Your zip code matters for Medicare because plan options change depending on your location. Also, Medicare Advantage plan networks are dependent on the private insurance company providing care to each client. Zip code is important in terms of Medicare program eligibility.

Does your zip code matter in terms of Medicare eligibility?

This is where your zip code matters in terms of Medicare eligibility. You will always be eligible for Original Medicare, but eligibility for specific Medicare Advantage plans require you to live in that plan’s service area. Get started now. Interested in learning more about Medicare, Medigap, and Medicare Advantage plans?

Where is the ZIP code that gives 148 dollars extra on social security?

Where is the zip code that gives 148 dollars extra on social security? It’s not a location. The deal is, if you switch to a Medicare Advantage plan, available everywhere, SSA won’t deduct $144 mas o menos from your benefit to pay for Part B.

What do nurses ask patients about their zip codes?

For example, nurses ask patients about alcohol consumption, tobacco or nicotine use, and any illicit drug usage. However, there is one thing nurses and doctors fail to consider in their assessments, and that is the zip codes of their patients.

What is a billing ZIP code?

A Billing Zip Code is the one that the card’s financial institution has on record for the user of that card. If you live in the USA then you know where your bank thinks you live. If you don’t live in the USA then you do not have a Zip Code.

How does zip code affect Social Security benefits?

Social security benefits are not impacted by geographic location but other federal benefits are.

Why do only certain ZIP codes get money back on Medicare?

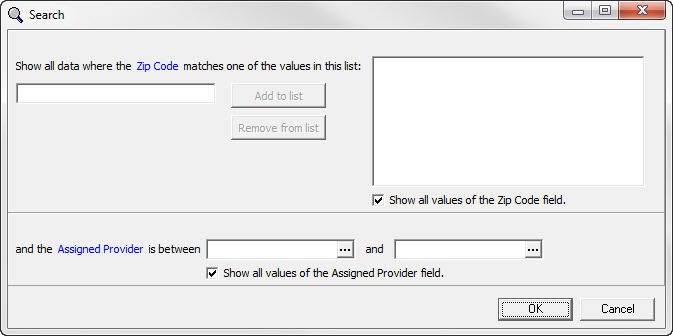

Location Is Key. According to the official U.S. government website for Medicare, the Medicare Advantage plans that are available to you differ according to your zip code. This is because Medicare Advantage plans are offered by private insurance companies who determine the specific service areas of their plans.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Does my income affect my Medicare premiums?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

At what income do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

What makes you eligible for Medicare?

To qualify to receive Medicare services, you must be aged 65 or older, and you must have been getting disability income from Social Security or the Railroad Retirement Board (RRB) for 24 months.

How can the service vary?

Medicare can be broken down into two different plans: Medigap and Medicare Advantage.

2. Many Advantage plans serve only a few counties

They are often limited to the area around particular hospitals. This is especially true for ones that are HMOs. Not all Advantage plans are HMOs.

4. It determines what plans are available in the area

I have a plan that is only available in about 10 states. And it is not available to the general public. I have the option of enrolling in a different plan that is available in all 50 states.

12. and woe be unto you if you have to seek treatment out of network

I do not want to make insurance companies any richer than I have to, so I took Medicare B. There are no networks. My plan is good no matter where I am in the US.

14. Your plan is mostly good everywhere with the Medicare part

That pays only 80% of covered cost. The 20% is covered by your own insurance which can be just traditional or with an Advantage plan.

27. Doesn't work well for people with chronic illnesses

Original Medicare B is not capped, so you'll be paying 20% forever. Medicare Advantage plans are capped ($6700 max this year). My daughter's billed medical expenses are $200,000/year. 20% of 200,000 every year is a whole heap of money.

18. To be clear, Medicare Advantage is NOT Medicare

It is private insurance disguised as Medicare, and has many disadvantages. In other words, it's a Trojan horse designed to destroy the original Medicare program.

28. It is a Godsend if you have a chronic illness

There is no cap on the annual out-of-pocket expenses for original Medicare. Those of us with chronic, costly illnesses need an annual cap.

Contributing Factors

There are a plethora of factors that contribute to the health and welfare of people. Social factors like whether a person has a stable place to live, the types of food they have access to, and whether they have access to health care services are generally the top tier issues among healthcare practitioners.

For Your Consideration

It is important for nurses and other medical professionals to consider social determinants of health during the diagnostic process. Taking a little time during the assessment process could mean the difference between life and death for a patient who is facing social challenges like homelessness, unemployment, or a lack of health insurance.

The Count

Another issue that has a huge impact on the type of healthcare a community has is directly connected to whether there is a hospital or a medical provider in the area. Most people in America are not aware that there have been over 100 rural hospital closures since 2010.

How many states will have Medicare Advantage in 2021?

In 2021, there will be 48 states offering a Medicare Advantage plan with a Part B premium reduction. So, it’s fair to say the popularity of these plans is increasing.

What is Medicare Part B give back?

Part B Premium Reduction Give Back Plans. The Medicare Part B give back plan, or premium reduction plan is a feature of Medicare Advantage. Yet, only some Medicare Advantage plans offer this benefit, and it isn’t available in all areas. Those with this plan may see a higher amount on their Social Security check, ...

What is a Part B premium reduction plan?

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage , you’ll see a section that says Part B premium buy-down; this is where you can see how much of a reduction you’ll get.

Can Medicare Advantage pay Part B?

The Medicare Advantage insurance company can pay either the whole or a portion of the Part B premium for enrollees. Since the Advantage plan handles your claim instead of Medicare, these plans make more sense than a standard Part C policy. How can Medicare Advantage plans give you back some of your Part B premium money?

Who is eligible for Part B buy down?

Who is Eligible for the Part B Buy-Down Plan? Those that pay their own Part B premium will be eligible for the Part B buy-down. But, anyone with Medicaid or other forms of assistance that could pay the Part B premium can’t enroll in these plans.

Does Cigna have a Part B plan?

In some areas, Cigna may have a Part B premium reduction plan. Even Aetna has a Part B give back in some areas. Further, there are likely more companies offering this type of policy than just the ones we’ve mentioned. Also, consider the plan ratings before you enroll.