What Does Supplemental Plan D Insurance Cover? Medicare Supplement

Medigap

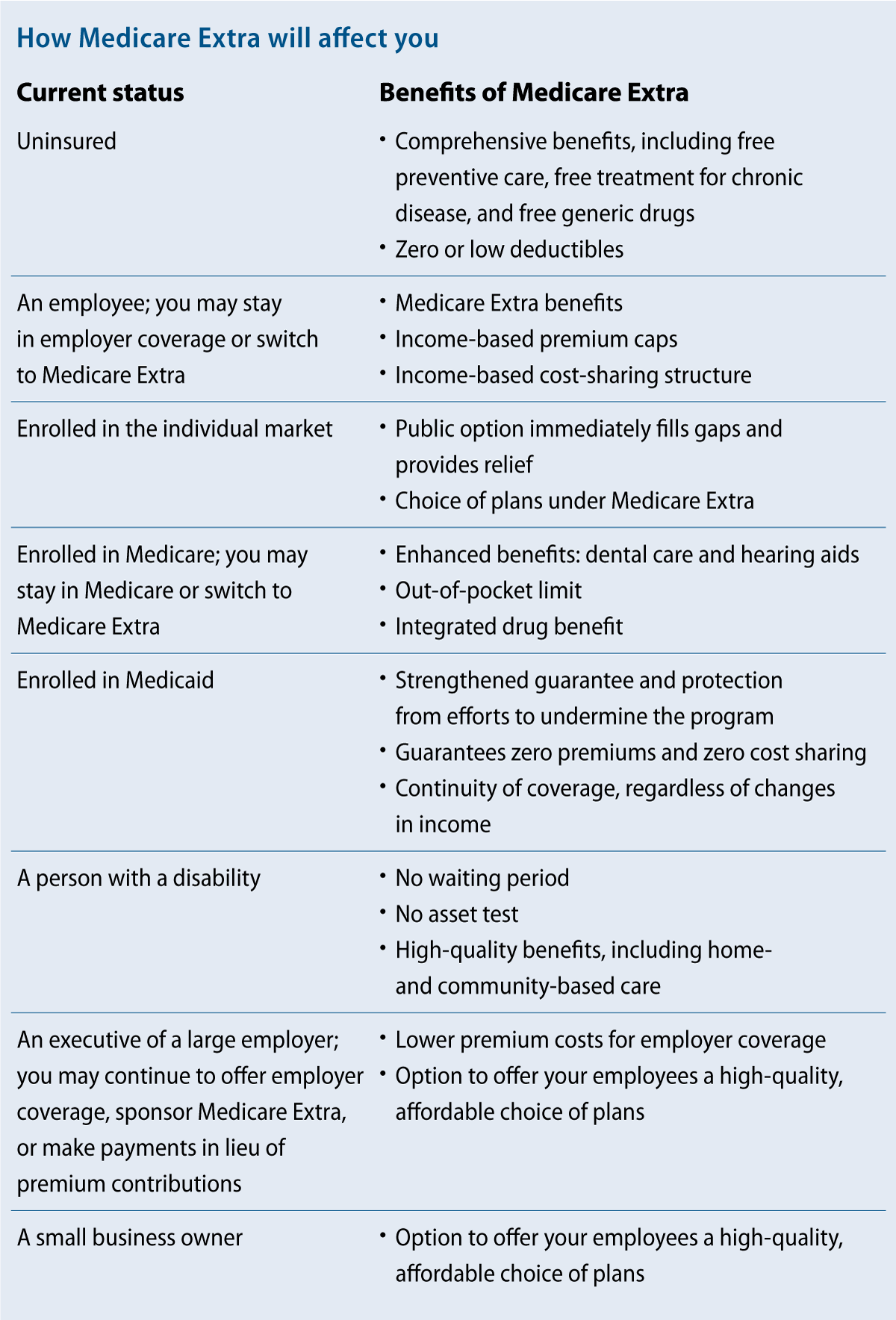

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Hospice

Hospice care is a type of care and philosophy of care that focuses on the palliation of a chronically ill, terminally ill or seriously ill patient's pain and symptoms, and attending to their emotional and spiritual needs. In Western society, the concept of hospice has been evolving in Europe since the 11…

Full Answer

What is the best Medicare supplement insurance?

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. ...

- You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. ...

- A Medigap policy only covers one person. ...

How to compare Medicare Part D plans?

- Biggest Medicare changes for 2022

- Medicare proposes limited coverage of controversial new Alzheimer's drug

- AARP interview: new Medicare chief outlines her vision

What does Medicare Part G cover and more?

Plan G offers great value for beneficiaries who are willing to pay a small annual deductible. After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

Do you have a Medigap policy with prescription drug coverage?

Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D).

What is included in Medicare Plan D?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

What is Medicare Part D responsible for?

The Part D drug benefit (also known as “Medicare Rx”) helps Medicare beneficiaries to pay for outpatient prescription drugs purchased at retail, mail order, home infusion, and long-term care pharmacies.[2]

What is difference between plan D and plan G in Medicare?

Medigap Plan D Just like the difference in Plans F and C, the only difference in Plans G and D is the coverage of the Medicare Part B Excess charges. Whereas Plan G covers those at 100%, Plan D does not cover them at all.

Does Medicare Part D cover supplements?

Every Medicare Prescription Drug Plan has its own formulary, or list of covered drugs. Generally, Medicare Part D doesn't cover vitamin supplements, as mentioned above.

What is not covered in Medicare Part D?

Drugs not covered under Medicare Part D Weight loss or weight gain drugs. Drugs for cosmetic purposes or hair growth. Fertility drugs. Drugs for sexual or erectile dysfunction.

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000 (beginning in 2024), while under the GOP drug price legislation and the 2019 Senate Finance bill, the cap would be set at $3,100 (beginning in 2022); under each of these proposals, the out-of-pocket cap excludes the value of the manufacturer price ...

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

How does plan D work?

You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications. Instead of paying full price, you will pay a copay or percentage of the drug's cost. The insurance company will pay the rest.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

What are the 4 phases of Medicare Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

What is the difference between Medigap and Part D?

The names “Medicare Plan D”, “Medicare Supplement Plan D”, and “Medigap Plan D all mean the same thing. But these plans are not the same thing as Medicare Part D, which is for prescription drug coverage. Medicare Supplement Plan D policies do not cover prescription drugs.

What is a Medigap plan?

These plans are also called Medigap. In return, the plan pays most of your out-of-pocket expenses. So when you go to the doctor, for example, you don't have to pay the 20 percent coinsurance required by Medicare. Your Medigap plan pays it for you.

What is Medicare Advantage?

Medicare Advantage plans help with your Medicare costs, too. They also offer additional health coverage that Medicare supplement plans don't. The table below breaks down the differences between Medicare supplement plans and Medicare Advantage plans. It might be a good place to start if you're wondering which type of plan is right for you.

What is coinsurance in Medicare?

Your coinsurance. Hospital costs after you run out of Medicare-covered days. Skilled nursing facility costs after you run out of Medicare-covered days. Here's how it works: You pay a monthly premium for your Medicare supplement plan. These plans are also called Medigap.

Does Medicare coordinate with Part D?

You coordinate between Medicare, your Medigap plan and your Part D prescription drug plan, if you have one. One company coordinates all your care. Helps pay for costs you have with Original Medicare. Many plans include extra benefits Original Medicare doesn't offer like dental, vision and prescription coverage.

Does Medicare Supplement Plan work?

Medicare supplement plans don't work like most health insurance plans. They don't actually cover any health benefits. Instead, these plans cover the costs you're responsible for with Original Medicare. Hospital costs after you run out of Medicare-covered days.

Is Medicare Supplement a good plan?

A Medicare supplement plan might be a good choice for you if you already have prescription coverage through an employer or military benefits. You can read more about how supplement and Medigap plans work in our help section.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

What is a Medigap Plan D?

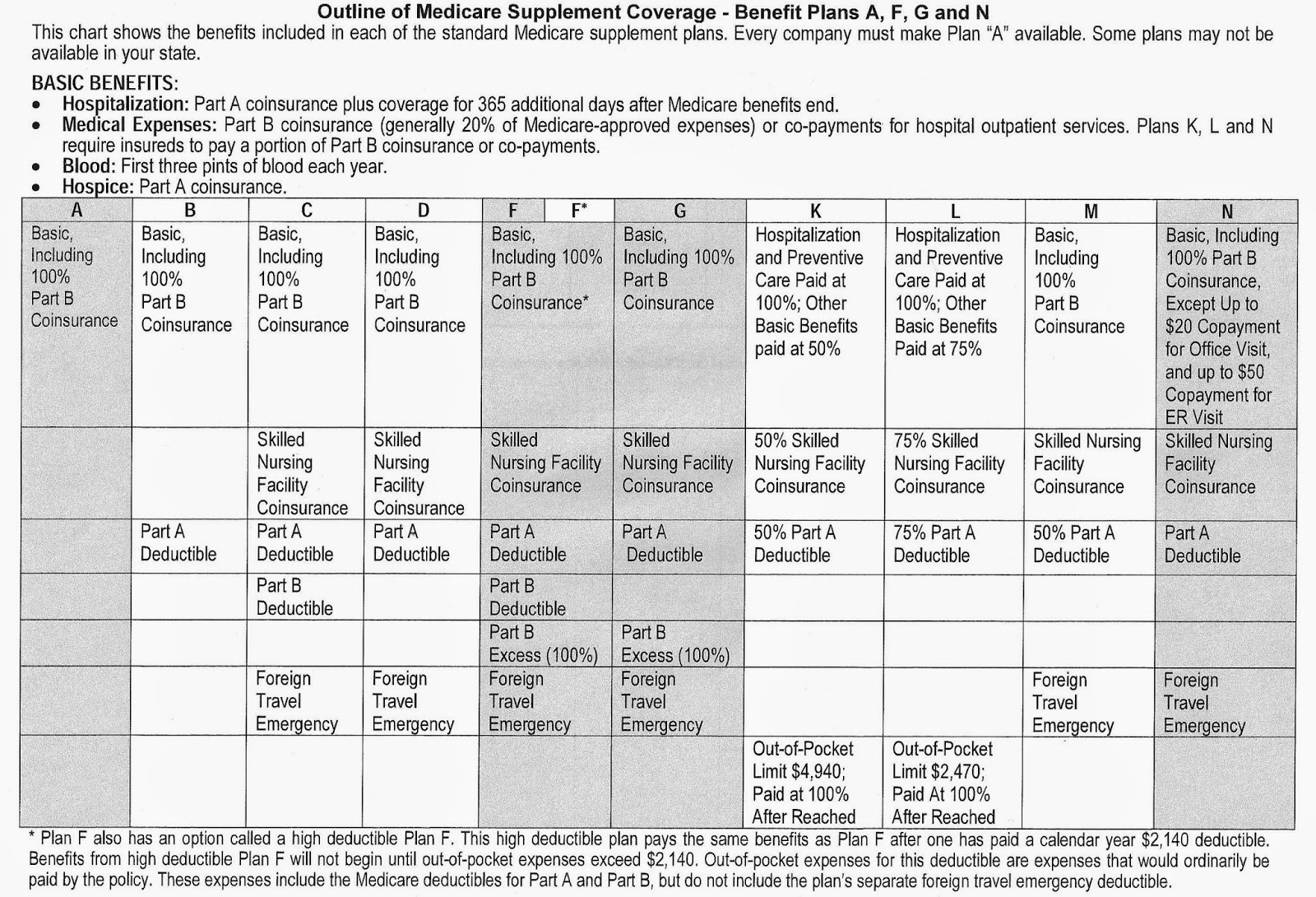

Medigap Plan D is one of the 10 Medigap plans available in most states, which include Plan A, B, C, D, F, G, K, L, M and N. Each type of Medigap plan offers a different combination of standardized benefits. Let’s take a look at what Medicare Supplement Insurance Plan D covers and review the average cost of Medigap Plan D.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap, is a type of private insurance that is used together with your Original Medicare coverage (Medicare Part A and Part B) to help cover certain Medicare out-of-pocket expenses, such as copays and deductibles. Medigap Plan D is one of the 10 Medigap plans available in most states, ...

What is the cost of Medicare Part B?

After you meet your Medicare Part B deductible (which is $203 per year in 2021), you are typically responsible for a coinsurance or copay of 20 percent of the Medicare-approved amount for covered services.

How much is coinsurance for skilled nursing?

Skilled nursing facility care coinsurance. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

What is the maximum out of pocket amount for Medicare Plan K?

2 Plan K has an out-of-pocket yearly limit of $6,220 in 2021.

How much does Medicare Part A cover in 2021?

If you are admitted to a hospital for inpatient treatment, Medicare Part A helps cover your hospital costs once you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021. For the first 60 days of your hospital stay, you aren’t required to pay any Part A coinsurance.

Can you have Medicare Advantage and Medigap at the same time?

Medigap Plan D vs. Medicare Advantage plans. Medigap plans and Medicare Advantage plans are very different things. You cannot have a Medicare Supplement Insurance (Medigap) plan and a Medicare Advantage plan at the same time. Medicare Advantage plans provide all the same benefits as Original Medicare.

What does Plan D cover?

Plan D covers the Part A deductible; this is one of the biggest things beneficiaries need to look for when considering a policy. Plan D also covers the Part A hospital and coinsurance costs up to 365 days after your Original Medicare benefits end. This policy also covers Part A hospice coinsurance and copayments.

What is Medigap Plan D?

Updated on April 6, 2021. Medigap Plan D is a Medicare Supplement policy that helps supplement Original Medicare. Plan D provides beneficiaries with a decent amount of coverage.

What is the difference between Medicare Part D and Medicare Part D?

What’s the difference between Medigap Plan D and Medicare Part D? Part D is not the same as Plan D; Plan D is a supplemental policy and Part D is a stand-alone prescription drug policy. Medigap Plan D, just like other Medicare Supplement plans, doesn’t cover prescription drugs.

What Does Medicare Supplement Plan D Cover?

Among the expenses covered by Medicare Supplement Plan D, according to the U.S. government website for Medicare:

What Does Medicare Supplement Plan D Not Cover?

Some health expenses aren’t covered by any Medigap insurance. According to the U.S. government website for Medicare, these include: 3

What Does Medicare Supplement Plan D Cost?

Keep in mind that all Medicare Supplement Plan D policies cover the same expenses, no matter which health insurance company you choose. The same is true of all the Medigap policies. Those within the same letter cover the same expenses. All Plan Ds offer the same coverage as of the Plan Ds, all Plan Fs offer the same coverage as other Plan Fs.

What Discounts Are Available for Medicare Supplement Plan D?

Some companies offer discounts for women, non-smokers or people who are married; others offer discounts for those who pay yearly, use electronic funds transfer, or buy multiple policies.

How Do You Enroll in Medicare Supplement Plan D?

As with all Medigap policies, the best time to buy Plan D health coverage without worrying about being rejected for coverage is during the six-month Medigap Open Enrollment Period, when you are 65 or older and enrolled in Medicare Part B for the first time. Your coverage can’t be canceled as long as you keep up your payments.

What Are Alternatives to Medicare Supplement Plan D?

What if you decide Medigap Plan D isn’t for you? If you are looking for similar levels of coverage but feel you don’t need quite as much as Plan D offers, you might want to consider Plan B, which covers nearly as much. The only difference is the lack of skilled nursing facility coverage and foreign travel emergency medical care.

How Medigap Plan D Helps Curb Costs

Medigap Plan D provides coverage for several of Medicare's out-of-pocket costs, including:

Enrolling in Medigap Plan D

In most states, you are eligible for a Medigap policy when you are at least 65 years old and enrolled in Medicare Part B.

Understanding Original Medicare's Coverage Gaps

Original Medicare is the federal health insurance program for Americans 65 years and older and younger people with certain medical conditions or disabilities. Original Medicare consists of two parts:

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.