a Medicare Part D prescription drug plan (PDP). These plans cover prescription drug costs ...

What is a Medigap Plan F?

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage.

What does Medicare Supplement Insurance Plan F cover?

Medicare Supplement Plan F covers costs that Medicare doesn’t cover, says Laura Decker, co-founder and president of the Employee Benefits Division at SSGI, a Maryland-based employee benefits insurance agency.

What doesn't Medicare Supplement Plan F cover?

Medicare Plan F won't cover any services not covered under Original Medicare.

How much does Medicare Part F cost?

The cost of Medicare Plan F depends on a few factors, including your age.

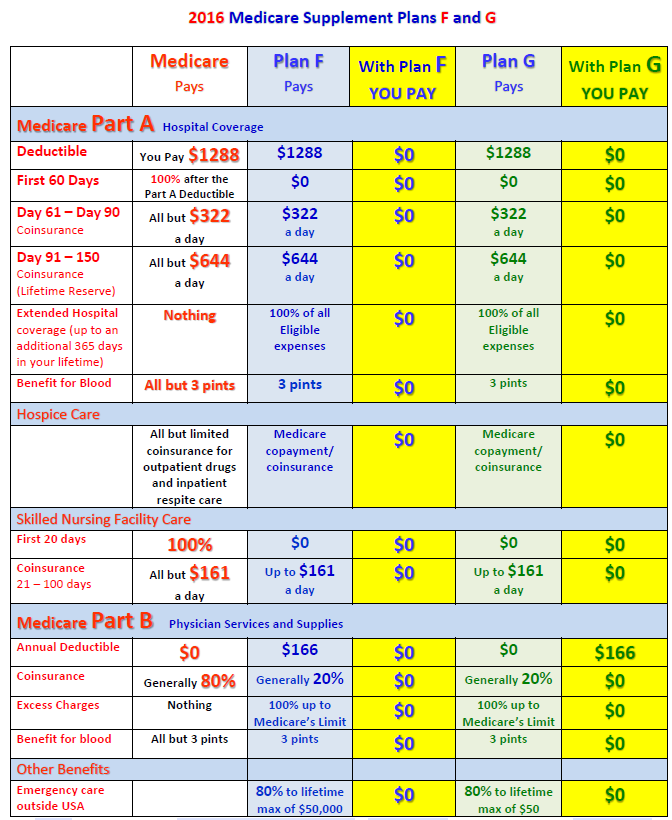

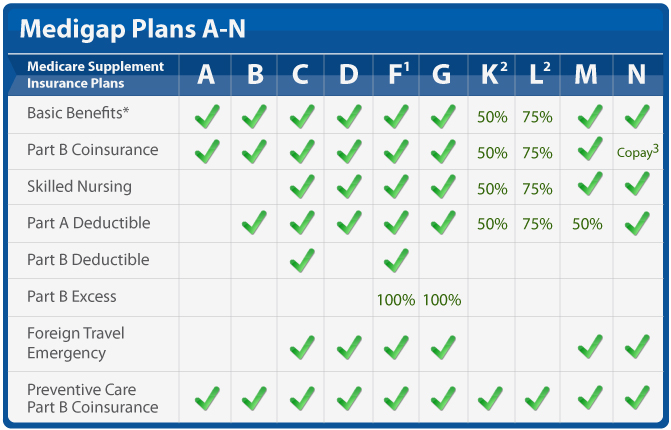

Medicare supplement plans comparison

Medicare Plan F is no longer available for purchase. However, several other Medigap supplement plans can help cover the out-of-pocket costs associated with Original Medicare.

Frequently Asked Questions

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium.

How much does Medicare Plan F cost?

The price of a Medicare Plan F policy is determined based on your age, location, gender, and use of tobacco. National averages are around $300 per month, but in many areas, rates start as low as $125 per month. For the high deductible version, you may pay as little as $68.

When will Medicare Supplement Plan F be available?

As a result, anybody who becomes eligible for Medicare on or after 1 January 2020 will not be able to purchase a Medicare Supplement Plan F policy.

What is Medicare Supplement Plan C?

Medicare Supplement Plan C, also called Medigap Plan C, is one of the most comprehensive of the 10 standardized supplemental Medicare plans available in most states. In fact, only Medicare Plan F offers more coverage.... , E, F, H, I, and J are no longer available to new Medicare beneficiaries.

How does Medigap work?

With a Medigap plan, you pay for most of your medical services in advance through your monthly premiums. A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ...

What is Medicare 2021?

March 12, 2021. The federal Medicare program. Medicare is a federal health insurance program for people ages 65 and older and people with certain disabilities.... is a series of lettered (A, B, C, and D) health insurance programs available to people, age 65 and older, and certain adults with qualifying disabilities. Medicare Part A.

What is Medicare Part B excess charge?

A Medicare Part B excess charge is the difference between a health care provider’s actual charge and Medicare’s approved amount for payment. ... . These occur when your doctor or specialist does not accept the standard Medicare payment for a service.

Which is better, Medicare Supplement Plan F or G?

Medicare Supplement Plan F and Plan G are nearly identical. Technically, Plan F is better because it offers first-dollar coverage. However, the one cost that Plan G does not cover, the Part B deductible, is often less than the annualized premium difference between the two plans.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Why is Medicare Plan F so popular?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

What is the most comprehensive Medicare plan?

If you became eligible for Medicare on or after January 1, 2020, you’ll find that Plan G is the most comprehensive Medigap plan available to you. (In recent years, Plan G has been the second most popular Medicare Supplement plan, and you can read more on that below.) A Medigap plan, or Medicare Supplement, pays after Medicare to help cover your ...

What is the best Medigap plan for 2021?

The best Medigap plans in 2021 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no longer available to new enrollees. Get a quote for both and see which ones offer you the best annual savings.

What happens if you don't have a Supplement?

You would also pay 20% of expensive procedures like surgery because Part B only pays 80%.

How much does it cost to have Gracie's surgery?

The total cost for Gracie’s surgery, hospital stay and follow-up care is $70,000.

Is Medicare Supplement Plan F the #1 seller?

This post has been updated for 2021. Medicare Supplement Plan F has also been the #1 seller with Baby Boomers for many years. According to a report from America’s Health Insurance professionals in 2016, about 57% of all Medigap policies in force were a premium Medicare Plan F policy.

How much is Plan F monthly?

The average cost of Medigap Plan F is around $130-$230 per month. There are many factors that impact the premium price. These include your location, gender, age, tobacco use, and more. However, it could be more or less depending on your zip code as well as other factors.

Does Plan F pay for prescriptions?

Medigap Plan F will only cover services if Original Medicare pays for them first. … Instead, you receive medication coverage from your Medicare Part D Prescription Drug plan. Because Medicare Supplement plans only pay secondary to Original Medicare, not Medicare Part D, Plan F would not pay for your prescriptions.

What happened with Plan F?

Changes to Medicare Supplement Plan F in 2020 The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Is Medicare Plan F being discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.

What is plan F 2020 high deductible?

High Deductible Plan F overview High Deductible Plan F includes the comprehensive benefits of regular Plan F, but you manage your health care costs until you’ve reached the calendar year deductible amount. After that, the plan functions like regular Plan F. Having a high deductible can reduce your monthly premiums.

When did Medicare Plan F stop?

In case you missed the news, Medicare Supplement Plan F is being phased out starting January 1, 2020. If you currently have a Plan F, don’t panic. You can keep your plan as long as you want. However, if you become eligible for Medicare after January 1, 2020, you can’t purchase a Plan F.

What Does Medigap Plan F Cover?

What exactly is covered in Medigap F plan? As mentioned above, Plan F is the most comprehensive Medigap plan. With Plan F, you would not have a charge for anything covered by health insurance. Medicare pays its share, then Plan F takes the rest.

How Does Medigap Plan F Work?

The Medigap F plan works in the same way as other Medigap planes. First, Medigap plans can be used wherever medicare is accepted, nationally. There are no networks on the Medigap plans. Plans are NOT PPO or HMO plans. They “follow” medicare.

Is Medigap Plan F Ending?

One of the recent developments with Plan F is the imminent end of the scheme for new beneficiaries. In April 2015, Congress passed the Medicare and CHIP Access Reauthorization Act of 2015. This bill, among other things, sets the end of coverage of the “first dollar”, specifically Plan F and Plan C.

Is Medigap Plan F the Best Deal?

The Medigap F Plan, regardless of the end of the 2020 plan, may not be the best deal for your situation anyway. As always, you should look at the rates for your specific postal code, as rates vary considerably from one geographic area to another. But often other plans will have more financial sense.